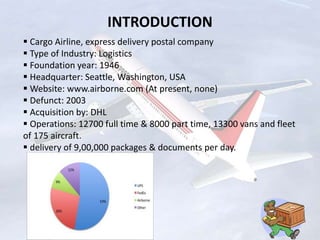

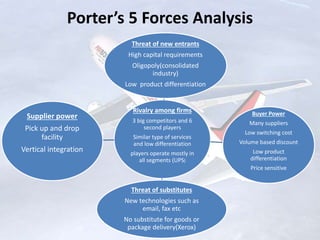

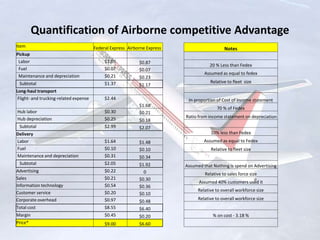

This document provides a case analysis of Airborne Express, a former cargo airline and express delivery company. It includes an introduction to the company's history and operations, as well as analyses of Porter's 5 Forces, Airborne's competitive strategies, its costs relative to FedEx, pricing approaches, and recommendations for strengthening its position. The document evaluates how industry structure has changed over time and the impact on attractiveness. It also analyzes Airborne's strategy of focusing on corporate clients, lower pricing, and metropolitan areas to differentiate itself from competitors.