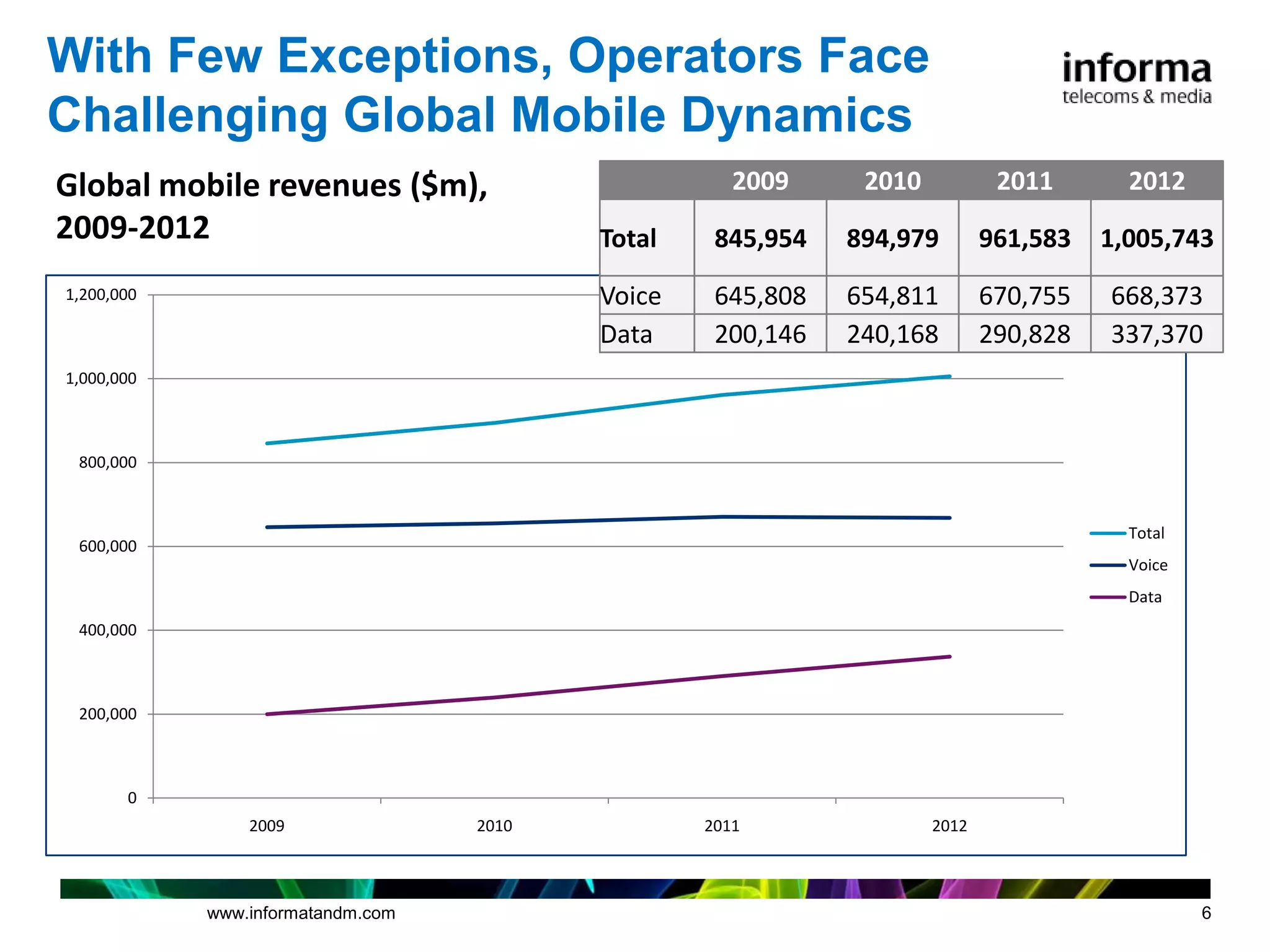

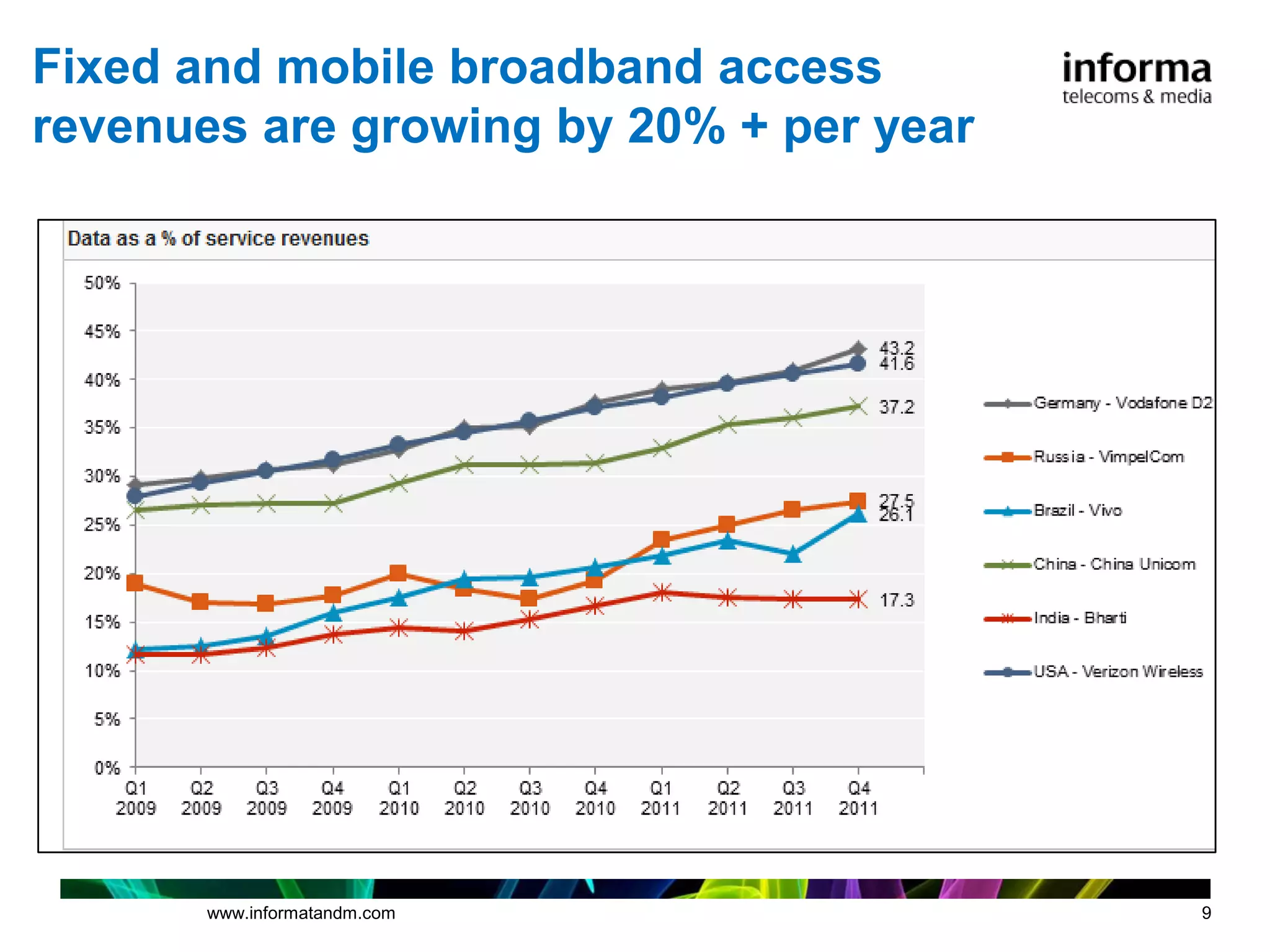

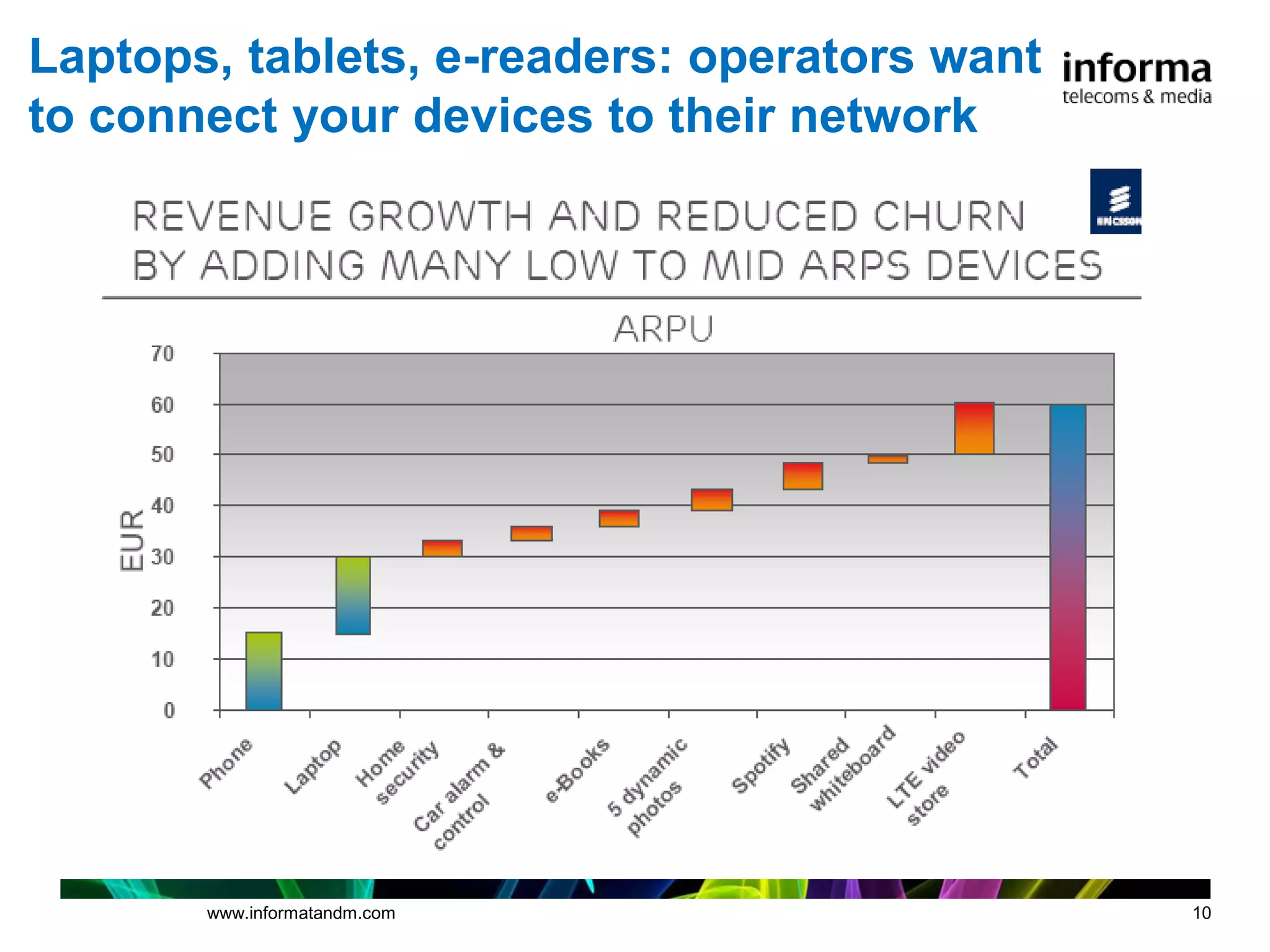

