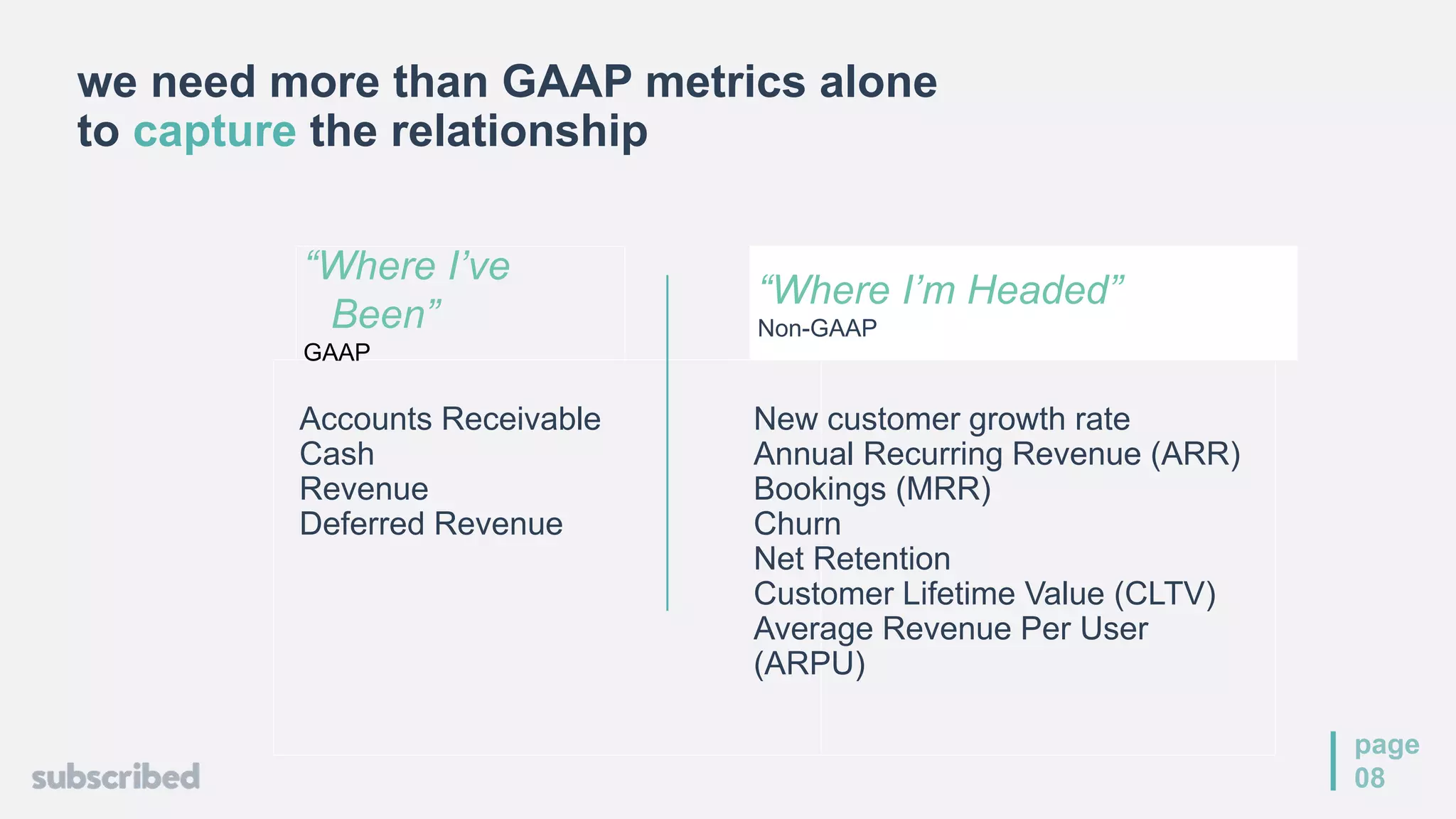

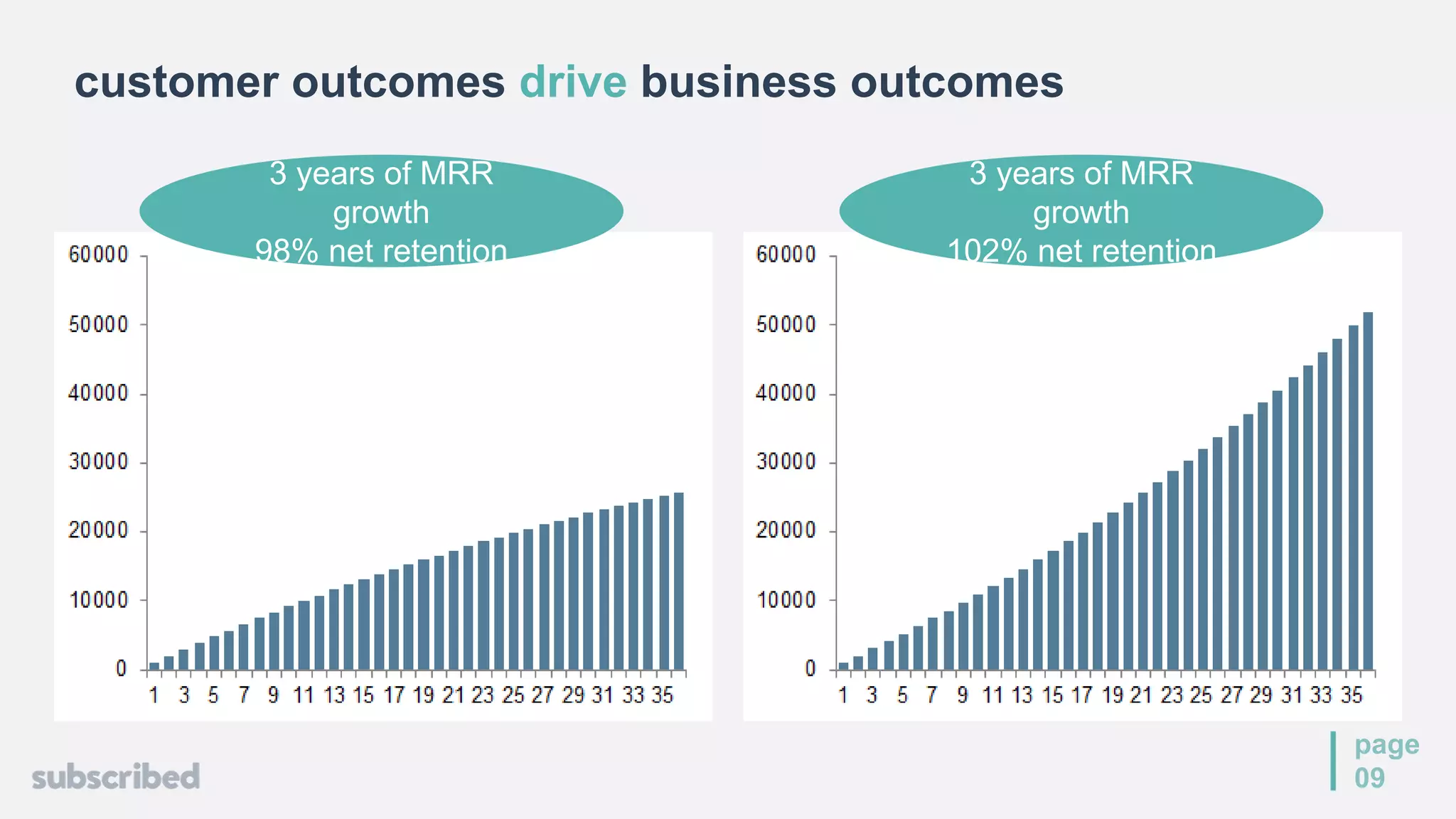

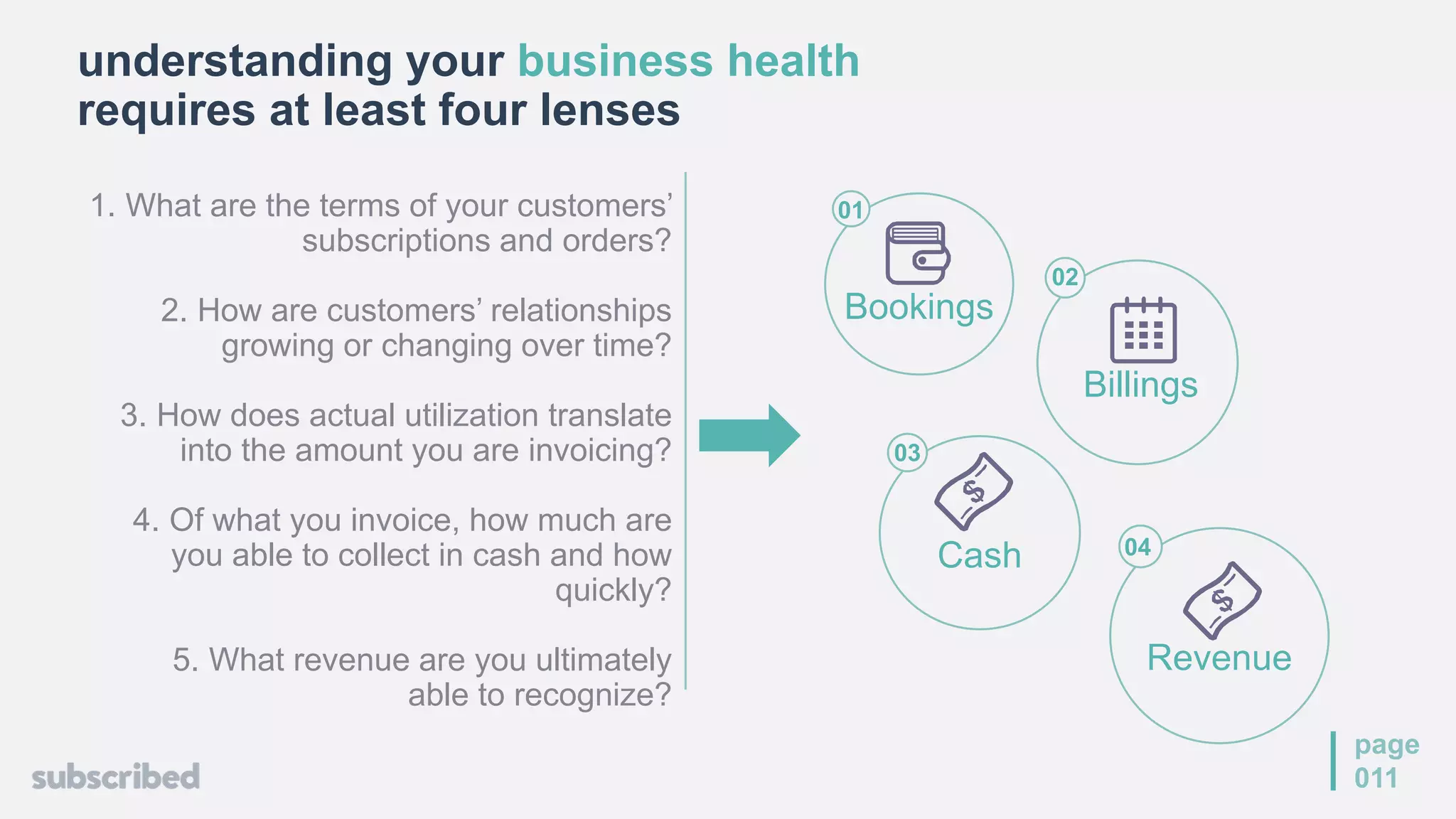

