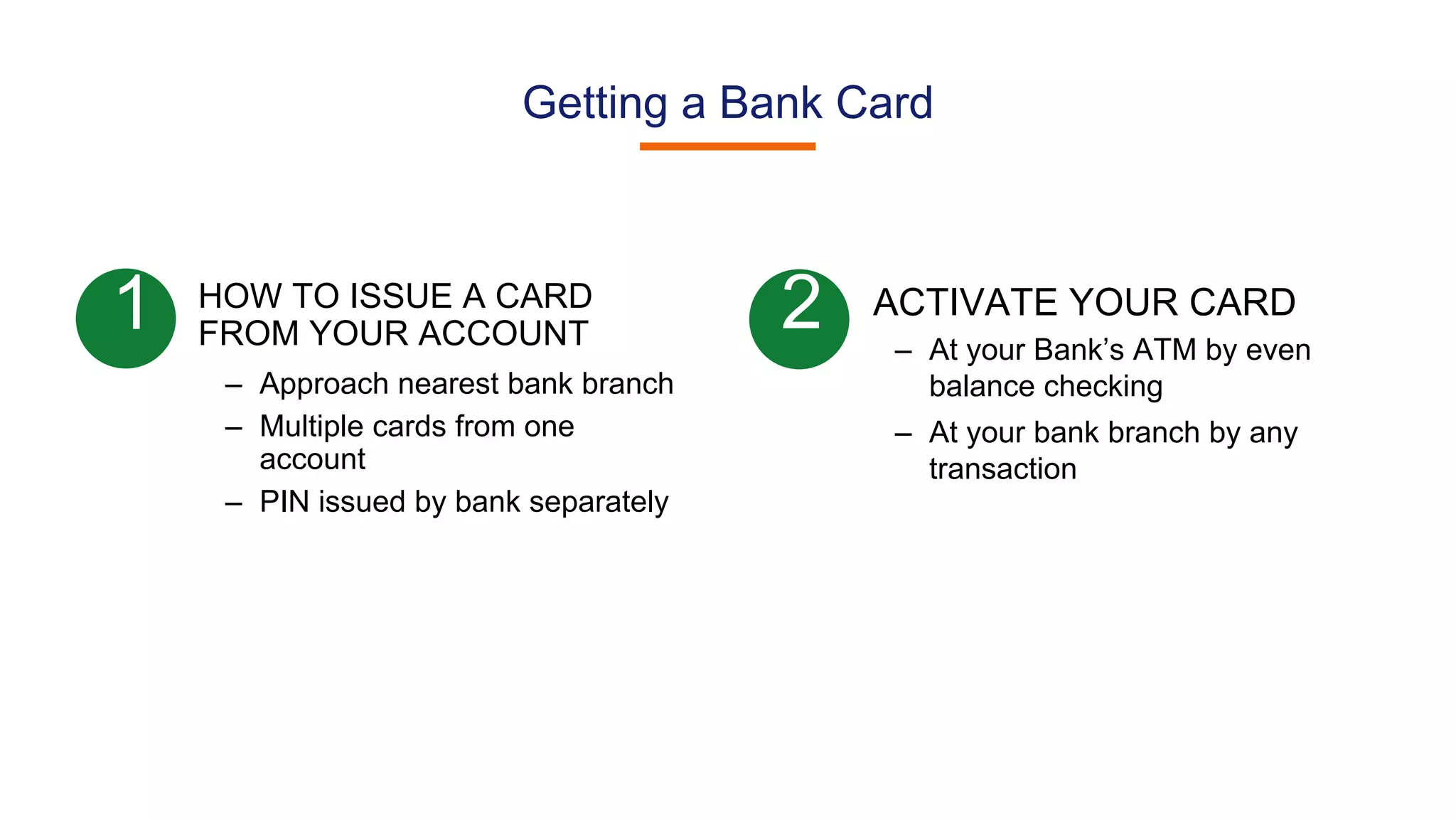

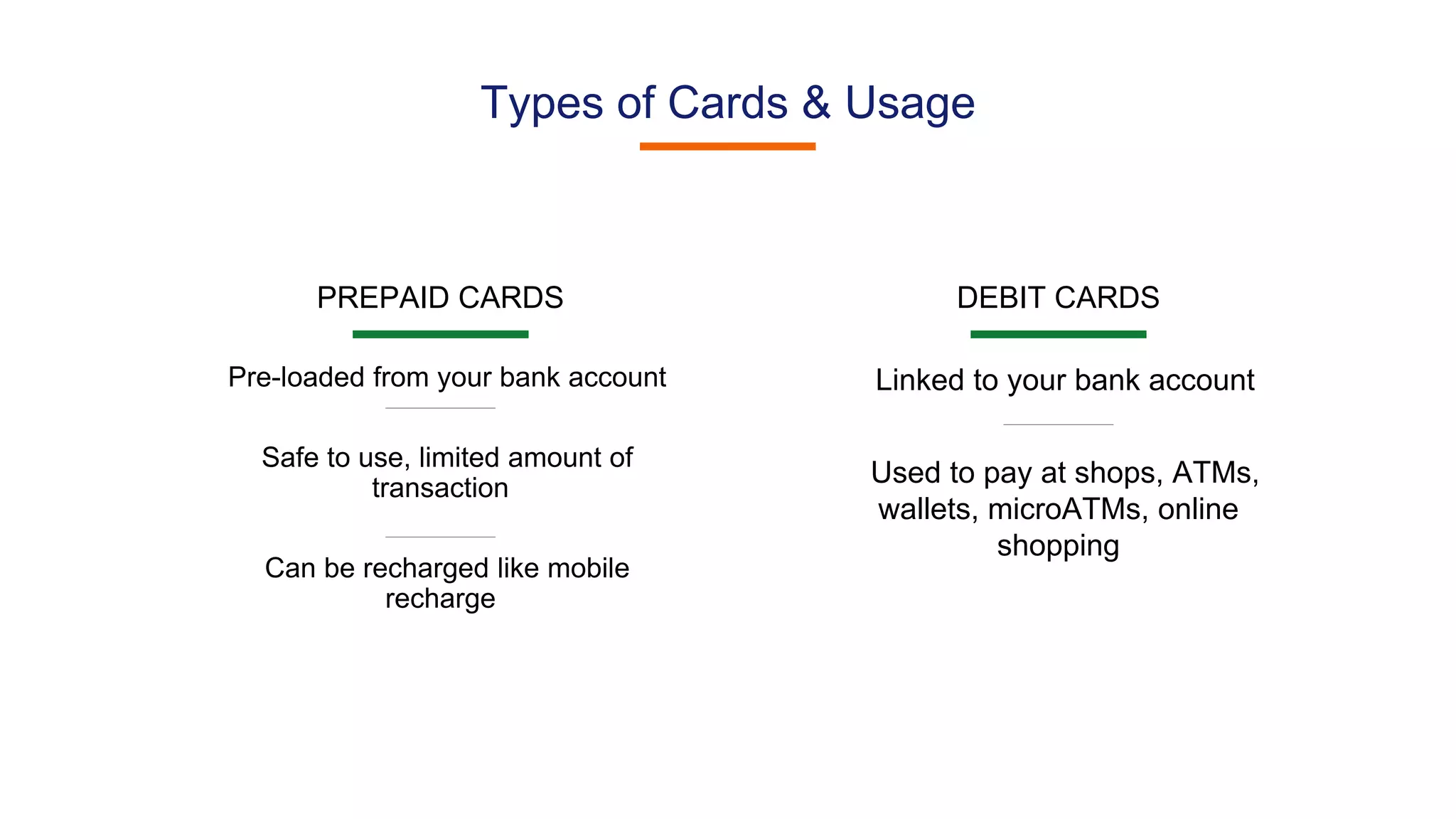

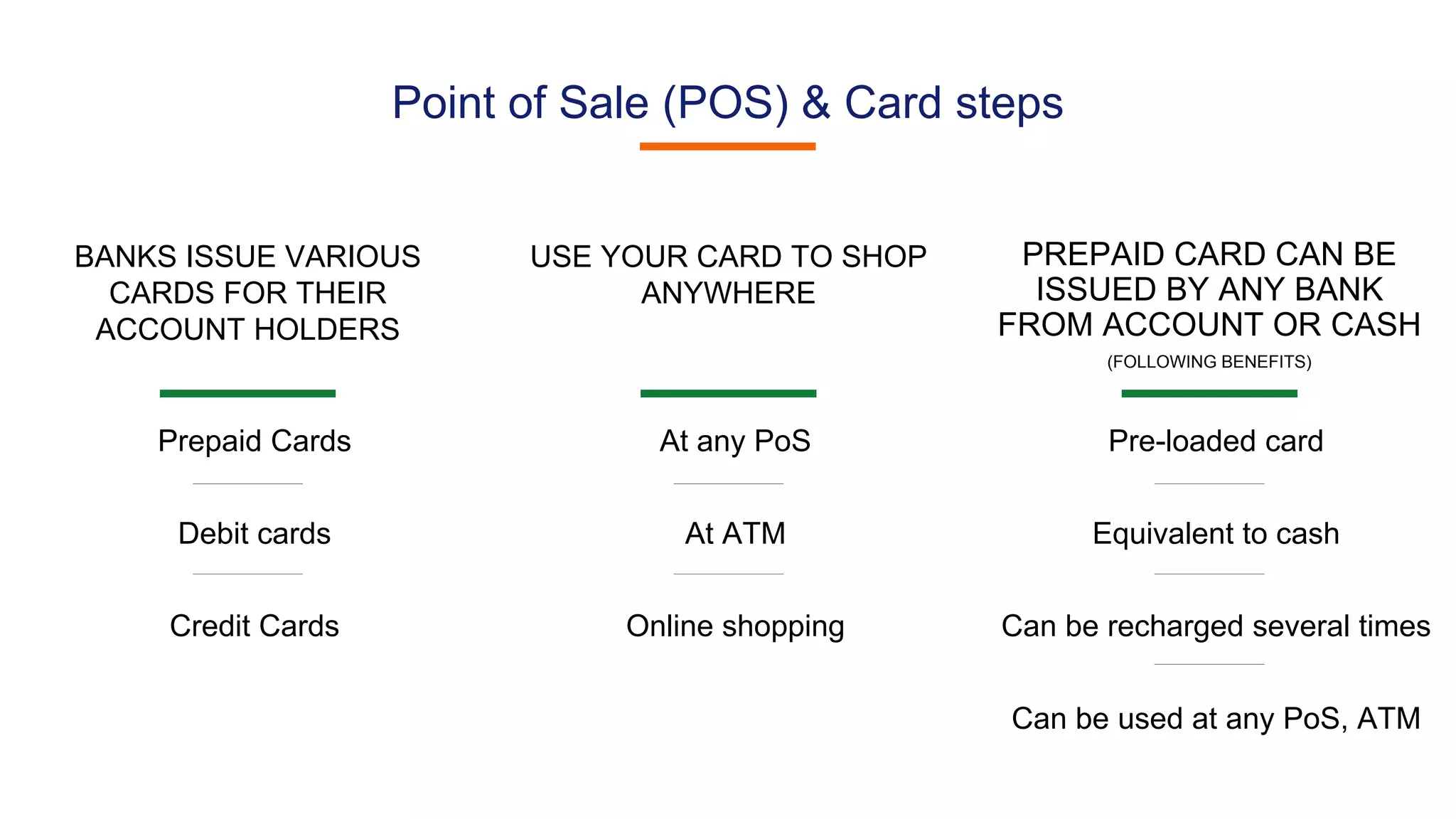

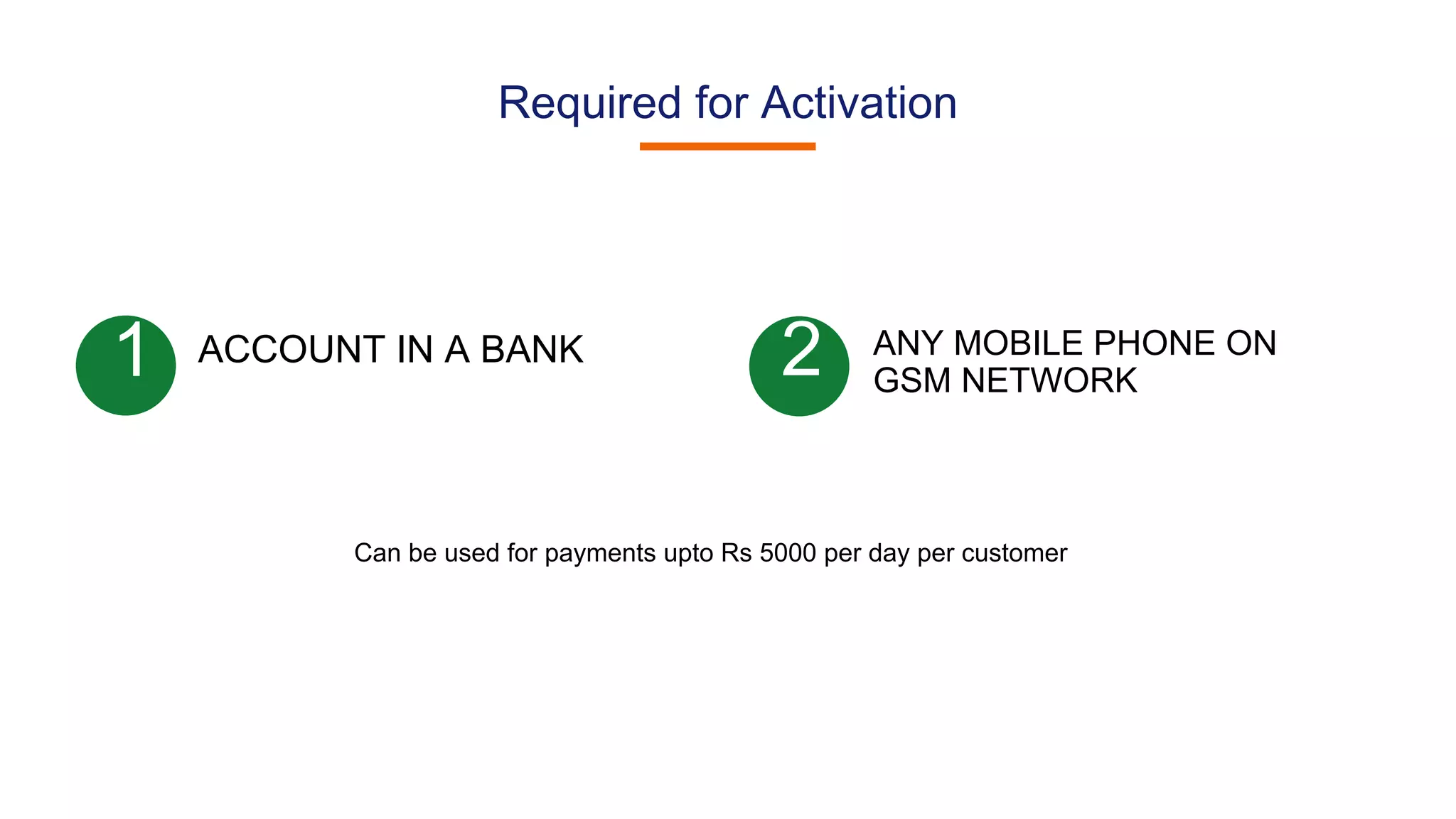

