The document discusses the issue of limited mobile wireless network capacity as demand for data continues to grow exponentially due to increasing use of smartphones, tablets, and cloud-based applications. It notes that wireless network capacity is inherently constrained compared to wired networks. While network upgrades can help alleviate capacity issues temporarily, fundamental business model changes are needed to manage unprofitable network usage and capture more revenue from high-volume data users. Specific technology providers like Broadcom and network upgrade strategies are mentioned as potential ways to address network capacity challenges.

![2

1

Gnostam

LTE

Network

Issue

15th

April

2012

1

Performance Through Independent Research

Wireless

network

capacity

issues:

Threats

and

opportunities

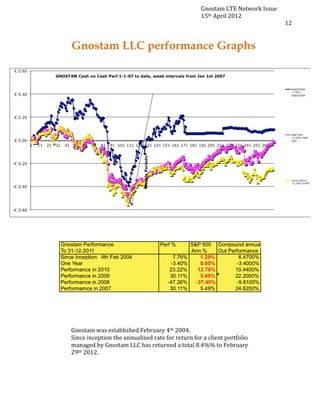

EXECUTIVE SUMMARY: that clients will pay for, without clogging up

the network with unprofitable users.

The Problem with Mobile wireless:

While most operators are managing to

In simple terms, demand is outstripping grow their top line with mobile data,

supply, and costs per gigabyte are rising margins on mobile data have been under

faster than revenues. Supply is constrained severe pressure for operators. Mobile data

by physics. One single fiber optic cable has ARPUs are not delivering the same

more capacity than the entire RF spectrum. EBITDA margins as voice: this leads to a

significant share of customers being

To avoid mobile networks being overwhelmed unprofitable. The carrier choice of mobile

by a flood of data, these networks which data bundled plans has limited the market

support widely desired mobility applications, segmentation capacity of these operators.

[e.g. Apple I-pad 3] these networks capacity Examples: the price of data plans are

must be upgraded. Reliability and access are decreasing at a rate of 60 percent p.a. on

key to long term survival, as we witnessed average. Plus, individual users can place a

with Blackberry. However this is not just an IT huge strain on the network: 10% are

technical issue. It is fundamentally a responsible for 50% of the network data

business model issue. traffic – without contributing one cent more

in revenues. Actual revenues per megabyte

The business issue is how to capture traffic are decreasing at around 50% p.a. – a

Continued

on

Page

4

Capacity

constraint

is

at

Radio

Link

“Cloud” economics are pushing mobile network capacity constraints. Mobile devices have

memory and speed limitations that might prevent them from acting as media consumption

devices, were it not for cloud applications and services. Cloud applications and services

such as Netflix, YouTube, Pandora, and Spotify allow mobile users to overcome the

memory capacity and processing power limitations of mobile devices. A user with an 8 GB

smartphone who streams cloud video and music will consume more content over the course

of 2 years than can be stored on the device itself. A smartphone user adopting Netflix,

Pandora, and Facebook will generate more than twice the volume of traffic generated by a

smartphone user adopting only email and web applications](https://image.slidesharecdn.com/networkltecapacityissues-13351298479992-phpapp02-120422162653-phpapp02/75/Mobile-Network-Capacity-Issues-1-2048.jpg)

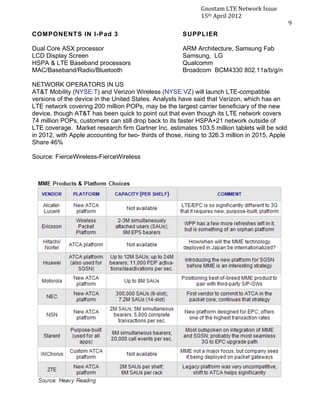

![4

3

Gnostam

LTE

Network

Issue

15th

April

2012

4

trend expected to continue over the next few pacing within the overall mobile

years if radical action is not taken soon. broadband strategy will ensure

success and optimize the road to

The solutions…… ……………… ……? 4G business cases. Operators

need to focus on topics such as

1. Choice of spectrum and technology regional rollout priorities, fixed

upgrade path. Operators [carriers and substitution propositions, and

enterprise solution providers] need to further capacity extension

decide on the succession of technology strategies. For instance, reforming

upgrades that will best fit their current 1,800 MHz 2G spectrum could be a

data ~ corporate strategy and expected viable strategy to build additional

market demand for mobile broadband. LTE capacity networks, but this

Does the company already have a requires advance planning.

dominant technology and service Partnering opportunities could offer

position, or is it a value-for- money operators great value creation

price leader? What is the spectrum potential as well. Those operators

application plan and spectrum auction that pool spectrum based on

positioning in their arena, including network-sharing agreements will

reservation prices? And what reap a significant cost-to-serve

technology succession in spectrum advantage.

bands will align best with the expected

demand development? MOBILE WIRELESS CAPACITY AS AN

2. Given that the main constraint is now ECONOMIC OPPORTUNITY:

supply and not demand, the main issue

becomes the choice of tactical We have witnessed the collapse of

implementation and timing of network Blackberry, [RIMM] a casualty of “failed”

upgrades, be they 3G LTE, 4G or some supply side network management. All

other evolution. Only optimal tactical major participants in the carrier and

Continued

on

page

6](https://image.slidesharecdn.com/networkltecapacityissues-13351298479992-phpapp02-120422162653-phpapp02/85/Mobile-Network-Capacity-Issues-4-320.jpg)

![Gnostam

LTE

Network

Issue

15th

April

2012

5

Diagrammatic

representation

of

an

LTE

wireless

network

switched

into

a

PSTN.

