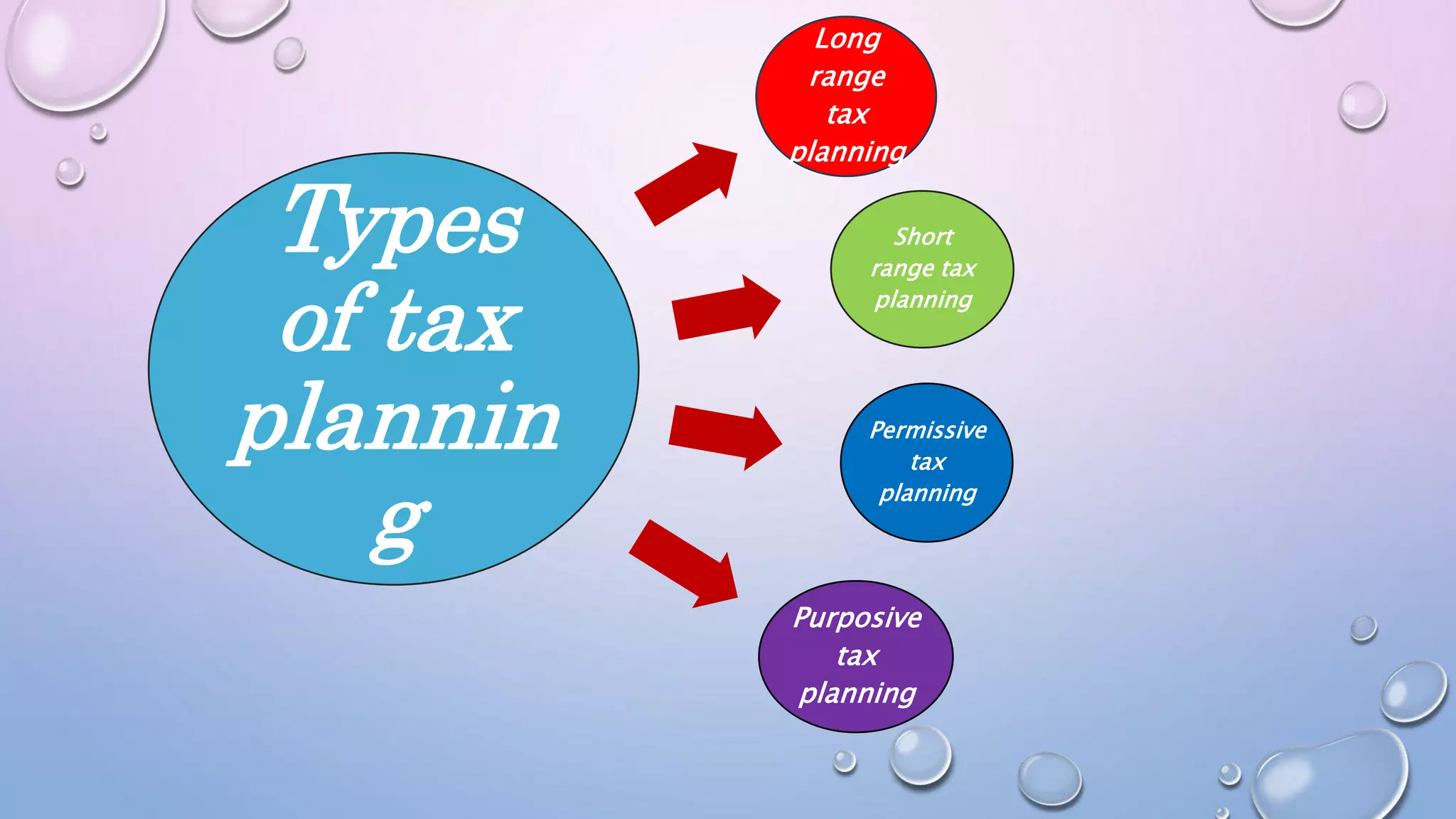

This document discusses tax planning and its importance. Tax planning helps minimize tax liability through legal means while complying with tax laws. It can be done through long-term or short-term strategies to take advantage of deductions, exemptions, and benefits. Common types of tax planning include permissive, purposive, long-range, and short-range planning. Tax planning has advantages like minimizing litigation, reducing tax liability, ensuring economic stability, and leveraging productivity.