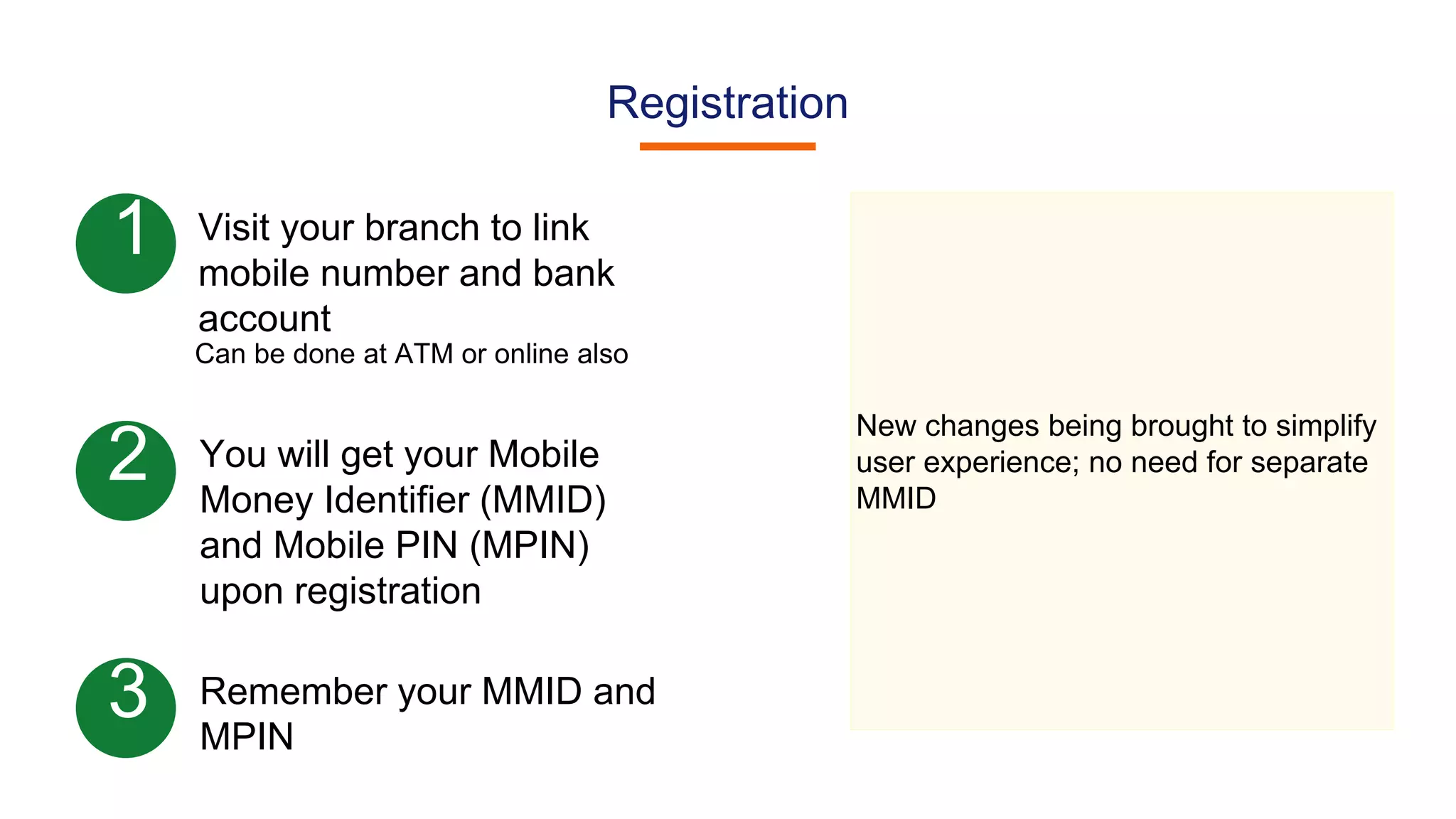

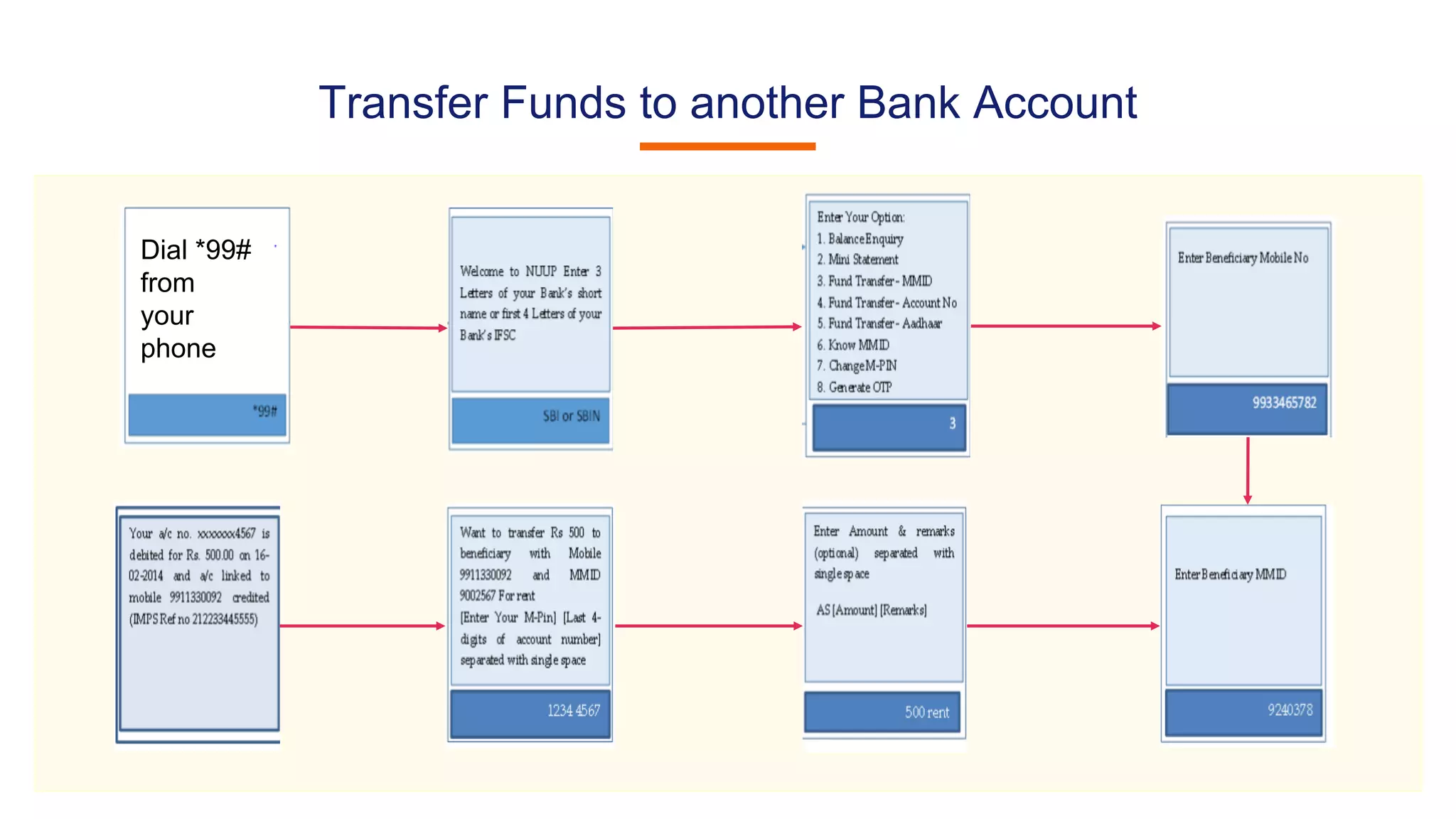

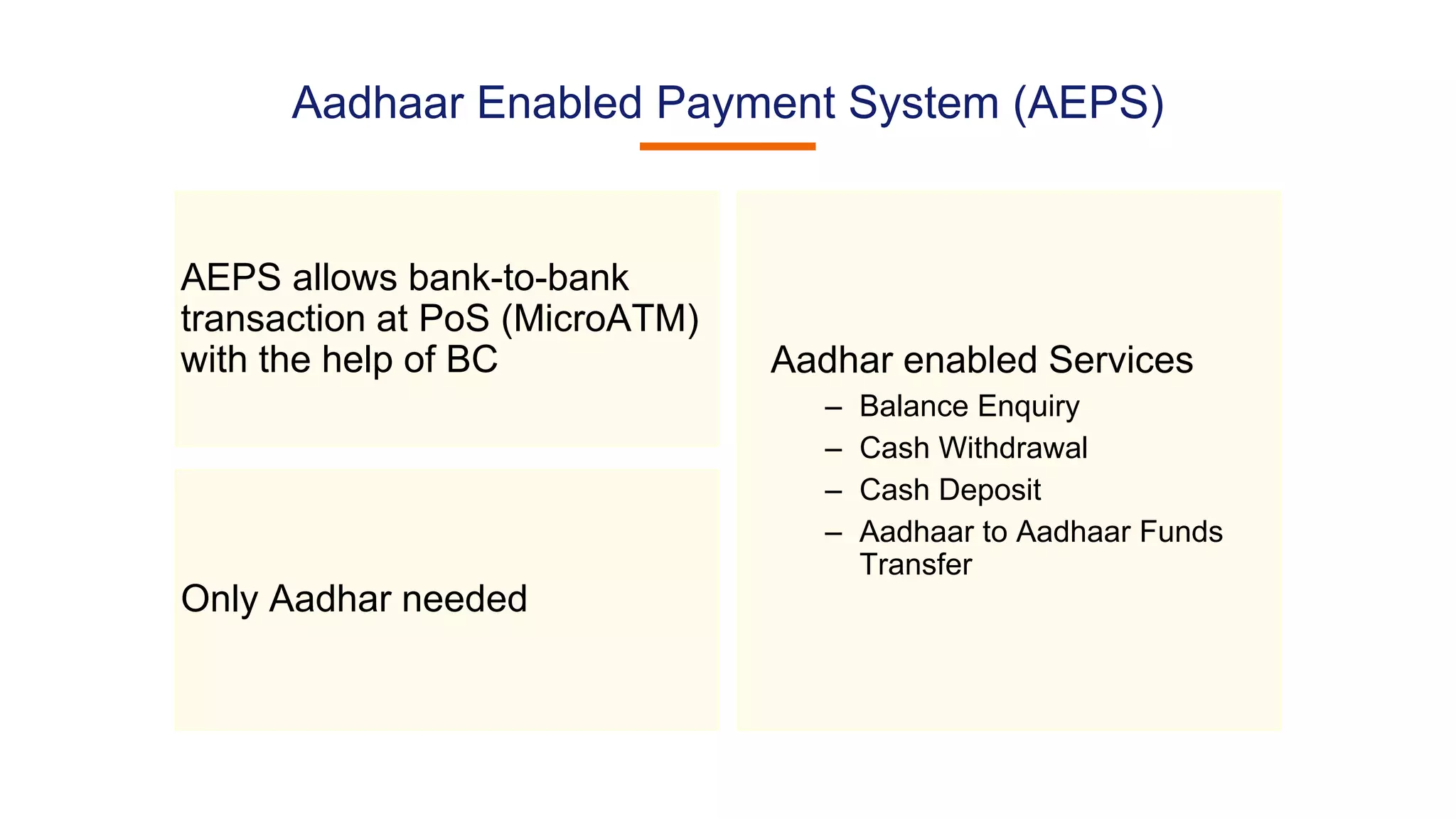

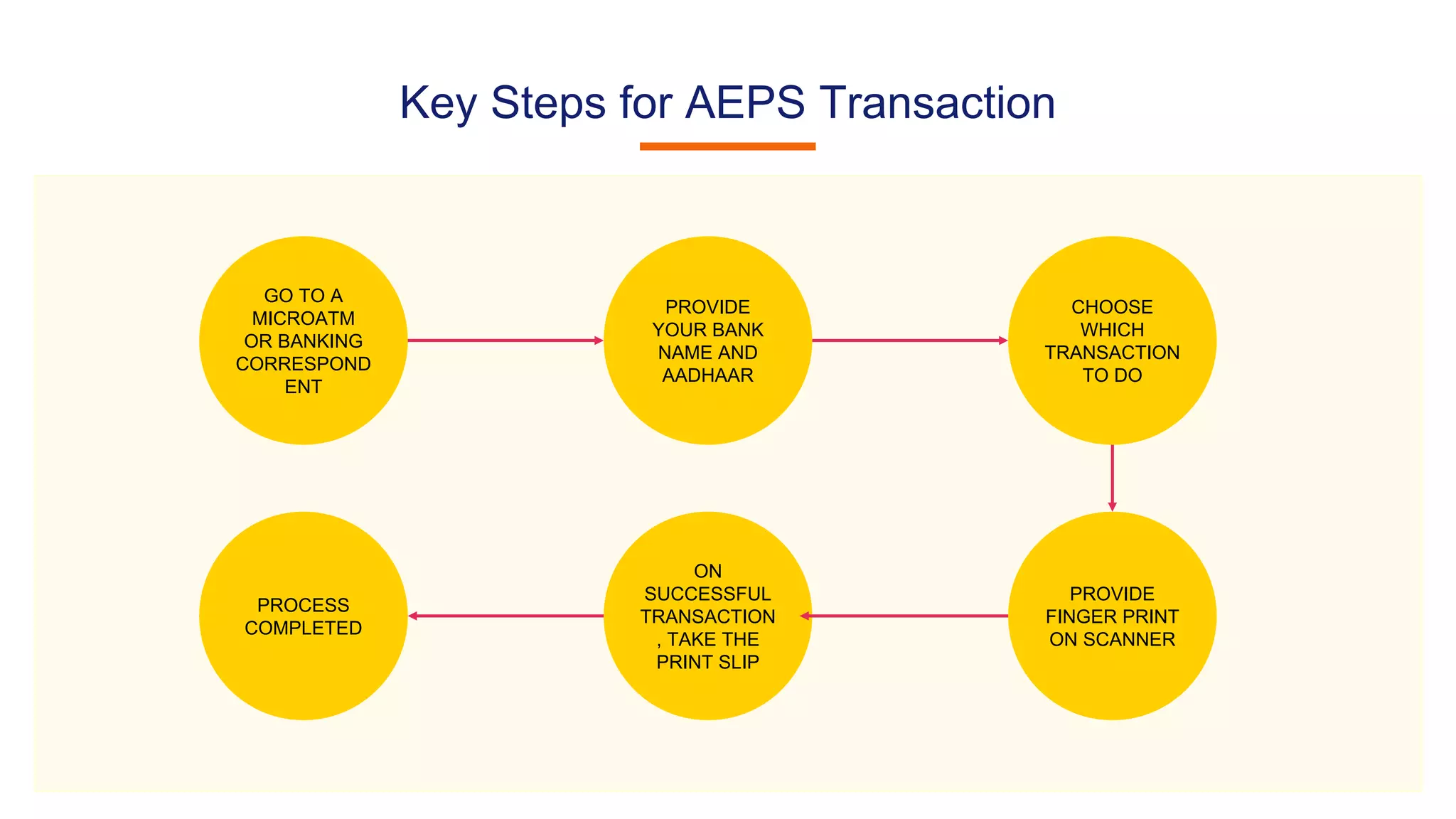

