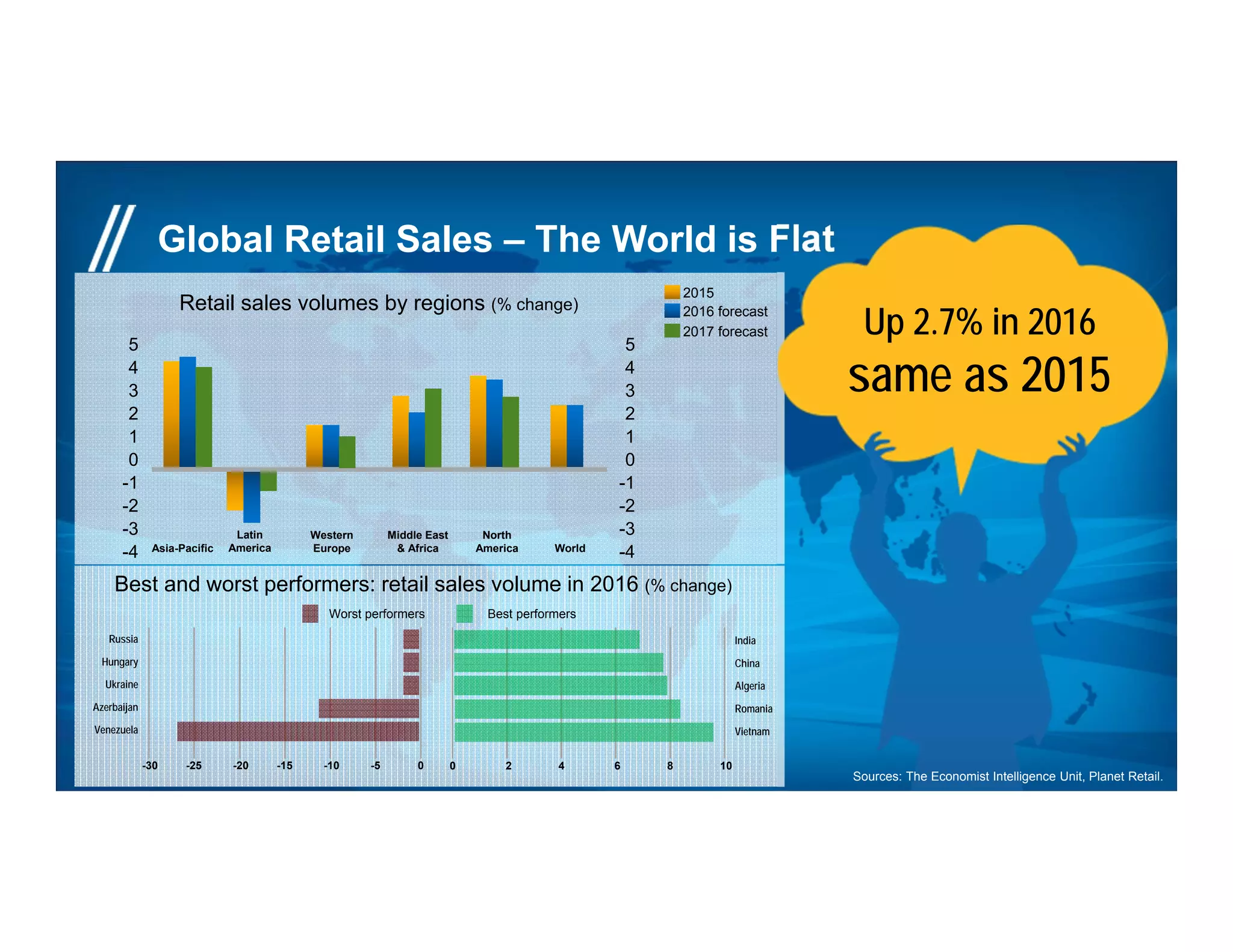

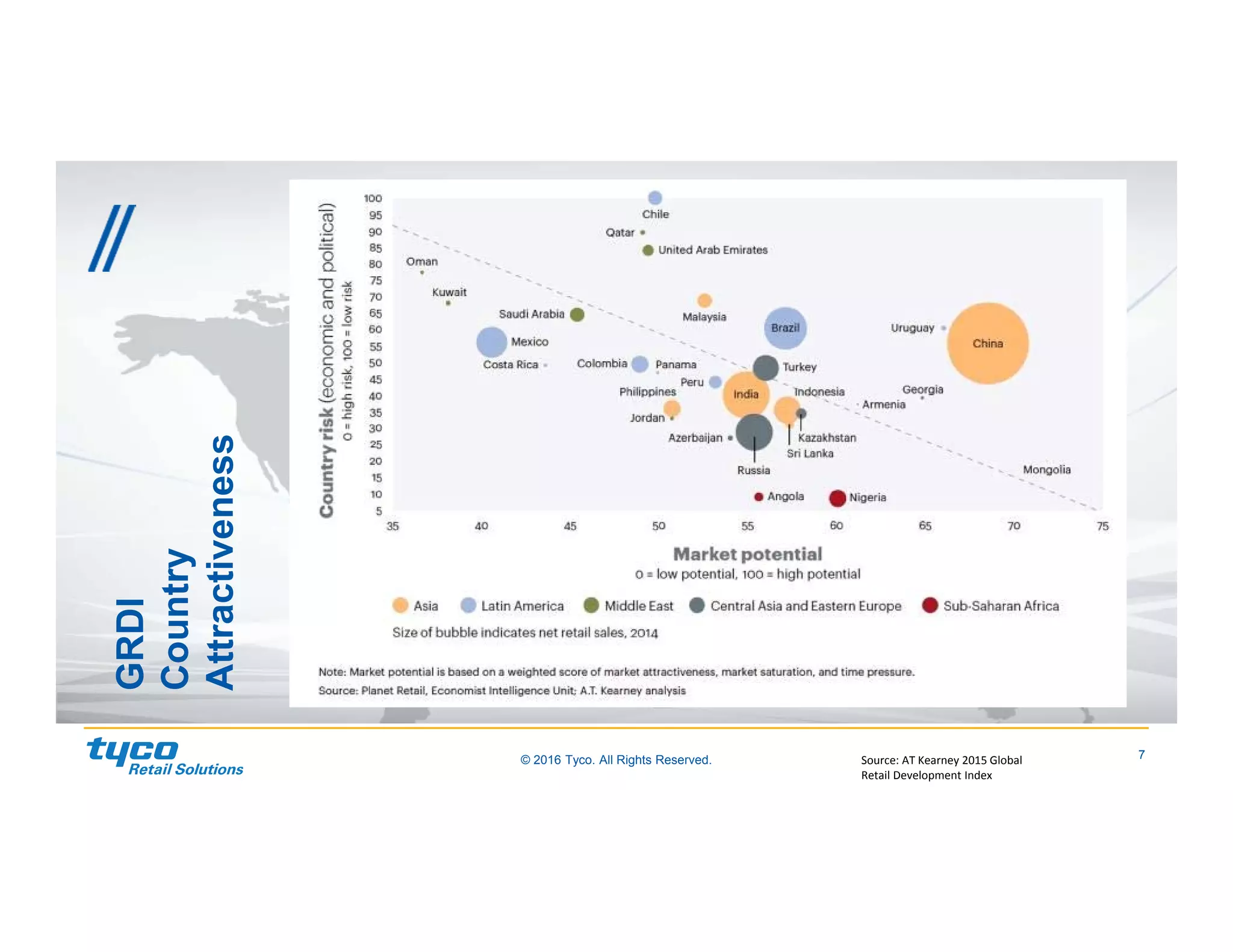

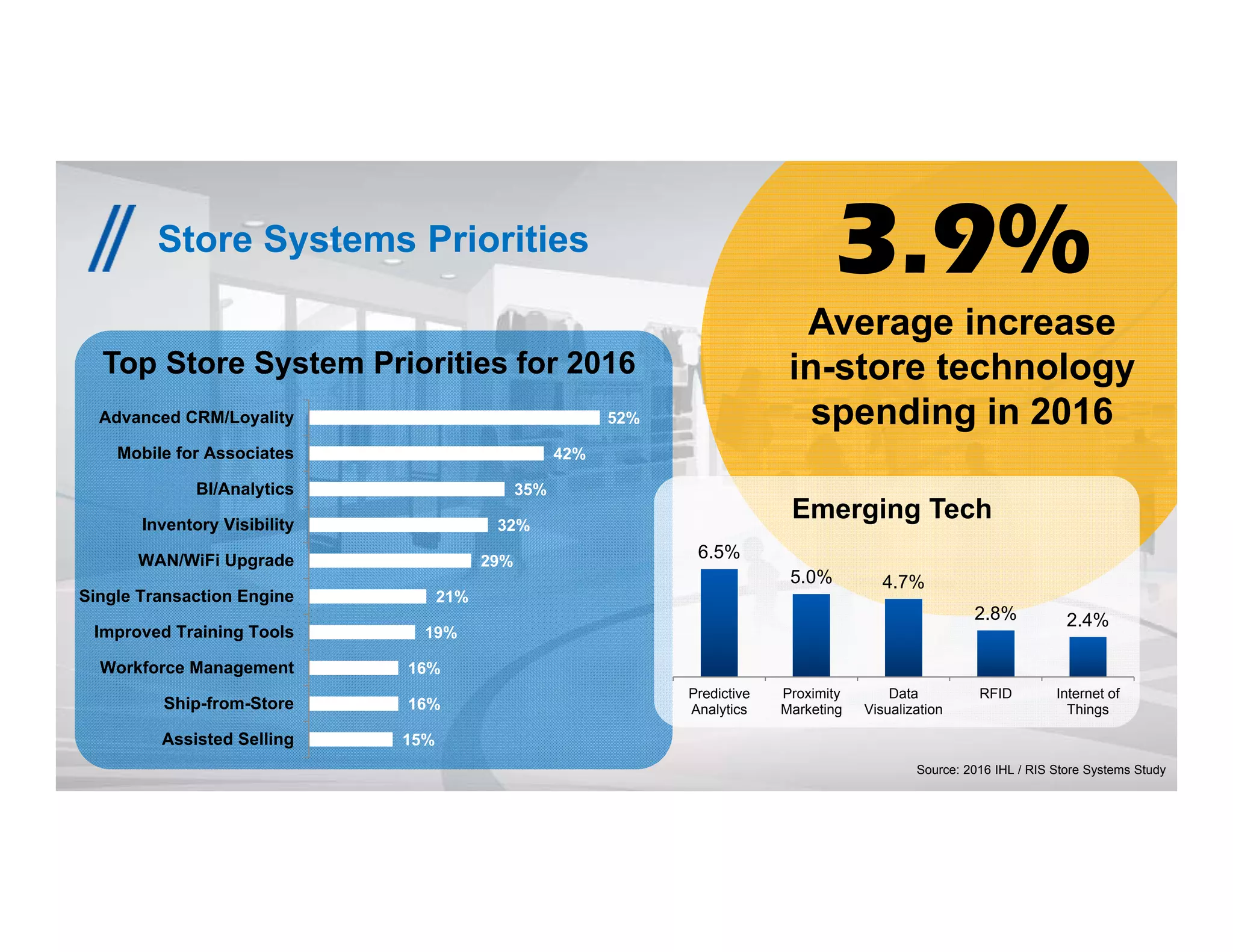

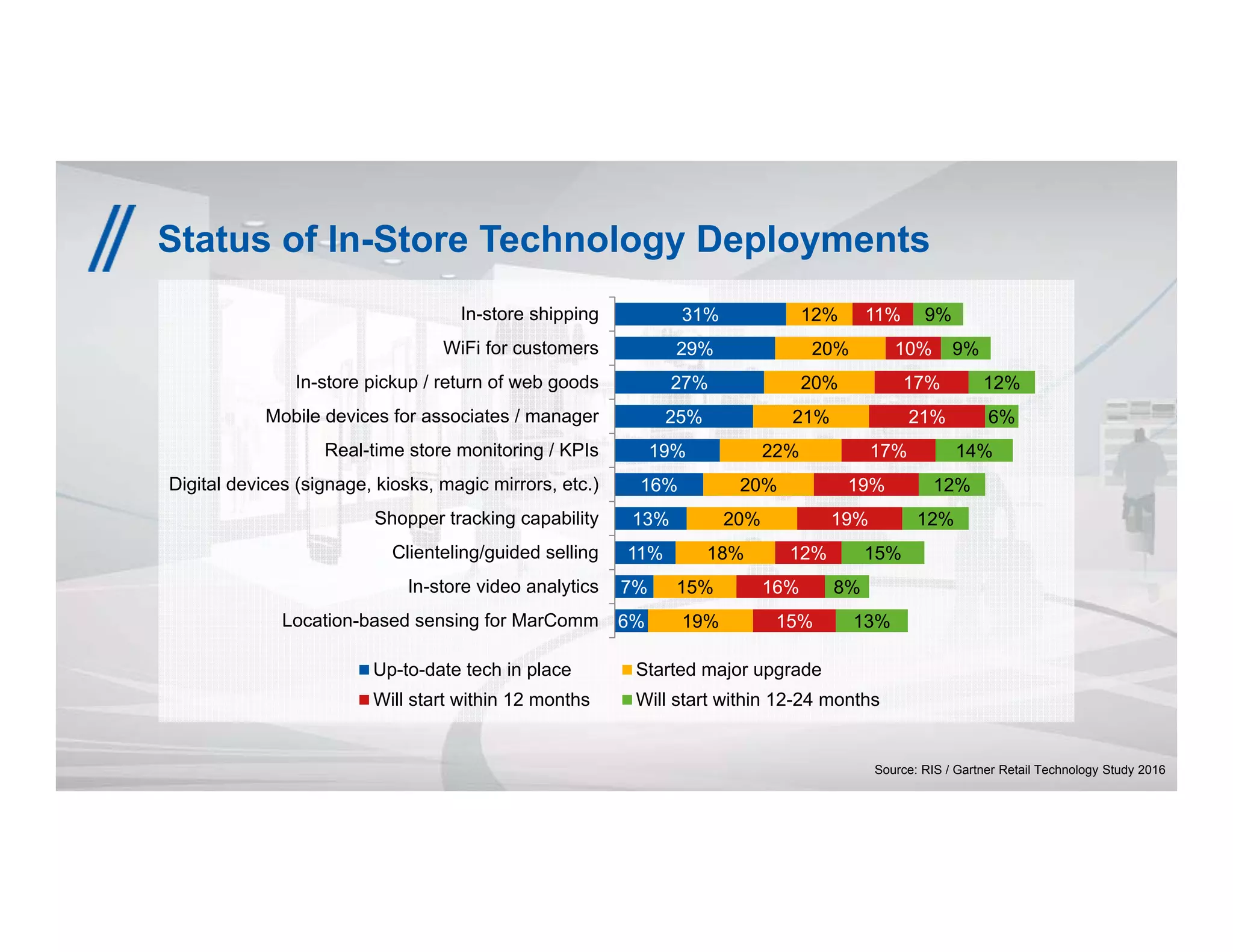

