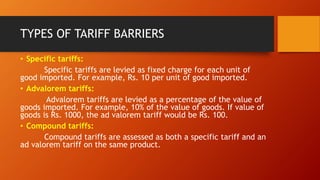

The document discusses tariff and non-tariff barriers used by governments to regulate trade and protect domestic markets. Tariff barriers include specific, ad valorem, and compound tariffs that increase the cost of imported goods, while non-tariff barriers encompass regulations like subsidies, quotas, and local content requirements that can restrict imports. The rationale for these barriers includes generating government revenue, protecting domestic industries, and promoting local development.