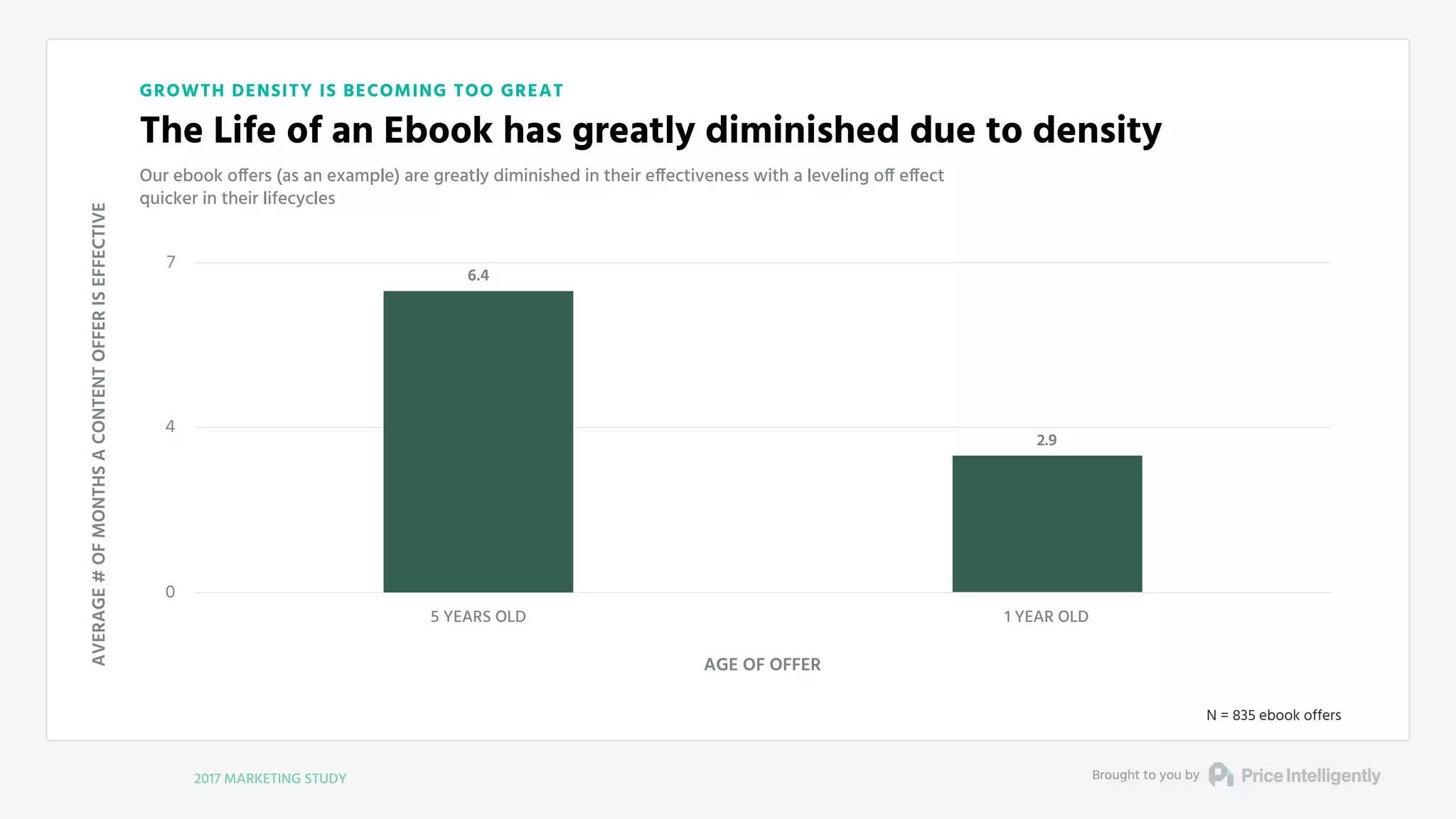

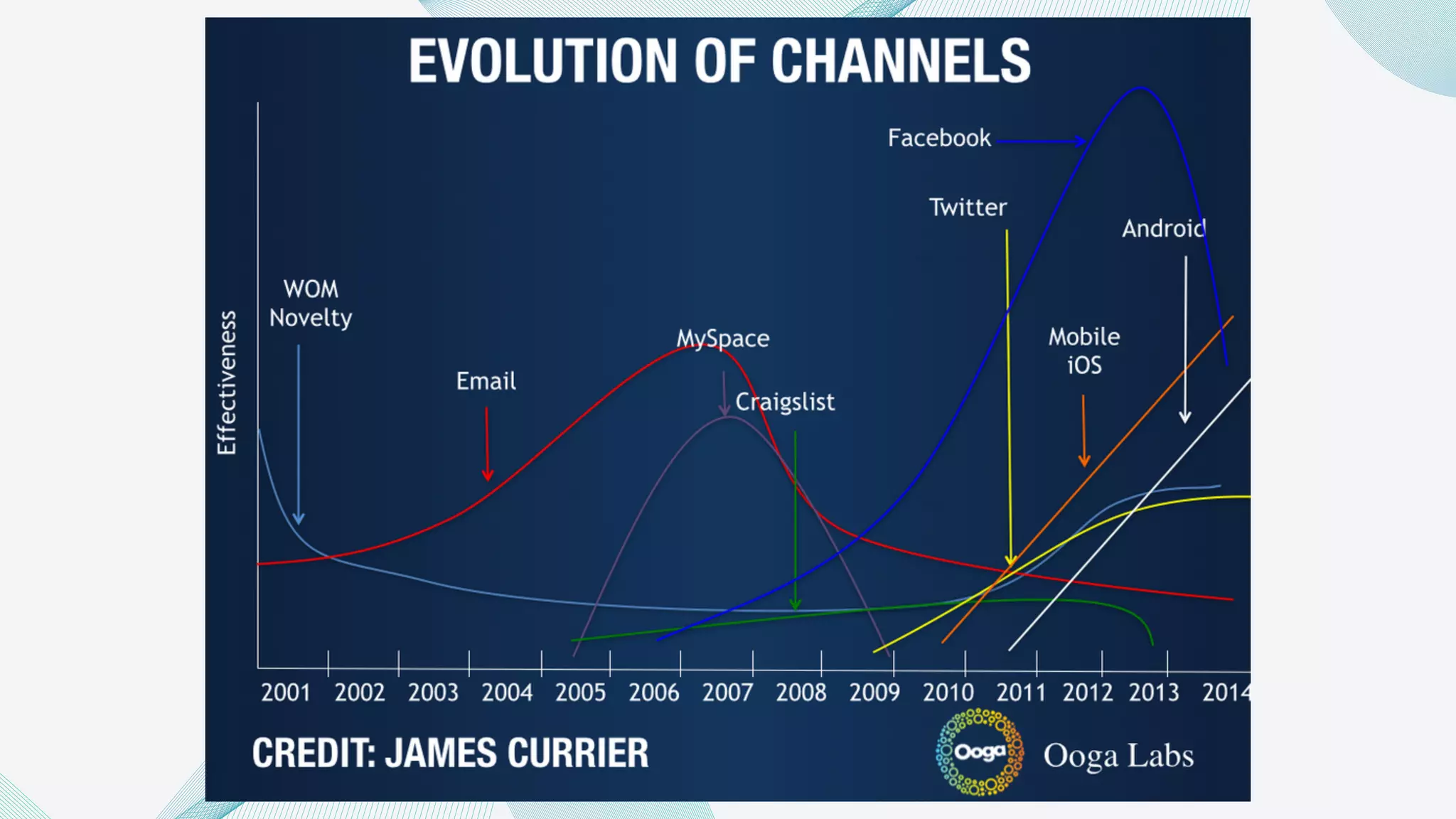

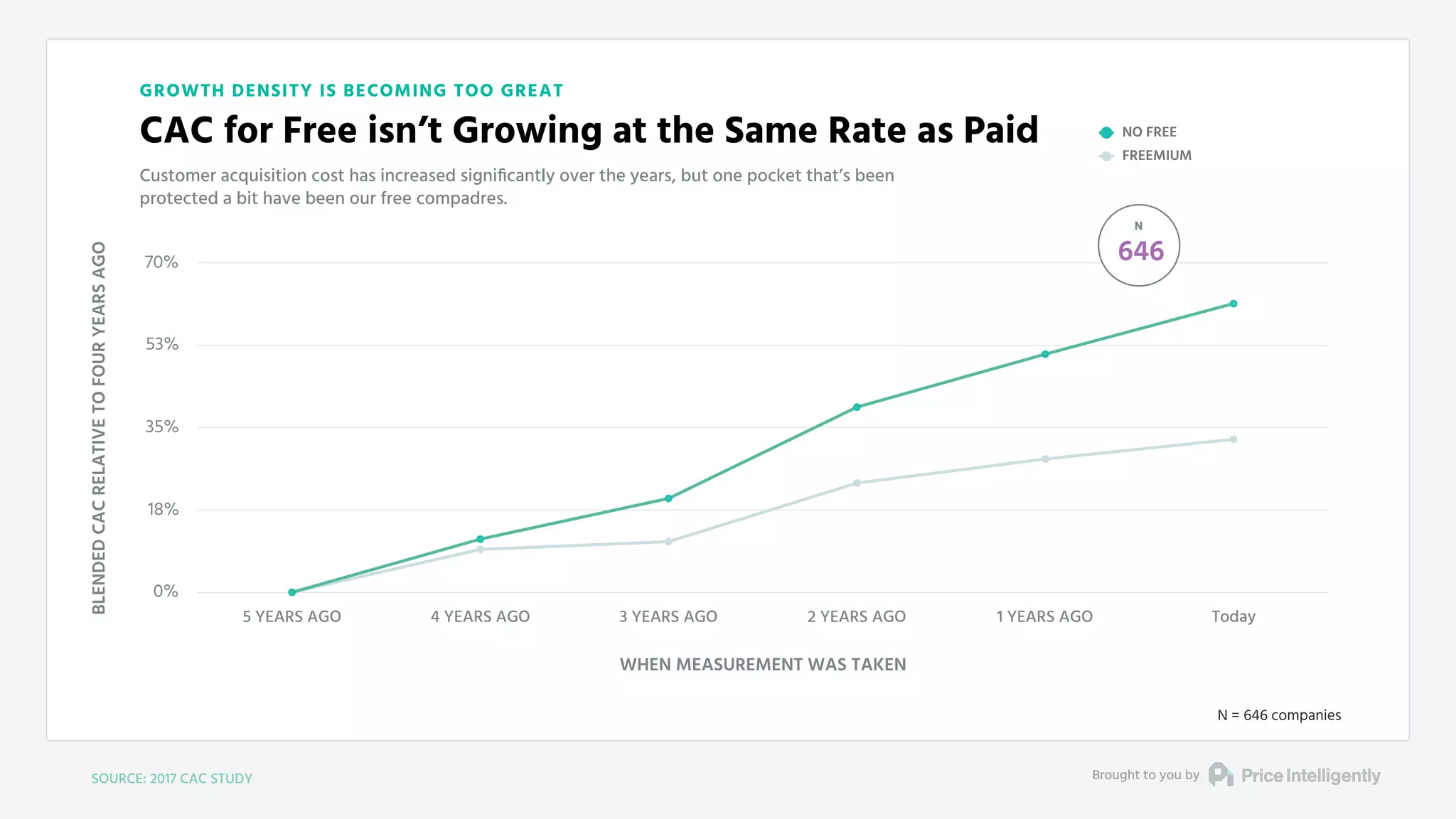

