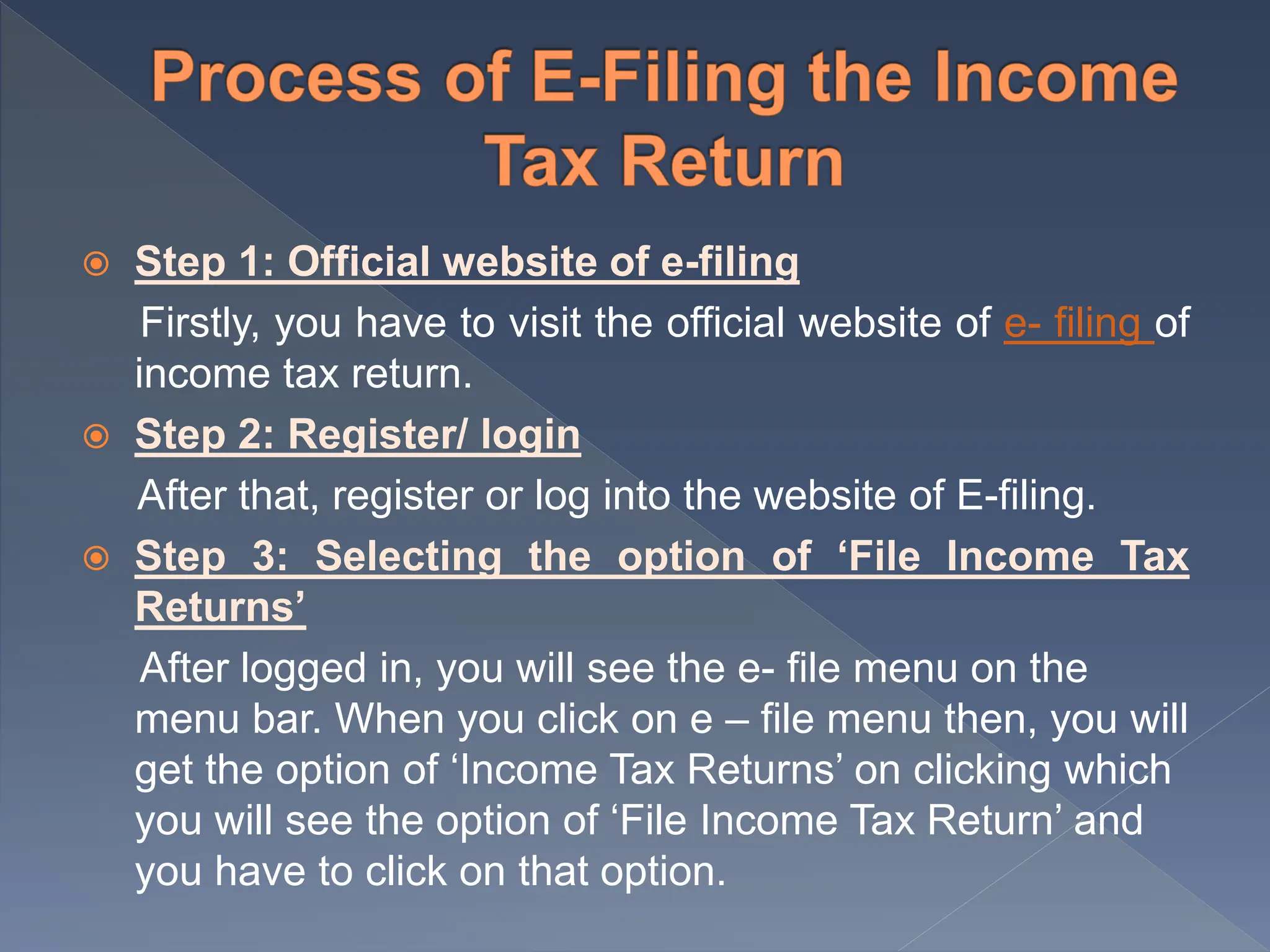

The document provides essential information about income tax return (ITR) filing, including its necessity for taxpayers, various forms of ITR for different income situations, and the online e-filing process. It emphasizes the requirements for filing ITR based on income levels, foreign assets, and expenses, and outlines the step-by-step process for e-filing. The deadline for ITR filing for FY 2023-24 is set for July 31, 2024, with an extended deadline of October 31, 2024, for certain taxpayers.