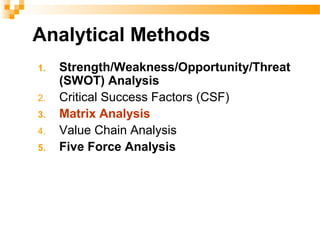

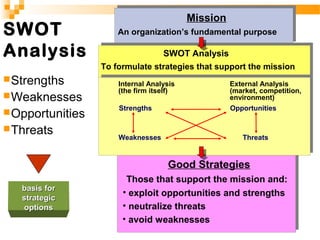

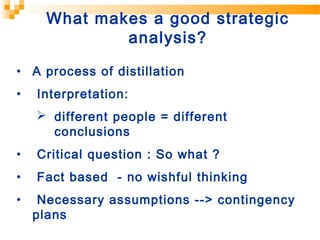

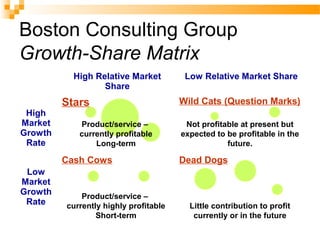

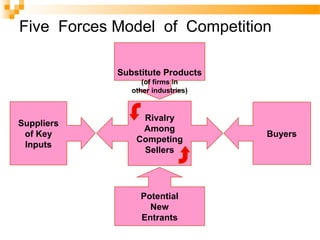

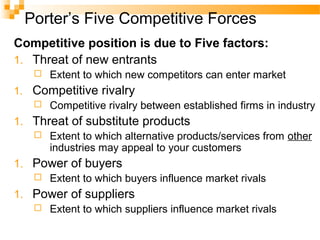

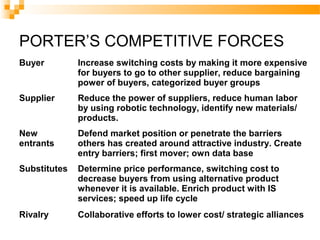

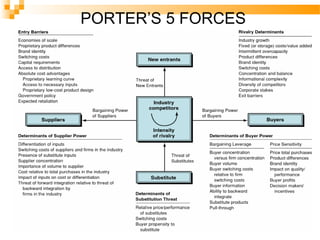

The document discusses several analytical methods used for strategic analysis including SWOT analysis, critical success factors analysis, matrix analysis, value chain analysis, and Porter's five forces analysis. It provides details on how to conduct a SWOT analysis, including examining a company's internal strengths and weaknesses as well as external opportunities and threats. It also outlines the key components of Porter's five forces model which examines the competitive environment including threats from new entrants, power of suppliers and buyers, and rivalry among existing competitors.