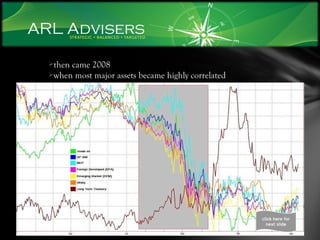

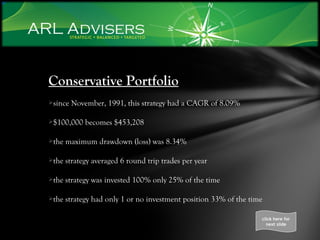

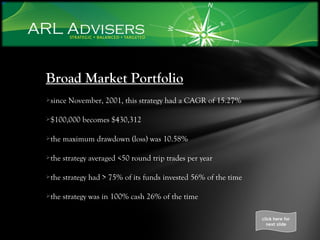

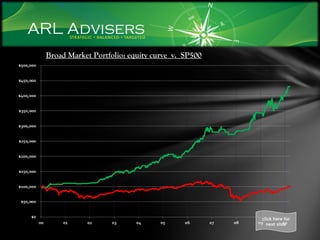

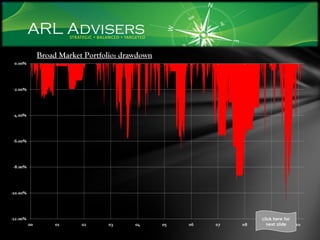

The document is a letter from Guy Lerner, managing partner of ARL Advisers, LLC, seeking to gain the reader's investment business. Lerner outlines his investment approach which focuses on strategic asset allocation using quantitative models, risk management, and disciplinized investing to target returns for investors. He provides hypothetical portfolio examples demonstrating returns superior to passive indexes with reduced risk and volatility. Lerner invites the reader to review additional presentation materials outlining ARL's services and Lerner's qualifications and experience in order to assess whether ARL can provide the best investment solution.

![Dear Fellow Investor: I have entered the asset management business. My company, ARL Advisers, LLC, is a registered investment advisory in the State of Kentucky, and I am seeking your business. With all the options out there, why consider what I have to offer? First, I like to think that what I do is unique, but not special. I will not be selling you hype or the latest and greatest. My methodology is driven by my own research and the data, and all investing decisions are objective. Second, my market edge is the ability to use my computer, and I level the playing field even more by investing in markets not companies. Third, I put a great emphasis on risk management as it is one of the few aspects of the markets that I can control. Please take 15 minutes to review my presentation. Here I outline my approach to the markets, and the types of portfolios that we customize for our clients. More importantly, you will understand what I have been doing for the past 10 years of my life, and I hope you will come away with the notion that I am committed to providing you with the best service possible. As you review the material, ask yourself these three questions: 1) what was my financial plan for the past 10 years?; 2) how will I navigate the markets in the next 10 years?; 3) what is my plan to capture new opportunities and reduce risks in the future? I don’t have a crystal ball nor do I need one. However, I do have a plan and a methodology that should capture the major themes. My emphasis is on a disciplined strategy. In essence, I am offering highly stylized, institutional quality portfolios but without the churn of excessive trading and without the high fees. I look forward to talking to you soon, and thank you for your time. Guy “ See why we are different.” [email_address] click here for next slide](https://image.slidesharecdn.com/arladviserslite-1-110901225029-phpapp02/85/ARL-Advisers-presentation-1-320.jpg)

![email : [email_address] phone: 502 552 0018 mailing address: ARL Advisers, LLC 528 Barberry Lane Louisville, KY 40206 business hours: Monday – Friday, 8 a.m. to 5:00 p.m. EST websites: www.arladvisers.com www.thetechnicaltake.com](https://image.slidesharecdn.com/arladviserslite-1-110901225029-phpapp02/85/ARL-Advisers-presentation-37-320.jpg)