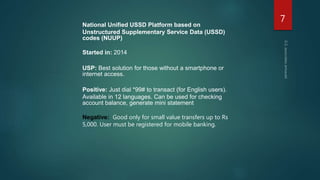

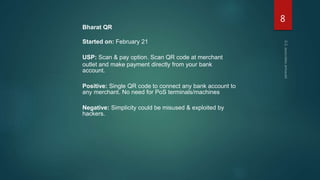

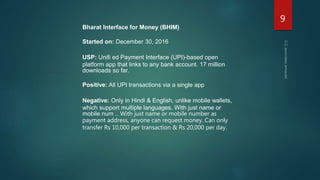

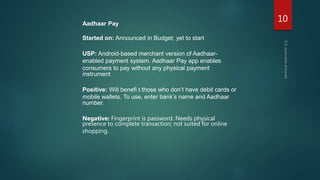

The document discusses various cashless payment systems introduced by the Indian government like Bharat QR, IMPS, USSD, BHIM, and upcoming Aadhaar Pay. It notes that while there are currently many options, experts believe they will converge over time. Bharat QR allows scanning a QR code to pay directly from a bank account without needing a POS terminal. UPI through the BHIM app allows transferring money using just a mobile number but has daily transaction limits. While multiple options exist now to boost digital payments, most are aimed at different use cases and the infrastructure will evolve further.