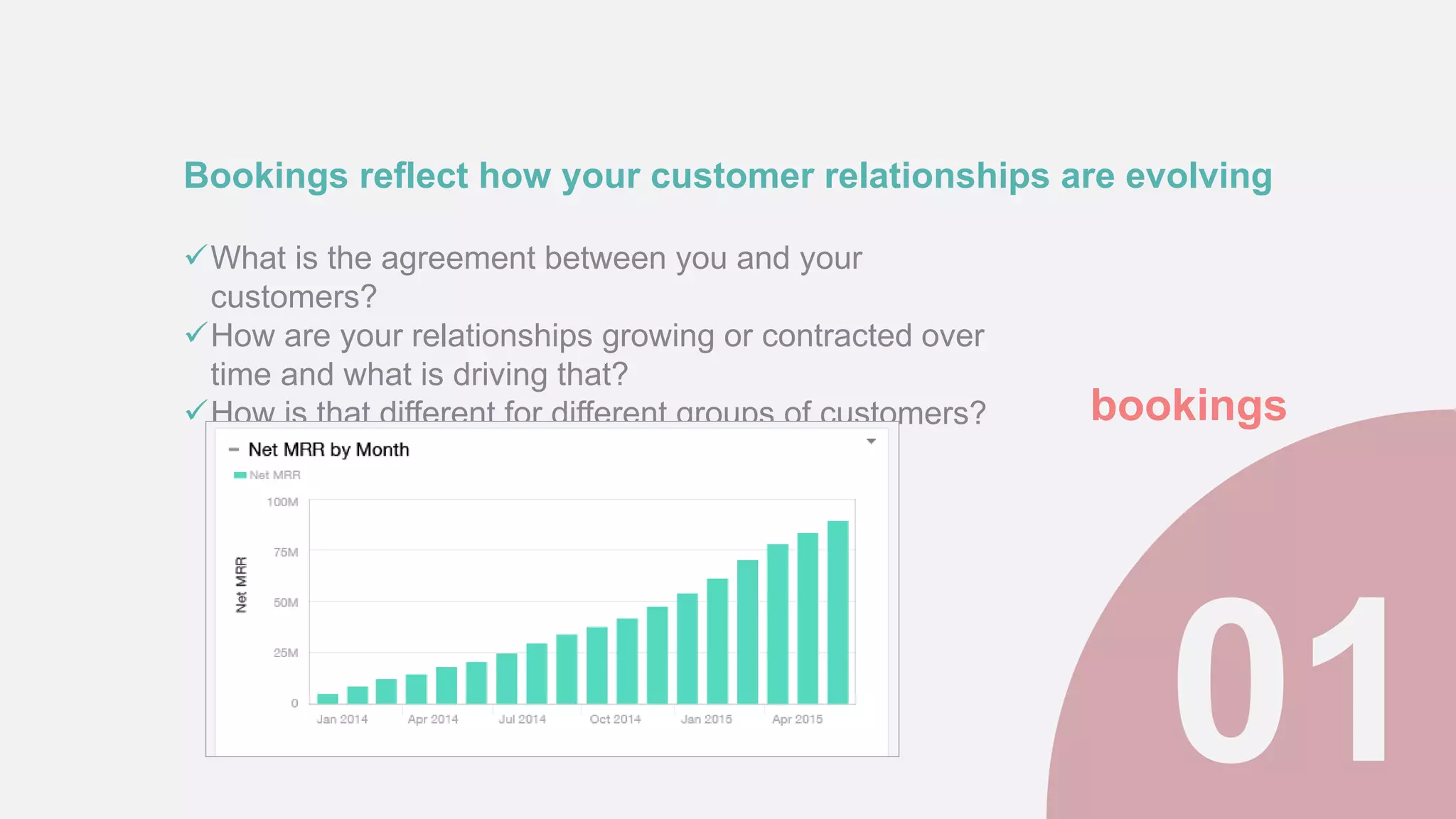

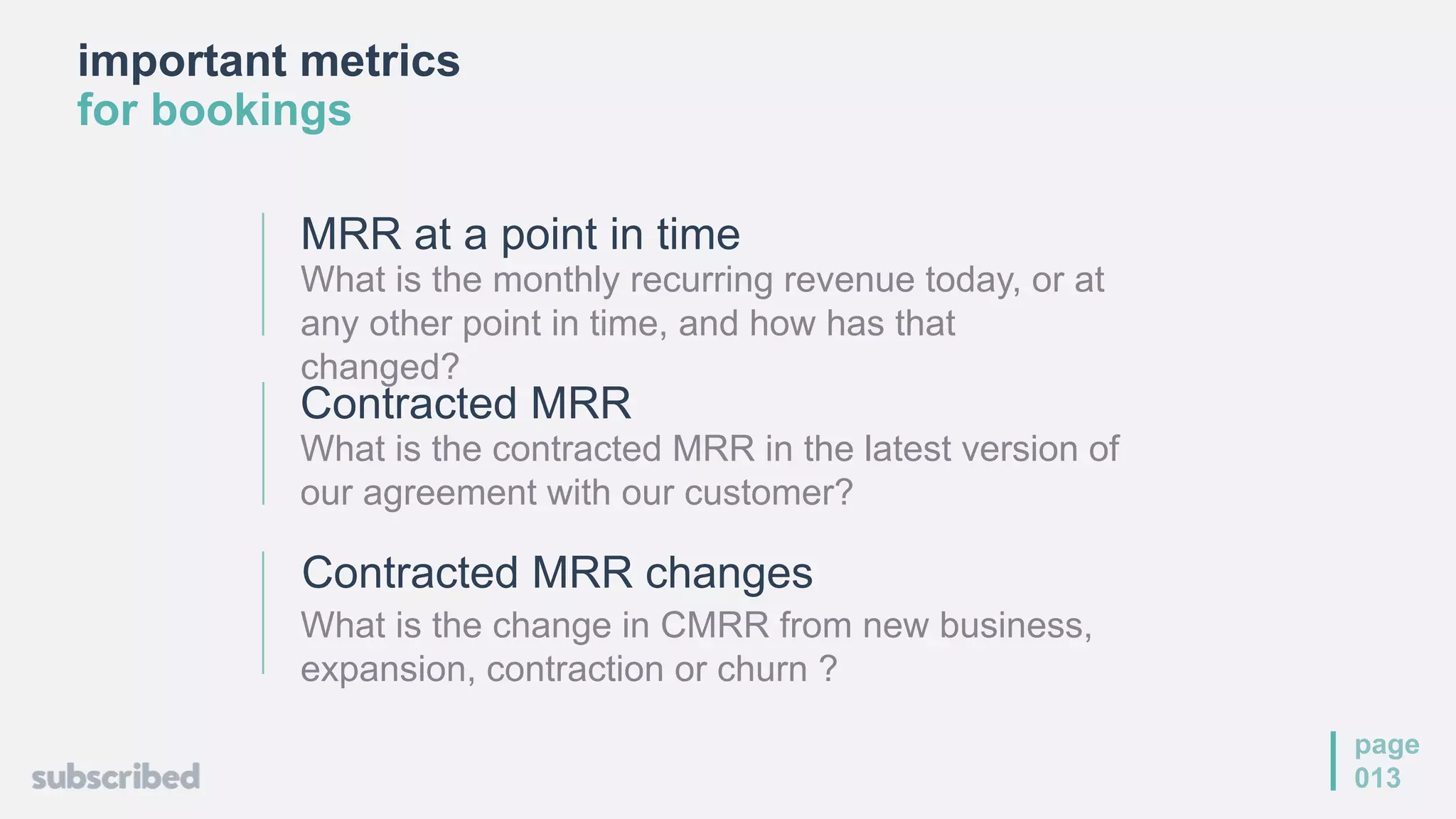

