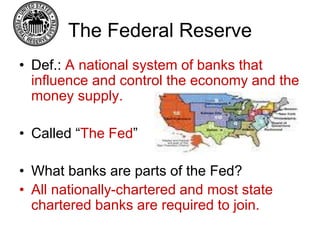

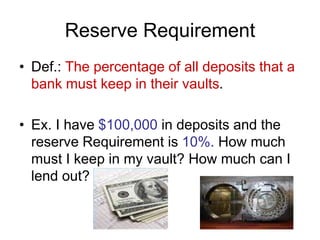

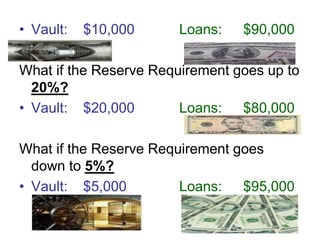

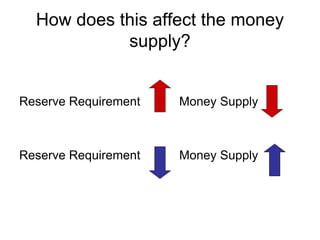

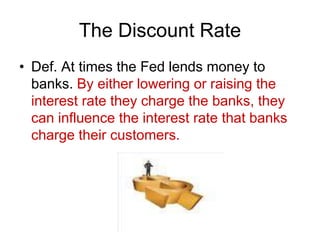

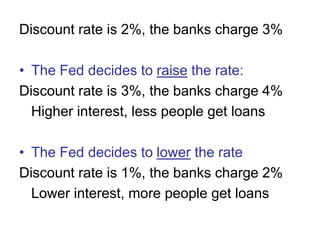

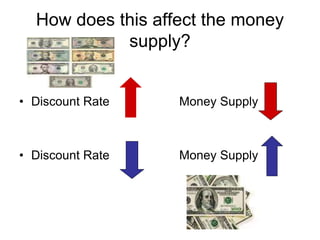

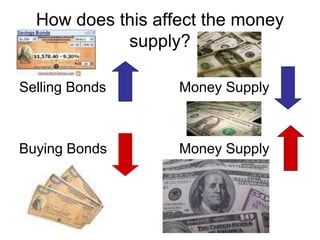

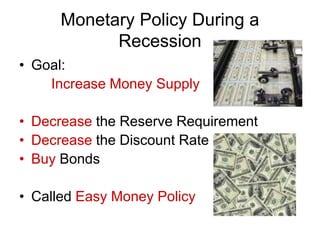

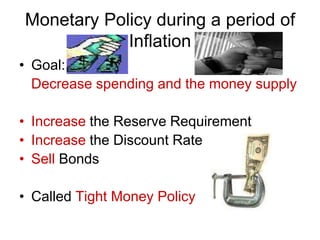

This document discusses monetary policy and the role of the Federal Reserve. It defines monetary policy as how the Federal Reserve influences the money supply to bring the country out of recession or inflation. It describes the Federal Reserve as the national system of banks that controls the money supply and economy. The Federal Reserve uses three tools - the reserve requirement, discount rate, and open market operations - to expand or contract the money supply and thus influence interest rates and spending levels in the economy. Raising the reserve requirement and discount rate and selling bonds decreases the money supply to curb inflation, while lowering them and buying bonds increases the money supply to boost a recession-plagued economy.