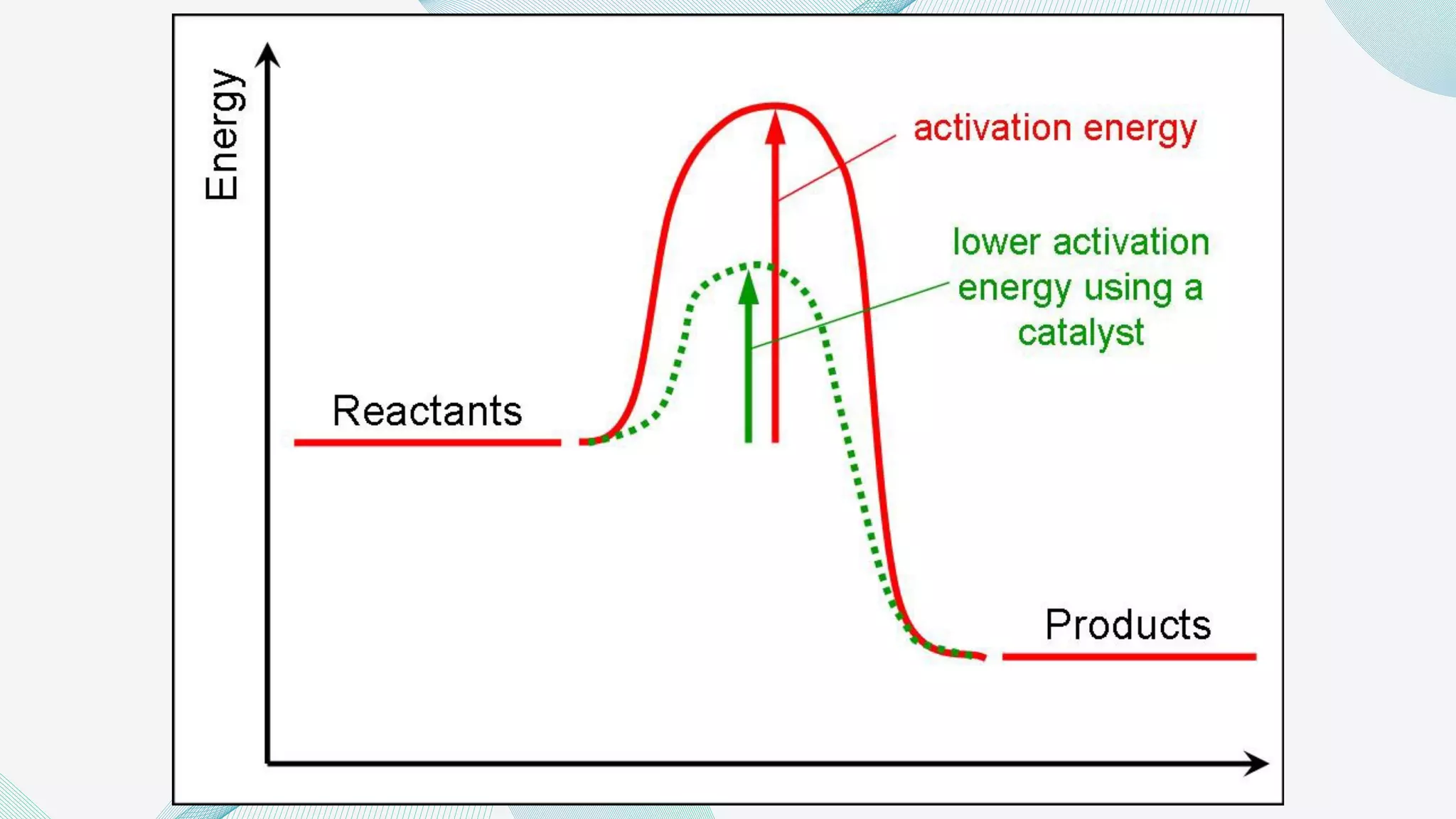

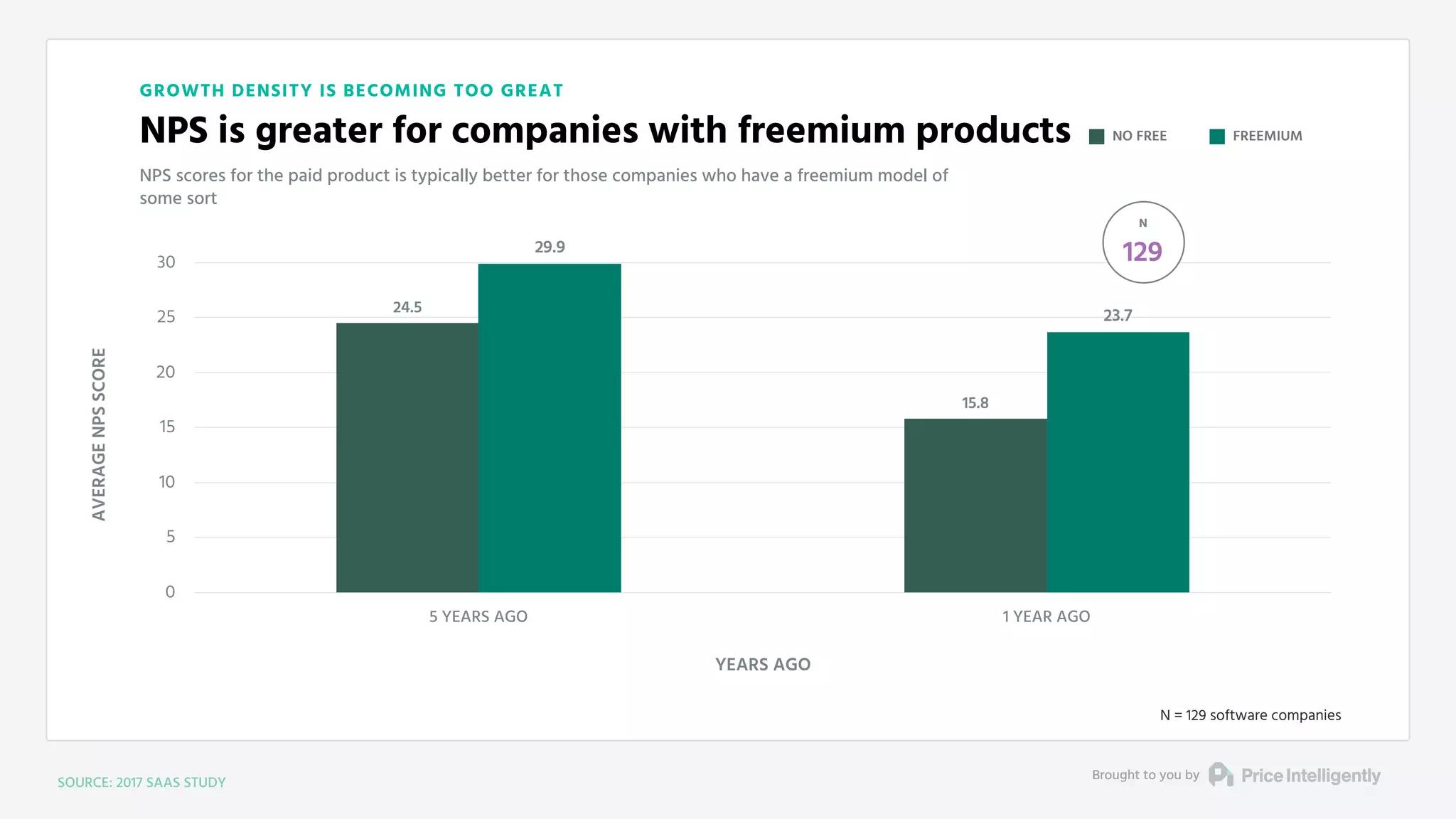

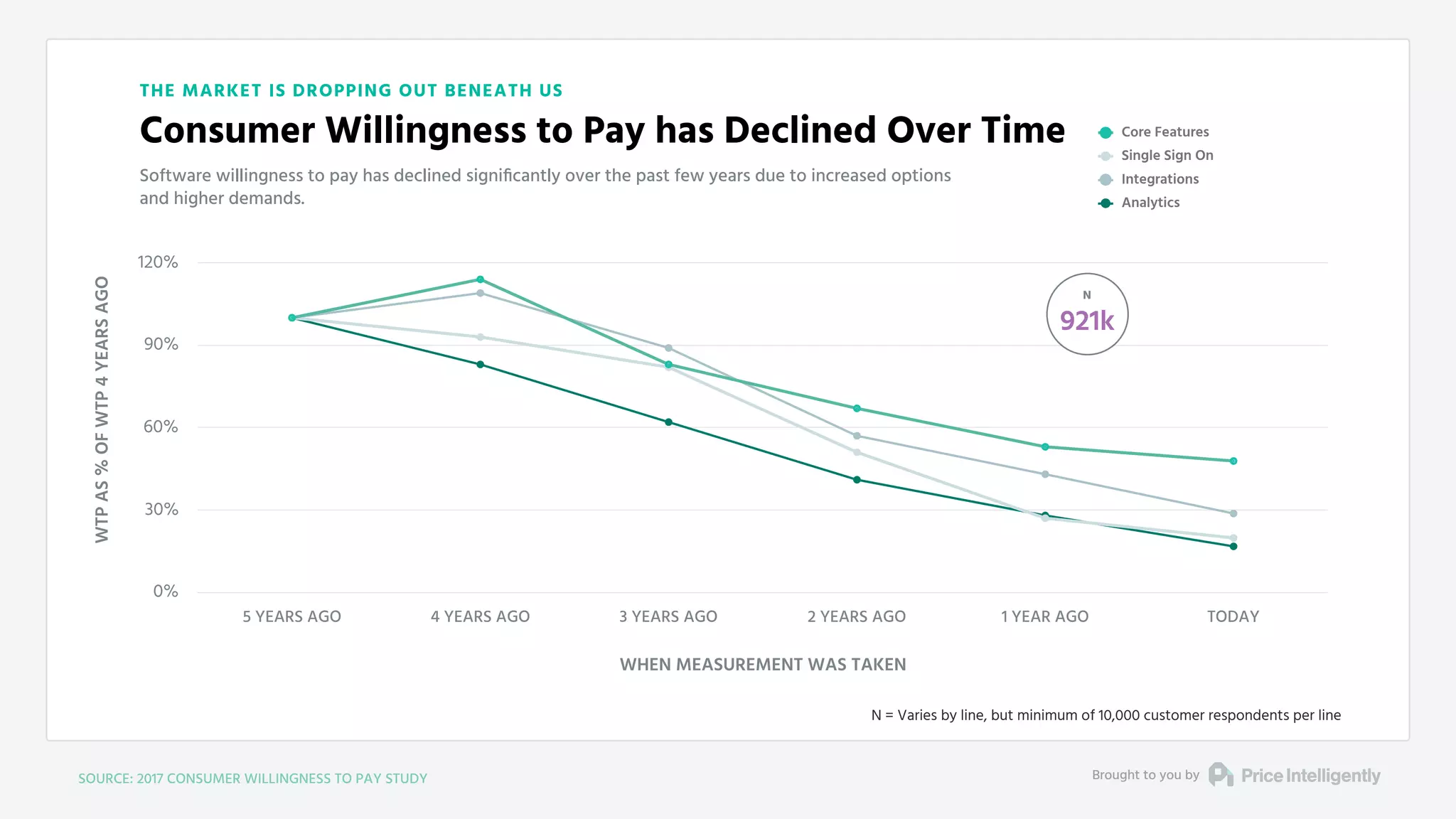

