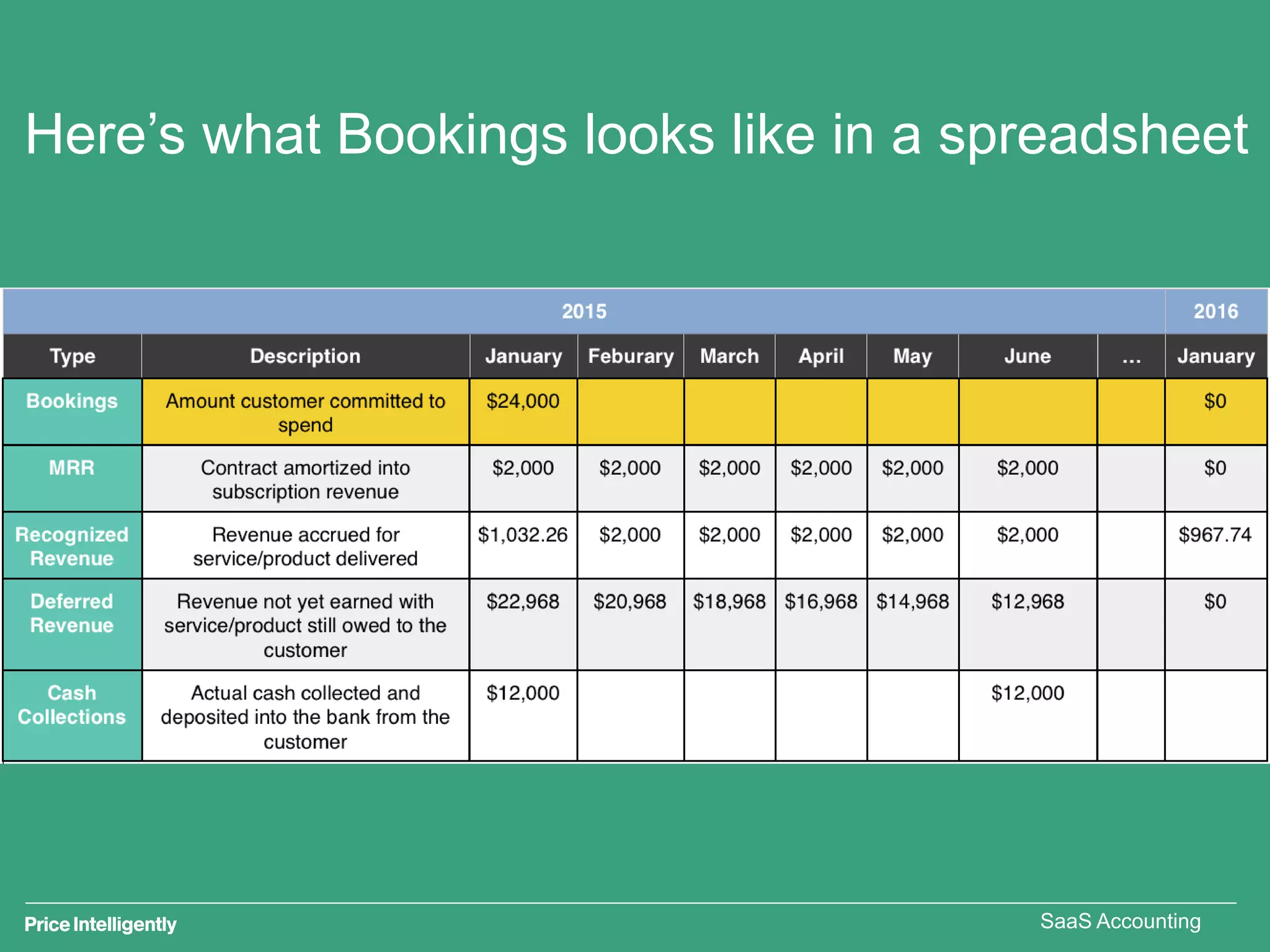

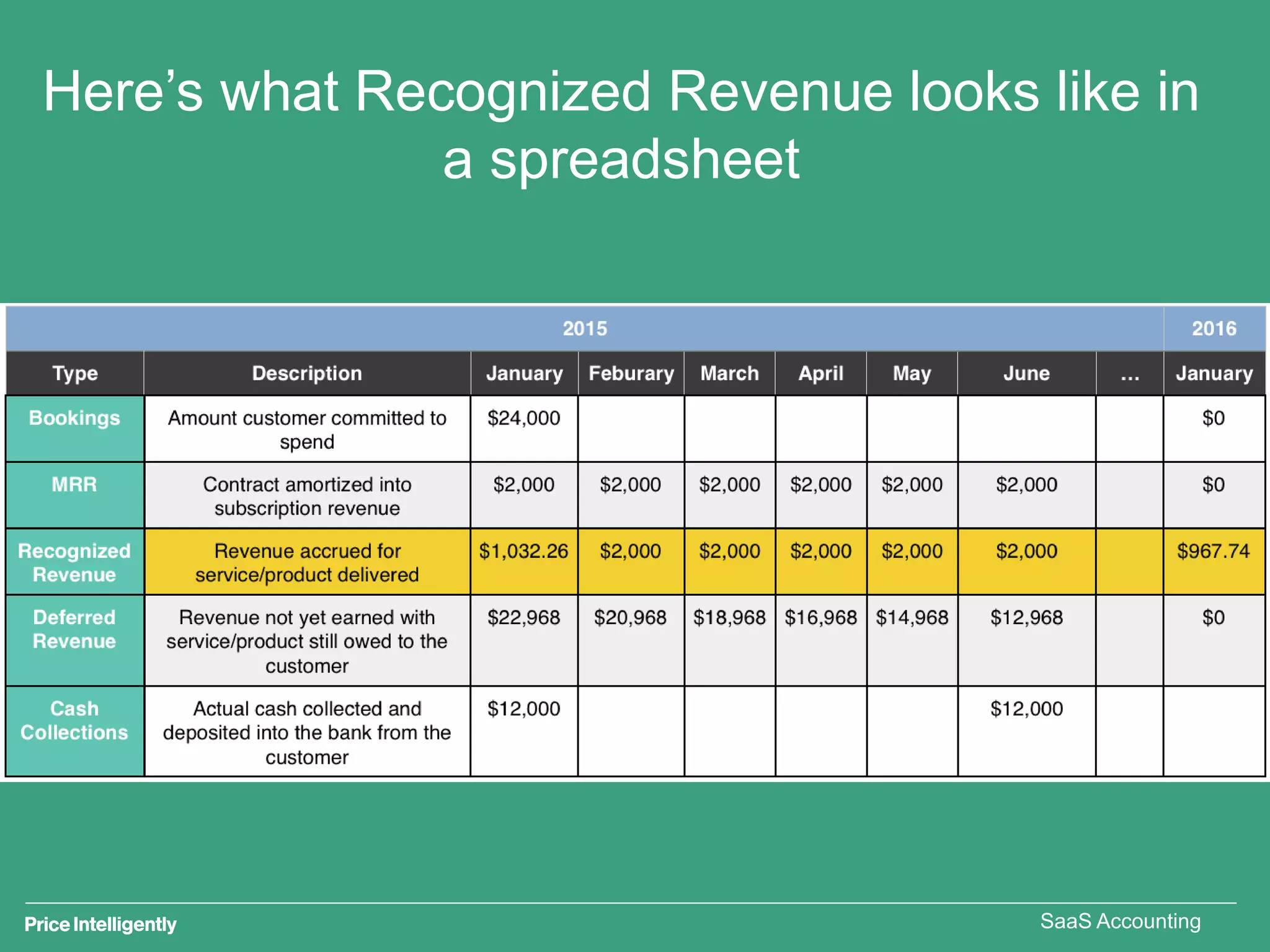

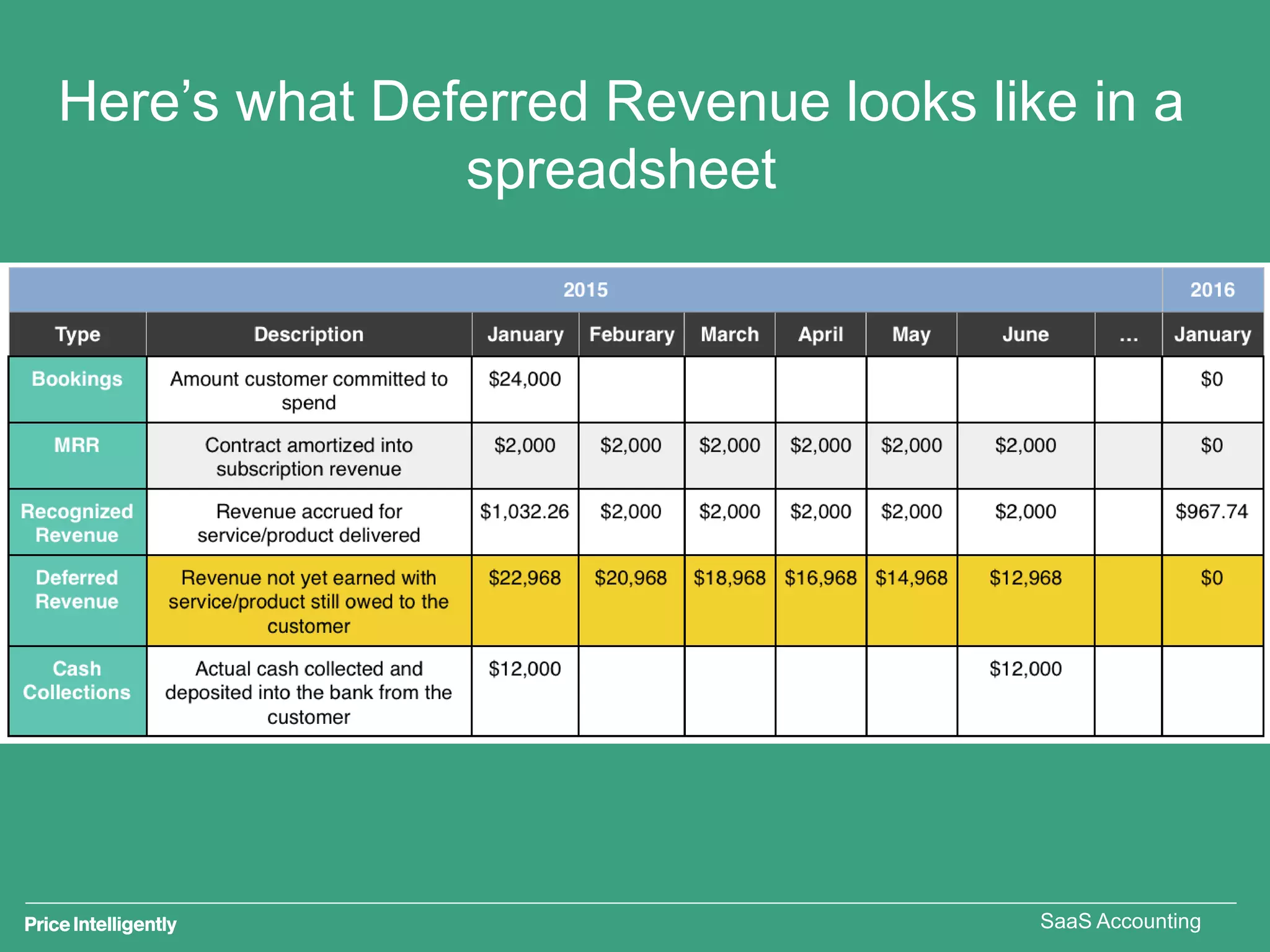