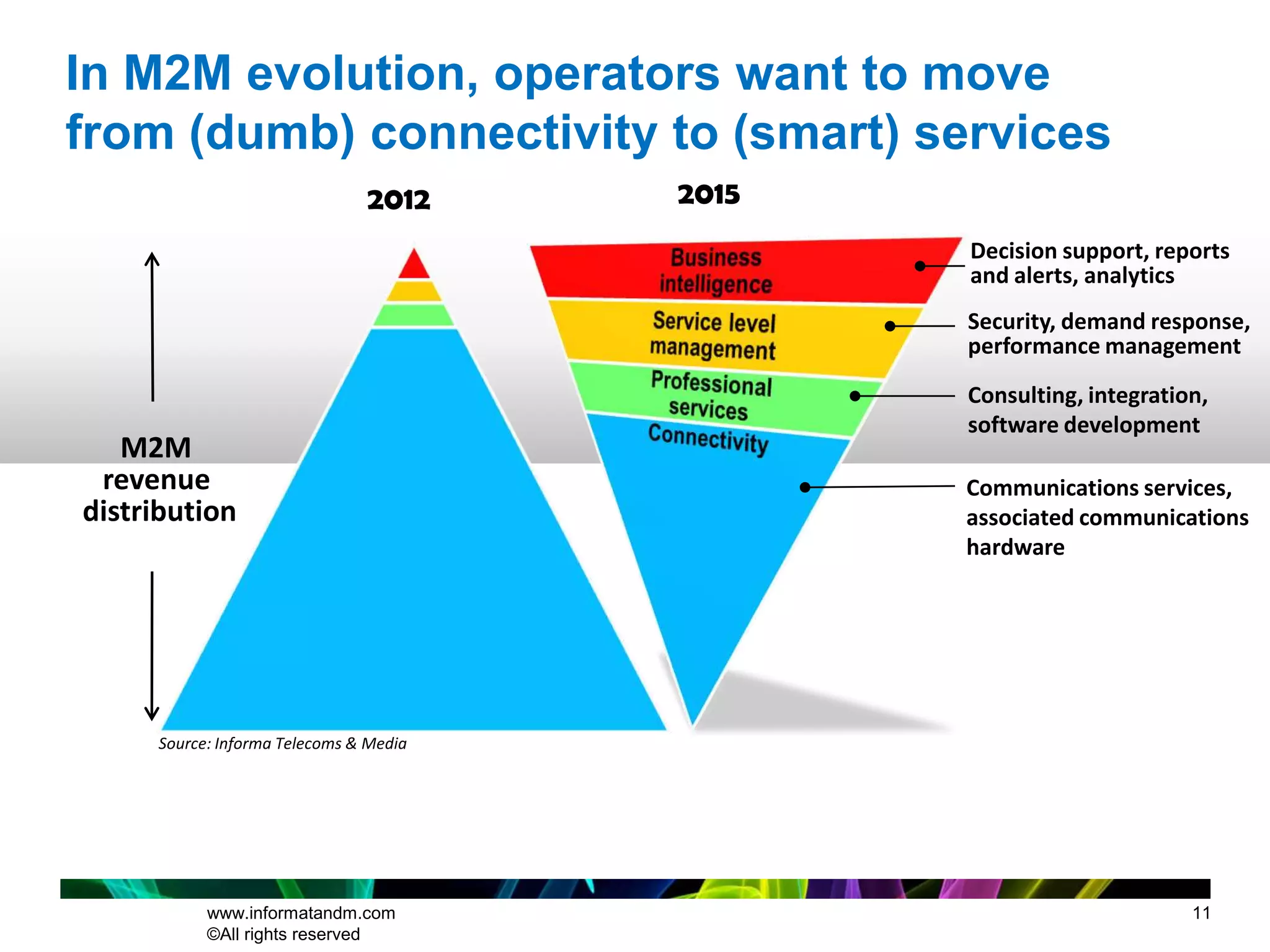

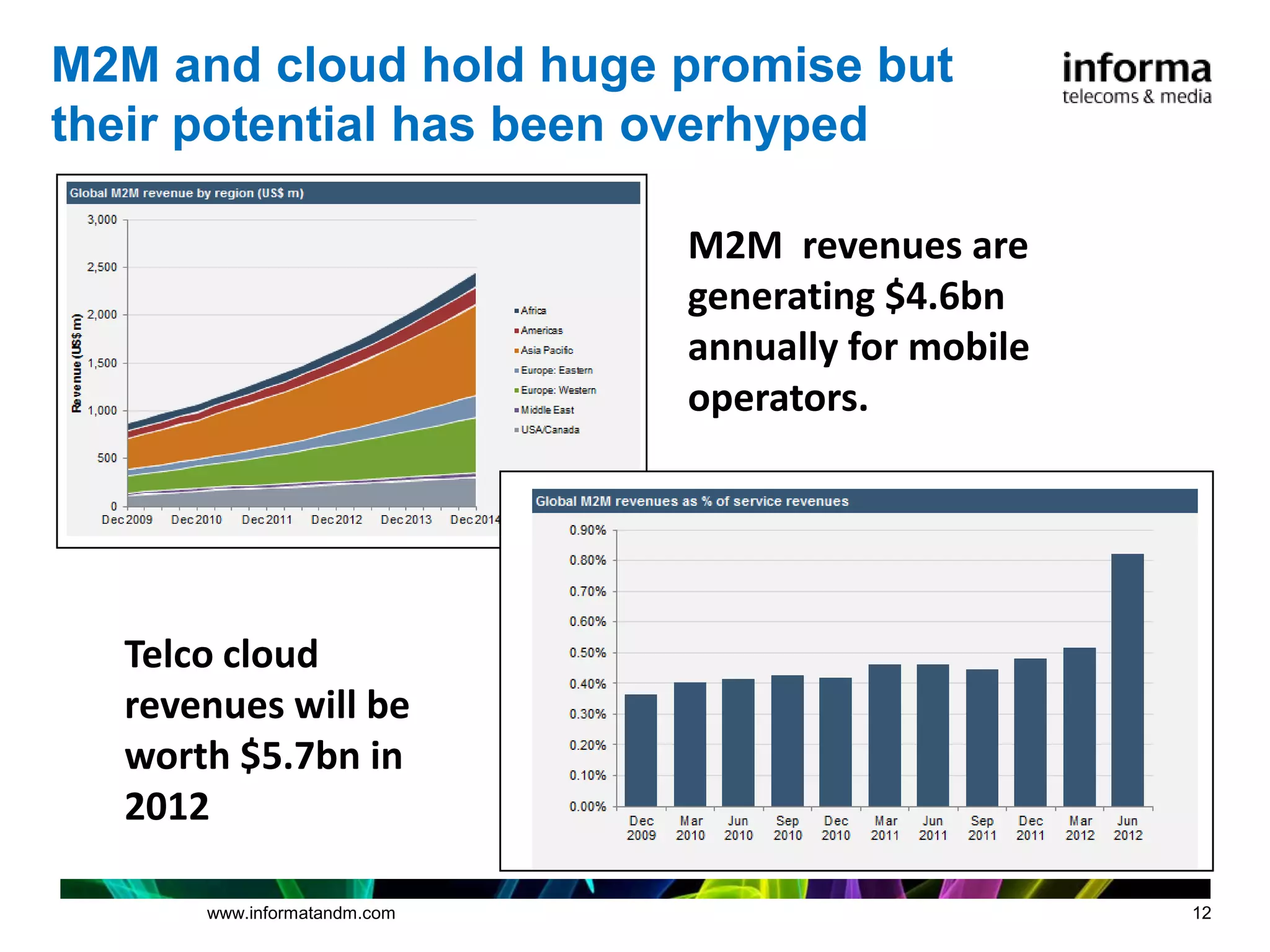

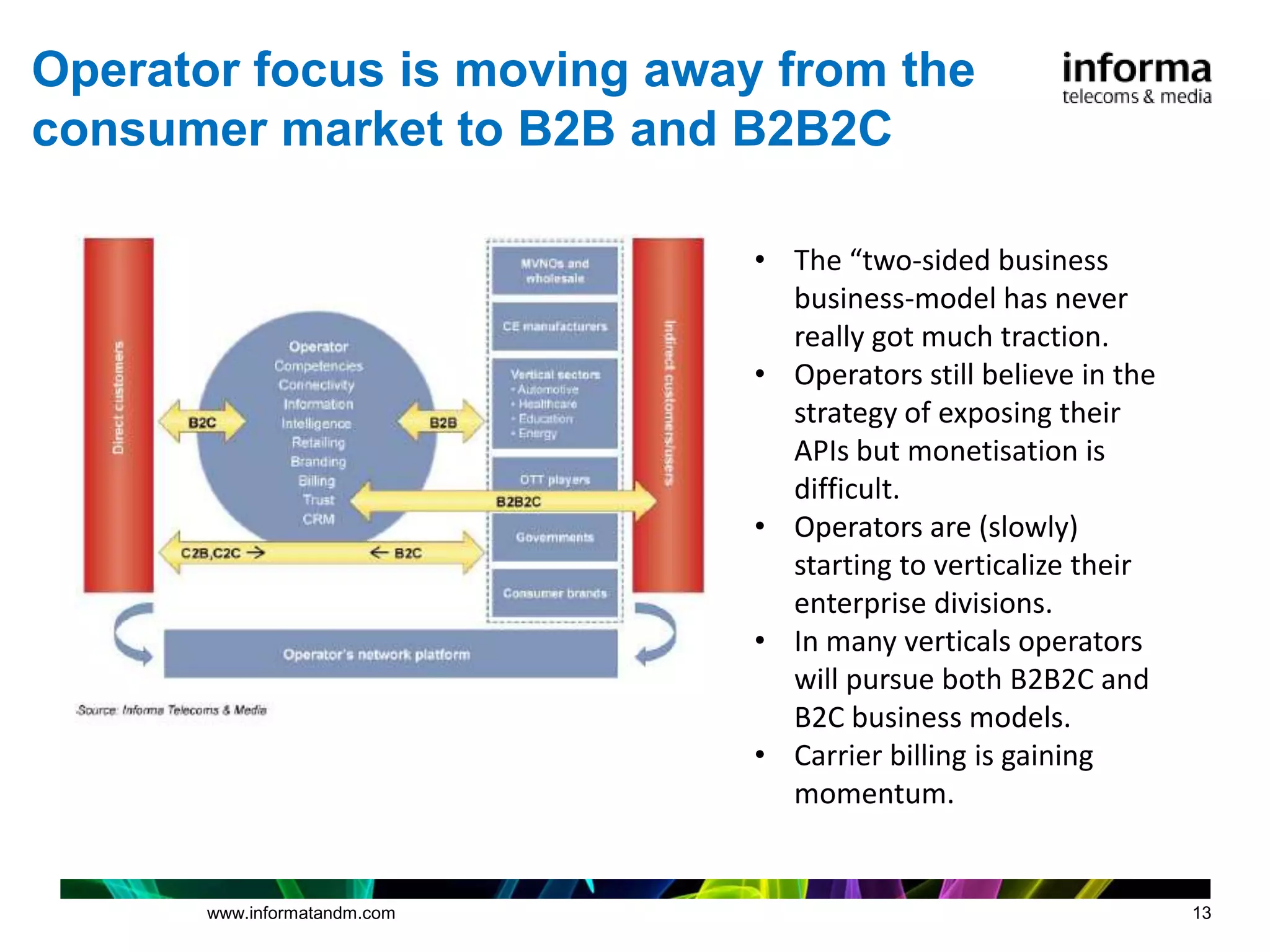

