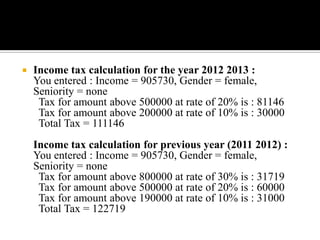

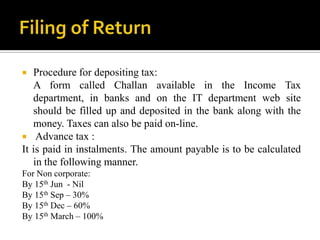

This document provides information on various aspects of income tax in India including different types of income and applicable tax rates, common deductions and exemptions available, procedures for tax filing and payment, due dates and forms for tax returns. Key points covered include income from salary and applicable tax deductions, capital gains tax rates, section 80C deductions, filing tax returns online or physically and related timelines.

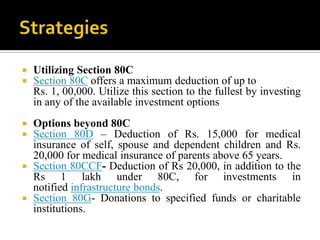

![ Section 80C Deductions

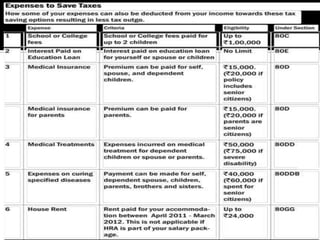

Section 80C of the Income Tax Act [1] allows certain investments and

expenditure to be deducted from total income up to the maximum of 1 lac. The

total limit under this section is ₹ 100,000 ) which can be any combination of

the below.

Contribution to Provident Fund or Public Provident Fund

Payment of life insurance premium

Investment in pension Plans

Investment in Equity Linked Savings schemes (ELSS) of mutual funds.

Investment in National Savings Certificates

Tax saving Fixed Deposits provided by banks for a tenure of 5 years

Payments towards principal repayment of housing loans. Also any

registration fee or stamp duty paid.

Payments towards tuition fees for children to any school or college or

university or similar institution (Only for 2 children)

Post office investments](https://image.slidesharecdn.com/taxcomputation-130117023819-phpapp01/85/Tax-computation-8-320.jpg)