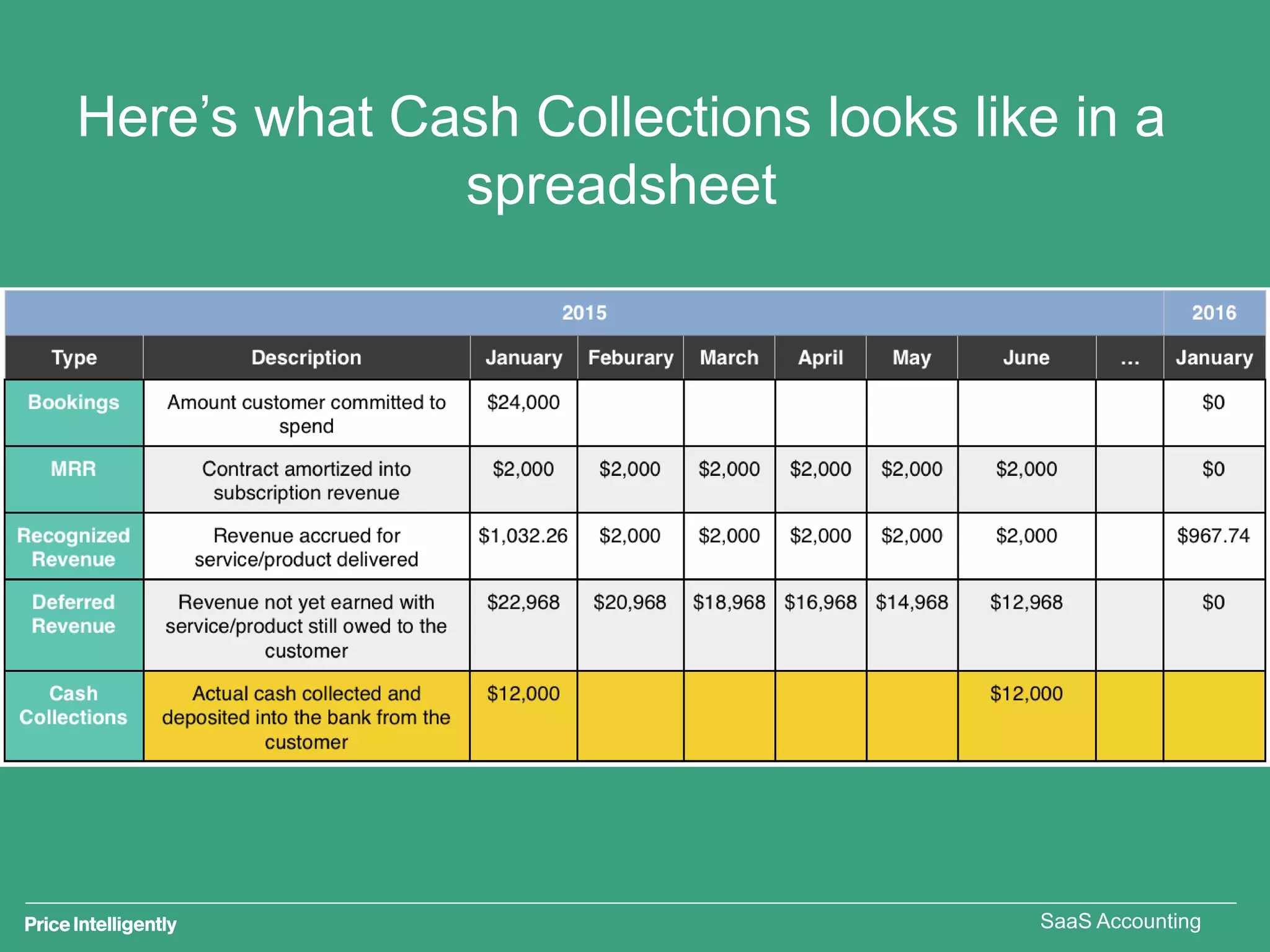

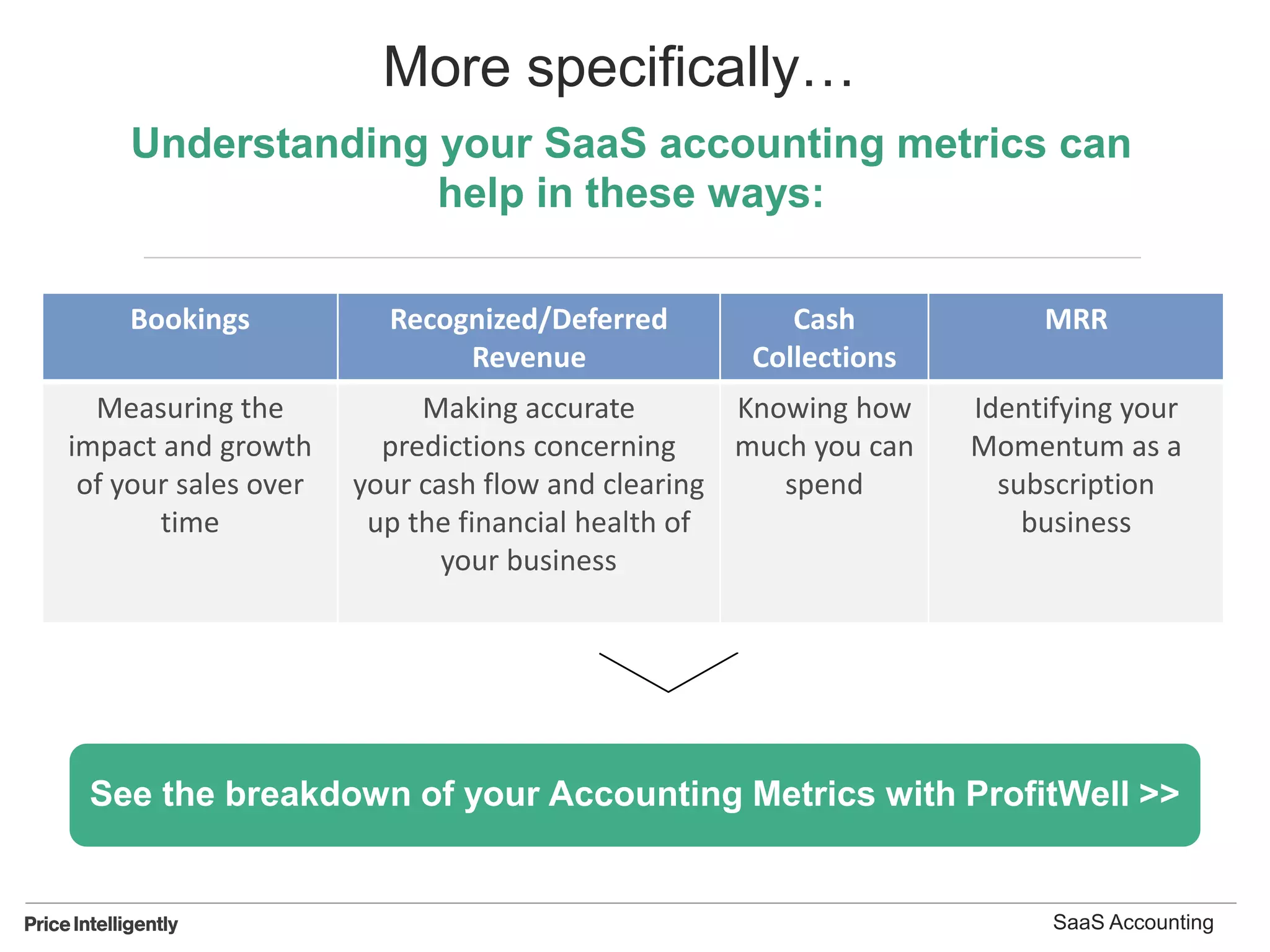

