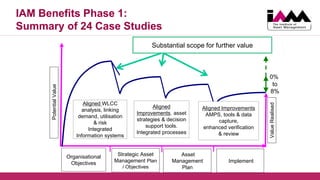

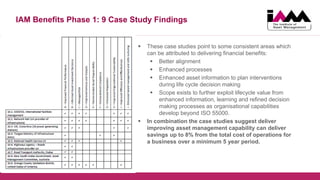

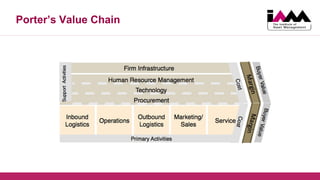

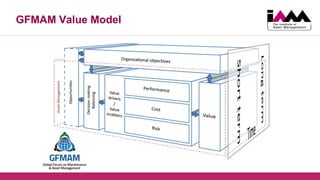

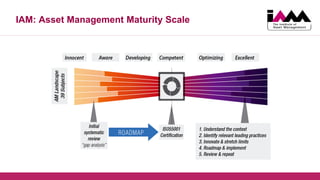

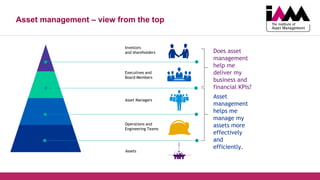

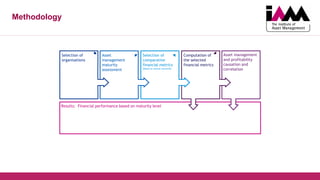

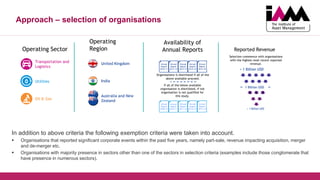

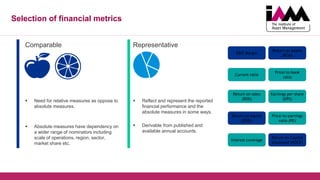

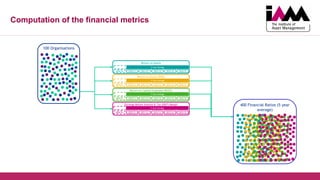

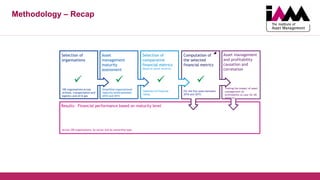

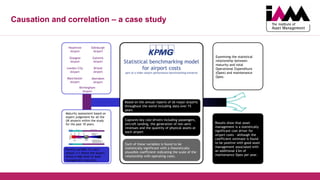

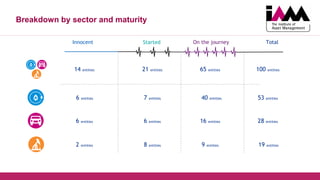

The document discusses several studies and frameworks related to analyzing the value and benefits of asset management. It summarizes findings from 24 case studies that identified benefits like improved financial performance, risk management, and compliance from implementing asset management practices. However, it also noted potential initial disbenefits like increased costs and changes required. Additional sections covered Porter's value chain model, the Global Forum on Maintenance and Asset Management's value model, and the Institute of Asset Management's asset management maturity scale. The document then outlined a case study analysis of 100 organizations that assessed financial metrics and maturity levels to investigate relationships between asset management capability and financial performance.