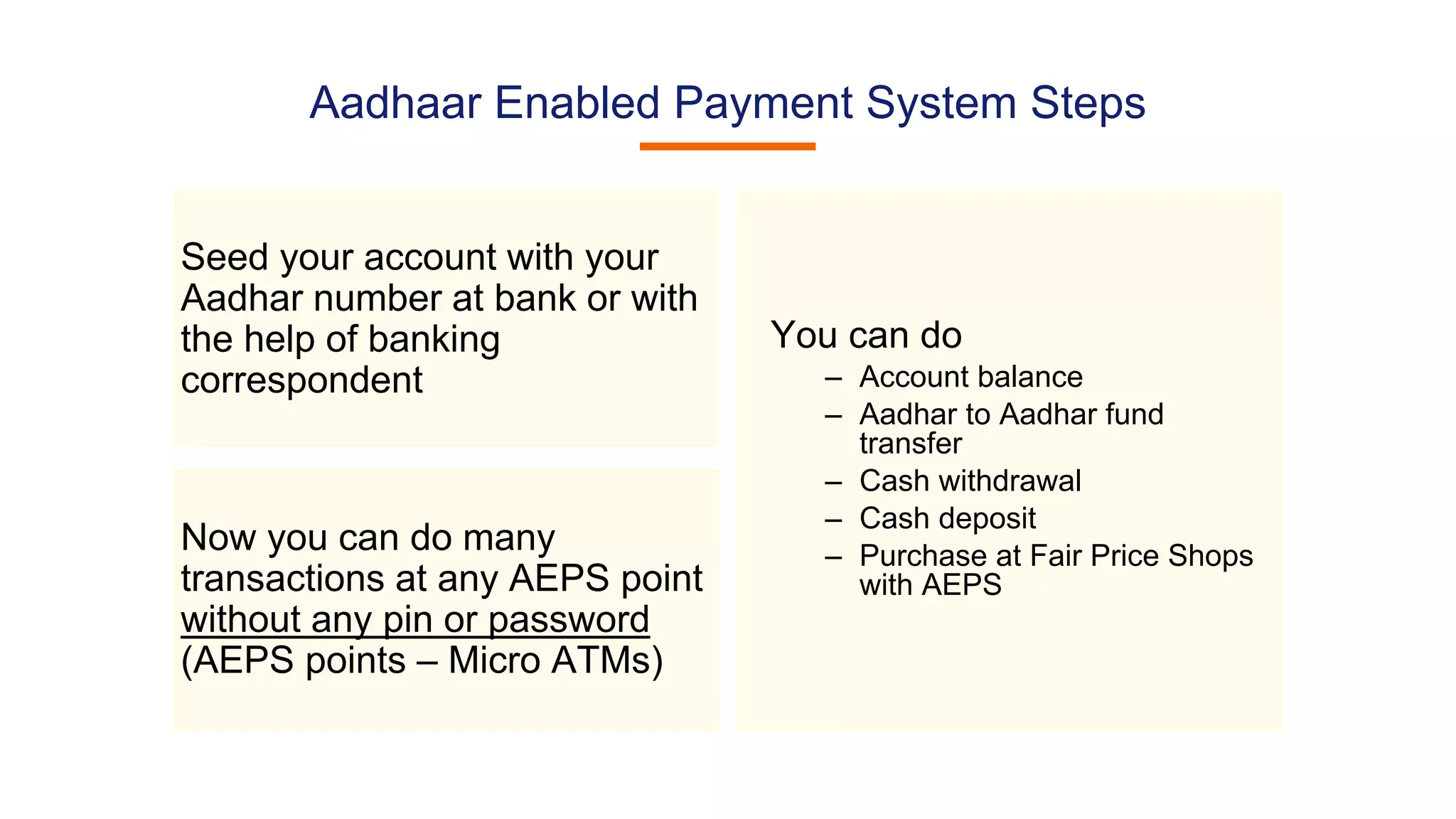

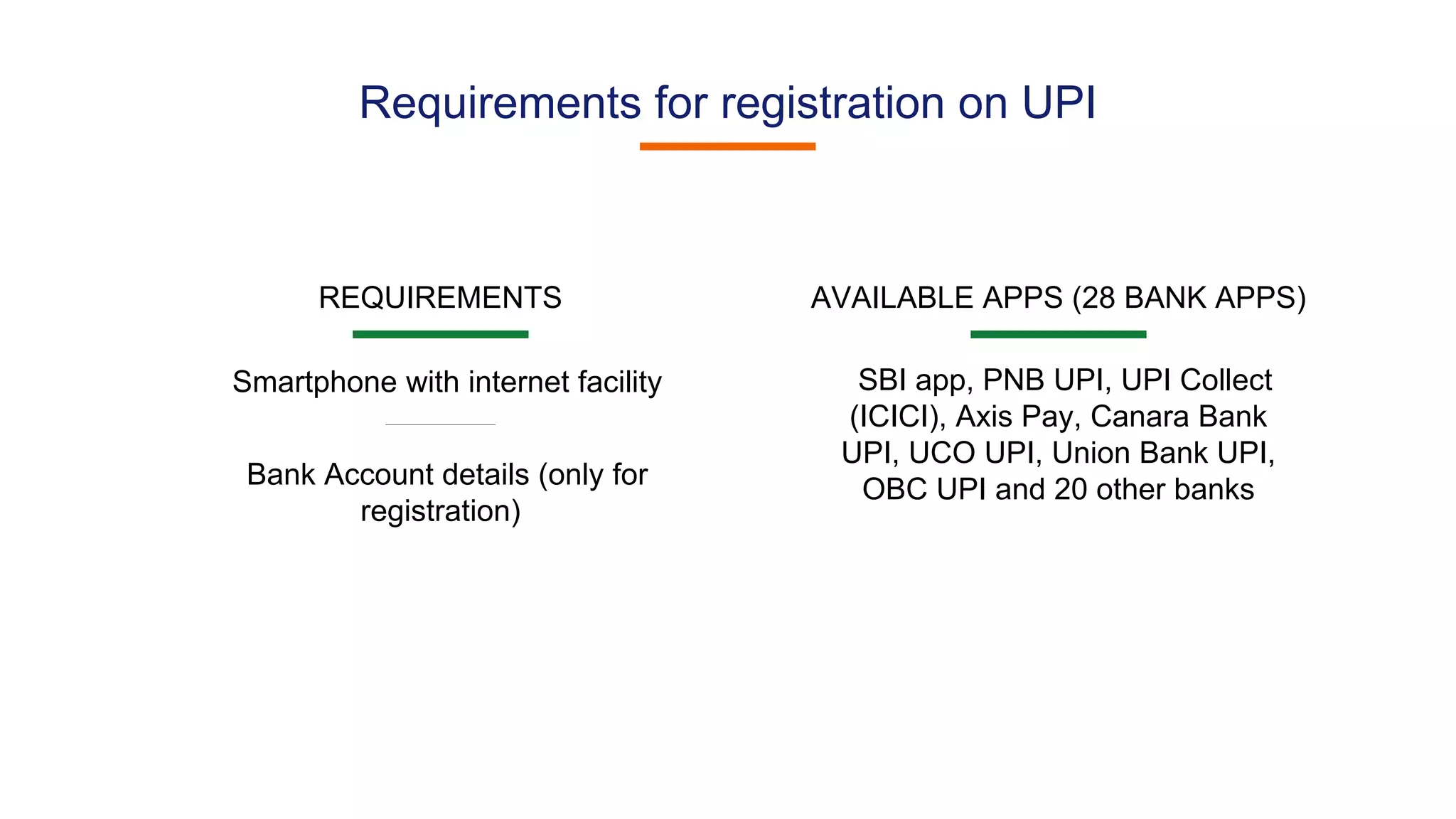

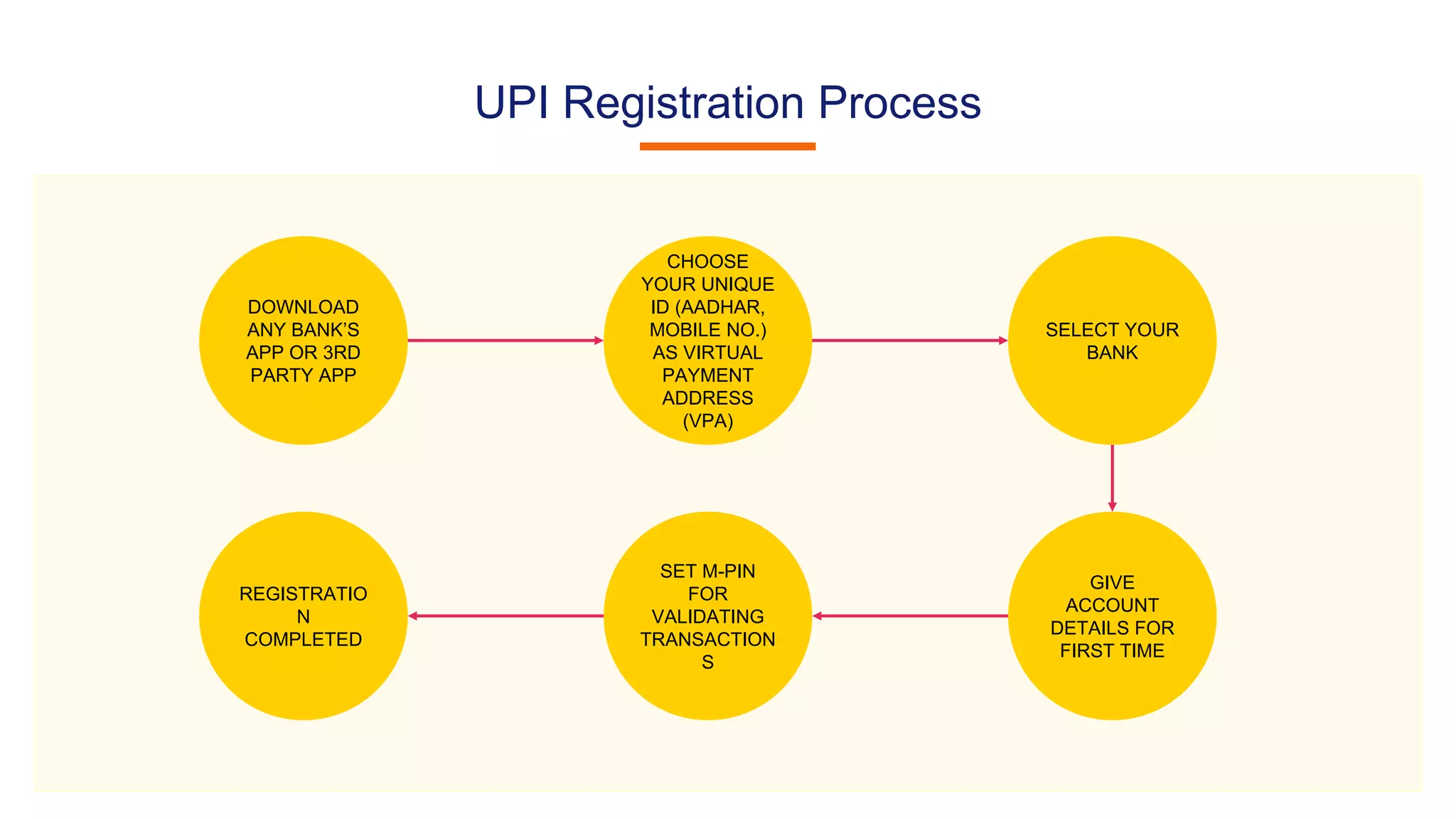

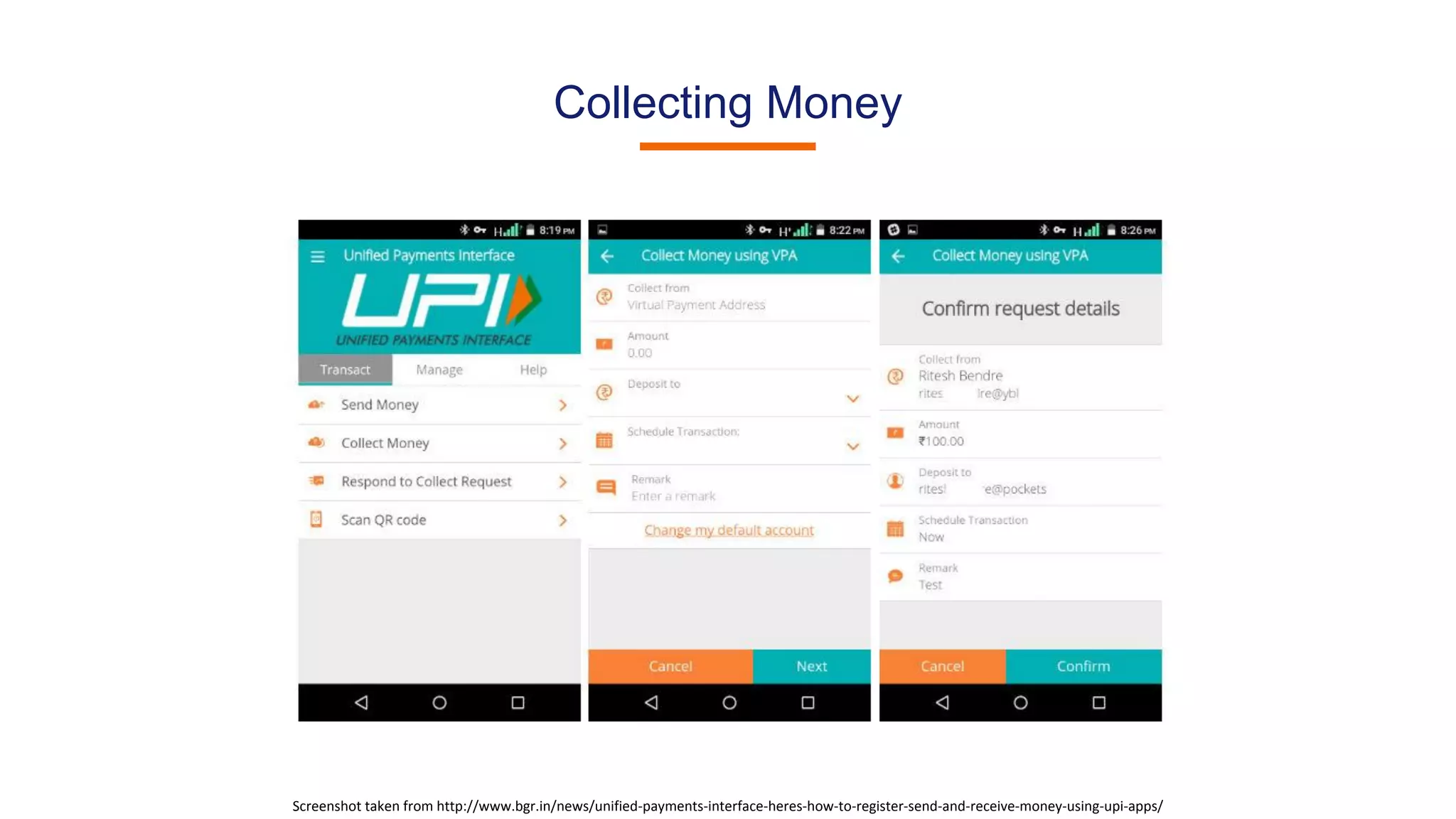

