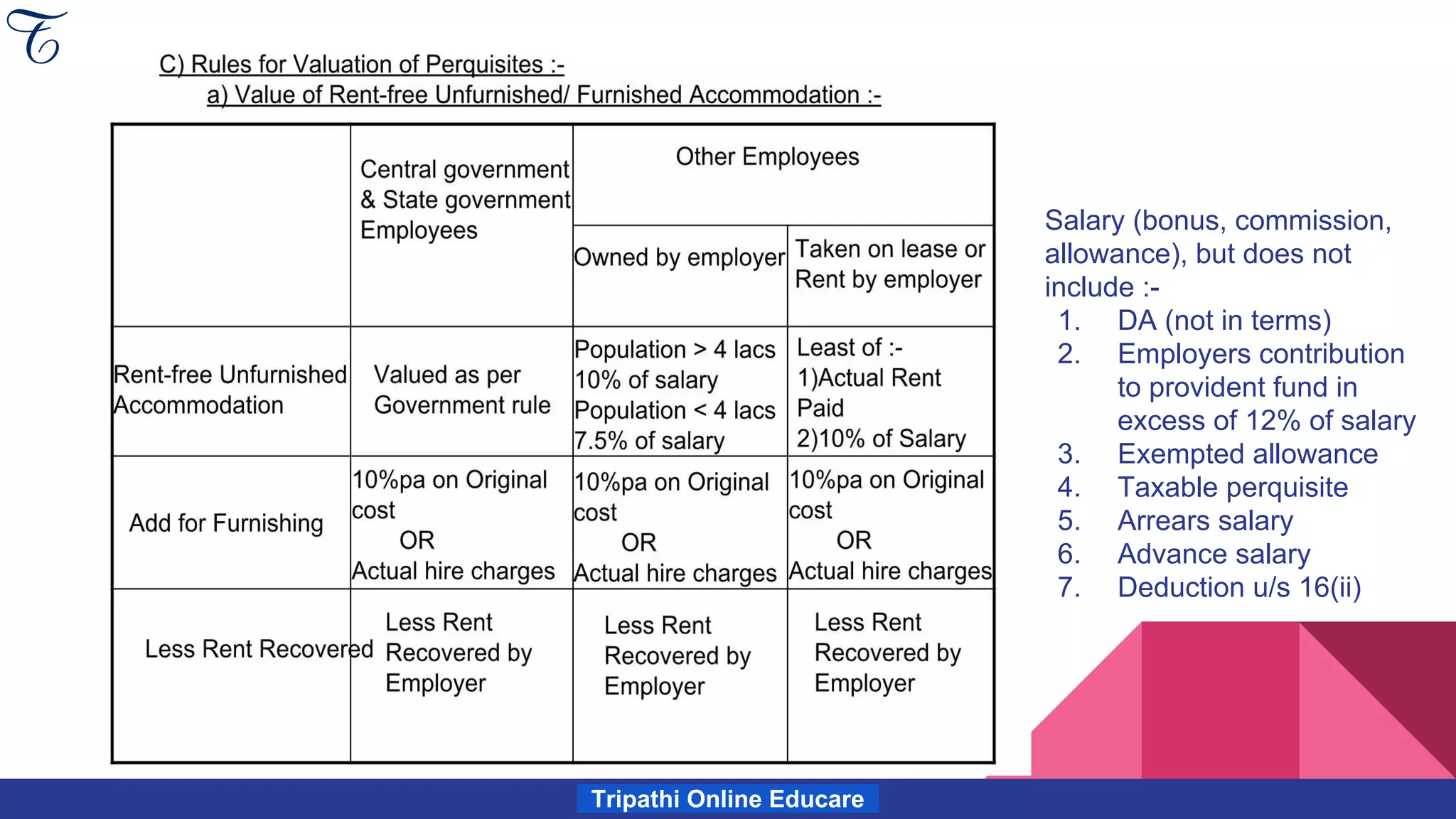

The document outlines the tax rules applicable to salary income, detailing the taxable components, such as dearness allowance, bonuses, and various perquisites, as well as the deductions available under specific sections. It also explains how different forms of compensation, such as advance salary and provident fund contributions, affect taxable income. Additionally, a practical example illustrates the calculation of taxable salary for an individual under the voluntary retirement scheme.

