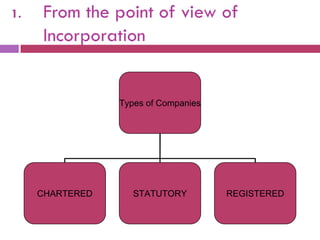

The document summarizes key aspects of company law in India as outlined in the Companies Act of 1956. It defines a company and lists its key characteristics such as separate legal entity status, transferable shares, and limited liability. It outlines different types of companies based on incorporation, liability, nationality, and public interest. It also describes the different types of companies that fall under each of these categories, such as private vs. public companies. Finally, it discusses the key documents of a company, namely the Memorandum of Association and Articles of Association.

![(4)

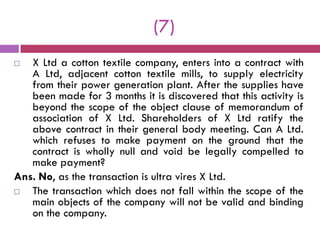

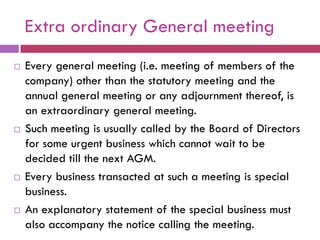

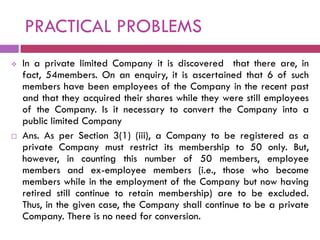

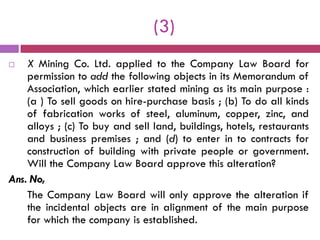

A Ltd. applies to the Company Law Board for approving an

alteration in situation clause of its Memorandum and thus

permitting it to change its registered office from Calcutta to

Delhi. The Government of West Bengal requests the Company

Law Board not to allow this change, for it would lead to a loss of

revenue of the Government. Decide.

Ans. No, The request of Government of West Bengal won‟t be

considered.

The change will be allowed if it is warranted by the interests of

the company [Rank Film Distributors of India Ltd. v. Registrar of

Companies]

The court observed that the state has no statutory right to oppose

the shifting of the registered office from one state to another.

Members of the company will decide whether the registered

office of the company is to be transferred from one state to

another. Moreover the shifting should be in the interest of the

company.](https://image.slidesharecdn.com/companiesact1956-130117023959-phpapp02/85/Companies-act-1956-50-320.jpg)

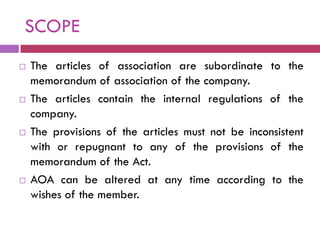

![(6)

The Memorandum of Association of a company formed to

Improve and encourage the breeding of poultry contained

a provision that no remuneration should be paid to the

members of the governing body of the company. But the

company owing to Its Increase in the business passed a

special resolution providing for equitable remuneration to

such members for services rendered, Can this alteration of

the Memorandum be confirmed? If so, state why and when.

Ans. Yes

It was decided that alteration is valid as it will help to

carry the business more economically or more efficiently

and any resolution passed will be within the scope of MOA.

[Scientific Poultry Breeders' Assn. Ltd.].](https://image.slidesharecdn.com/companiesact1956-130117023959-phpapp02/85/Companies-act-1956-52-320.jpg)