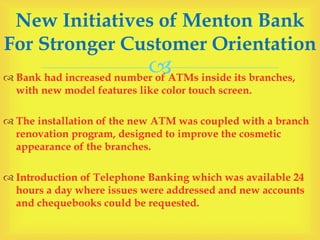

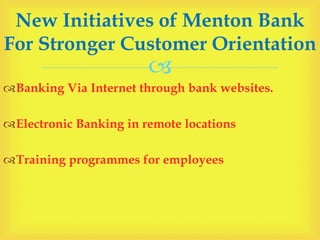

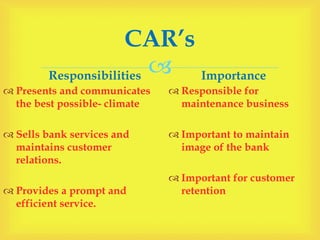

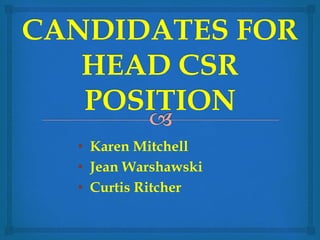

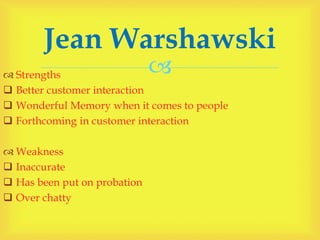

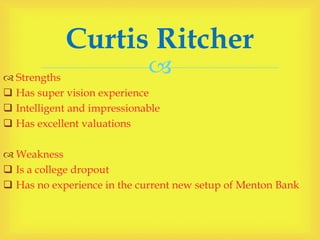

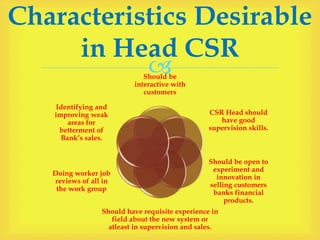

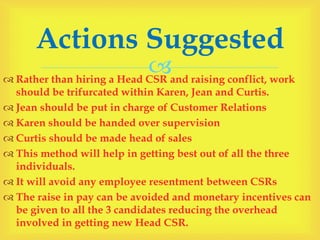

Menton Bank recently appointed a new CEO and created a banking technology team to help the bank compete. It has since modernized its branches with new ATMs and renovations. It also introduced telephone and internet banking. New roles of Customer Service Representatives and Customer Assistance Representatives were created to improve customer interaction and sell financial products. Three candidates - Karen Mitchell, Jean Warshawski, and Curtis Ritcher - were being considered for the Head CSR role. However, splitting the responsibilities among the three, with Jean overseeing customer relations, Karen handling supervision, and Curtis leading sales, would make best use of their strengths and avoid potential conflicts from appointing one as Head CSR.