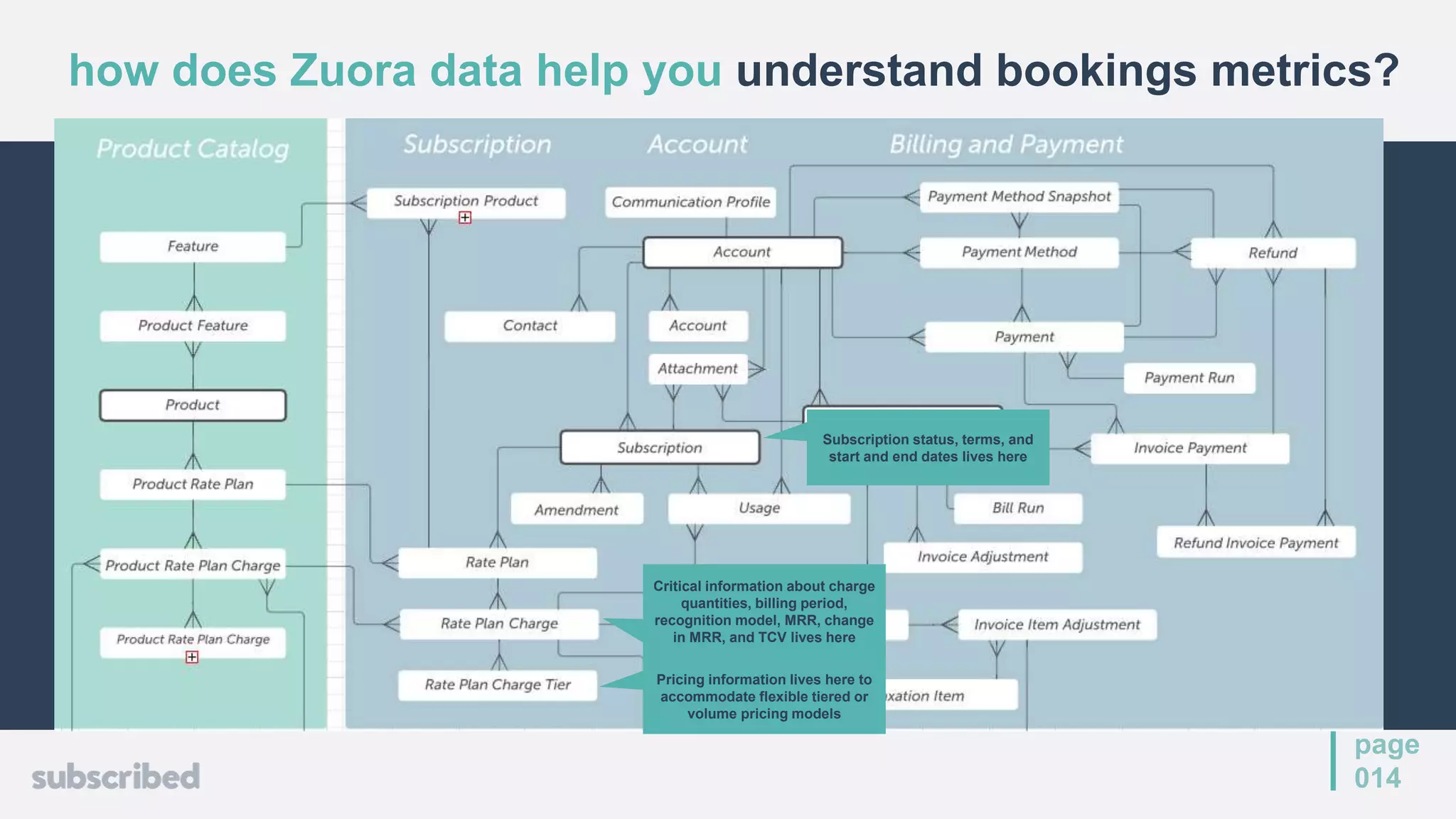

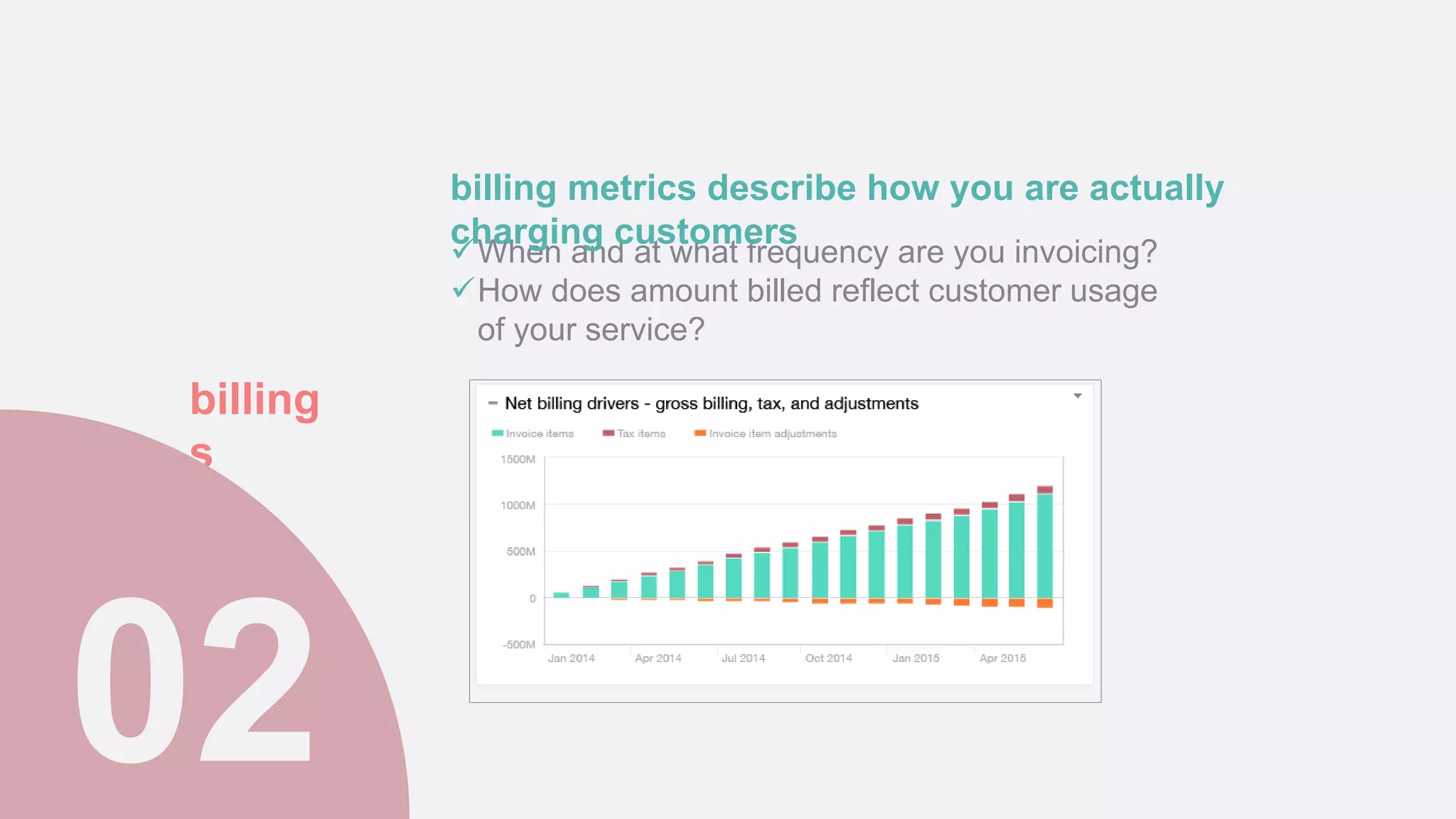

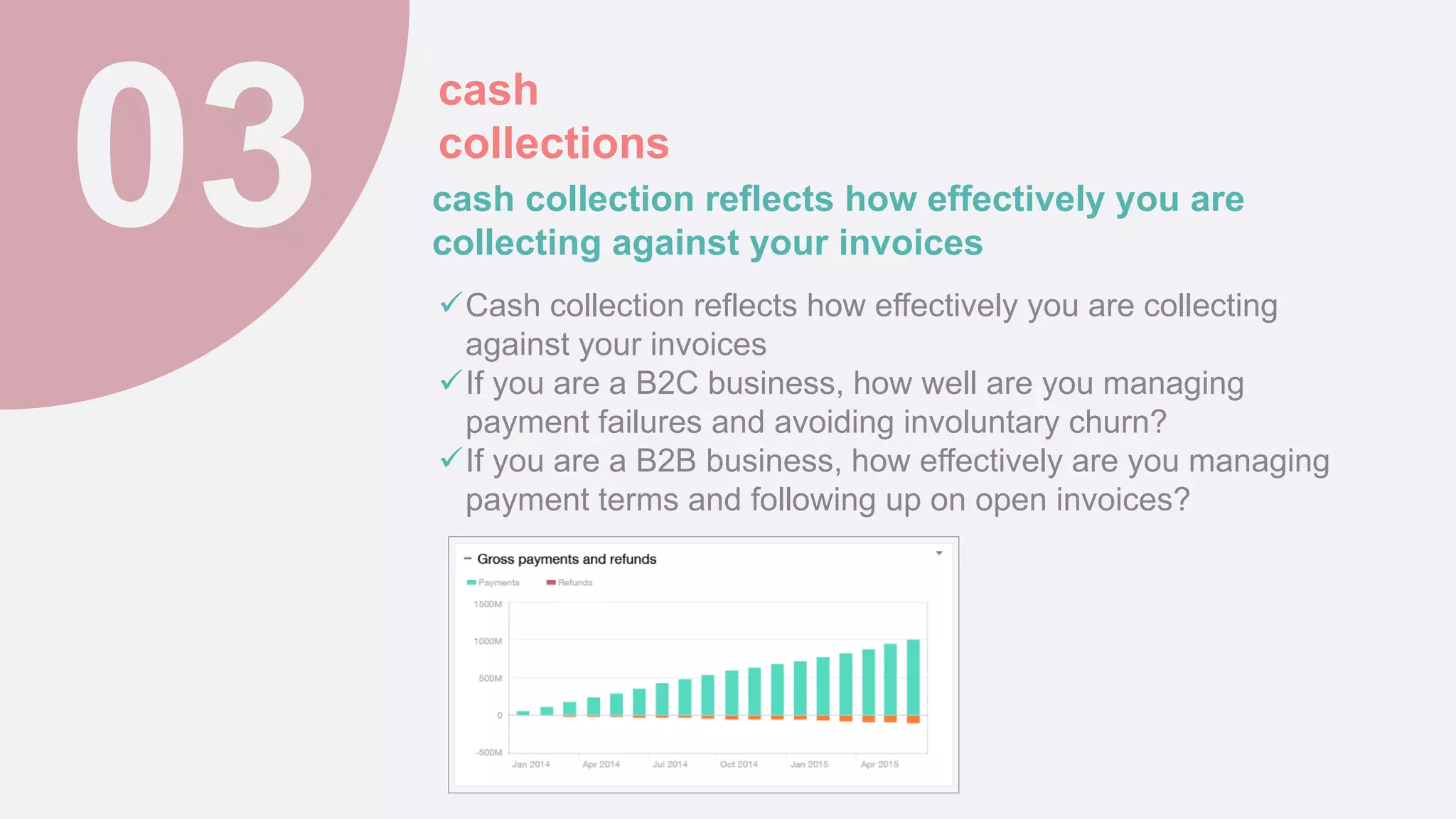