![Tripathi Online Educare

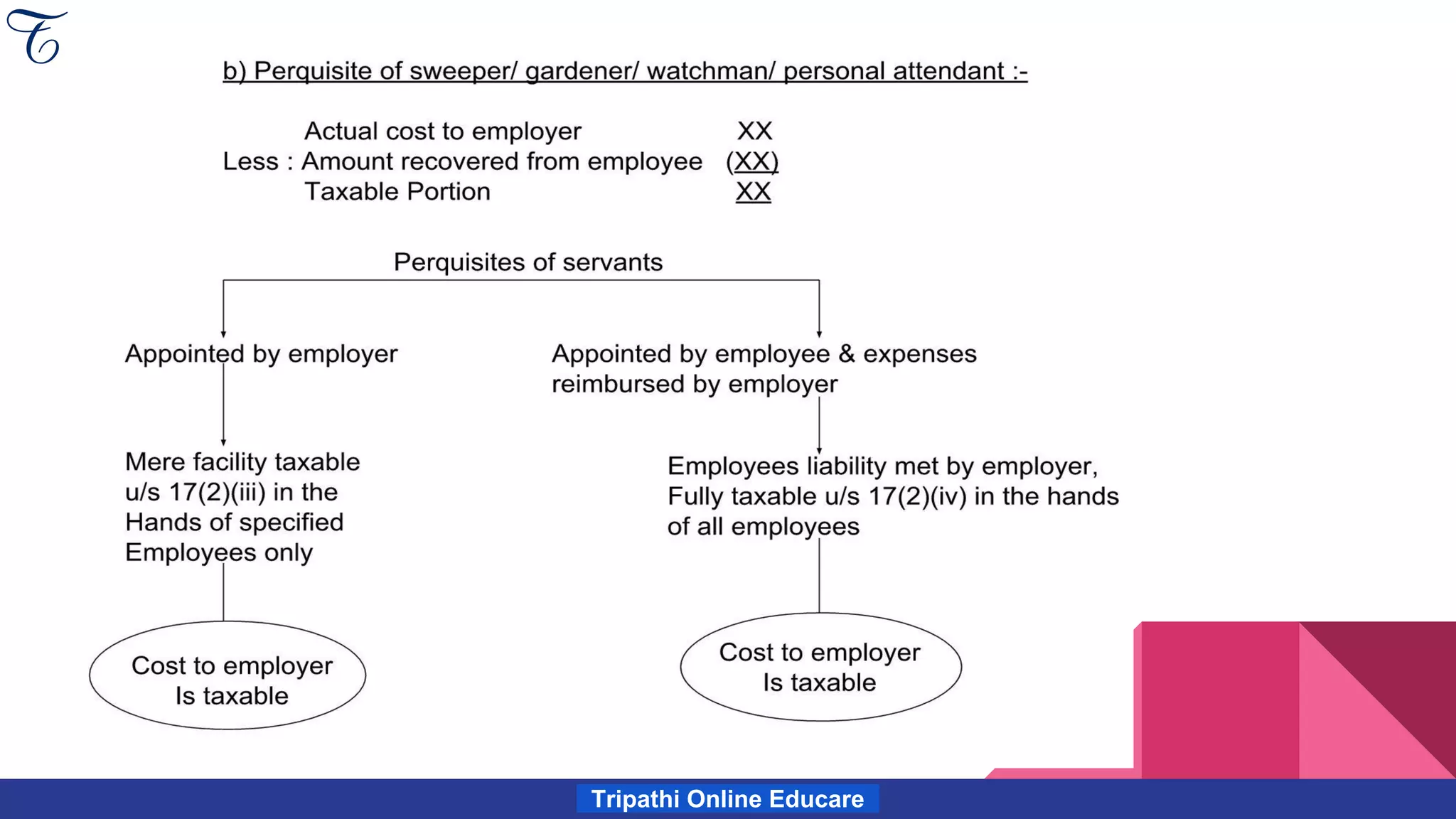

B) Taxable Perquisite for Specified Employees :-

Facility such as motorcar, servants, gas, water etc. are taxable only in the

hands of the following specified employees u/s 17(2)(iii) -- Facility

a) Director Employee

b) Employee having 20% or more voting power

c) Employee drawing salary in excess of Rs. 50,000/- i.e.

