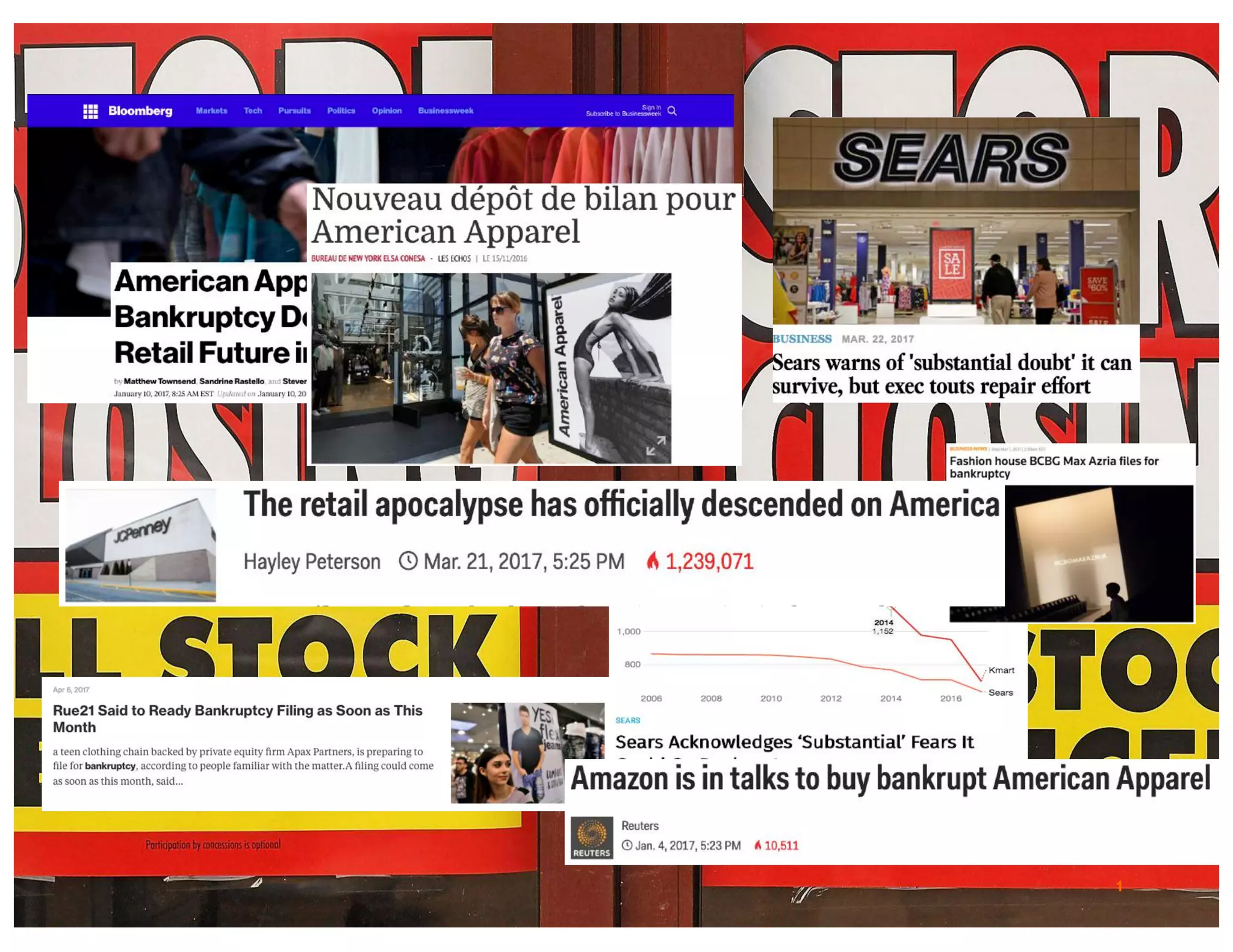

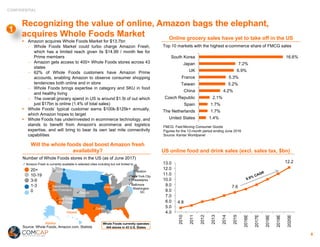

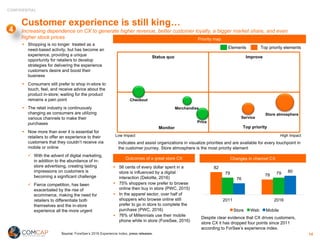

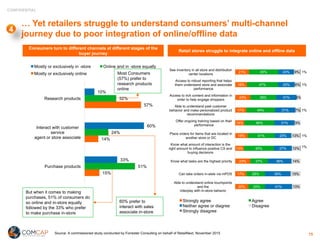

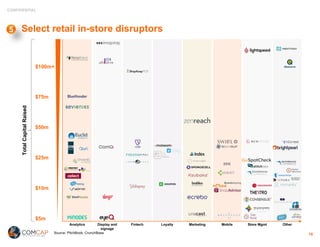

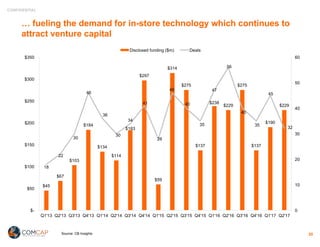

ComCap is an investment bank focused on the digital retail ecosystem. The document discusses ComCap's perspectives on in-store retail technologies and how they can help retailers compete with Amazon. These technologies include analytics, signage, fintech, loyalty programs, marketing, and store management solutions. While retailers have been slow to adopt such technologies, the current environment demands change in order to improve the customer experience and store operations. ComCap works with both financial and strategic investors globally to facilitate understanding of investment opportunities in this area.