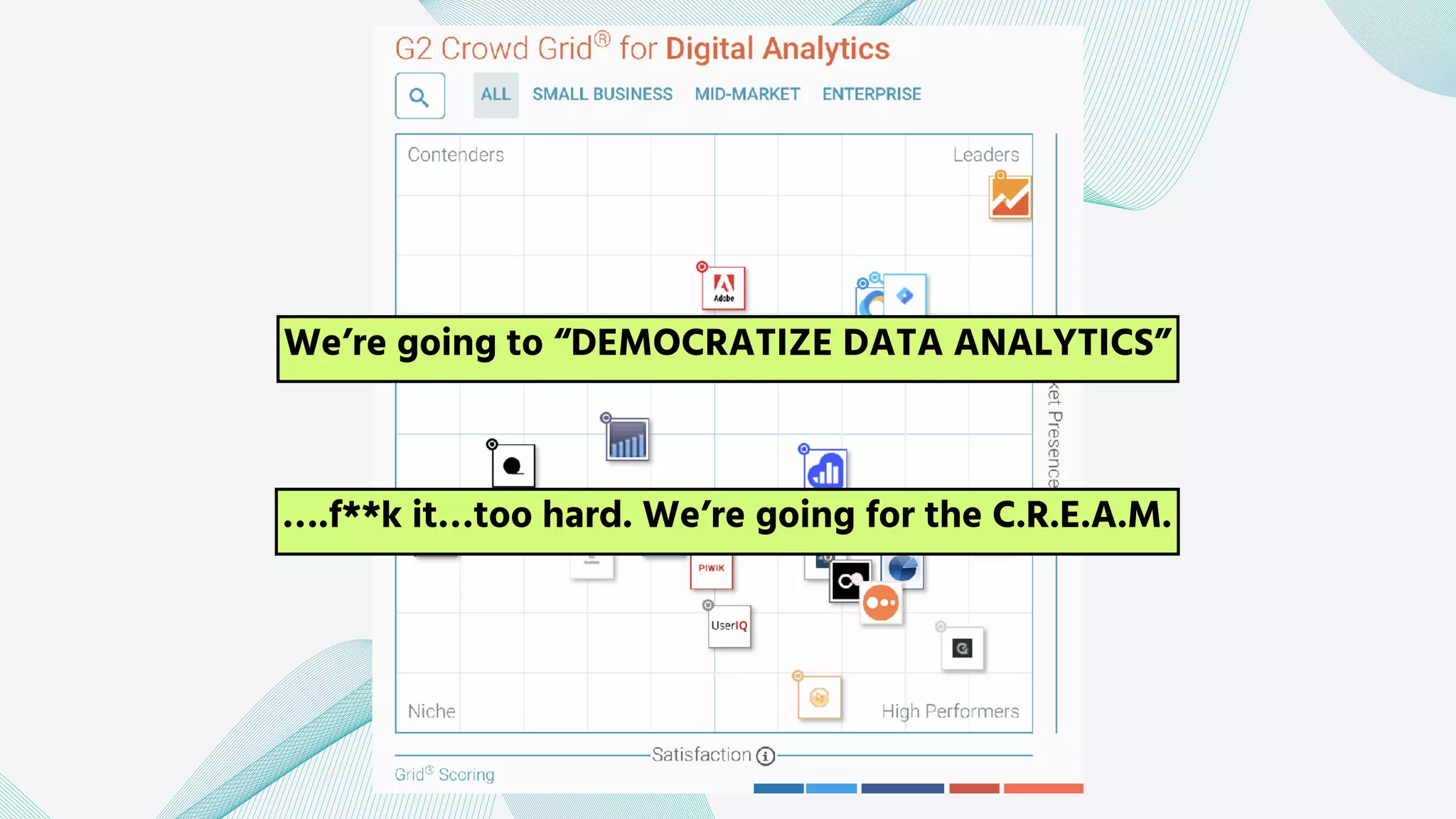

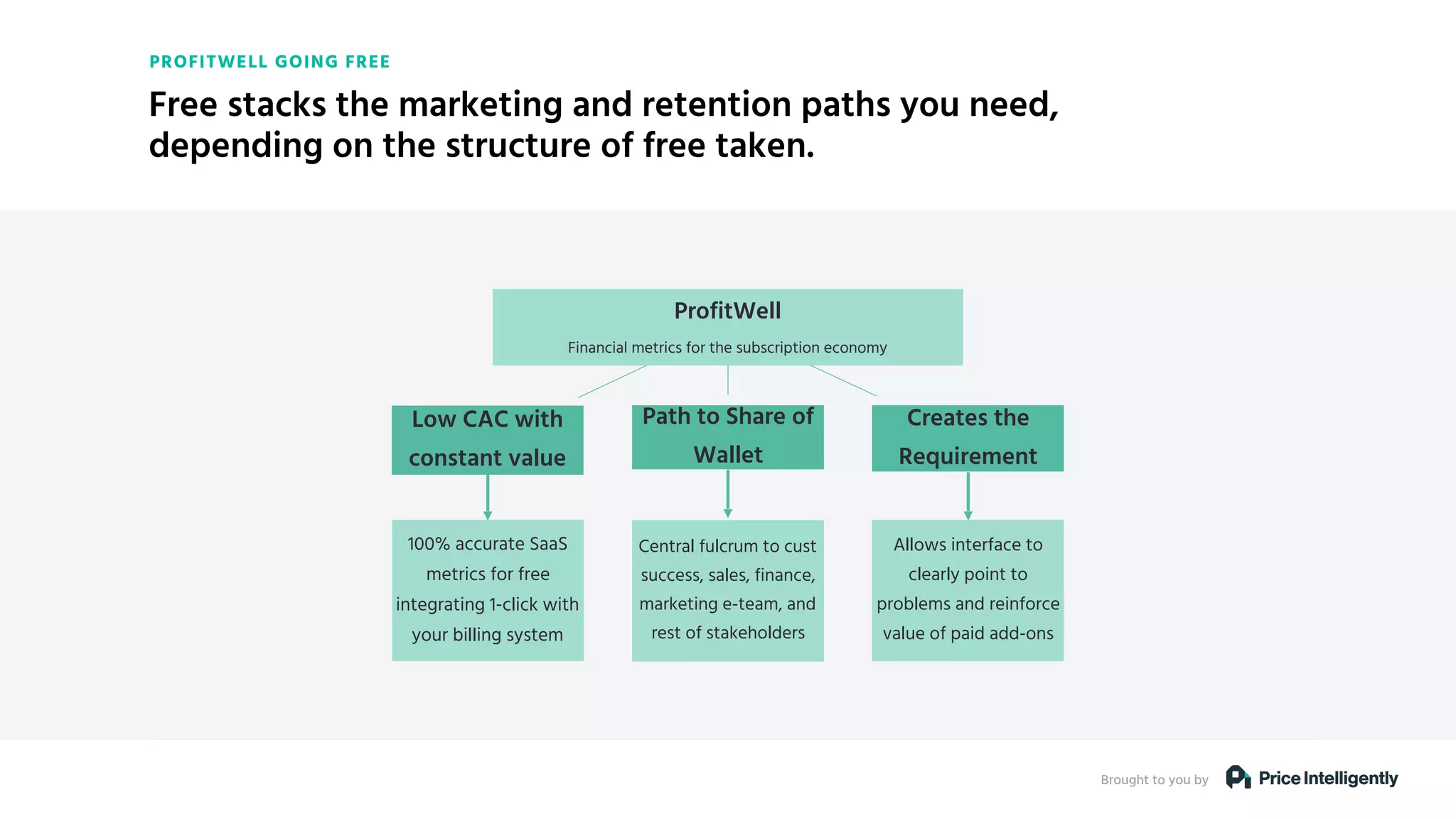

