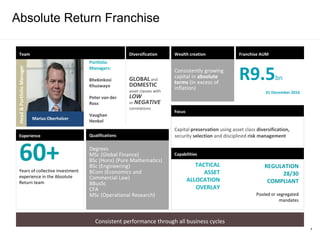

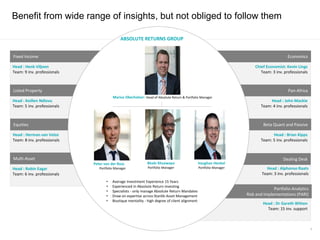

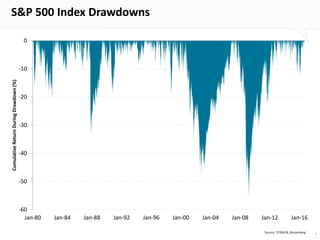

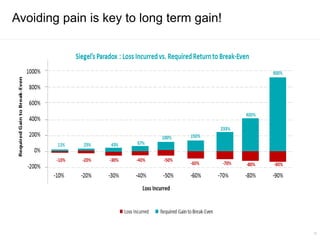

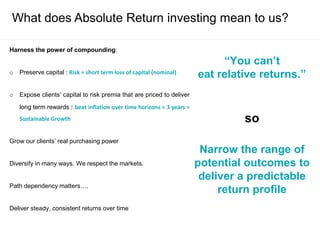

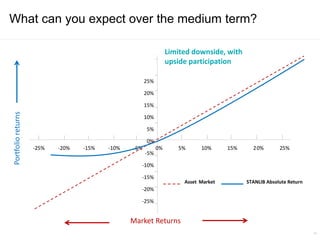

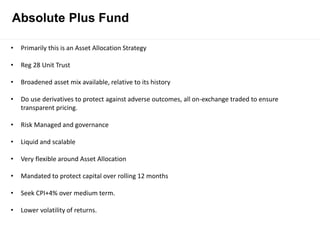

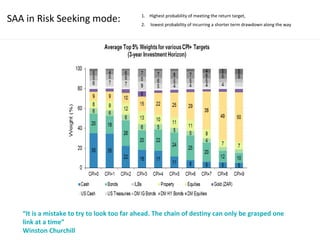

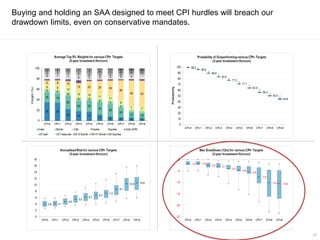

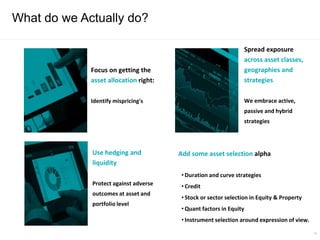

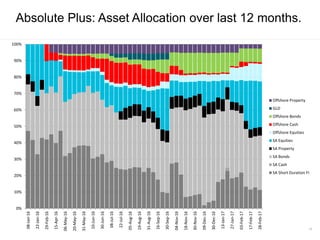

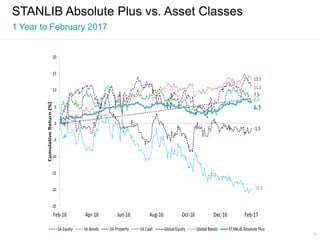

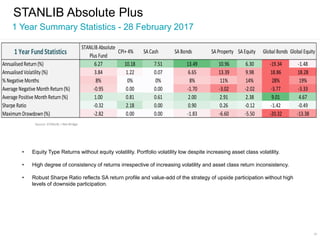

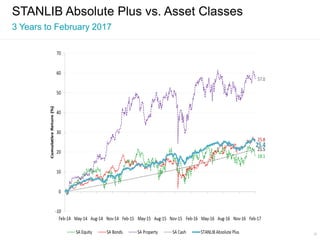

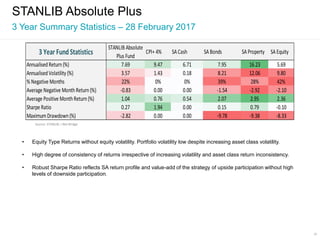

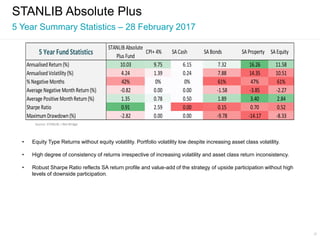

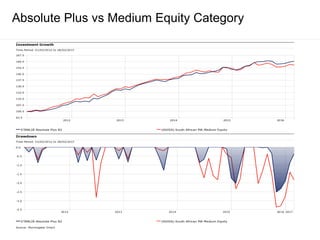

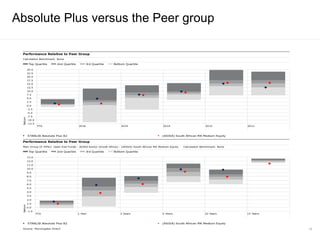

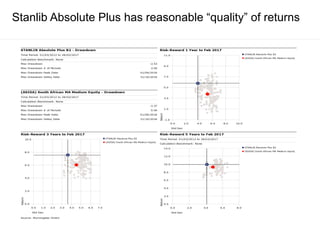

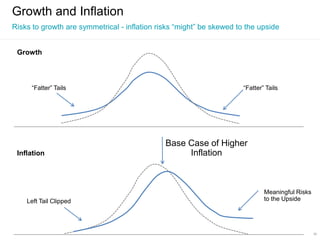

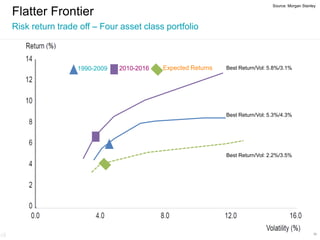

This document provides an overview of the Absolute Plus Fund managed by Marius Oberholzer and his team at STANLIB. It discusses the people and philosophy behind the fund, the aims and high-level process, performance comparisons, the current market environment, and concludes with a summary. The fund uses an absolute return strategy with a focus on capital preservation, diversification across lowly correlated asset classes, and disciplined risk management to aim for returns above inflation over the medium term while keeping volatility low.