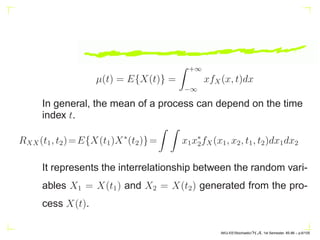

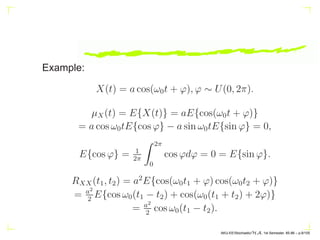

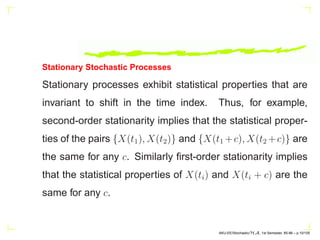

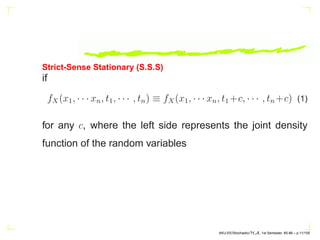

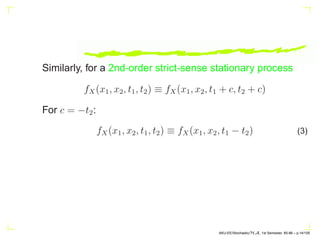

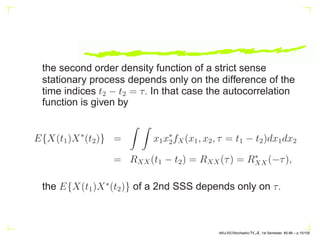

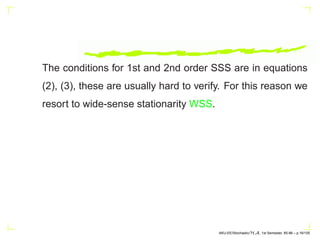

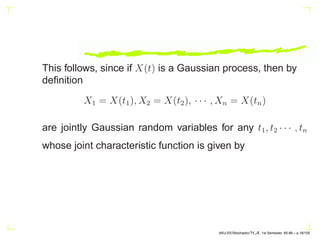

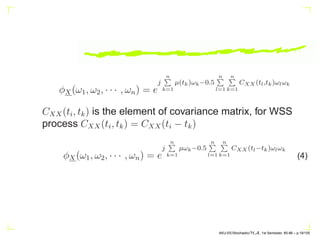

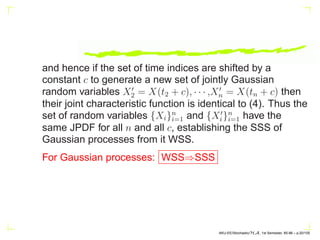

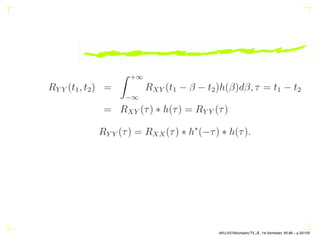

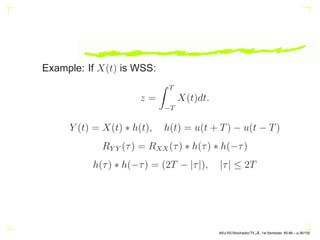

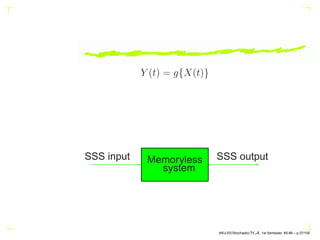

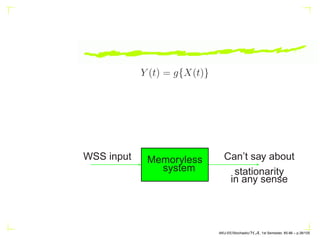

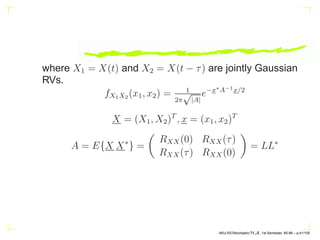

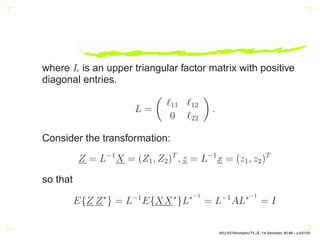

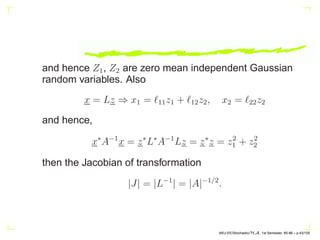

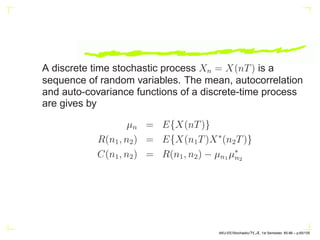

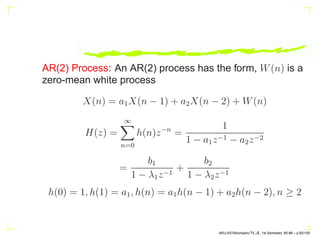

The document discusses stochastic processes, defining outcomes of experiments as waveforms that create random variables dependent on time. It covers key concepts such as mean functions, correlation functions, and the specifications required to analyze these processes. The distinction between strict-sense stationary and wide-sense stationary processes, along with the properties of Gaussian processes, is also elaborated.

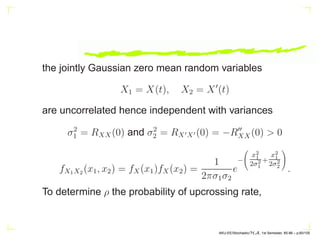