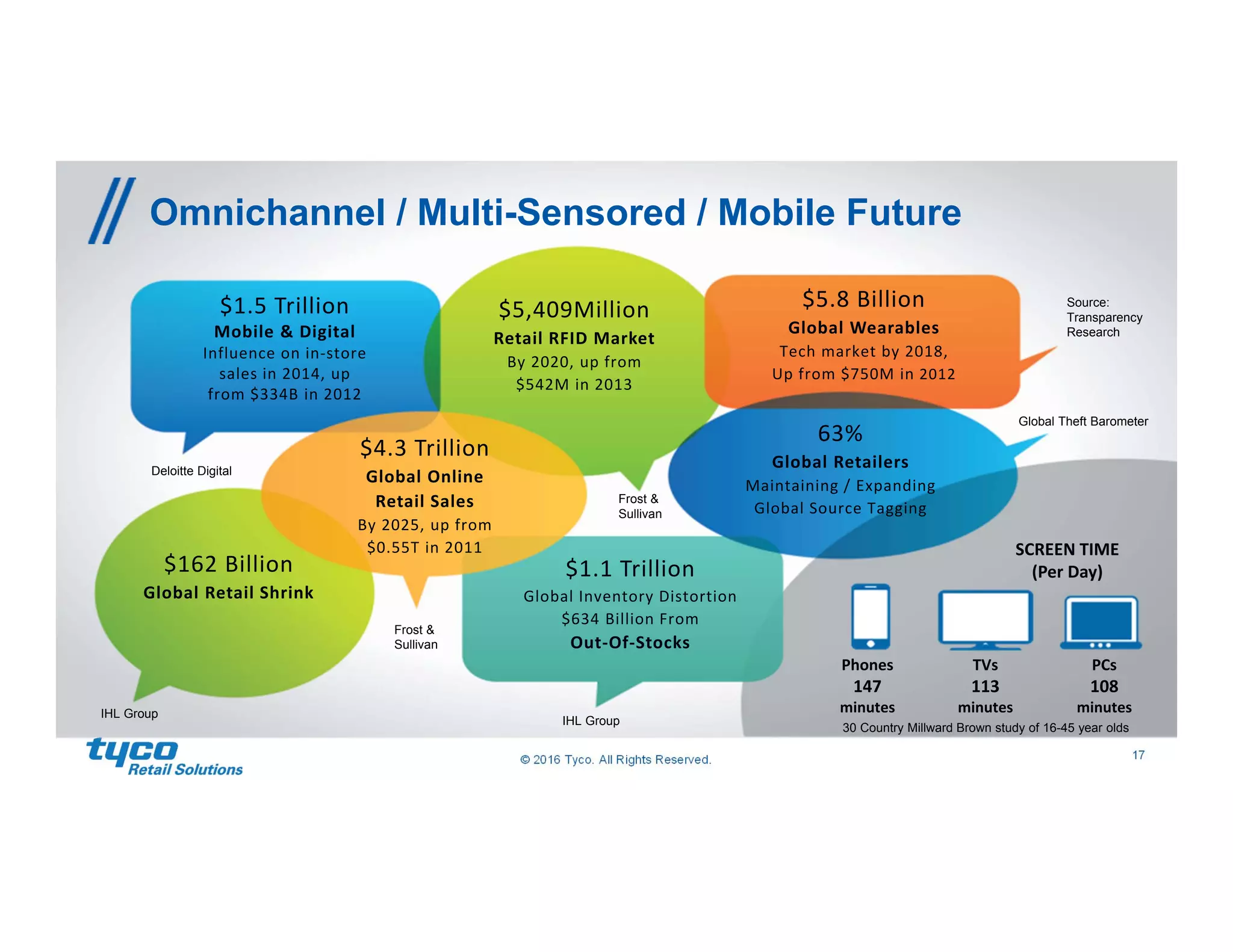

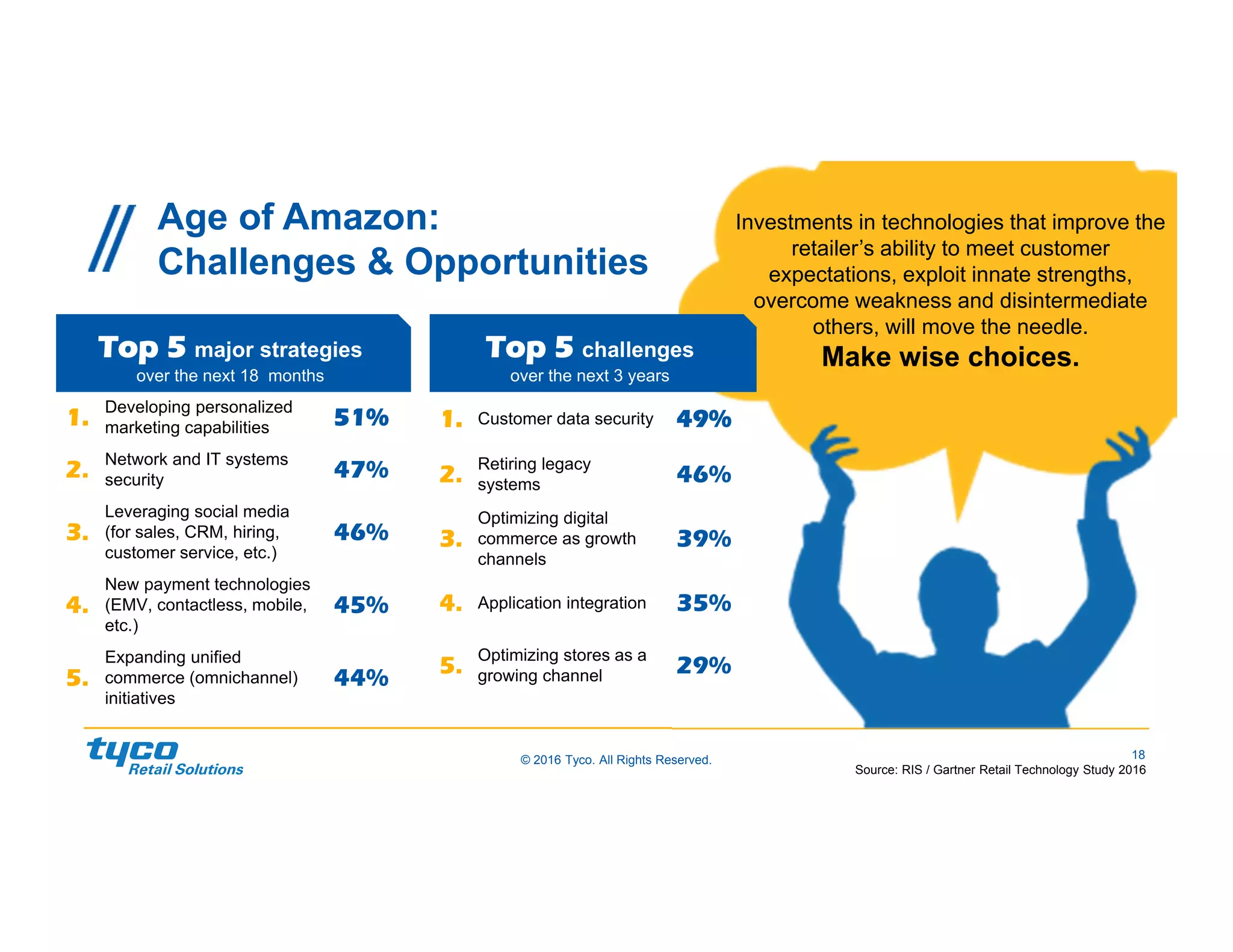

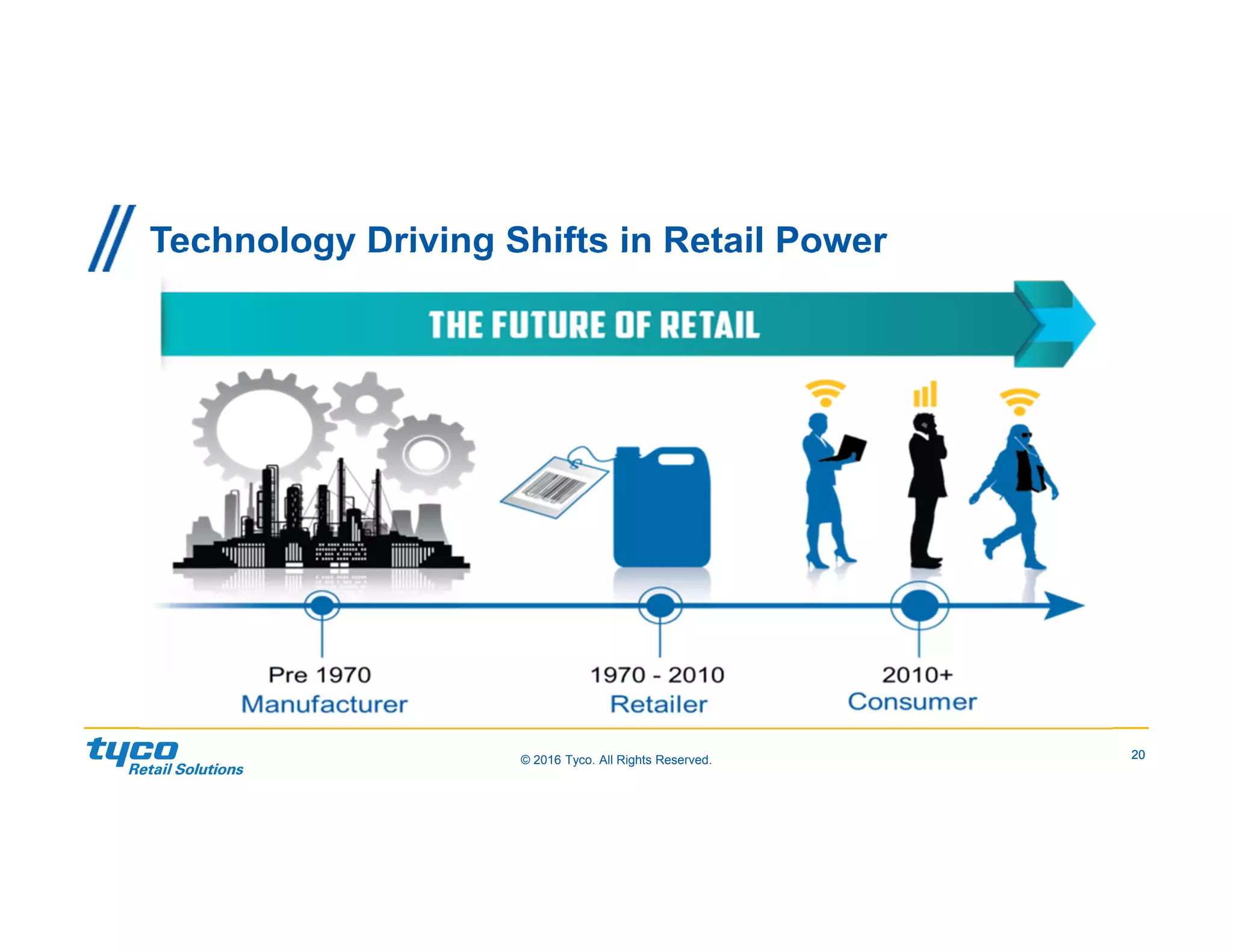

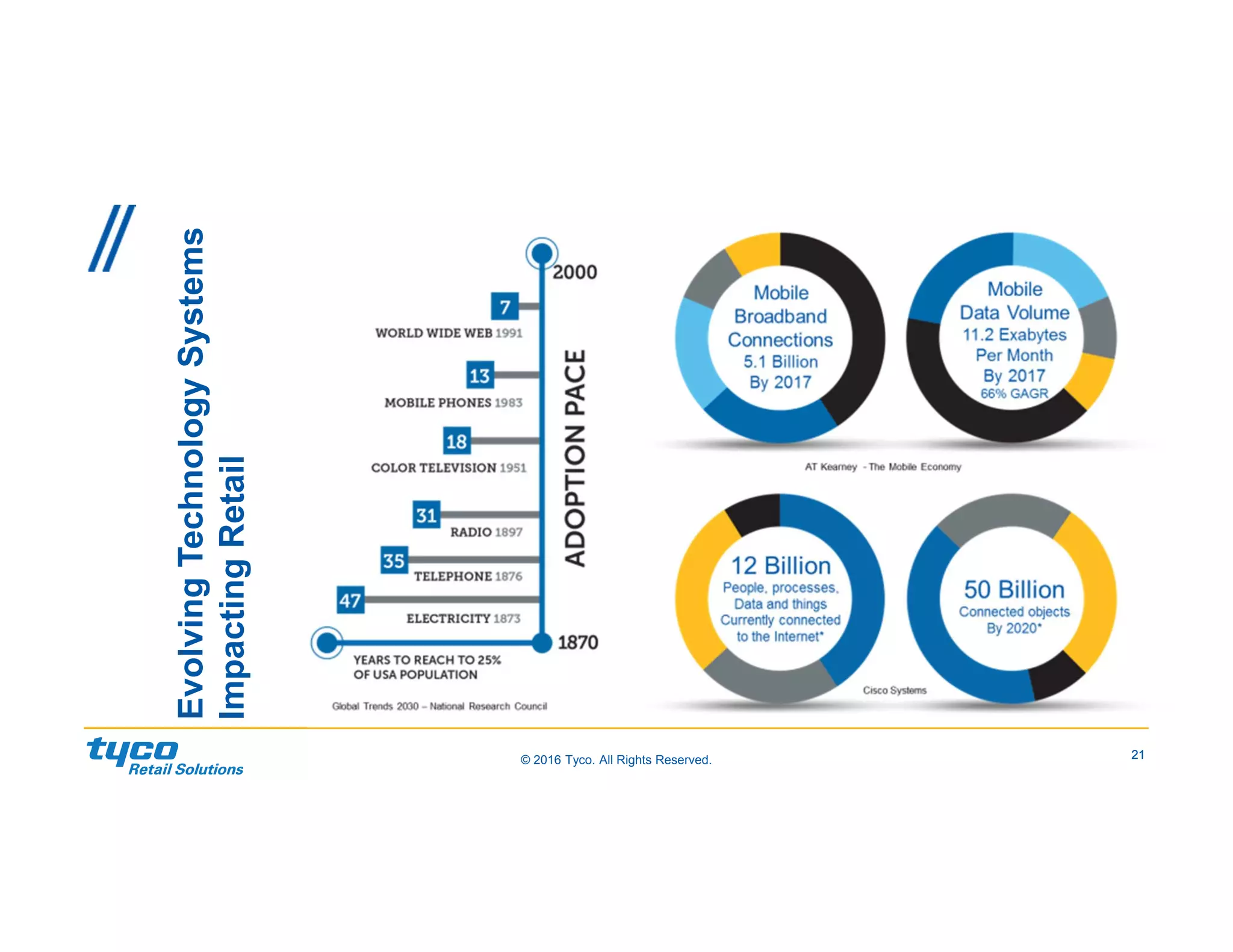

