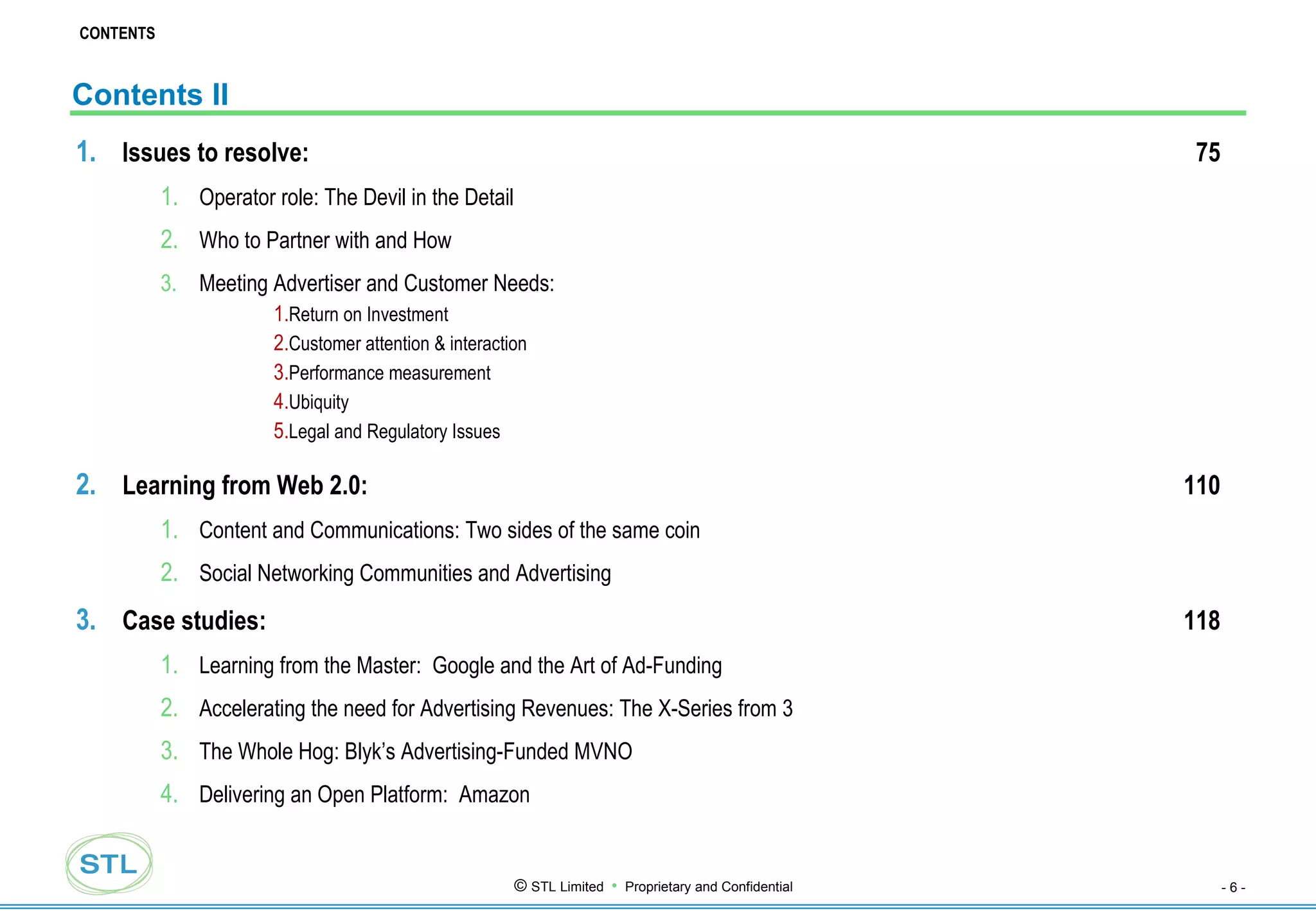

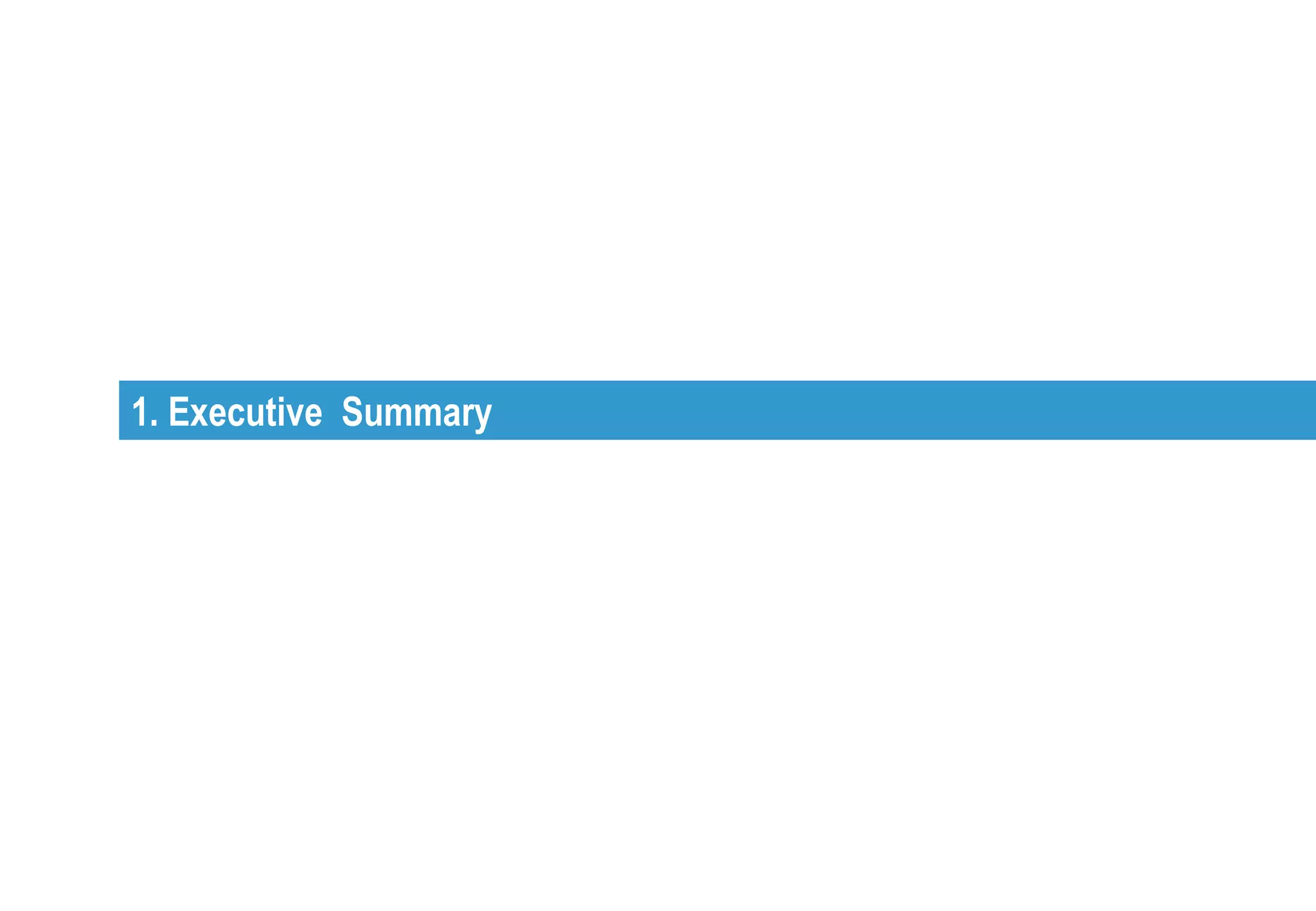

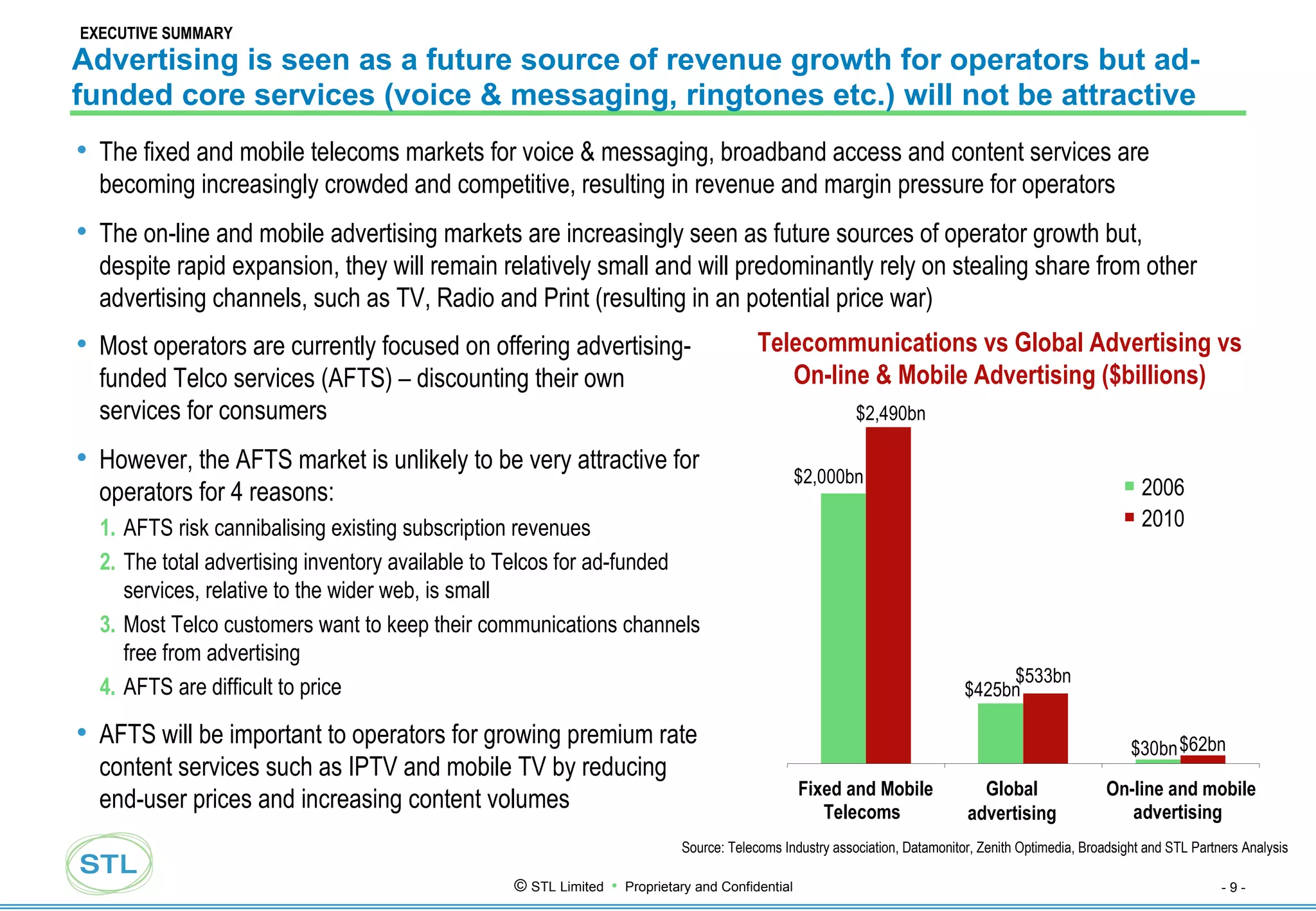

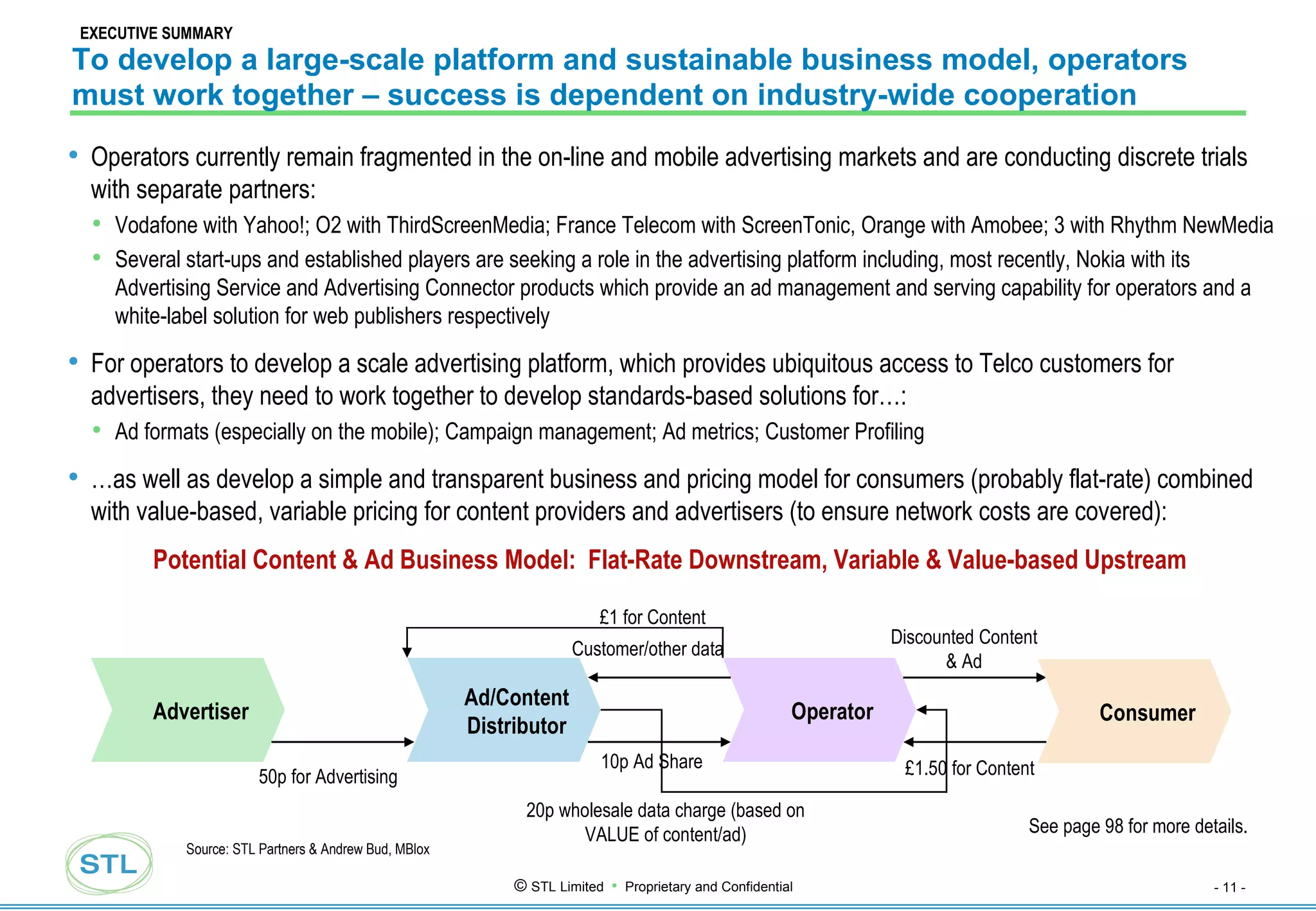

The document discusses the role of telecommunication companies (telcos) in the digital advertising value chain. It notes that while advertising-funded services are seen as a future revenue source, they are unlikely to be very attractive for telcos and risk cannibalizing subscription revenues. The big opportunity for telcos is to develop a large-scale advertising enablement platform leveraging their large customer base and customer data. However, telcos currently remain fragmented in pursuing this opportunity. To successfully develop a platform, telcos need to work together on open standards and provide an end-to-end solution through partnerships across the advertising value chain.

