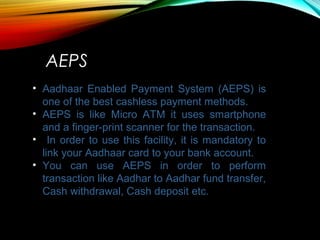

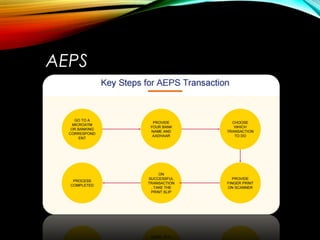

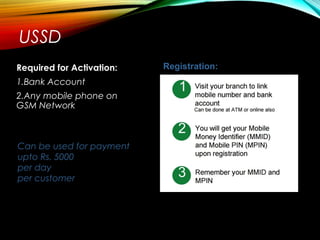

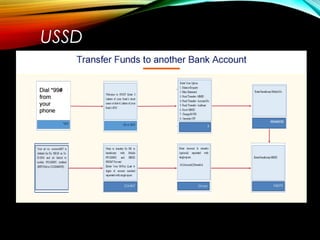

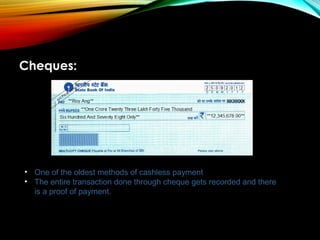

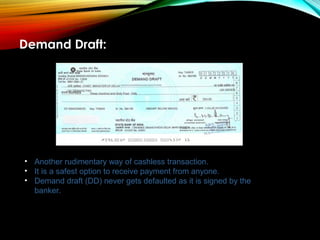

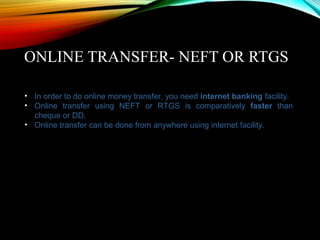

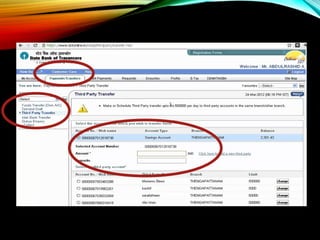

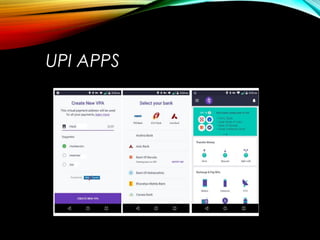

This document discusses various digital payment methods available in India to encourage cashless transactions. It outlines 8 main cashless payment options: cheques, demand drafts, credit/debit cards, online transfers (NEFT/RTGS), e-wallets, UPI apps, Aadhaar Enabled Payment System (AEPS), and Unstructured Supplementary Service Data (USSD). Each method is described in 1-2 paragraphs explaining how it works and key features. The document emphasizes promoting digital payments to reduce cash usage and enable transparent transactions that can be easily traced.

![Payments

UsInG

aePs

[Aadhaar Enabled

Payment System]](https://image.slidesharecdn.com/digitalpaymentsinindia-180607054934/85/Digital-Payments-in-India-22-320.jpg)