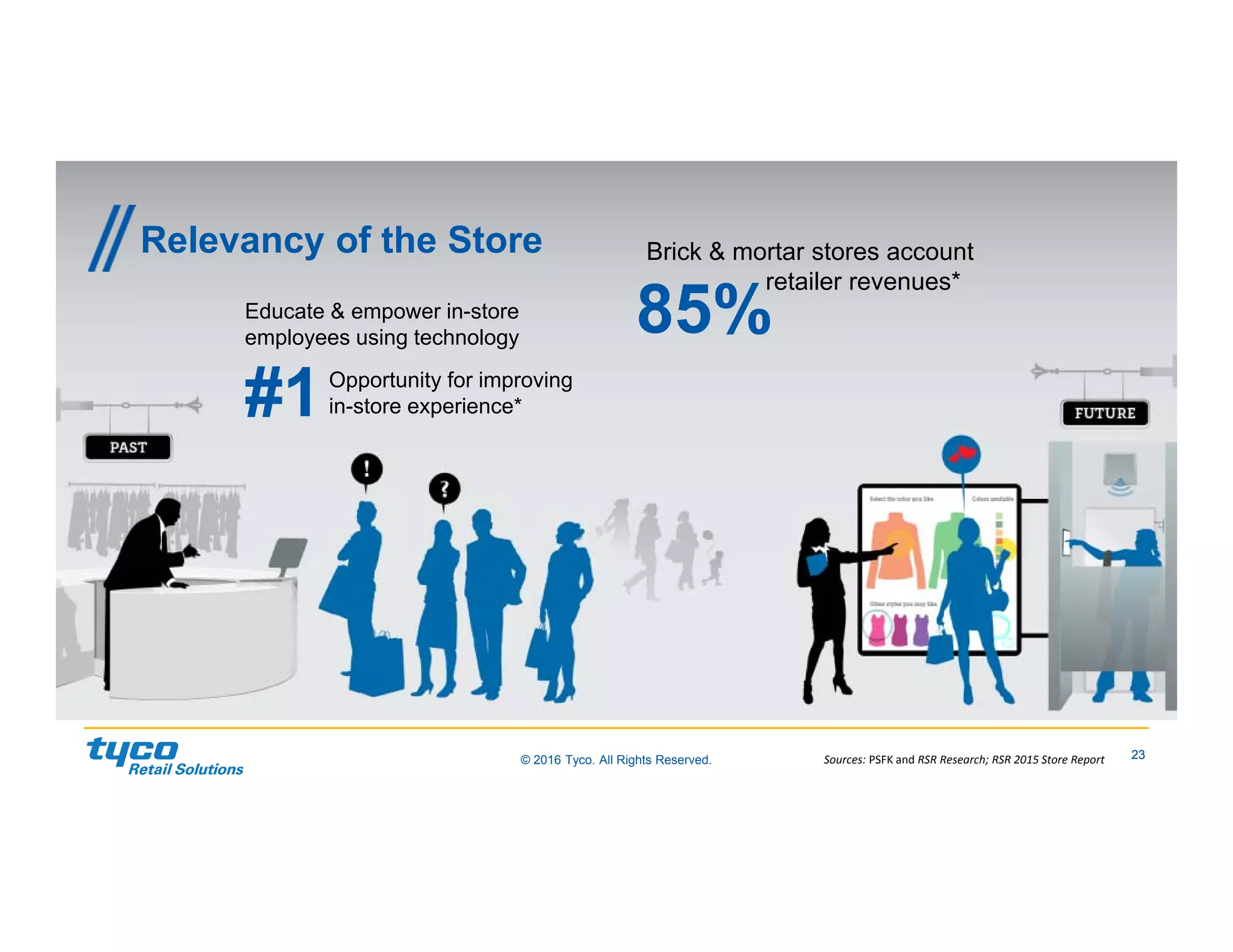

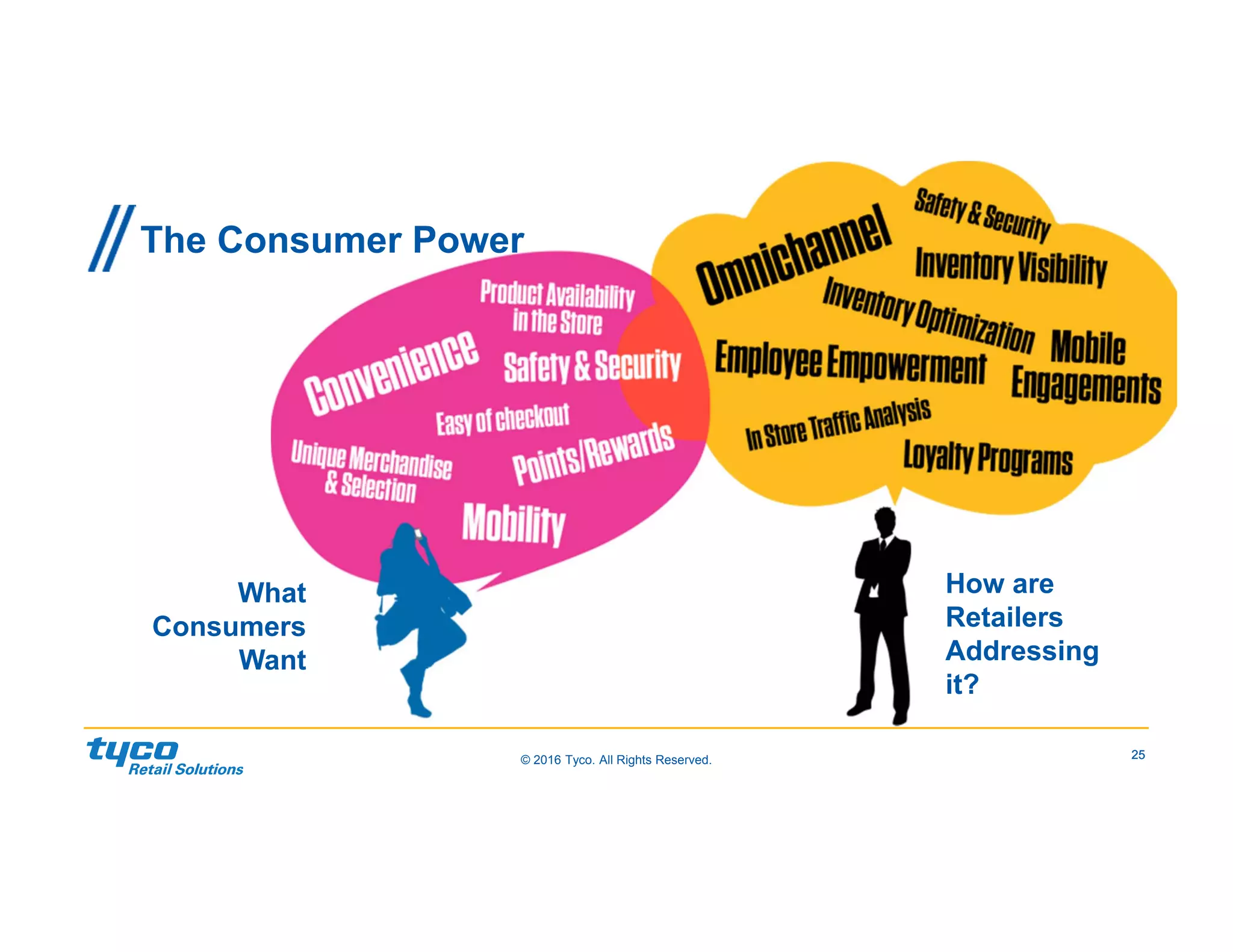

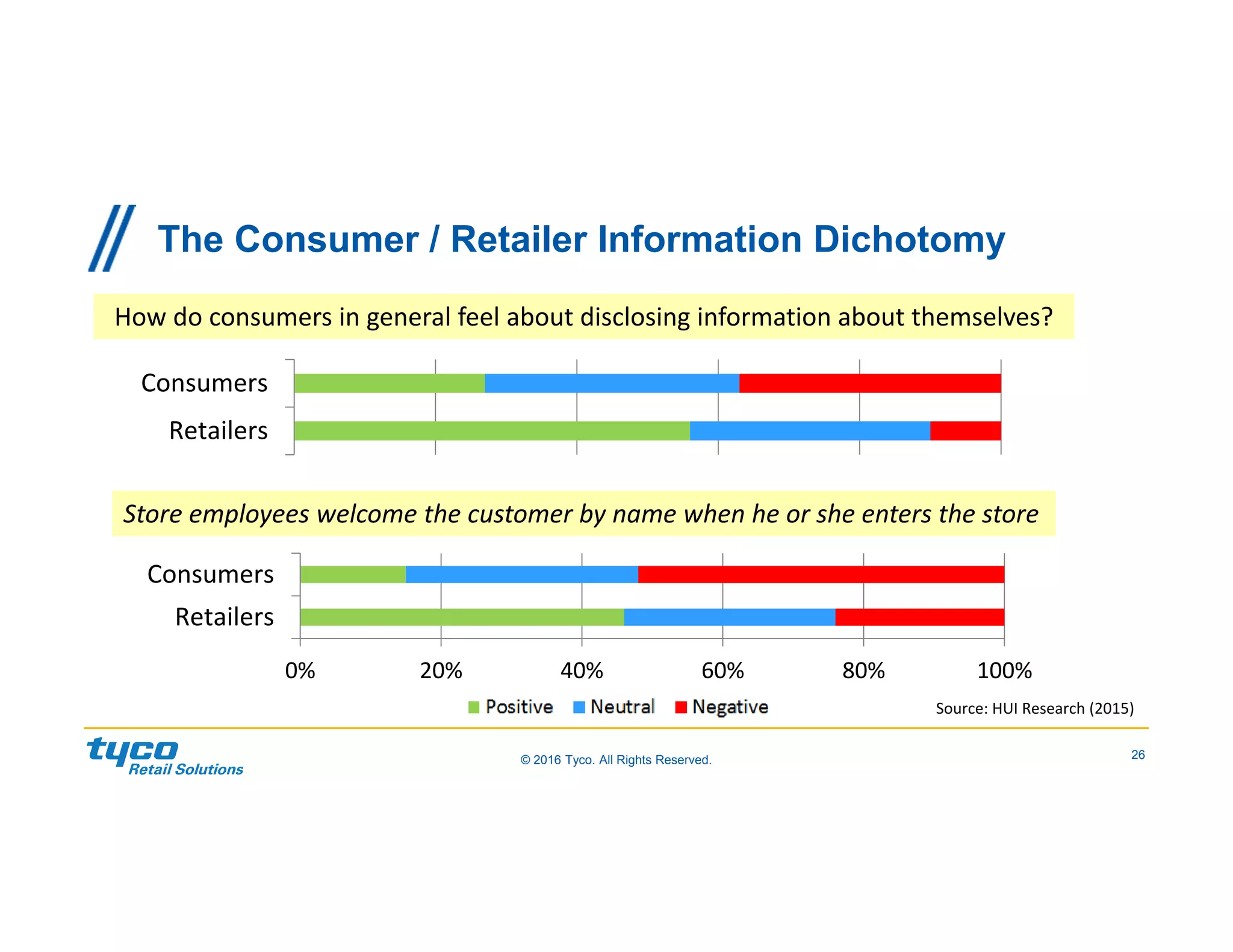

