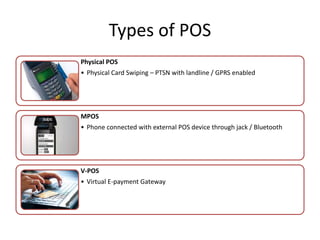

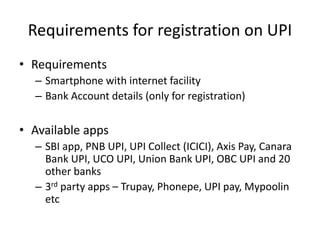

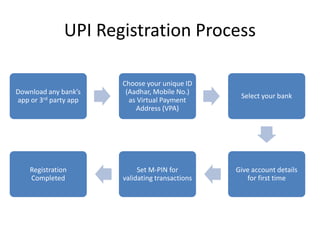

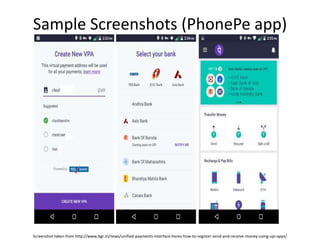

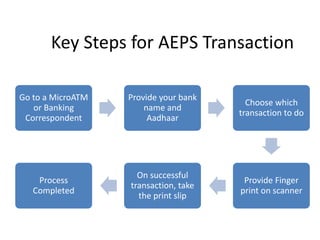

1) The document provides step-by-step instructions for various digital payment modes in India including Points of Sale (POS), Unstructured Supplementary Service Data (USSDS) based mobile banking, Unified Payments Interface (UPI), e-wallets, and Aadhaar Enabled Payment System (AEPS).

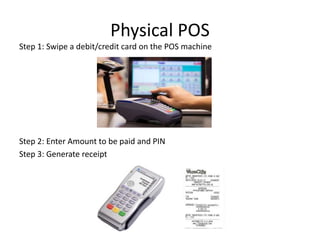

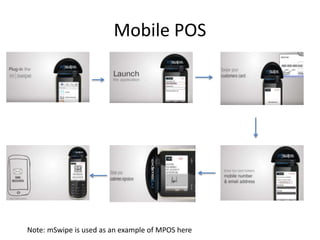

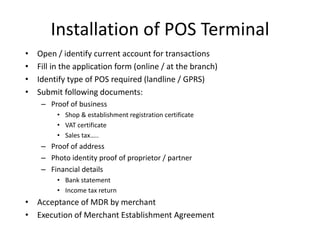

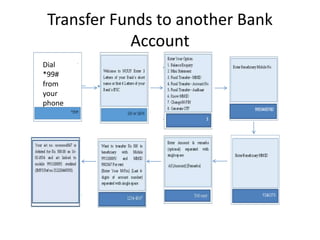

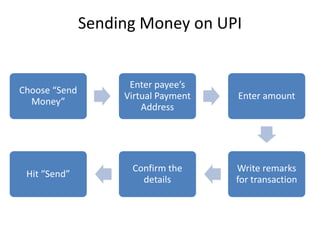

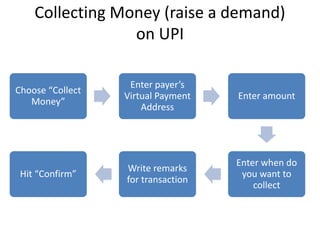

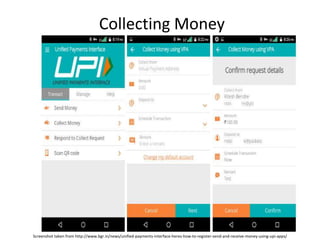

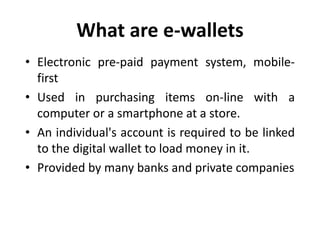

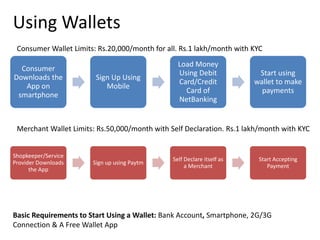

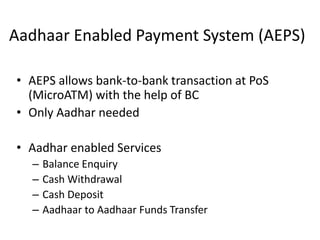

2) It explains the registration process and key steps to send and receive money for different payment methods like using a physical POS machine, mobile POS, virtual POS, USSD-based banking, UPI, and e-wallets.

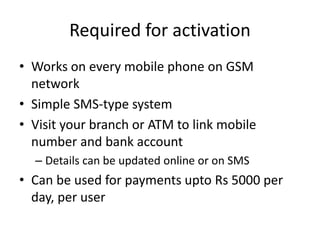

3) The document also outlines the requirements and limits for using various payment modes like linking a bank account and mobile number for USSD, choosing a