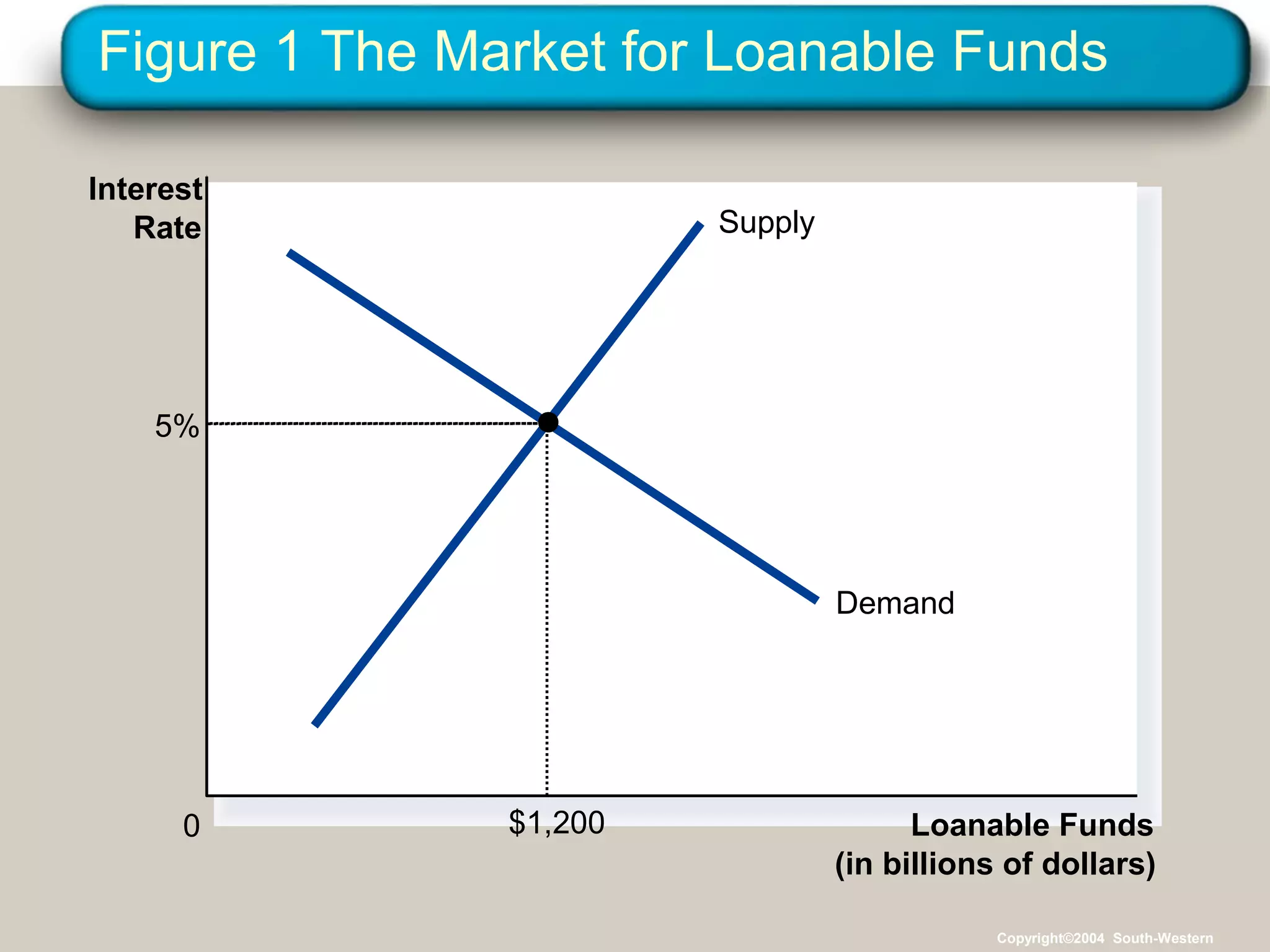

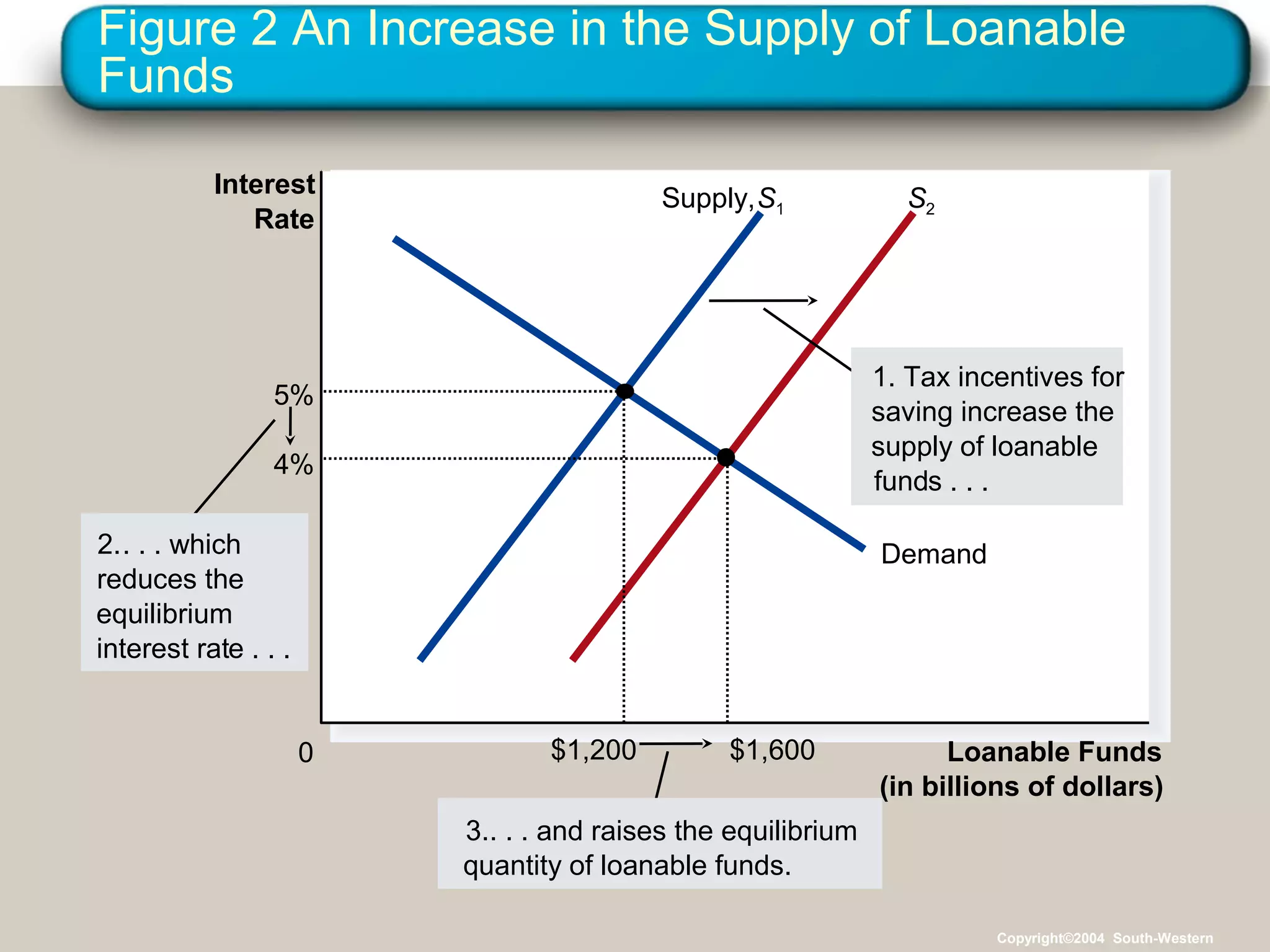

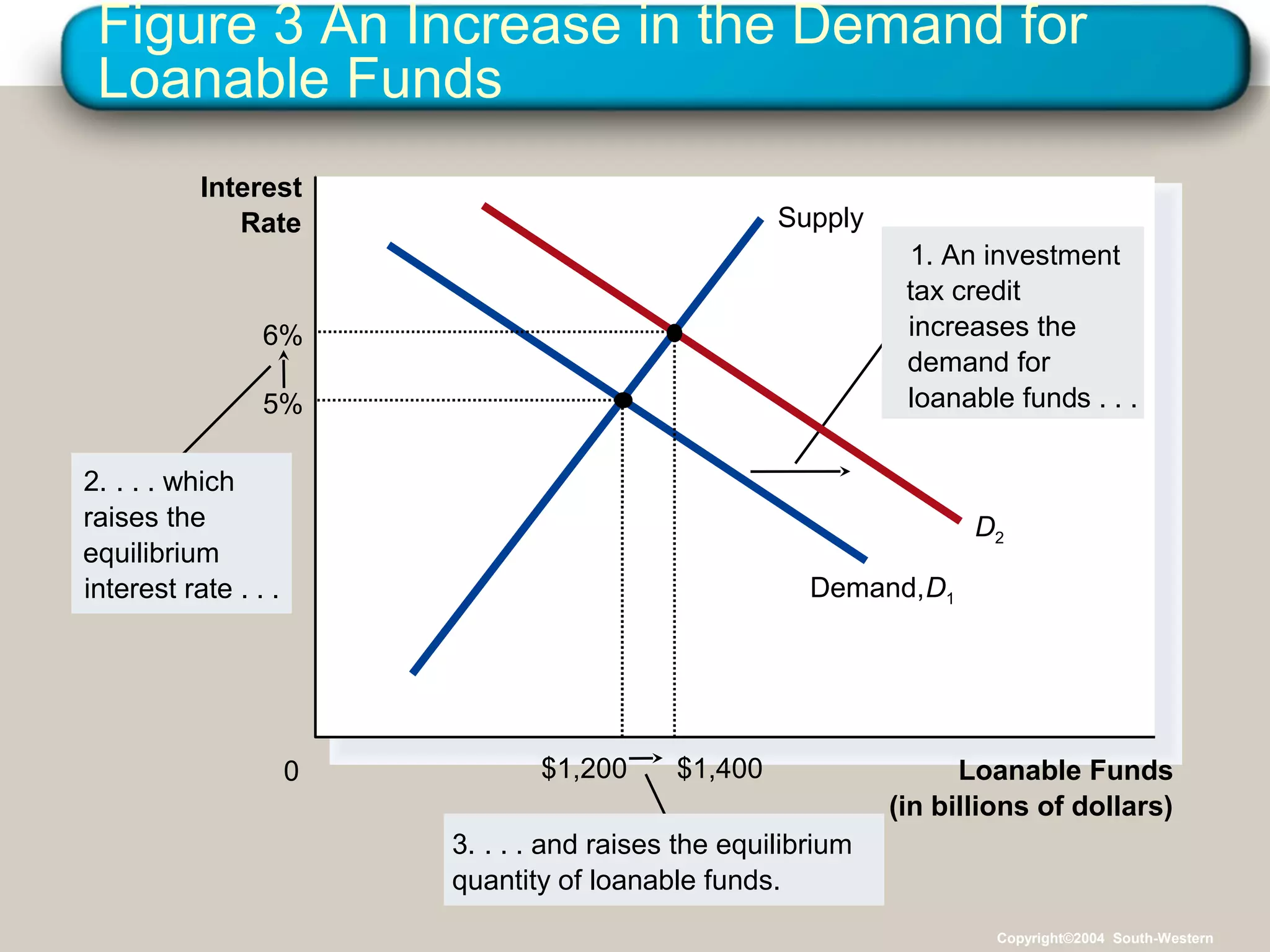

