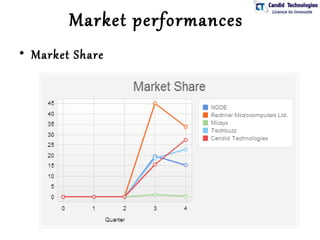

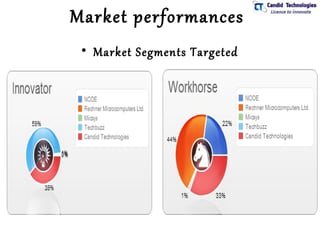

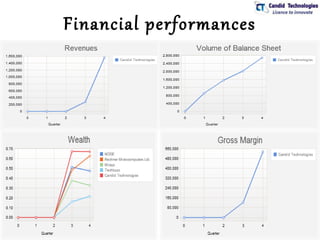

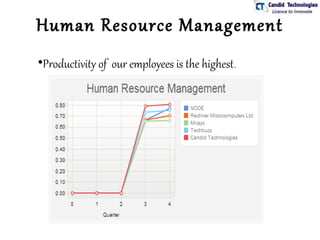

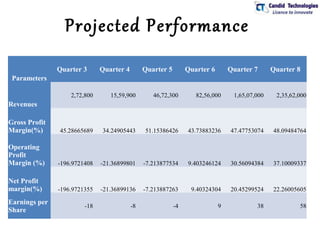

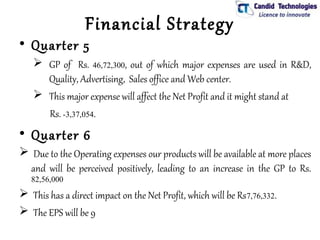

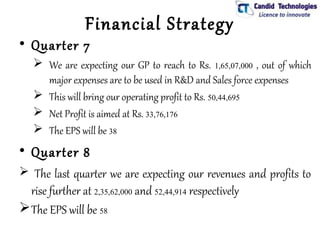

The document outlines the management team and various departments of Candid Technologies. It then discusses the company's mission to provide quality computers at affordable prices and its vision to be a market leader. Financial projections show increasing revenues, profits, and earnings per share over the next eight quarters as new products are launched and market share grows.