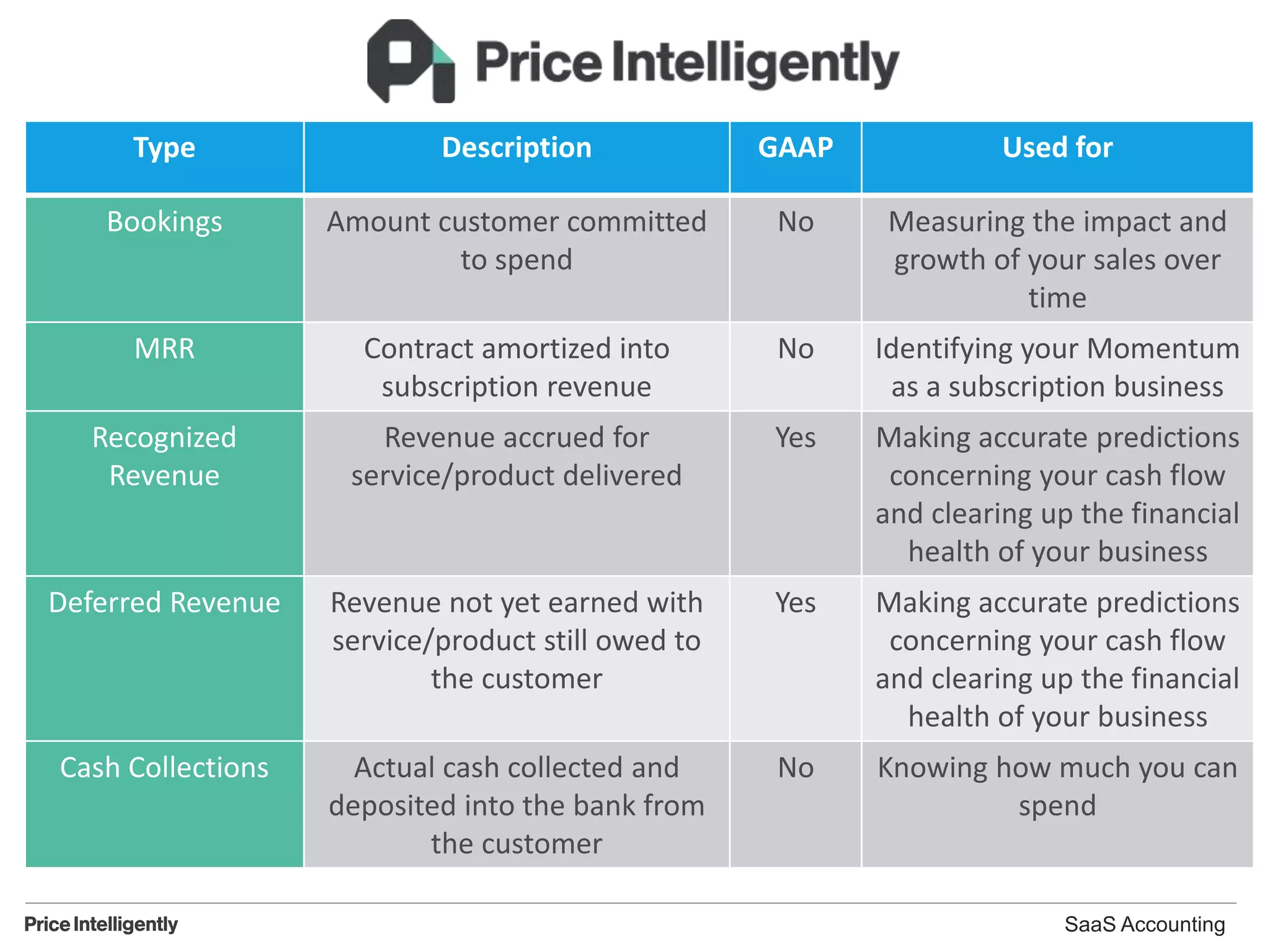

The document provides an overview of SaaS accounting metrics, focusing on key concepts such as bookings, recognized revenue, deferred revenue, and cash collections. It emphasizes the importance of tracking these metrics for accurate financial health insights and effective cash flow management. The document also encourages the use of tools like ProfitWell for real-time SaaS metrics analysis.