It

only

supports

the

IP

protocol

for

voice

calls.

The LTE standard only supports packet

switching with its all-IP network. Voice calls in

GSM, UMTS and CDMA2000 are circuit

switched, so with the adoption of LTE, carriers

will have to re-engineer their voice call

network. Three different approaches sprang

up:

1.CSFB (Circuit Switched Fallback): In this

approach, LTE just provides data

services, and when a voice call is to be

initiated or received, it will fall back to

the CS domain. When using this

solution, operators just need to upgrade

the MSC instead of deploying the IMS,

and therefore, can provide services

quickly. However, the disadvantage is

longer call setup delay. The diagram above shows the increased

▪ SVLTE (Simultaneous Voice and LTE): In volume in wireless data capacity usage

this approach, the handset works from different mobile devices. A

simultaneously in the LTE and CS smartphone on average uses 35 x more

modes, with the LTE mode providing capacity than a regular cell phone. A

data services and the CS mode Tablet, on average uses 121 x more

providing the voice service. This is a capacity than a regular cell phone.

solution solely based on the handset,

which does not have special Demand for tablets and I–pad’s is

requirements on the network and does growing exponentially because these

not require the deployment of IMS tools are seen as the single most

either. The disadvantage of this solution important productivity tool [source

is that the phone can become expensive Information Week 8/2011, mobile device

with high power consumption. management and security survey of 323

business technology professionals].

VoLTE (Voice Over LTE): This approach is

based on the IP Multimedia Subsystem

network.](https://image.slidesharecdn.com/networkltecapacityissues-13351298479992-phpapp02-120422162653-phpapp02/85/Mobile-Network-Capacity-Issues-5-320.jpg)

![Gnostam

LTE

Network

Issue

15th

April

2012

11

CONCLUSIONS:

The mobile-broadband industry is experiencing tremendous success, yet its very success is

undermining its ability to deliver a consistent, reliable trouble-free experience. As the

number of users increases with ever more demanding applications, it is inevitable that there

will be ever more cases in which the volume of traffic in different coverage areas exceeds

capacity, resulting in congested operation.

More efficient applications not only reduce the likelihood of congestion occurring in the first

place, but they also are inherently more resilient, since they require less time and data to

operate. They also reduce battery consumption, and most importantly for users, reduce

costs, especially with usage-based pricing plans.

Beyond user benefits, greater application efficiency results in significant savings for

operators including lower costs in the radio network, lower costs in backhaul, lower

infrastructure costs and the need for less new spectrum.

We think this environment is an opportunity to buy several of the LTE emerged

technologies, namely, ARMH, RFMD, CIEN, CSCO, BRCM.

GLOSSARY OF ACRONYMS:

GSM: Global System for Mobile Communications;

LTE- Long Term Evolution, [of 4-g networks from 3-g wireless networks];

HPSA: High Speed Packet Access

UE: Ultra Edit, a software text editor for Microsoft Windows;

MSC: Message Sequencing Chart;

IMS: IBM Information Management System;

SGSN: Serving a GPRS Service Node;

MME: Mobility Management Entity, System Architecture Evolution, core of 3GPP LTE;

GERAN: GSM EDGE Radio Access Network;

UTRAN: Universal Terrestrial Radio Access Network;

E-UTRAN: air interface of 3GPP's Long Term Evolution (LTE) upgrade path for mobile

networks.

Sources & References:

Cisco Networks White Paper – Global mobile data traffic: Forecast update 2011-2016;

Accelerate Technology Challenges in technology roll-out, 2012;

Infonetics 2011 White Paper, Research in optical equipment leaders;

Rysavy 2011 Mobile broadband capacity constraints;

Infonetics: The road to plain 4G survey excerpts 2011;

Net neutrality regulatory proposals, Rysavy Research;

Shifting the supply axis: The road to 4-G McKinsey White Paper;

Wireless design magazine: Testing LTE network, benefits and challenges;

Mobile broadband with HSPA and LTE – capacity and cost aspects, Nokia Siemens White

Paper;

Dragonwave: The Road to 4G is Easier with Microcellular Solutions;

Agilent: The road to 4G IMT Advanced LTE Advanced webinar;](https://image.slidesharecdn.com/networkltecapacityissues-13351298479992-phpapp02-120422162653-phpapp02/85/Mobile-Network-Capacity-Issues-11-320.jpg)