The document discusses several monetary policy tools used by the Federal Reserve:

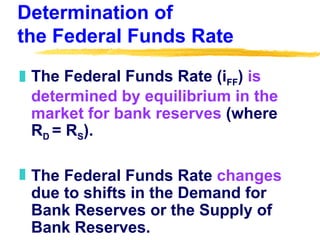

1) Open market operations, where the Fed buys or sells bonds to influence the money supply and interest rates. This is the most flexible and reversible tool.

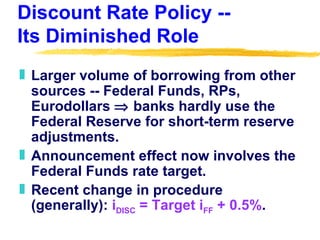

2) The discount rate, which is the interest rate banks pay to borrow from the Fed. Lowering this rate makes borrowing cheaper and expands the money supply.

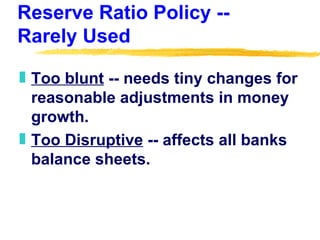

3) Reserve requirements, which set the minimum reserves banks must hold. Lowering these ratios expands the money supply by increasing bank lending capacity.