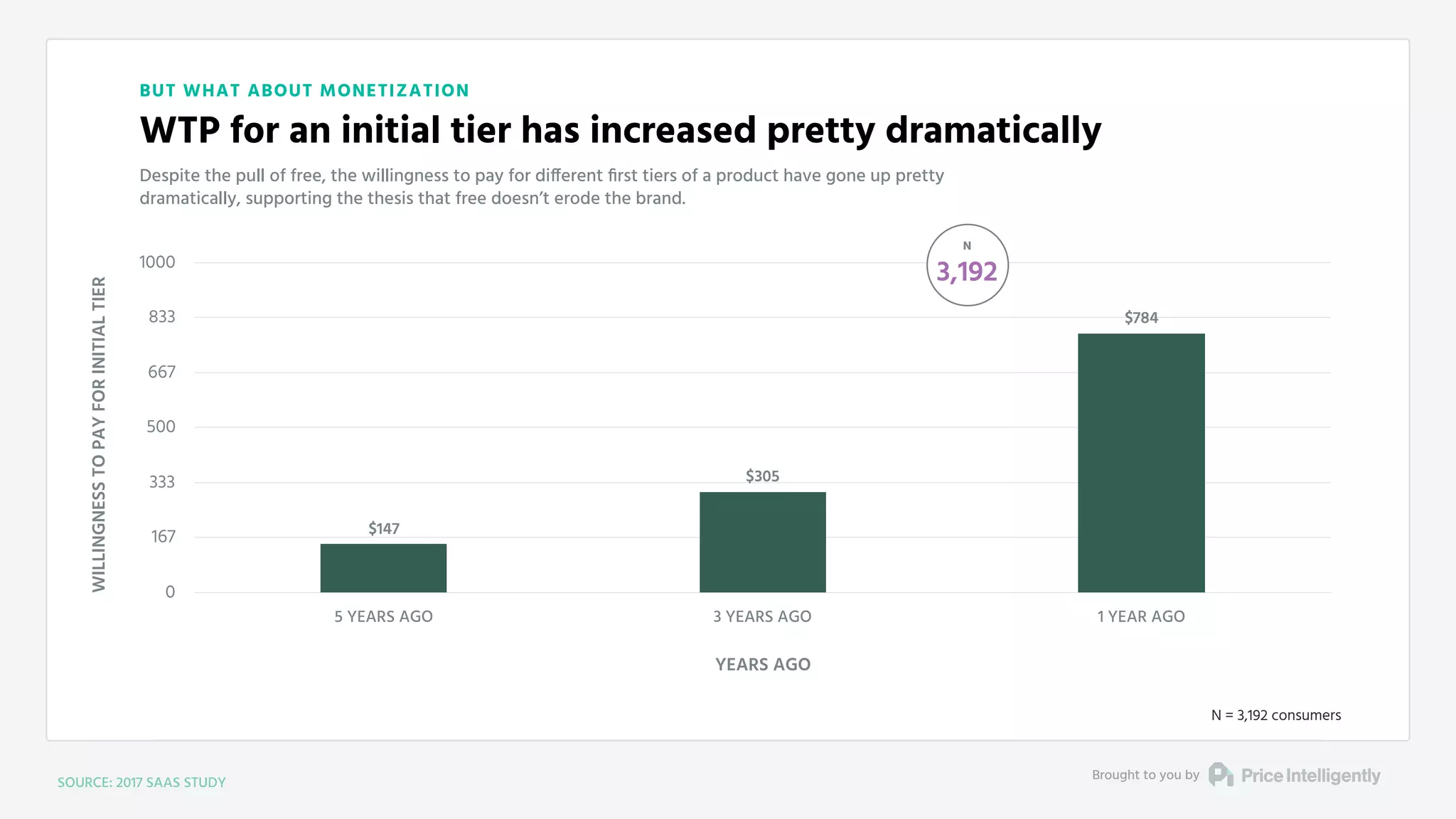

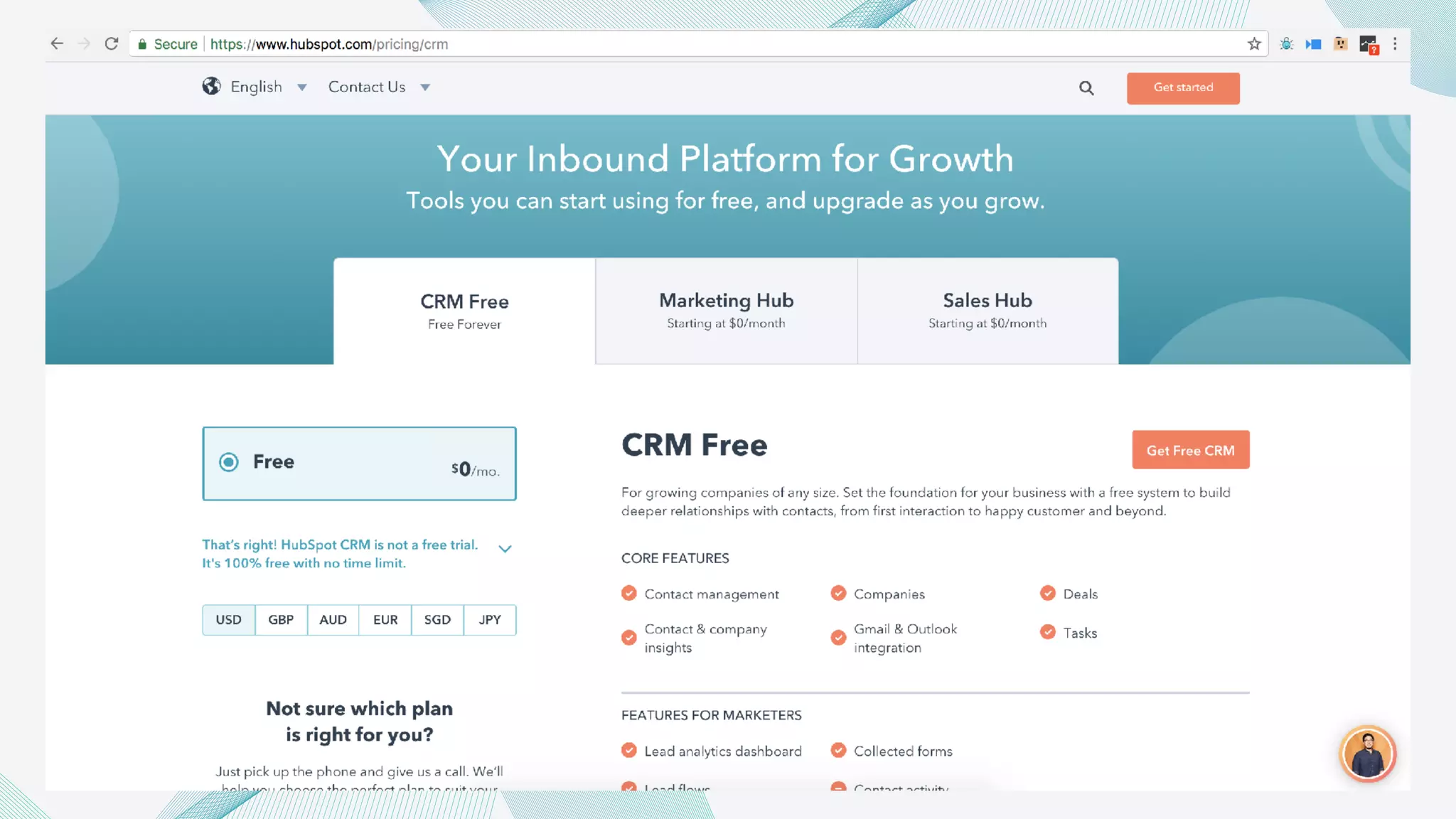

The document argues that the freemium model is essential for customer acquisition in a saturated market and can lower customer acquisition costs through free offerings. It highlights the importance of net dollar retention and customer engagement for companies using freemium strategies, showing better results compared to those without. Additionally, the document emphasizes that consumer willingness to pay has declined, necessitating companies to adapt their products and marketing approaches to remain competitive.