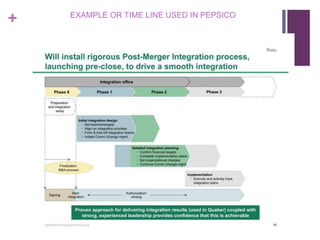

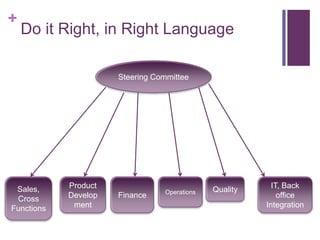

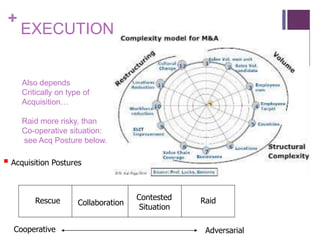

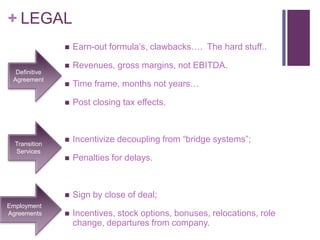

This document discusses best practices for post-merger integration. It notes that 60% of acquisitions destroy value and winning acquirers implement the right M&A strategy, especially for cross-border deals. It recommends moving quickly, establishing decision-making frameworks, ensuring integration budgets, addressing culture and communication, creating 100- and 360-day integration timelines, prioritizing high-value initiatives, and focusing on cultural integration through cross-functional teams. Communication breakdown is expensive, so the document stresses the importance of transparent storytelling and addressing employee concerns from career impacts.

![+

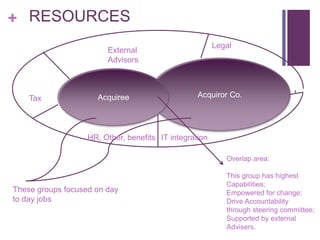

It’s Like this…..

Acquirers destroy value of acquired company in 60% of

acquisitions undertaken, [Academic data, Wharton School];

BUT: Winning acquirers put right M&A strategy in place,

especially in cross border acquisitions.](https://image.slidesharecdn.com/postmergerintegration-141119175348-conversion-gate02/85/Successful-Post-merger-integration-2-320.jpg)

![+

Best Practices

Move Quickly: Change is expected!

Establish Strategic Framework for Decision Making: Articulate what is NON NEGOTIABLE

ƒRESOURCES: Ensure budget exists for Integration

ƒ CULTURE: Identify resistance in organization

COMMUNICATE: Formalize communication through steering committee, communication plan

ACTION: Formulate a 100 and 360 day Integration, with detailed time line

MEASURE: Performance Versus Benchmarks

PRIORITIZE: Make recommendations to Steering Committee for any changes of priority

FOCUS: On high NPV with high probability of success, [Decision Trees]](https://image.slidesharecdn.com/postmergerintegration-141119175348-conversion-gate02/85/Successful-Post-merger-integration-4-320.jpg)