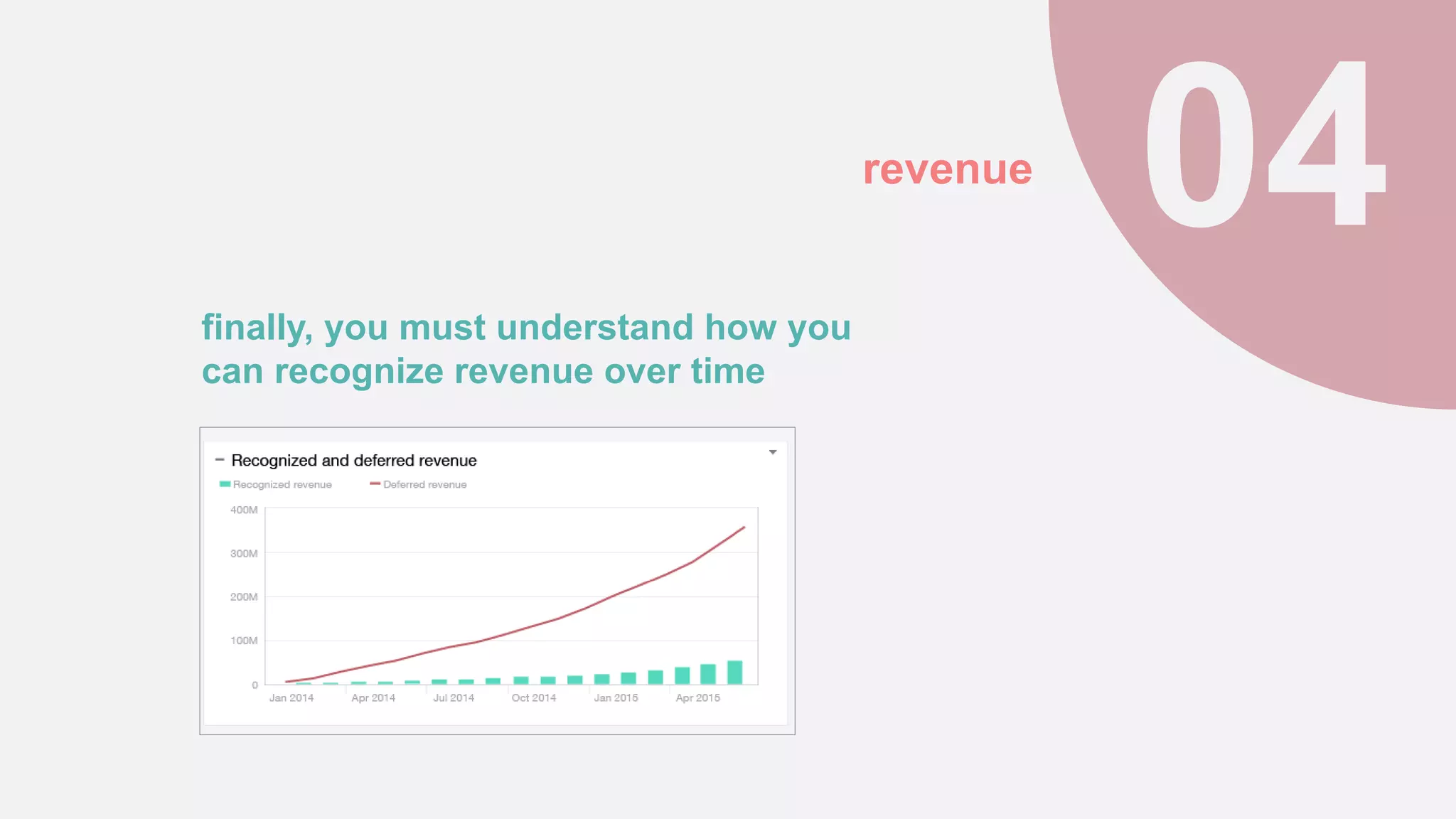

The document outlines the fundamentals of Zuora reporting metrics tailored for the subscription economy, focusing on key performance indicators such as bookings, billings, cash, and revenue recognition. It emphasizes the unique aspects of reporting in subscription models and the importance of analyzing customer relationships throughout their lifecycle. The presentation also showcases the Zuora report builder and provides insights into effectively managing and sharing subscription-related reports.