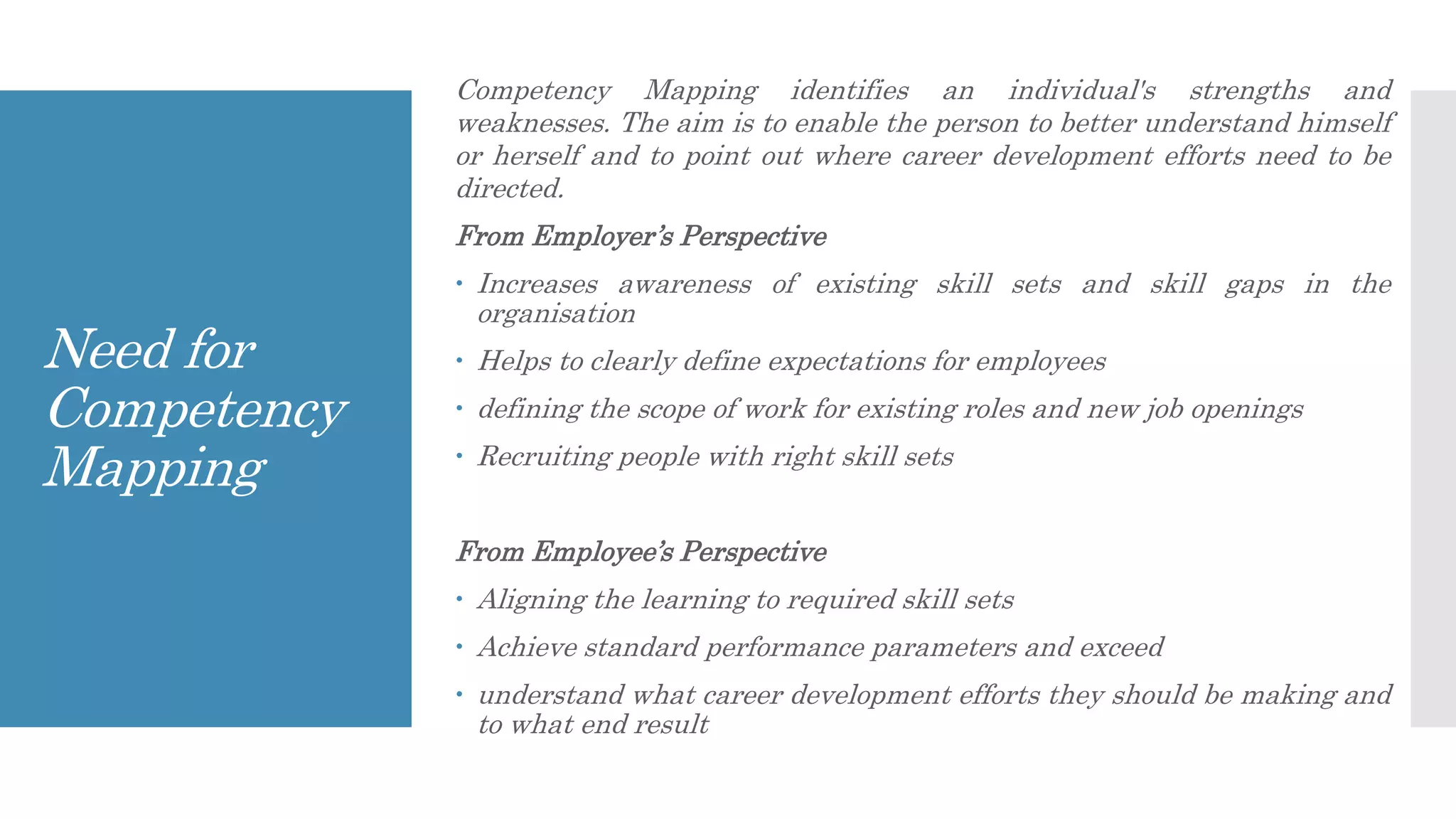

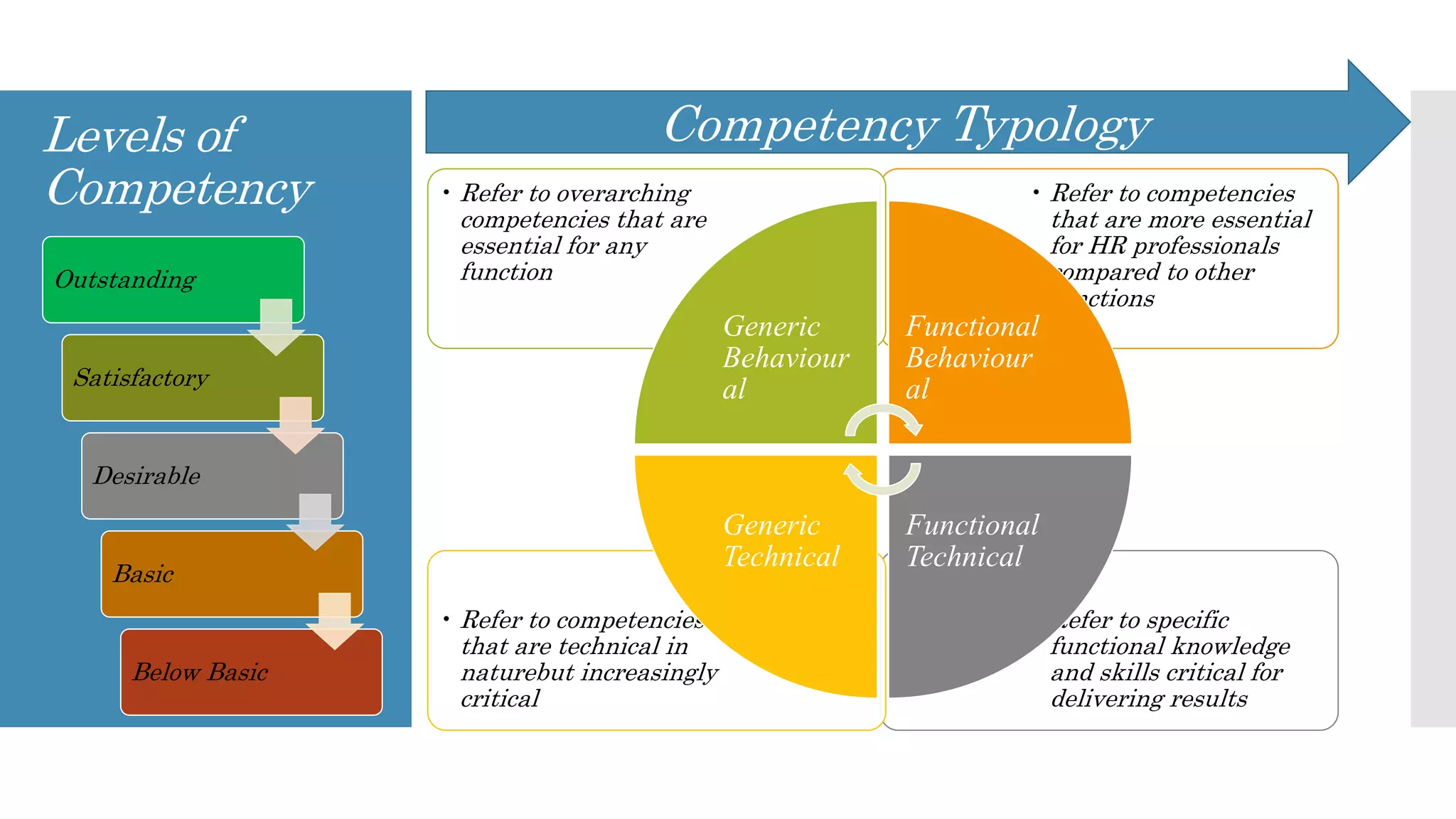

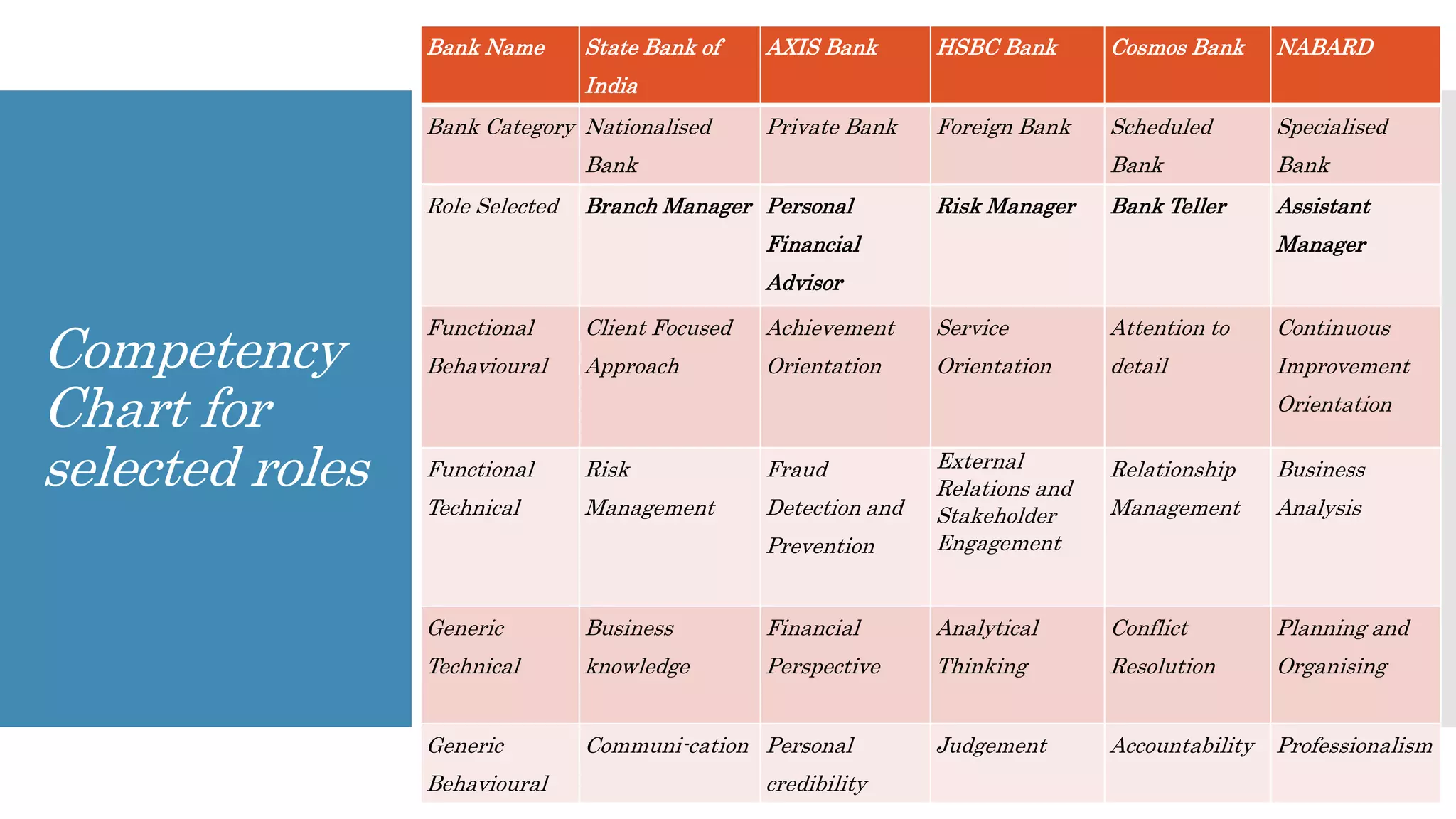

