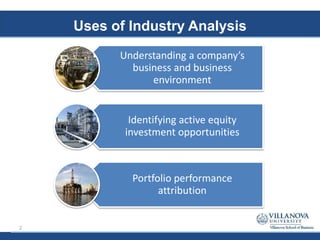

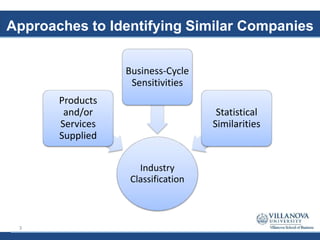

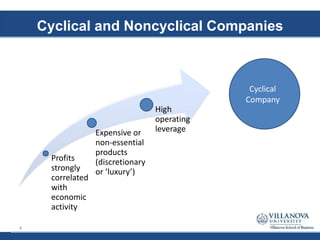

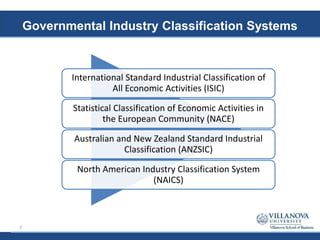

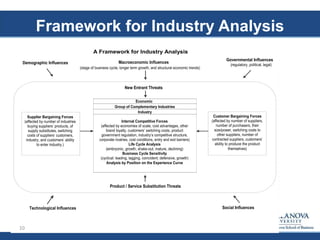

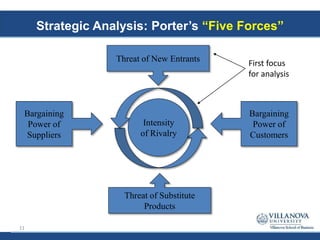

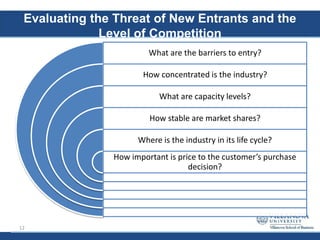

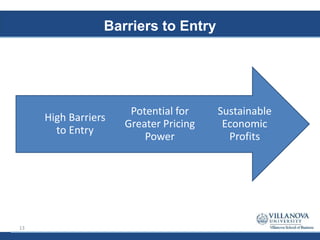

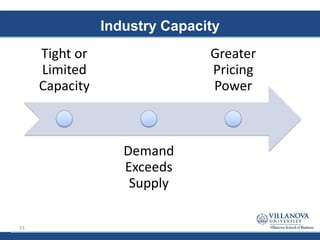

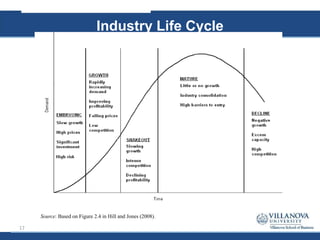

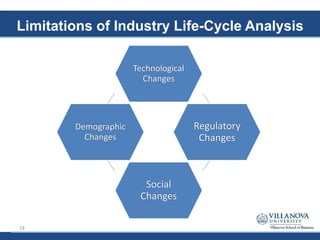

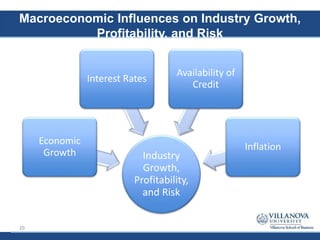

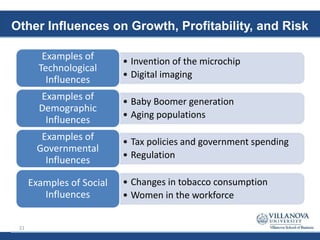

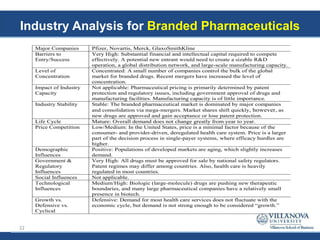

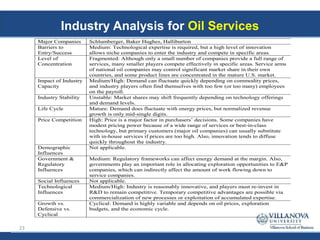

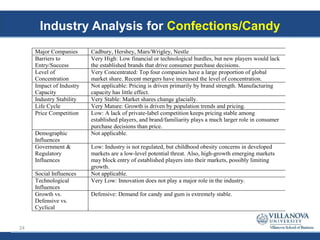

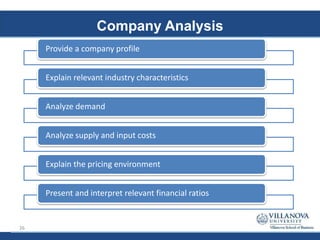

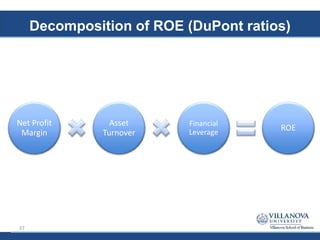

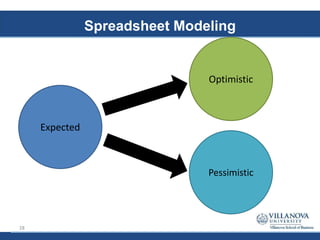

Industry analysis is useful for understanding a company's business environment, identifying investment opportunities, and performing portfolio attribution. Key aspects of industry analysis include understanding classification systems, constructing peer groups, analyzing competitive forces and barriers to entry, evaluating the impact of life cycle stage and macroeconomic factors, and modeling financial performance. Company analysis examines demand, costs, pricing, financial ratios, and strategies to achieve competitive advantages in cost leadership or differentiation.