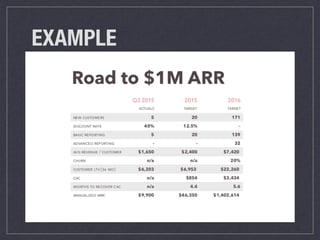

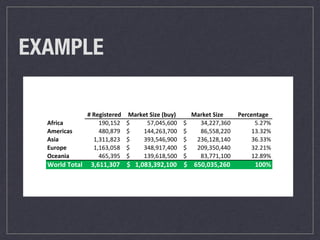

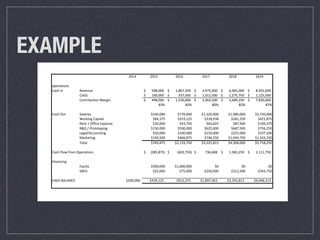

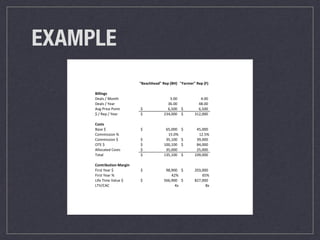

The document outlines essential elements of startup financial forecasting, focusing on unit economics, market opportunities, and cash flow planning. It provides detailed examples of potential market sizes across different regions and presents a cash flow plan with projections for several years. Additionally, it discusses sales representative structures, associated costs, and key metrics like contribution margins and lifetime value.