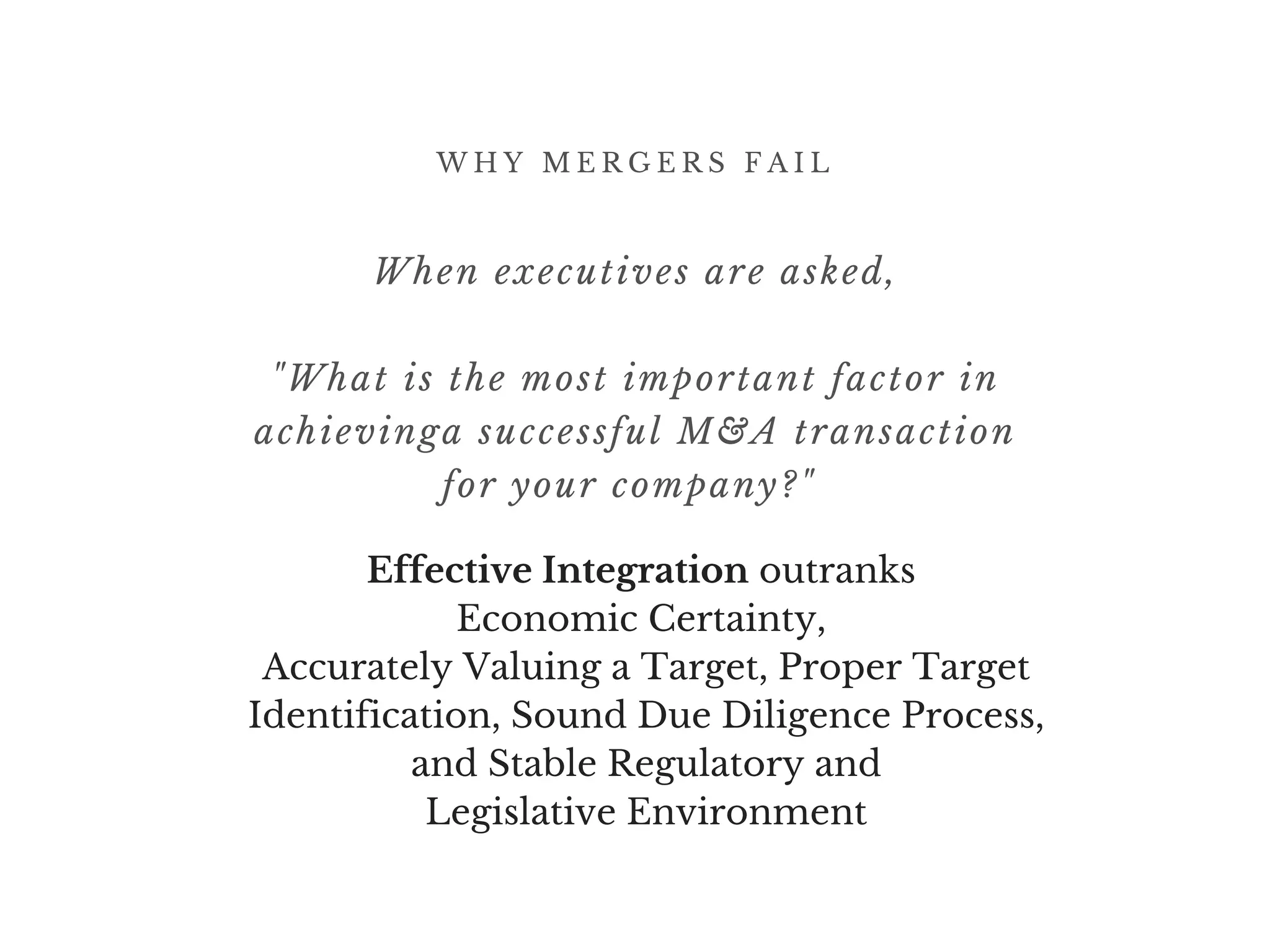

The document outlines key factors contributing to the failure of mergers and acquisitions (M&A), emphasizing that successful integration is critical for realizing the value of an acquisition. It advocates for the use of an interim executive to lead the integration process, highlighting their objectivity, experience, and ability to manage organizational dynamics effectively. Key areas of focus include customer experience, sales organization, system integration, and the importance of strategic communication on 'day one' post-acquisition.