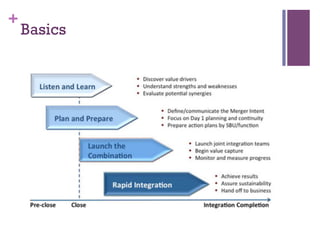

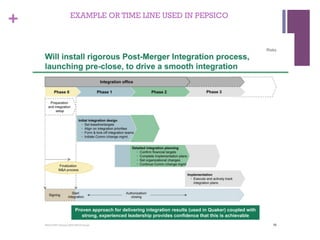

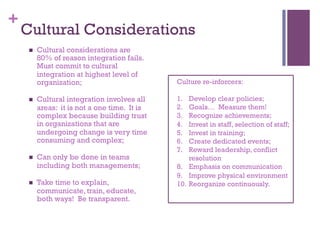

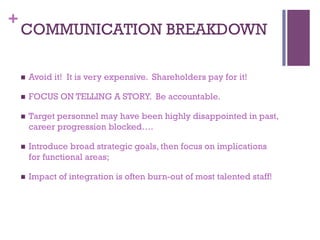

This document provides best practices for post-merger integration. It recommends moving quickly to establish a strategic framework, ensuring budget and resources exist for integration. Communication is key, with a formalized plan and steering committee. A detailed 100-360 day integration timeline should be formulated, measuring performance against benchmarks and prioritizing high-value initiatives. Cultural integration is also important, requiring commitment from leadership and efforts to build trust across organizations through transparency and training.

![+

It’s Like this…..

n Acquirers destroy value of acquired company in 60% of

acquisitions undertaken, [Academic data, Wharton School];

n BUT: Winning acquirers put right M&A strategy in place,

especially in cross border acquisitions.](https://image.slidesharecdn.com/postmergerintegration-141122173150-conversion-gate01/85/Post-merger-integration-2-320.jpg)

![+

Best Practices

n Move Quickly: Change is expected!

n Establish Strategic Framework for Decision Making: Articulate what is NON NEGOTIABLE

n ƒ RESOURCES: Ensure budget exists for Integration

n ƒ CULTURE: Identify resistance in organization

n COMMUNICATE: Formalize communication through steering committee, communication plan

n ACTION: Formulate a 100 and 360 day Integration, with detailed time line

n MEASURE: Performance Versus Benchmarks

n PRIORITIZE: Make recommendations to Steering Committee for any changes of priority

n FOCUS: On high NPV with high probability of success, [Decision Trees]](https://image.slidesharecdn.com/postmergerintegration-141122173150-conversion-gate01/85/Post-merger-integration-4-320.jpg)