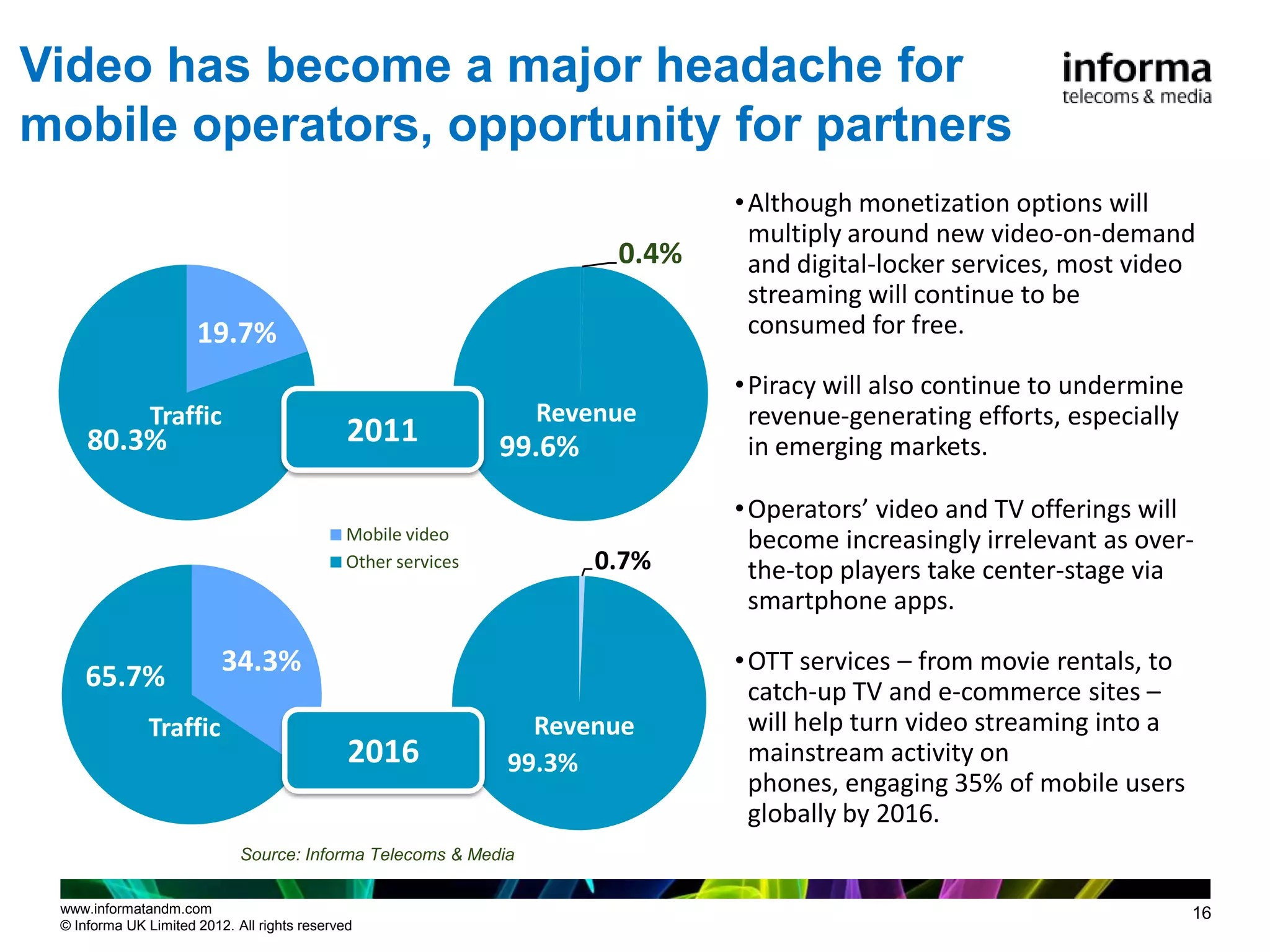

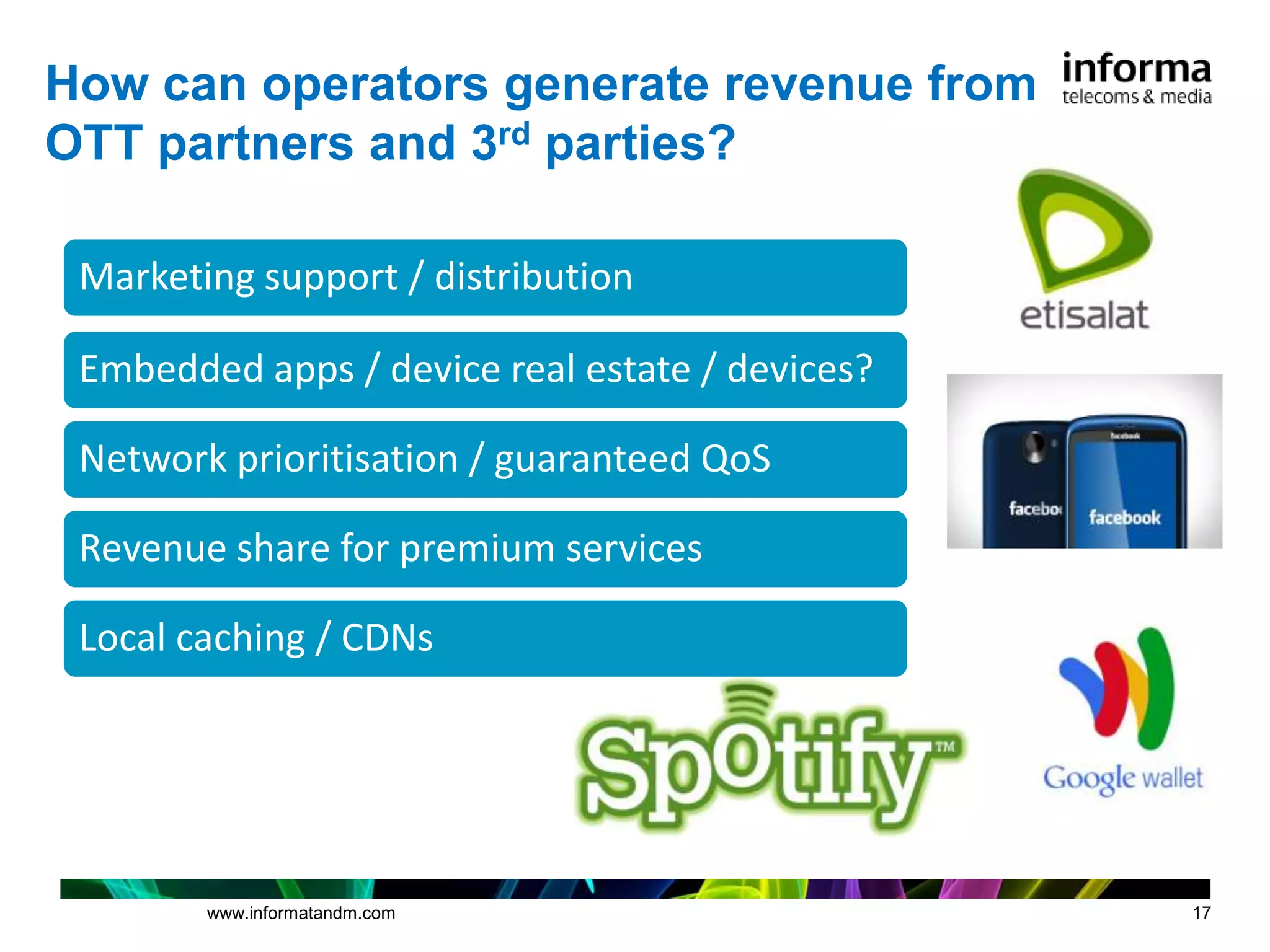

