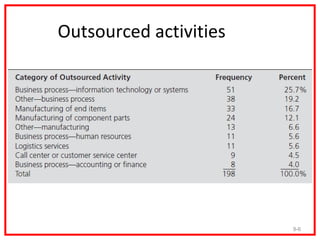

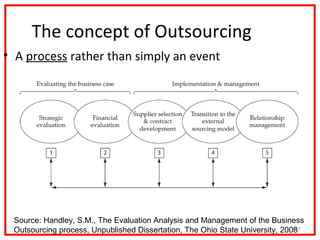

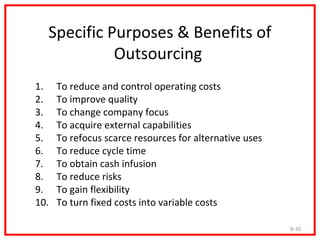

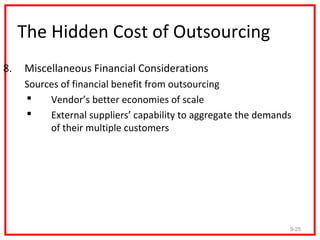

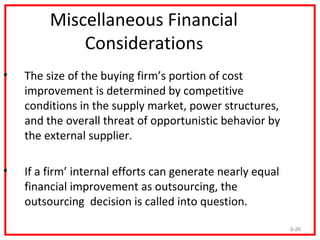

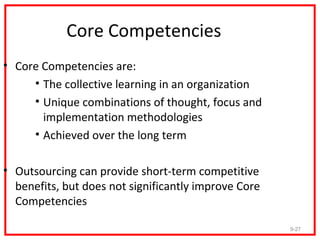

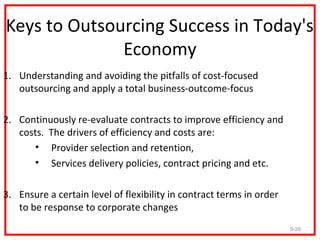

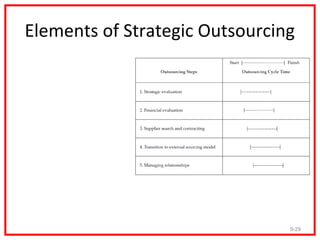

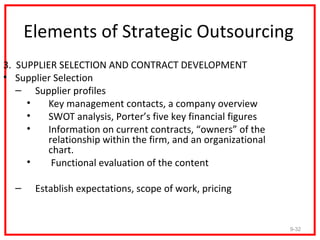

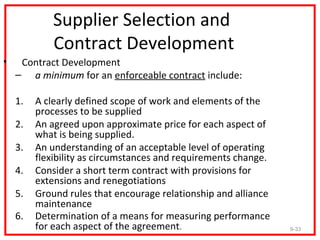

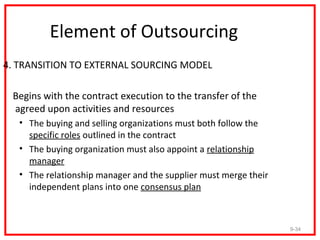

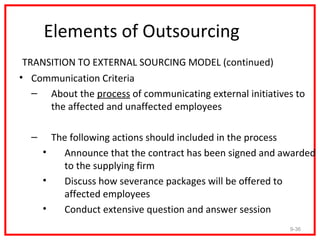

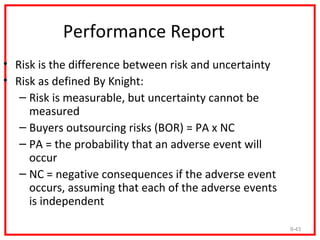

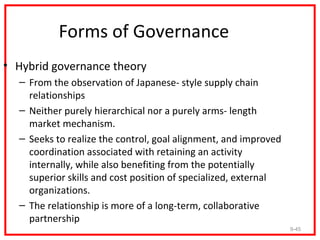

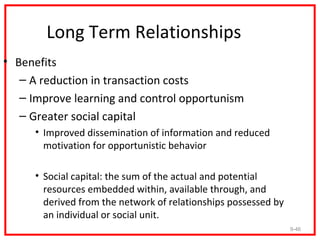

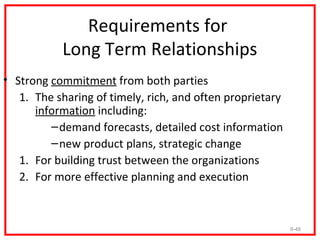

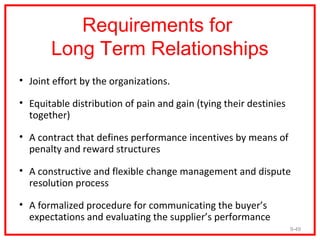

Chapter nine of 'Purchasing and Supply Chain Management' focuses on strategic outsourcing, outlining its definition, benefits, and hidden costs. The chapter emphasizes the importance of a thorough strategic assessment, relationship management, and continuous contract evaluation to maximize outsourcing effectiveness. Key components covered include core competencies, risk management, and the need for long-term partnerships to mitigate traditional outsourcing concerns.