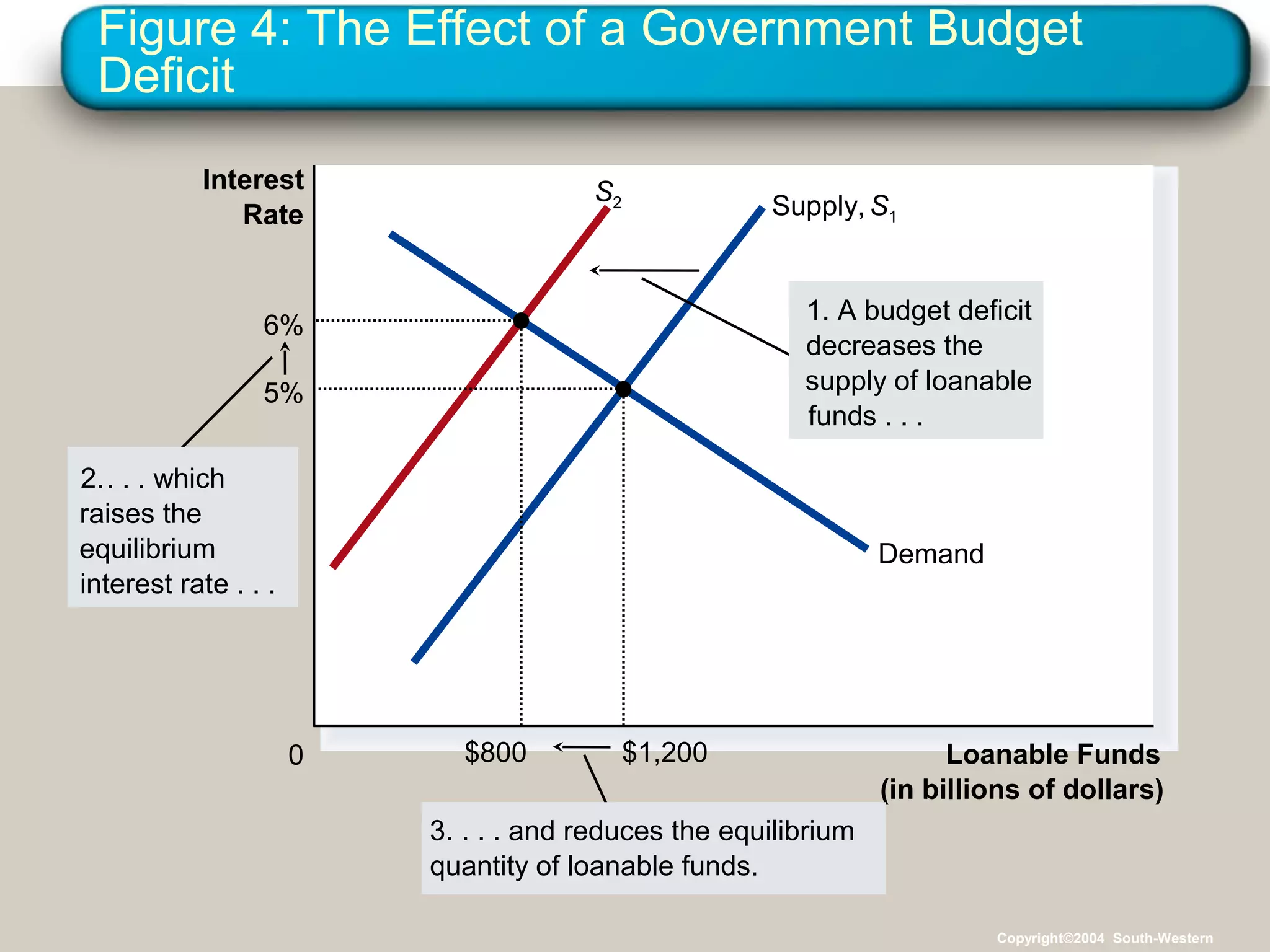

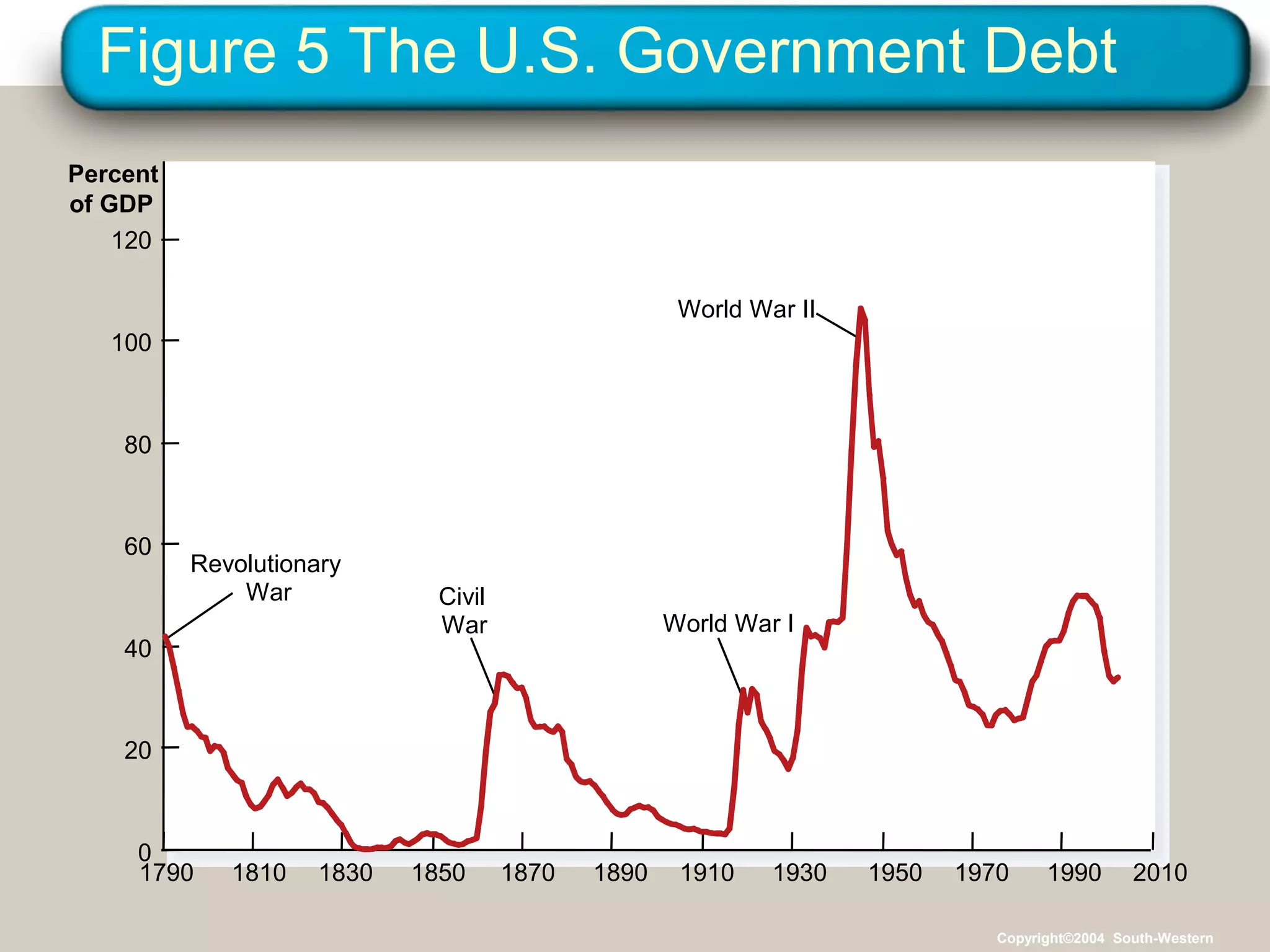

The document discusses the U.S. financial system and how it coordinates saving and investment. It describes how financial institutions like banks and markets direct resources from savers to borrowers. It also explains how government policies on taxes, deficits, and investment credits can influence interest rates, saving, and investment in the market for loanable funds.