[Gross salary – value of any perquisite –employers contribution to RPF in

excess of 12% of salary – interest accrued to RPF in excess of 9.5%pa –

entertainment allowance u/s 16(ii) – professional tax u/s 16(iii)]](https://image.slidesharecdn.com/ppt-180213115527/75/Income-from-Salaries-10-2048.jpg)

![From Bank of Baroda (1/4/2016 to 30/11/2016):

1. Basic Salary (6000 X 8) 48,000

2. Dearness Allowance (1,500 X 8) 12,000

3. Voluntary Retirement Scheme 4,52,000

Less: Exempt u/s 10(10C) (4,52,000) NIL

4. Pension :

a. Commuted

Received 90,000

Less: Exempt u/s 10(10A)

[1/2 of FCV is exempt]

(90,000 X 100/60) X ½ (75,000)

a 15,000

b. Uncommuted

01/12/2016 to 28/02/2017 (4,000 X 3) 12,000

01/03/2017 to 31/03/2017 (4,000 X 40% X 1) 1,600

b 13,600

Taxable Pension (a + b)

28,600

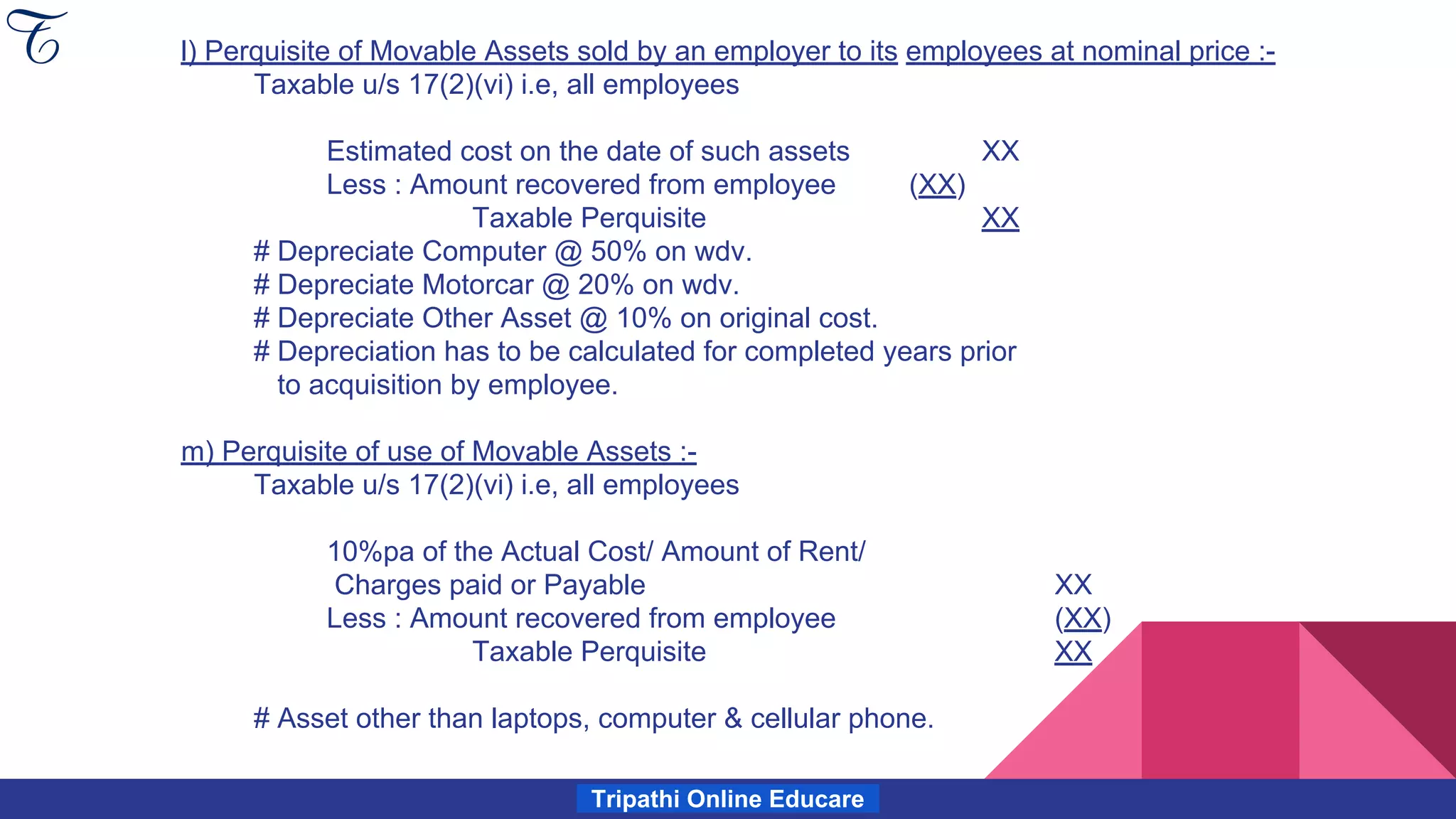

Particular Rs Rs

Computation of Income From Salary

Tripathi Online Educare](https://image.slidesharecdn.com/ppt-180213115527/75/Income-from-Salaries-27-2048.jpg)