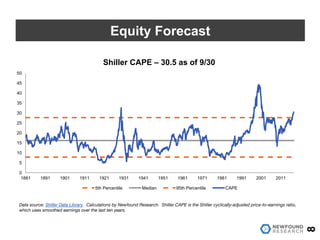

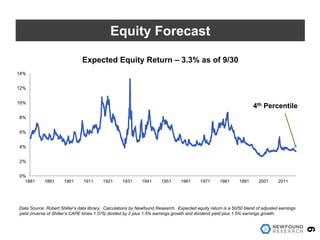

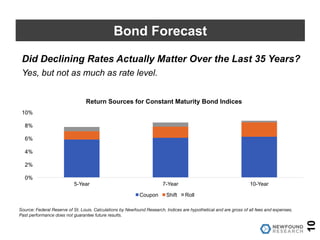

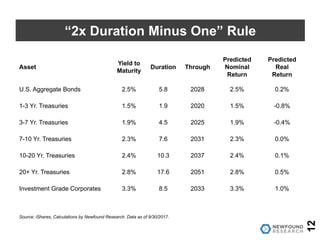

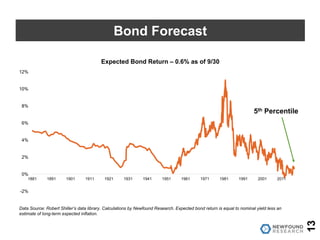

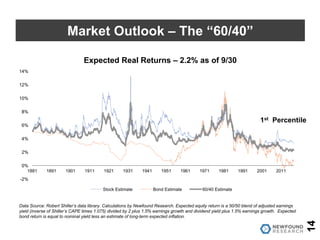

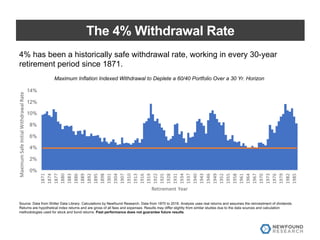

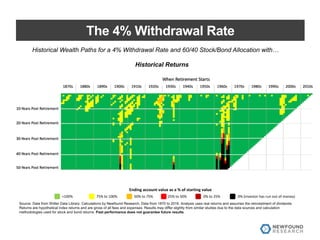

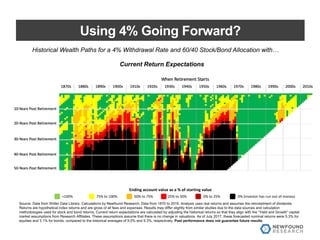

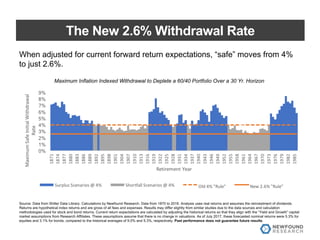

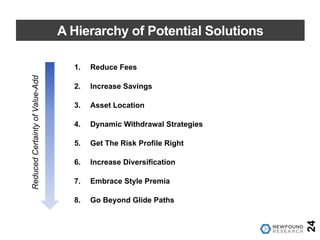

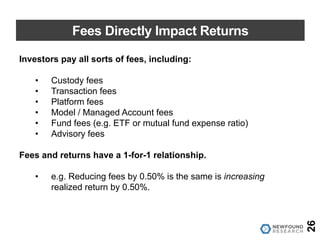

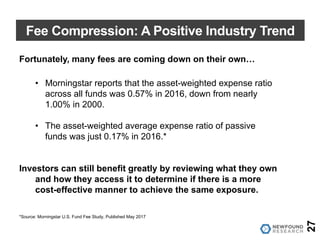

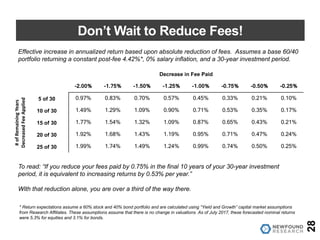

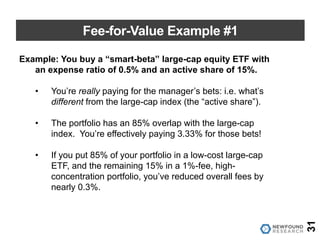

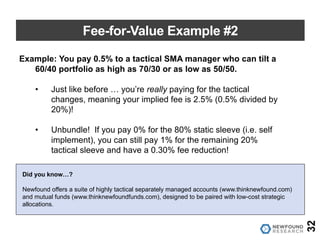

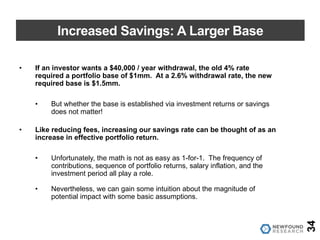

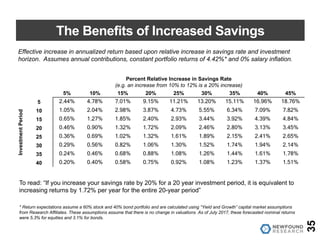

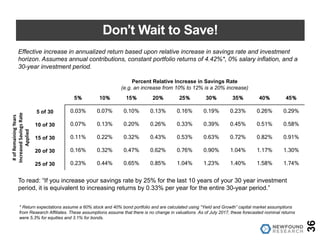

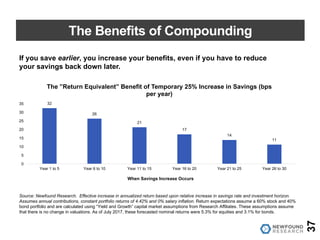

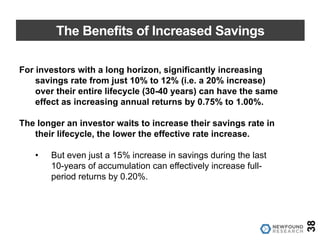

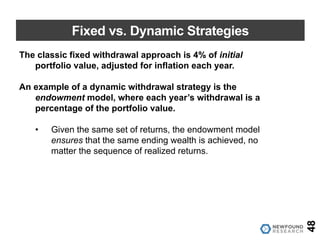

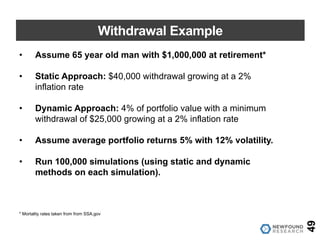