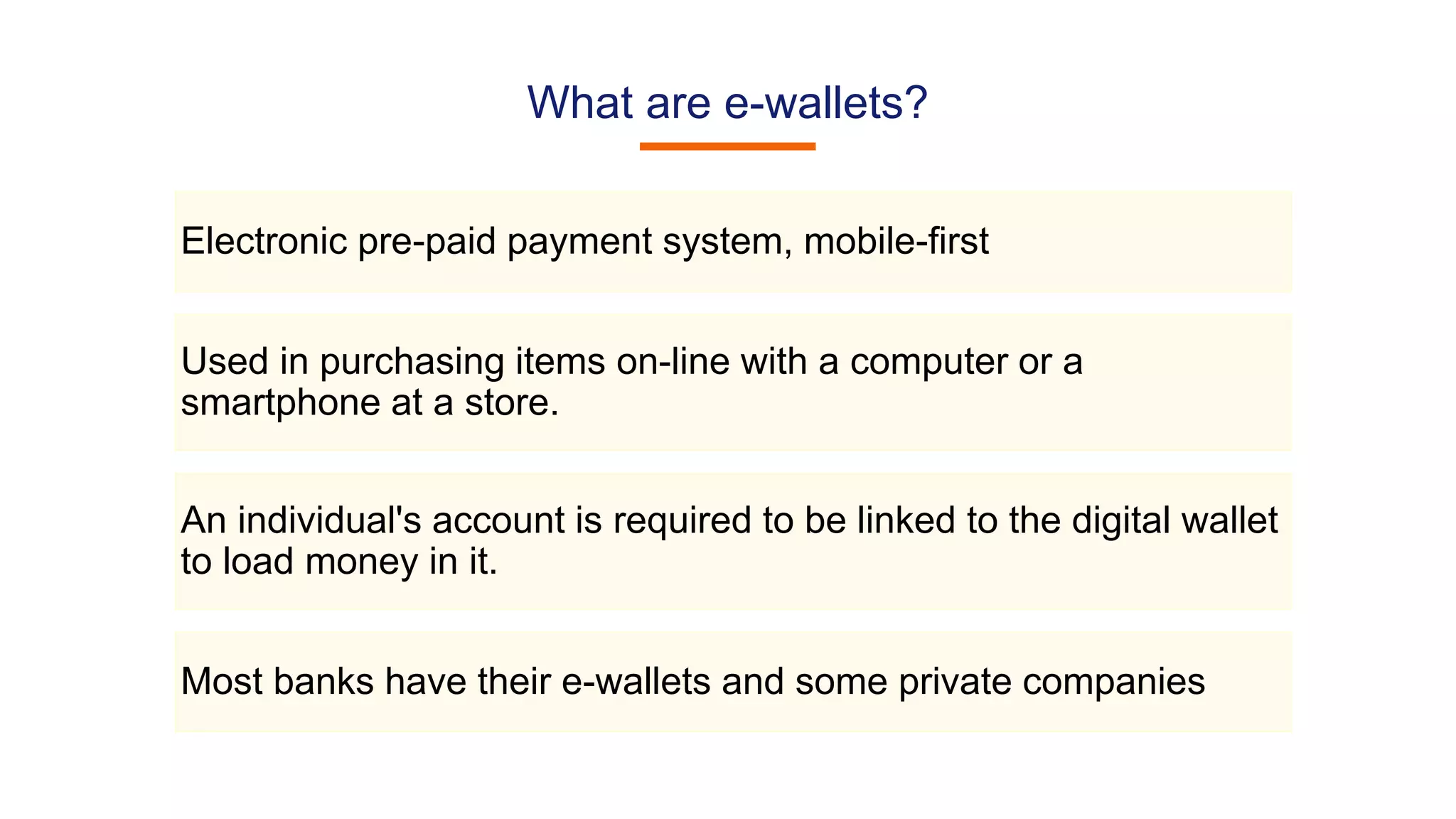

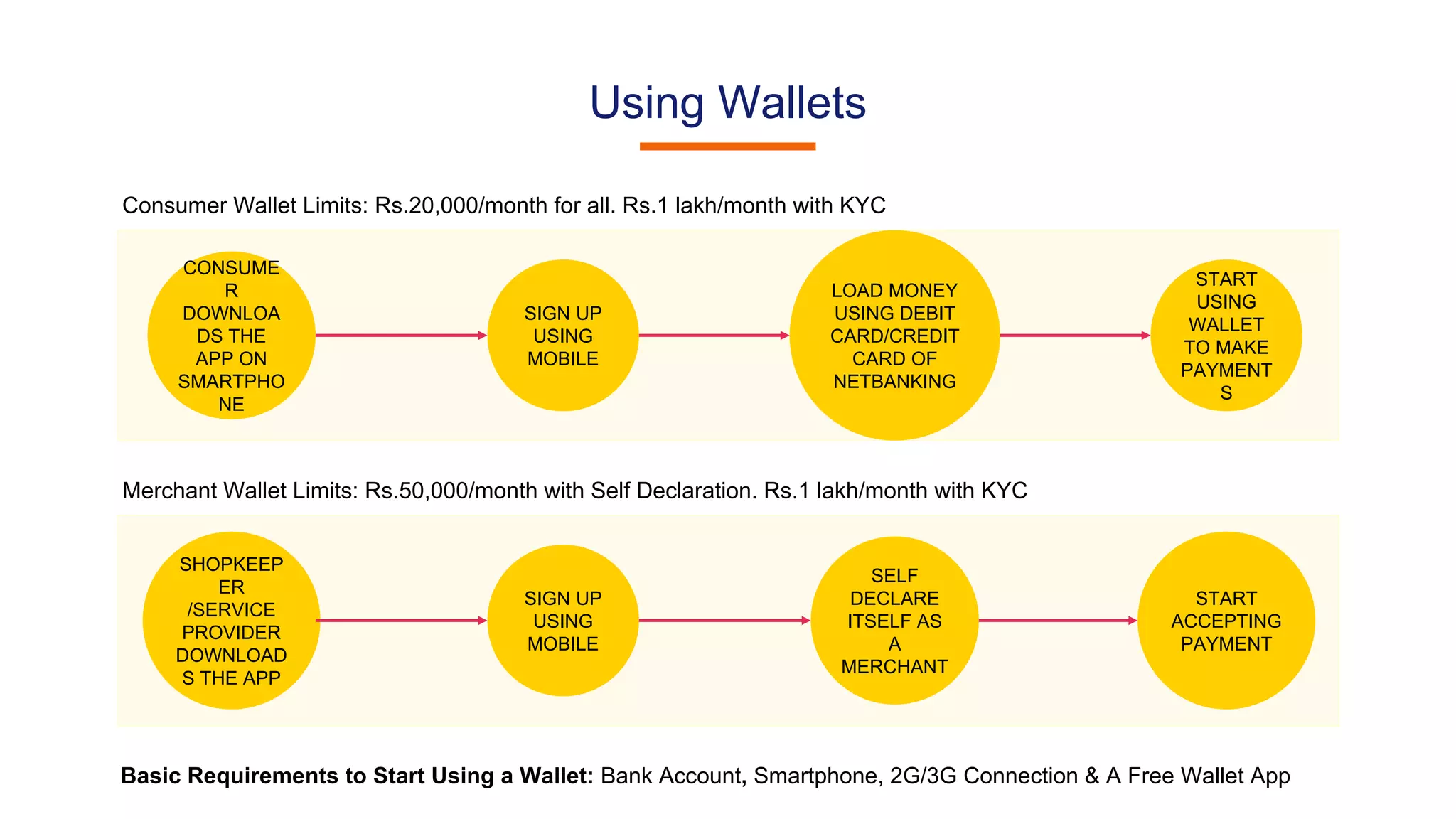

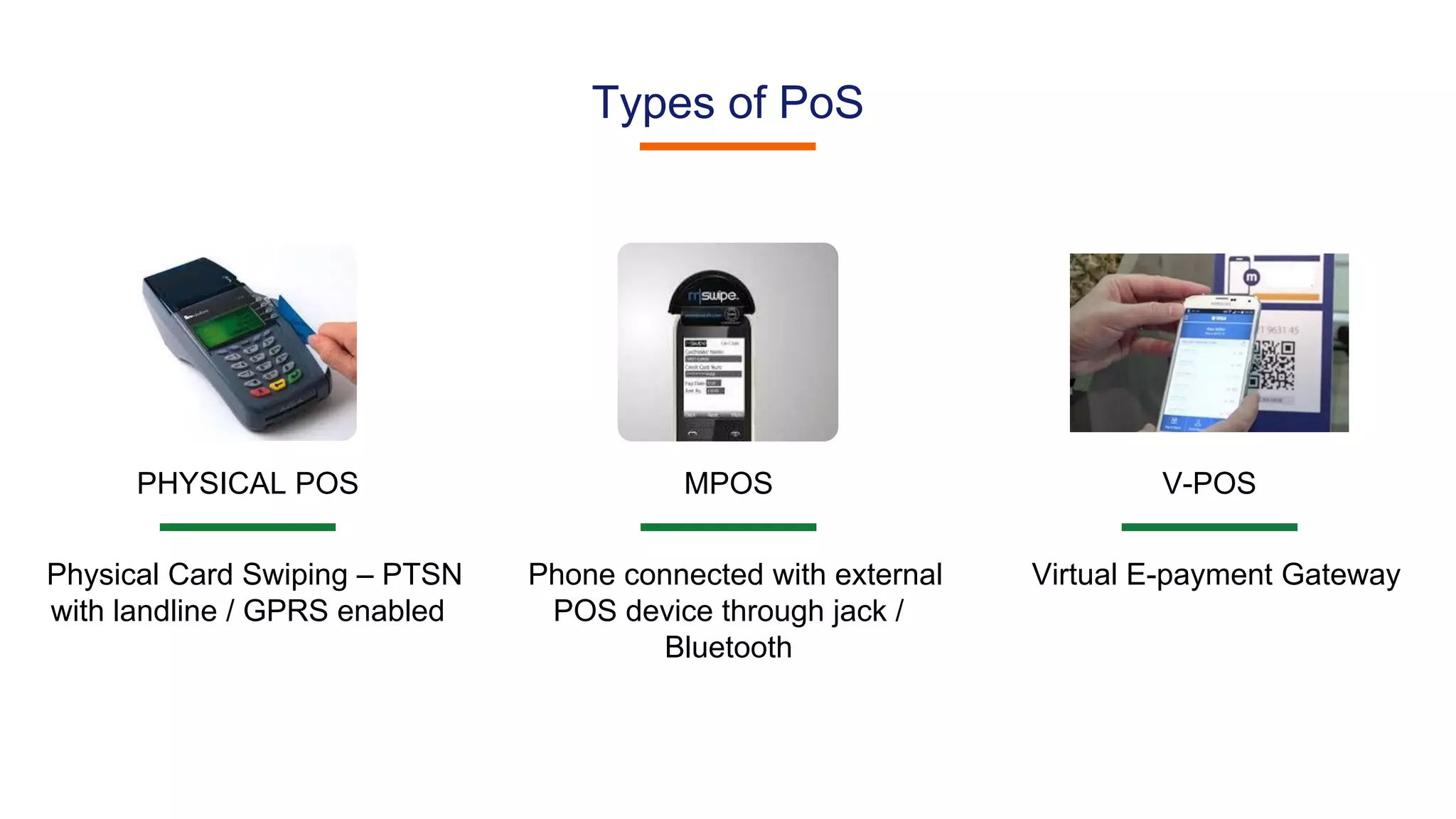

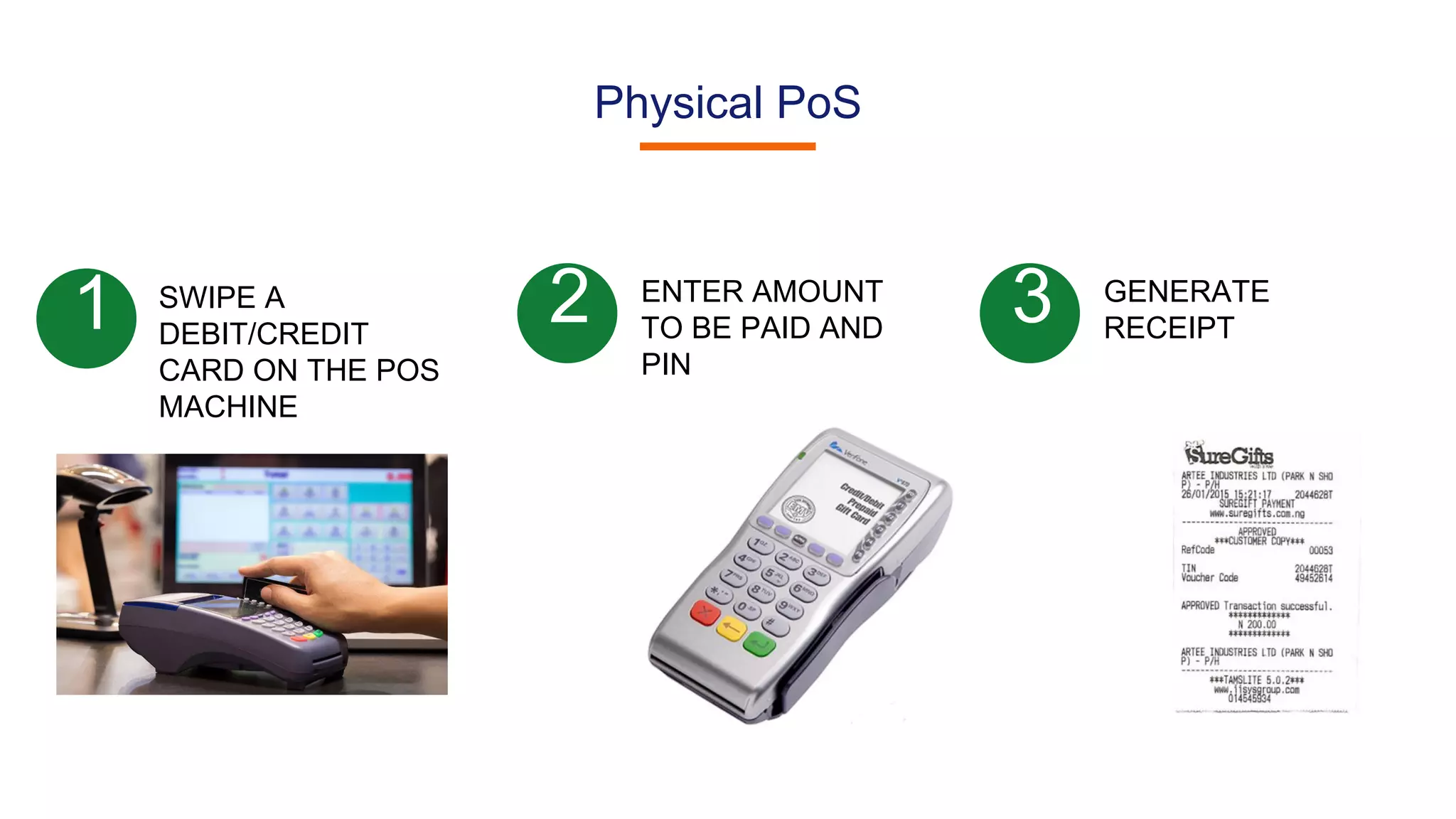