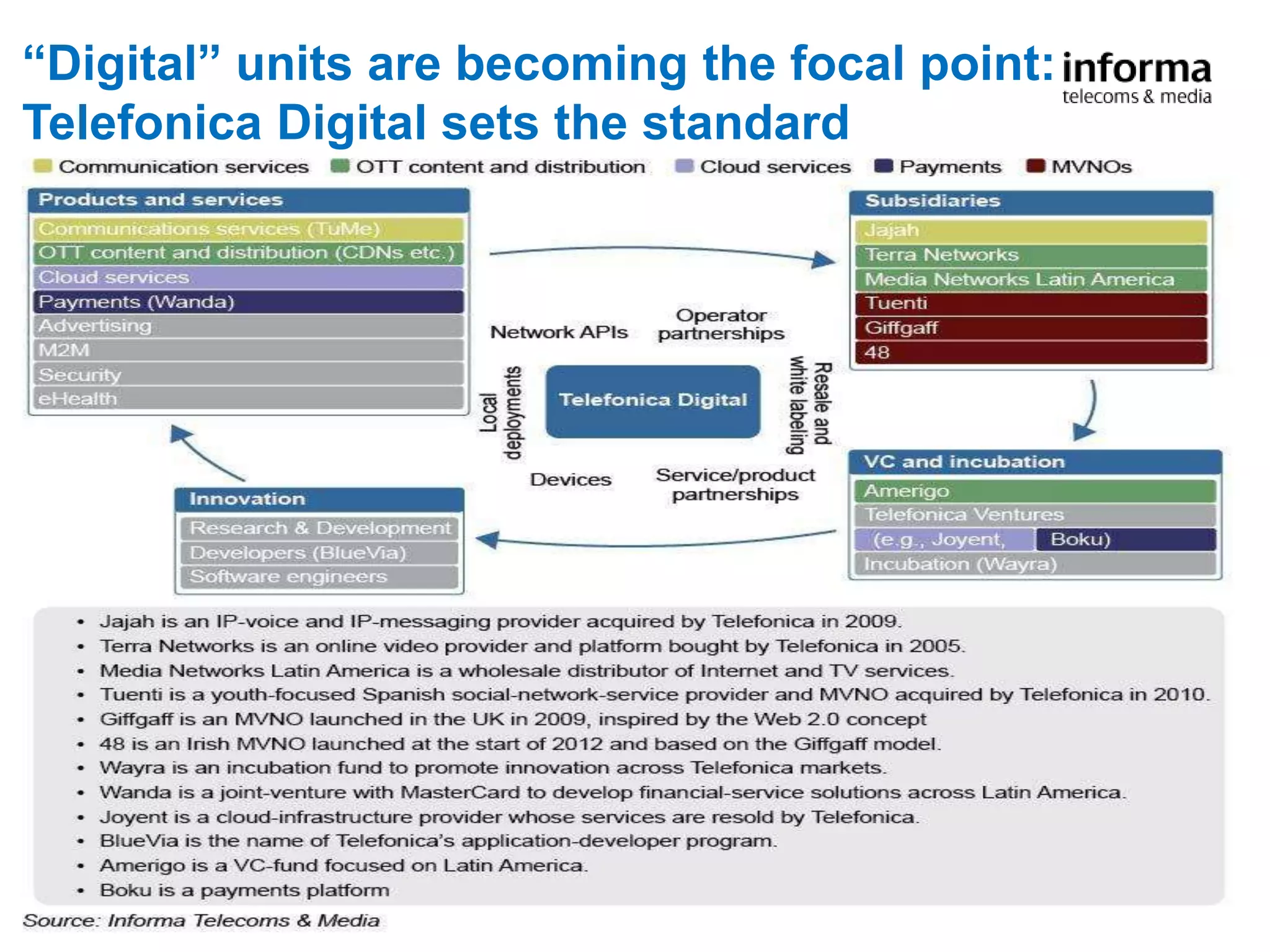

The document summarizes strategies and challenges for telecom operators in growing and innovating their businesses. It discusses how operators are investing in ventures and partnerships to develop new services and revenue streams around areas like digital media, advertising, cloud, applications, and machine-to-machine communications. It also notes the challenges operators face from growing over-the-top players and declining voice revenues, and how they are looking to partners to help enhance core services, attract new customers, and improve network monetization.