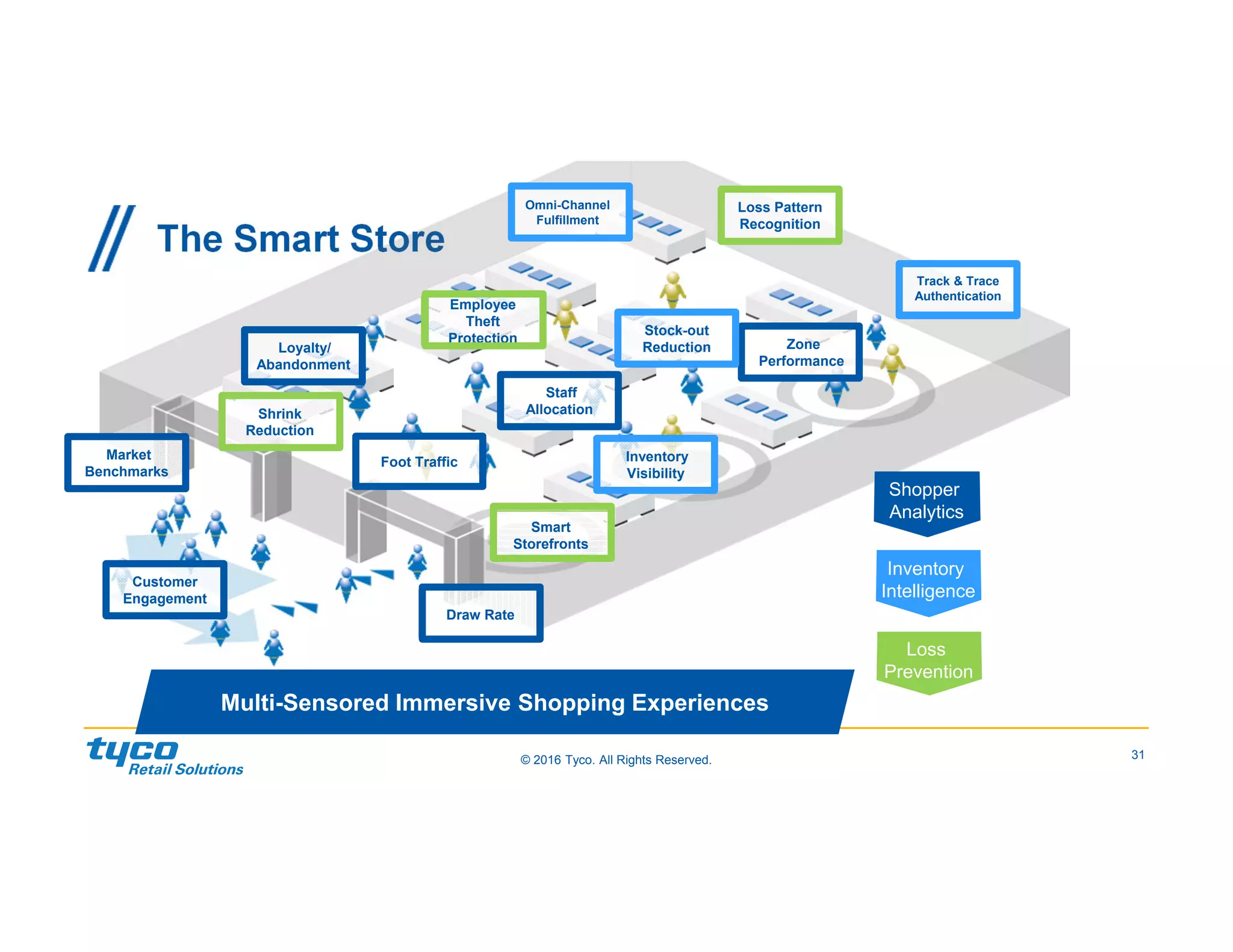

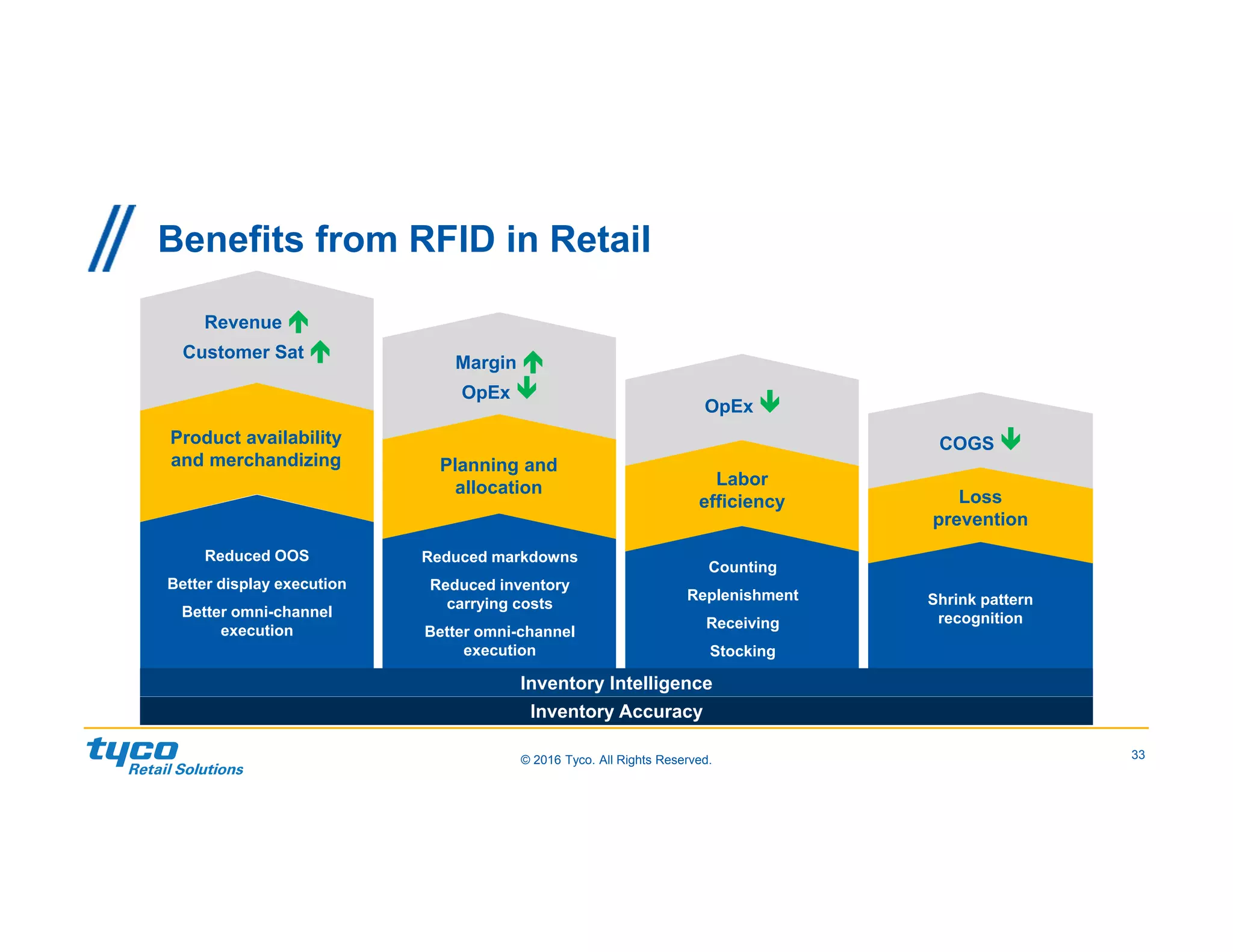

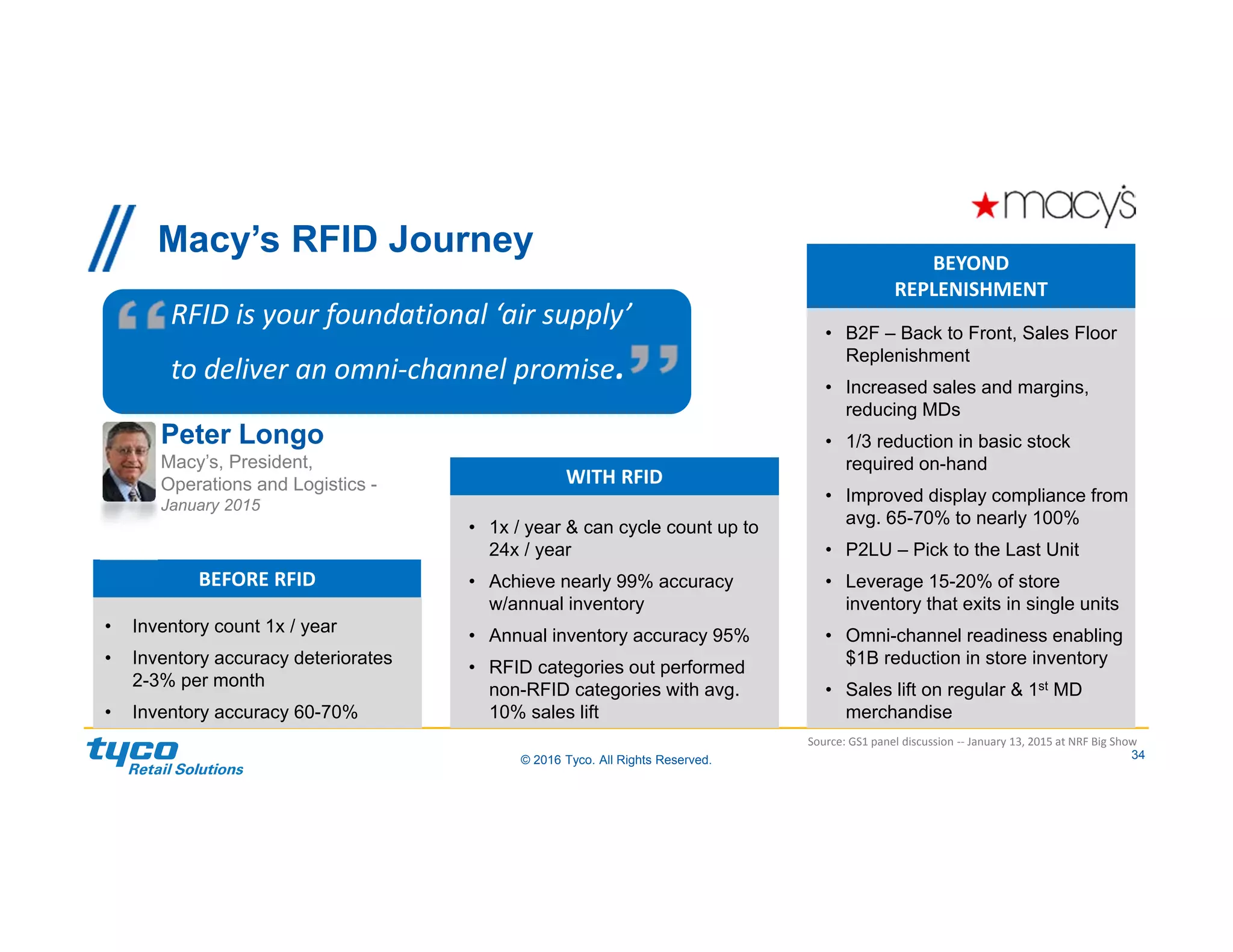

The document discusses the disruptive future of retail and how emerging technologies are impacting the industry. It provides an overview of key retail trends like the rise of omnichannel shopping and importance of mobile. Data shows retailers are focusing technology investments on areas like personalized marketing, security, and payment technologies to address challenges from Amazon. The future of retail is highlighted as one driven by consistency, convenience and accessibility across all channels for shoppers. Technology like RFID and analytics are allowing stores to become smarter with benefits like improved inventory visibility, customer engagement and loss prevention.