![Telcos’ Role in the Advertising Value Chain Market Study – Executive Summary www.stlpartners.com/telco2_research-analysis_ad-funded.php Chris Barraclough, STL Partners with support from Alan Patrick, Broadsight March 2007 Chris Barraclough [email_address] +44 (0)7932 043 808; +44 (0)207 193 9585; Skype:chrisbarraclough](https://image.slidesharecdn.com/telco-20-report-summary-telcos-role-in-advertising-value-chain-27051/75/Telco-2-0-Report-Summary-Telcos-Role-in-Advertising-Value-Chain-1-2048.jpg)

![About Broadsight Transforming Business for a Networked Century Broadsight's mission is to help companies take advantage of the dislocation and disruption these shifts will cause - and manage the risks involved. We are a strategic consultancy and system house specialising in broadband digital media. We have served large companies, startups, academic and government bodies in areas including: Interactive Advertising Media – Fixed and Mobile Multimedia OSS / Service Management systems IPTV, Web TV and Digital TV services Web 2.0 based business transformation New Media Business Strategy and launch Digital Multimedia Systems Design Contact Alan Patrick www. broadsight.com [email_address] Weblog www.broadstuff.com ABOUT BROADSIGHT](https://image.slidesharecdn.com/telco-20-report-summary-telcos-role-in-advertising-value-chain-27051/75/Telco-2-0-Report-Summary-Telcos-Role-in-Advertising-Value-Chain-4-2048.jpg)

![Telcos need to provide an end-to-end ad platform solution – this will require strong partnerships across the value chain and best-in-class CRM tools Many operators’ advertising aspirations are currently too narrow: Focusing on providing advertisers with reach to their customer base, together with some customer profiling information to facilitate ad targeting Operators need to provide an end-to-end solution via partnerships based on open standards: Each operator’s ad platform may be different but they need to be open and interoperable (just as each fixed and mobile network is discrete but interoperable) For ad-enablement and provision of AFTS operators will need to develop their customer data mining and customer relationship management capabilities: To better understand the economics of advertising across each micro-segment and to provide targeted content and advertising offers Publishing Consumer Targeting Distribution Creation & Production Consumer Current Telco platform focus Location Customer Profile Real-time service usage Campaign management Metrics collection Customer service Ad distribution Service usage data Service hosting & support Distribution service management Billing & Collection Ad service delivery Service management Potential Telco platform focus How broad is your advertising platform? Source: Broadsight and STL Partners Analysis The new Telco 2.0/GSMA Market Study provides guidance on how to achieve this. Details: www.stlpartners.com/telco2_research-analysis_ad-funded.php [email_address] EXECUTIVE SUMMARY](https://image.slidesharecdn.com/telco-20-report-summary-telcos-role-in-advertising-value-chain-27051/75/Telco-2-0-Report-Summary-Telcos-Role-in-Advertising-Value-Chain-12-2048.jpg)