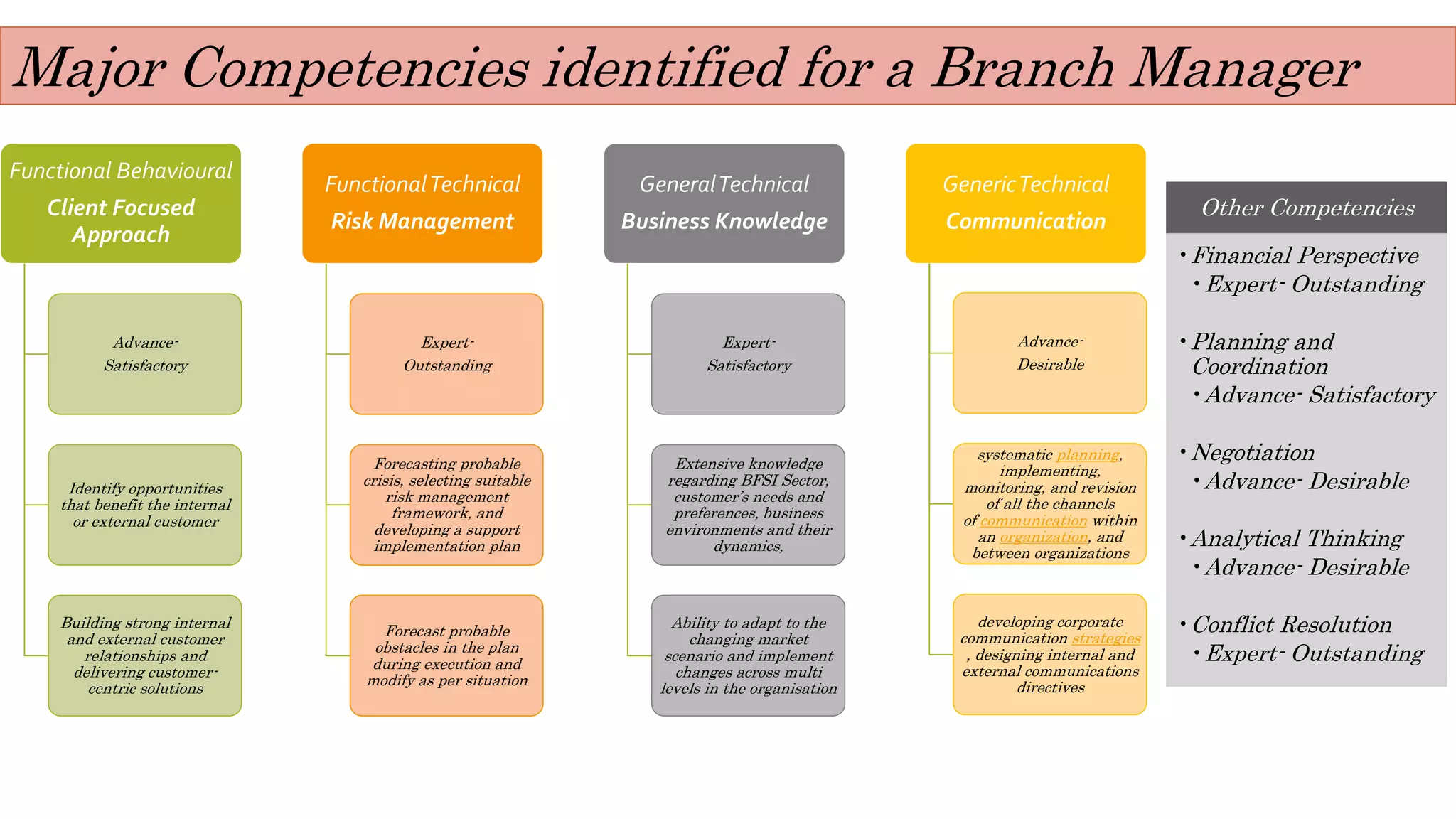

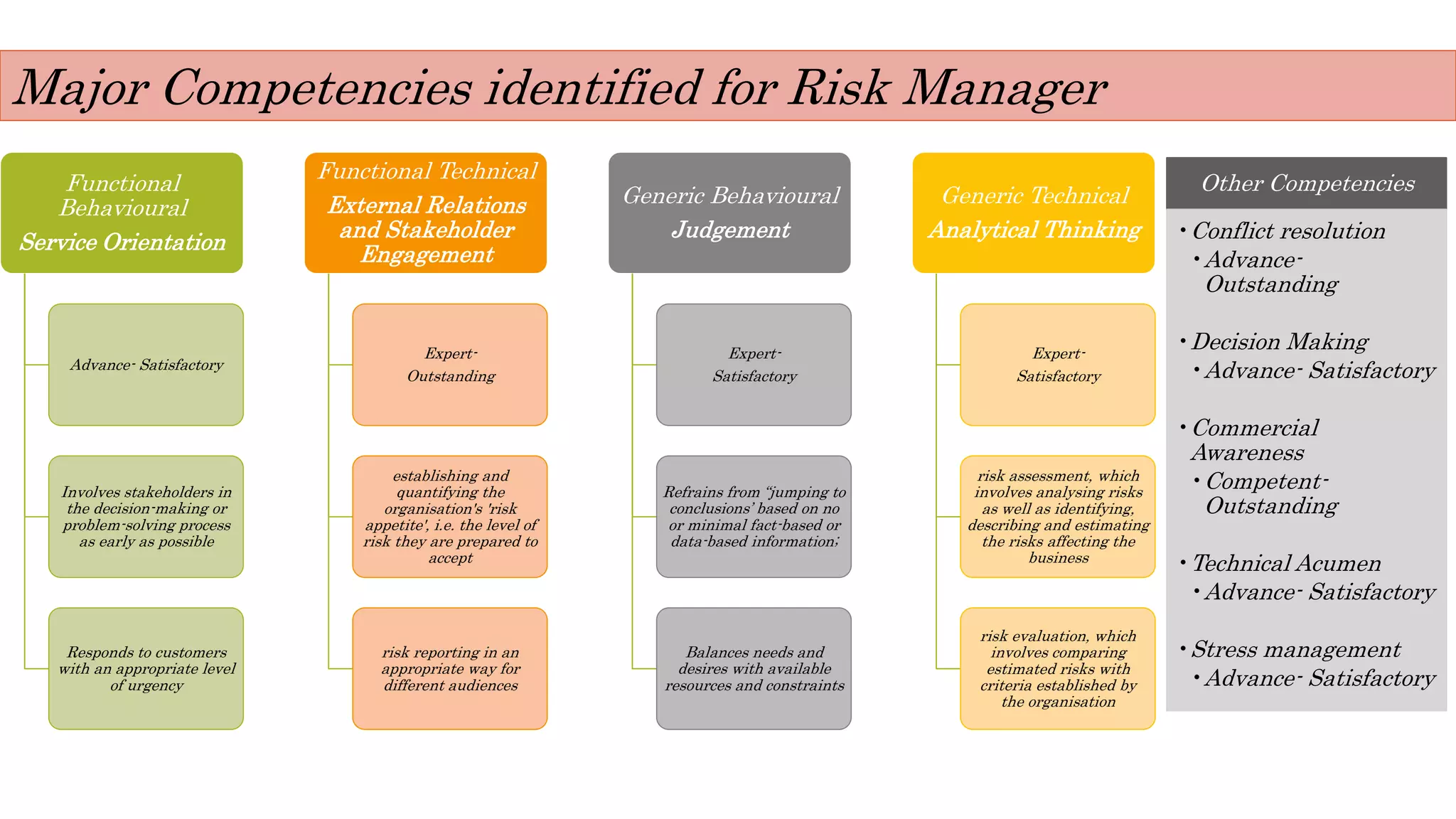

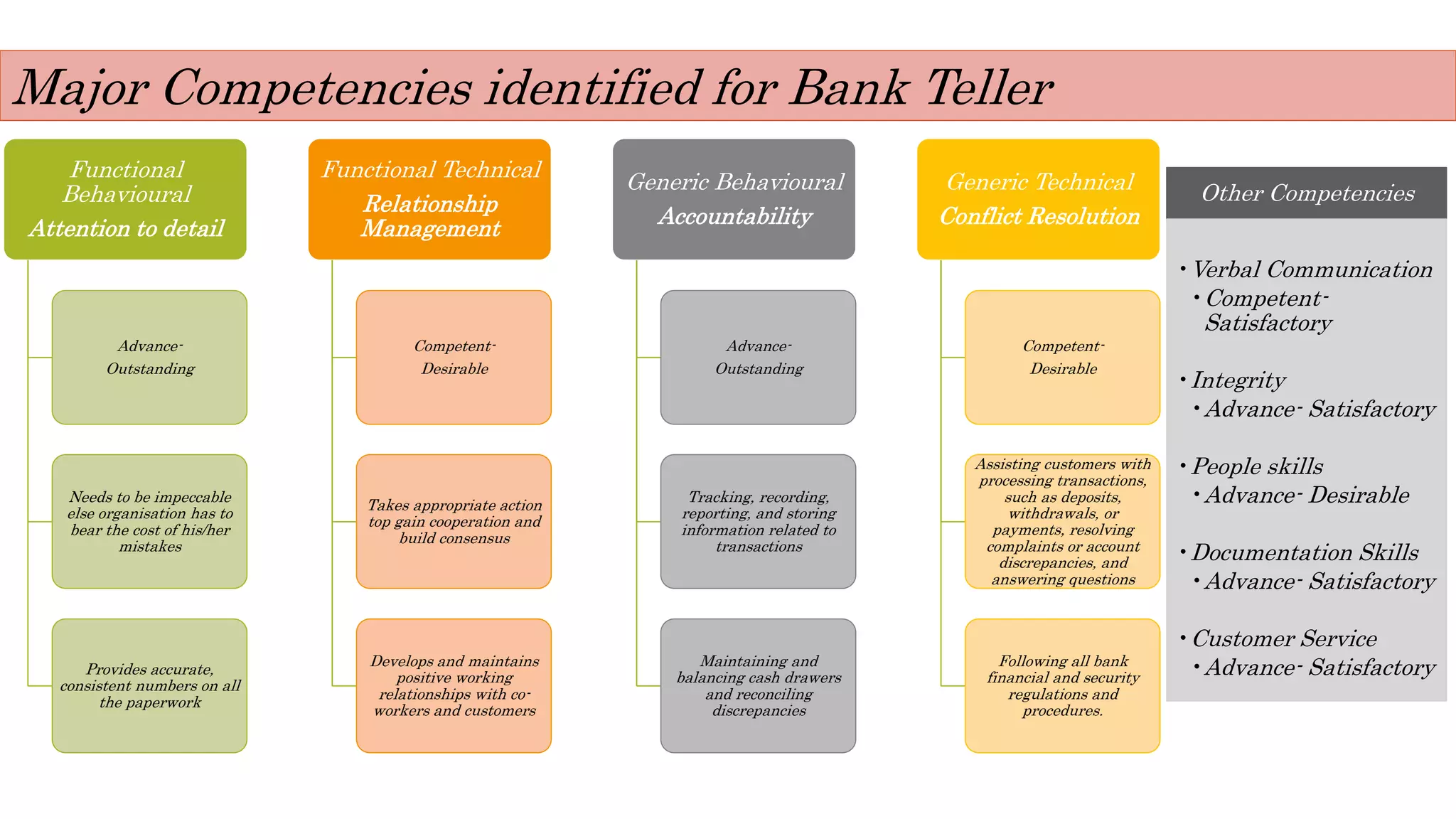

The document discusses competency mapping in the banking sector, emphasizing its importance for both employers and employees in identifying strengths, weaknesses, and skill gaps. It categorizes competencies into behavioral and technical types, providing a competency chart for various banking roles such as branch manager, personal financial advisor, risk manager, bank teller, and assistant manager. Key takeaways include the classification of the banking sector in India and the significance of aligning job descriptions with required competencies.