![1. RXX(t1, t2) = R∗

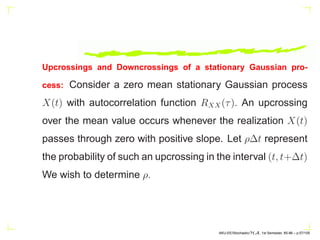

XX(t2, t1) = [E{X(t2)X∗

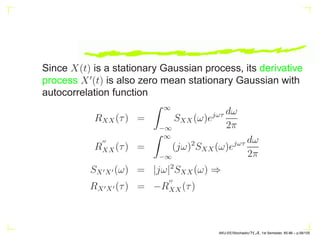

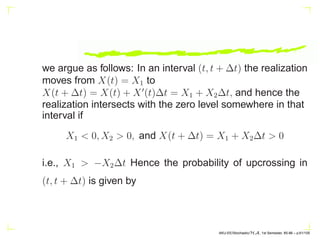

(t1)}]∗

2. RXX(t, t) = E{|X(t)|2

} > 0.

3.

n

P

i=1

n

P

j=1

aia∗

j RXX(ti, tj) ≥ 0.

CXX(t1, t2) = RXX(t1, t2) − µX(t1)µ∗

X(t2)

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.7/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-7-320.jpg)

![Example:

z =

Z T

−T

X(t)dt

E[|z|2

] =

Z T

−T

Z T

−T

E{X(t1)X∗

(t2)}dt1dt2

=

Z T

−T

Z T

−T

RXX(t1, t2)dt1dt2

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.8/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-8-320.jpg)

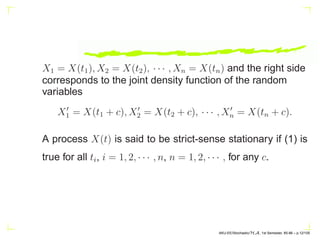

![For a first-order strict sense stationary process,

fX(x, t) ≡ fX(x, t + c)

for c = −t,

fX(x, t) = fX(x) (2)

the first-order density of X(t) is independent of t. In that

case

E[X(t)] =

Z +∞

−∞

xf(x)dx = µ, a constant.

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.13/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-13-320.jpg)

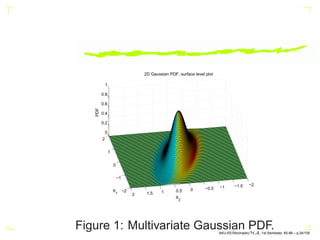

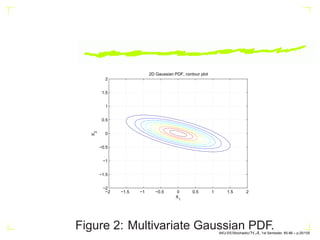

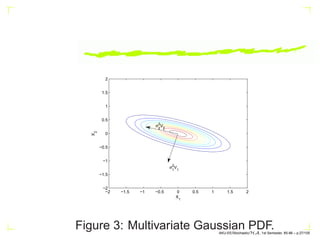

![N-dim Gaussian

C=[.5,-.15;-.15,.2]; mu=[1 -1];