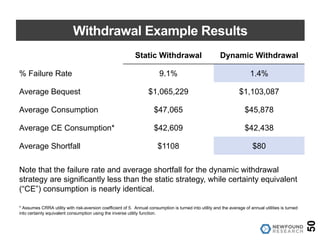

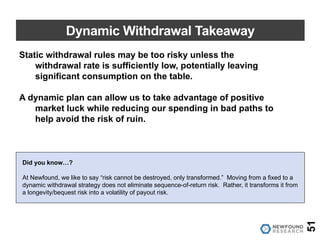

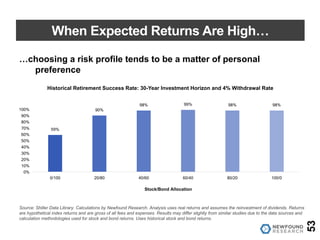

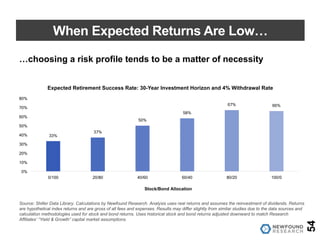

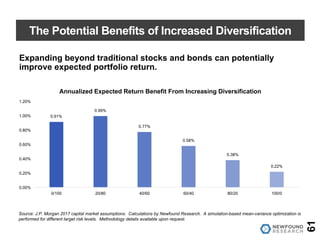

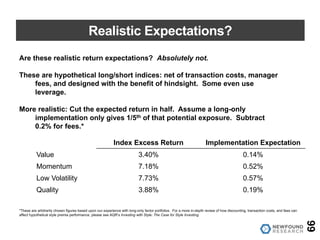

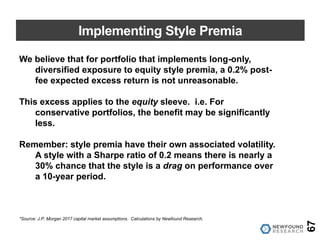

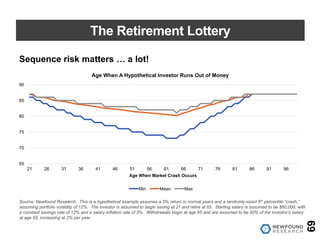

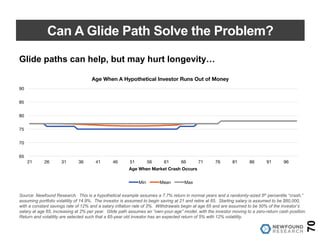

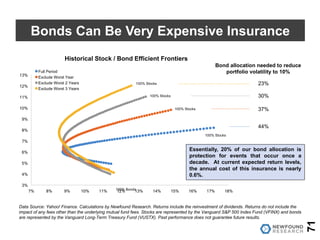

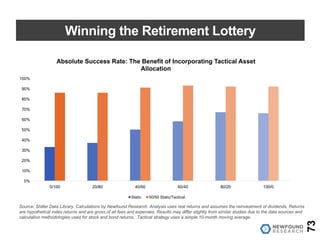

The document discusses strategies for financial planning in a low-return environment, highlighting the challenges of achieving traditional withdrawal rates given current market conditions. It emphasizes the importance of reducing fees, increasing savings, and implementing dynamic withdrawal strategies as ways to enhance portfolio returns. The research indicates that the historically safe 4% withdrawal rate may need to be adjusted to around 2.6% due to lower expected market returns.