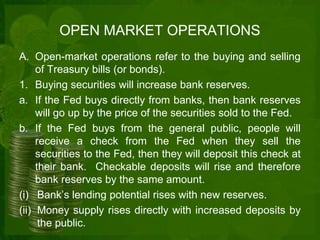

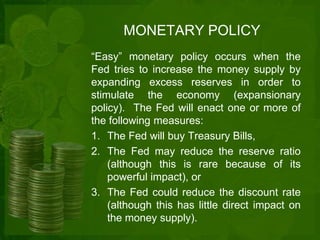

The Federal Reserve uses three main tools to implement monetary policy: open market operations, the reserve ratio, and the discount rate. Open market operations, which involve buying and selling Treasury securities, are the most important tool as they directly change the amount of bank reserves and money supply. The Fed conducts expansionary policy by buying Treasury securities to increase bank reserves and money supply, while contractionary policy involves selling securities to decrease reserves and money supply. The reserve ratio and discount rate can also expand or contract the money supply but are used less due to their greater impact.