[X1,X2] = meshgrid(linspace(-2,2,100)’,

linspace(-2,2,100)’);

X = [X1(:) X2(:)];

p = mvnpdf(X, mu, C);

surf(X1,X2,reshape(p,100,100));

contour(X1,X2,reshape(p,100,100));

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.23/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-23-320.jpg)

![C = V DV H

, V = [V1 V2]

C =

0.5 −.15

−0.15 0.2

V =

0.31625 −.9487

−0.9487 0.3162

D =

0.05 0

0 0.55

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.26/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-26-320.jpg)

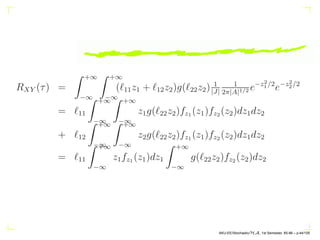

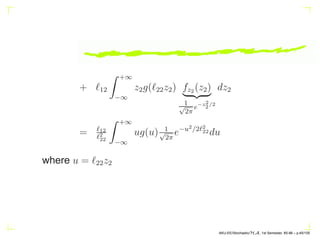

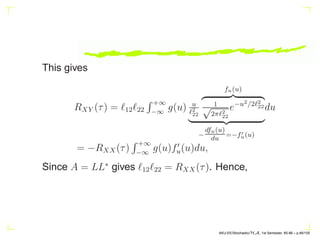

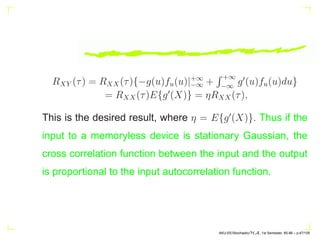

![If X(t) is a zero mean stationary Gaussian process, and

Y (t) = g{X(t)}, where g(·) represents a nonlinear

memoryless device, then

RXY (τ) = ηRXX(τ), η = E{g′

(X)}.

Proof:

RXY (τ) = E{X(t)Y (t − τ)} = E[X(t)g{X(t − τ)}]

=

Z Z

x1g(x2)fX1X2 (x1, x2)dx1dx2, (5)

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.40/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-40-320.jpg)

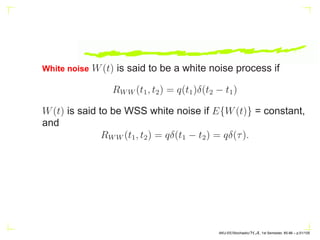

![E[N(t)] = µW

Z +∞

−∞

h(τ)dτ = a constant

RNN (τ) = qδ(τ) ∗ h∗

(−τ) ∗ h(τ)

= qh∗

(−τ) ∗ h(τ) = qρ(τ)

ρ(τ) = h(τ) ∗ h∗

(−τ) =

Z +∞

−∞

h(α)h∗

(α + τ)dα.

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.54/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-54-320.jpg)

![Further X(t) and X′

(t) and are jointly Gaussian stationary

processes, and since

RXX′ (τ) = −

dRXX(τ)

dτ

,

RXX′ (−τ) = −

dRXX(−τ)

d(−τ)

=

dRXX(τ)

dτ

= −RXX′ (τ)

which for τ = 0 gives

RXX′ (0) = 0 ⇒ E[X(t)X′

(t)] = 0

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.59/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-59-320.jpg)

![WSS:

E{X(nT)} = µ, a constant

E[X{(k + n)T}X∗

{(k)T}] = R(n) = rn = r∗

−n

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.66/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-66-320.jpg)

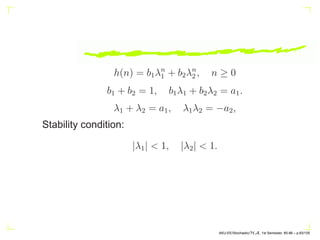

![RXX(n) = E{X(n + m)X∗

(m)}

= E{[a1X(n + m − 1) + a2X(n + m − 2)]X∗

(m)}

+ E{W(n + m)X∗

(m)}

= a1RXX(n − 1) + a2RXX(n − 2)

Because W(n) and X(n) are uncorrelated

E{W(n + m)X∗

(m)} = 0

ρX(n) =

RXX(n)

RXX(0)

= a1ρX(n − 1) + a2ρX(n − 2).

AKU-EE/Stochastic/HA, 1st Semester, 85-86 – p.84/105](https://image.slidesharecdn.com/stoch1-210301121813/85/Stochastic-Processes-part-1-94-320.jpg)