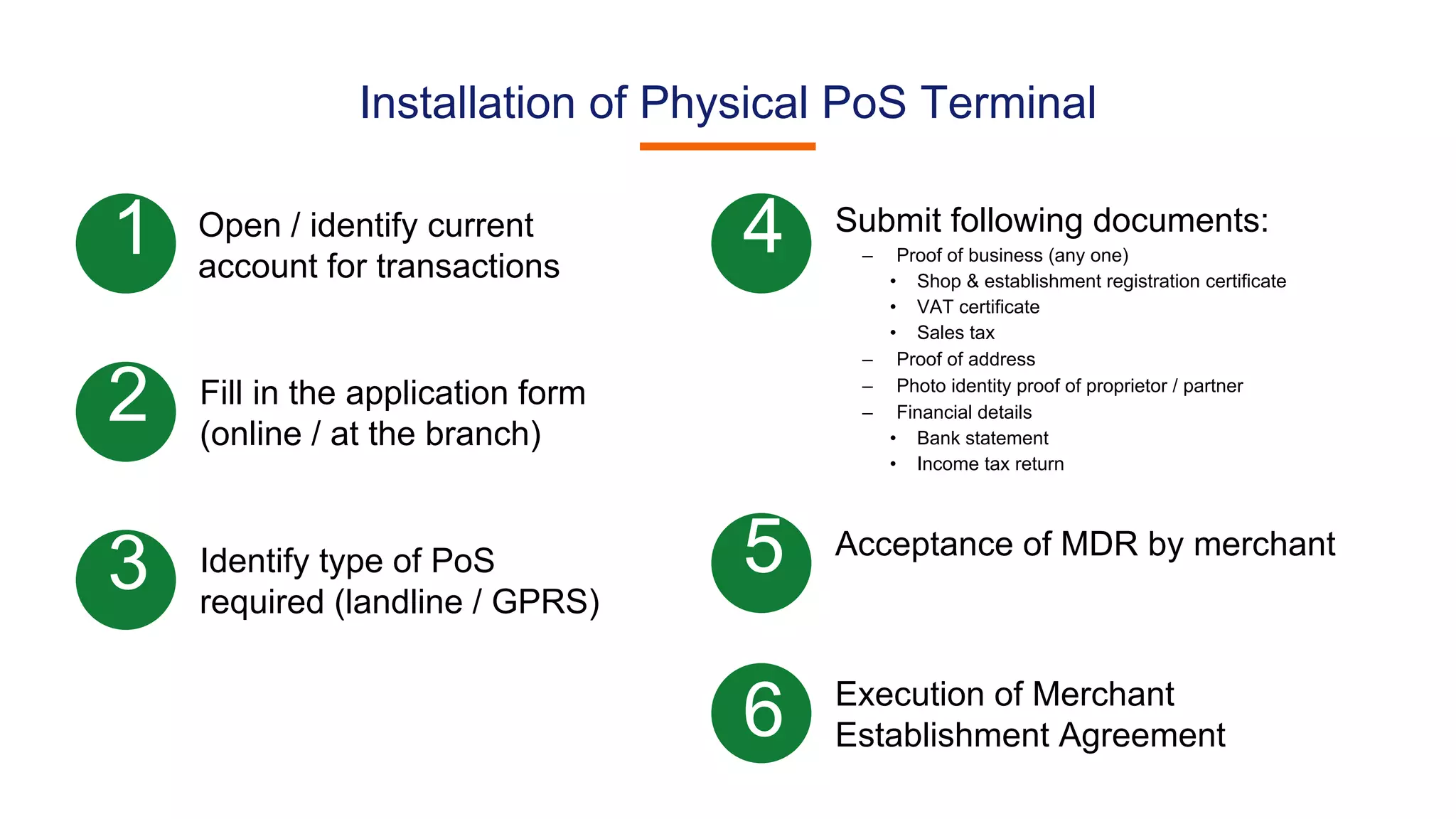

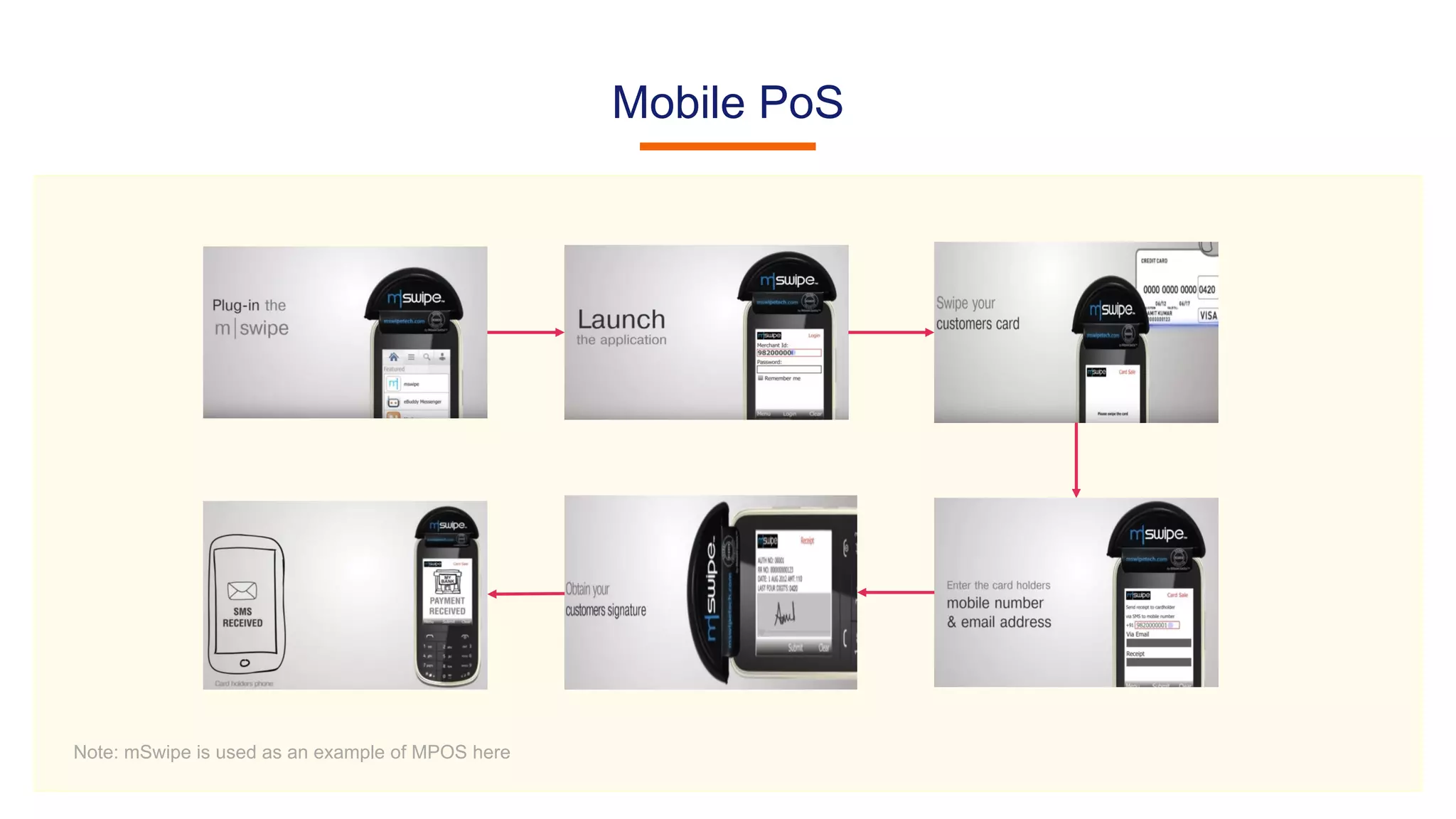

This document provides step-by-step instructions for various digital payment modes in India including bank cards, USSD-based mobile banking, Aadhaar Enabled Payment System (AEPS), Unified Payments Interface (UPI), and wallets. It explains how to issue and activate bank cards, register and use USSD, conduct AEPS transactions using Aadhaar, register and send/receive money using UPI, and load and use digital wallets to make payments. Requirements, processes, and transaction limits for each payment mode are outlined. Physical and virtual point of sale (POS) options are also summarized.