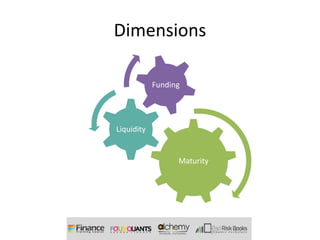

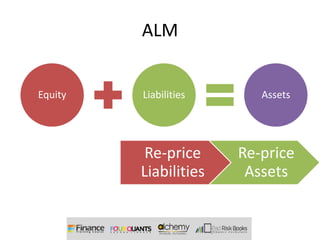

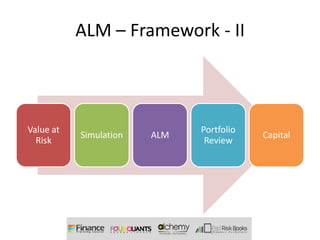

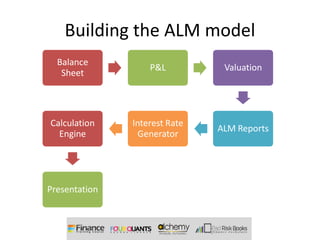

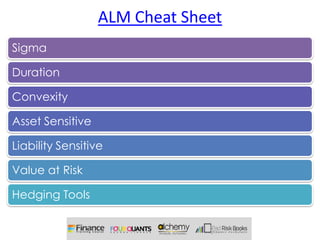

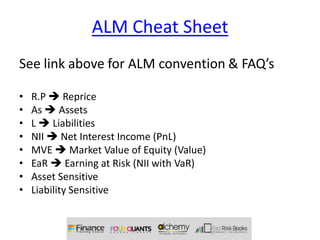

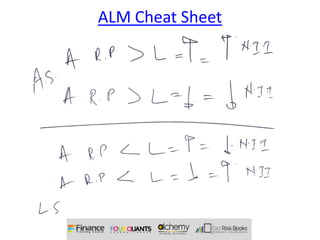

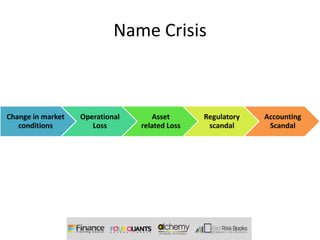

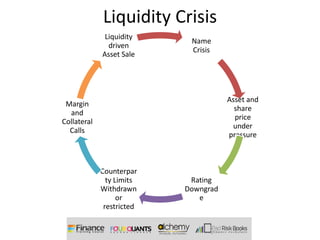

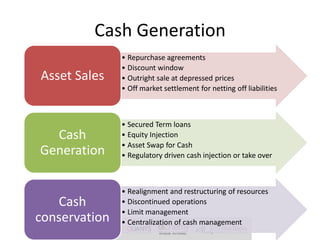

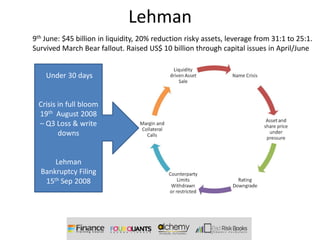

This document discusses asset liability management (ALM) frameworks and concepts. It covers key dimensions of ALM including interest rates, maturities, funding, liquidity, and the relationship between liabilities and assets. It also outlines ALM frameworks including business models, risk analysis, capital and financial models, liquidity models, and simulation. Additional sections provide an ALM cheat sheet and discuss liquidity risk, stress testing, and examples of liquidity crises at Bear Stearns and Lehman Brothers.