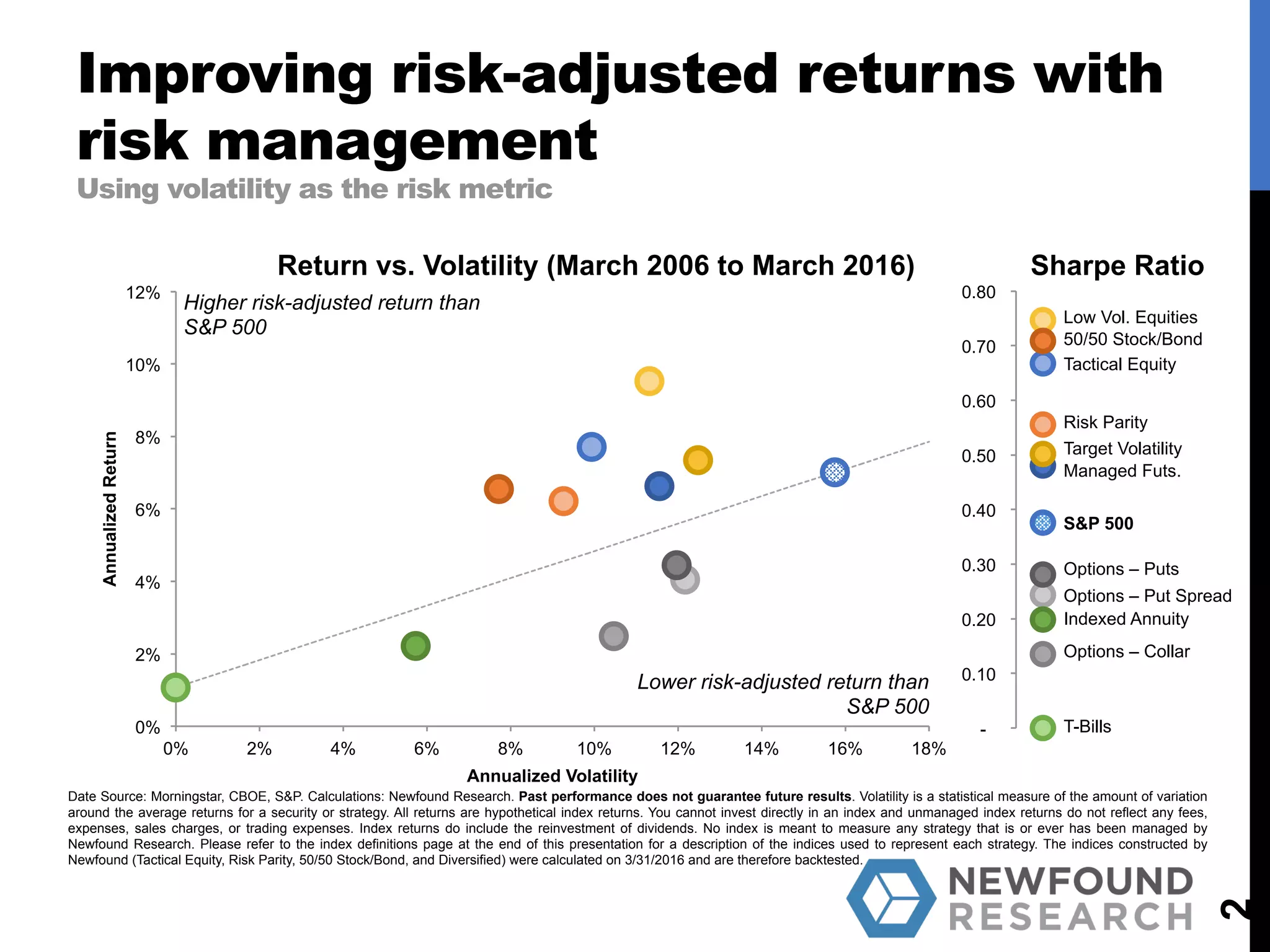

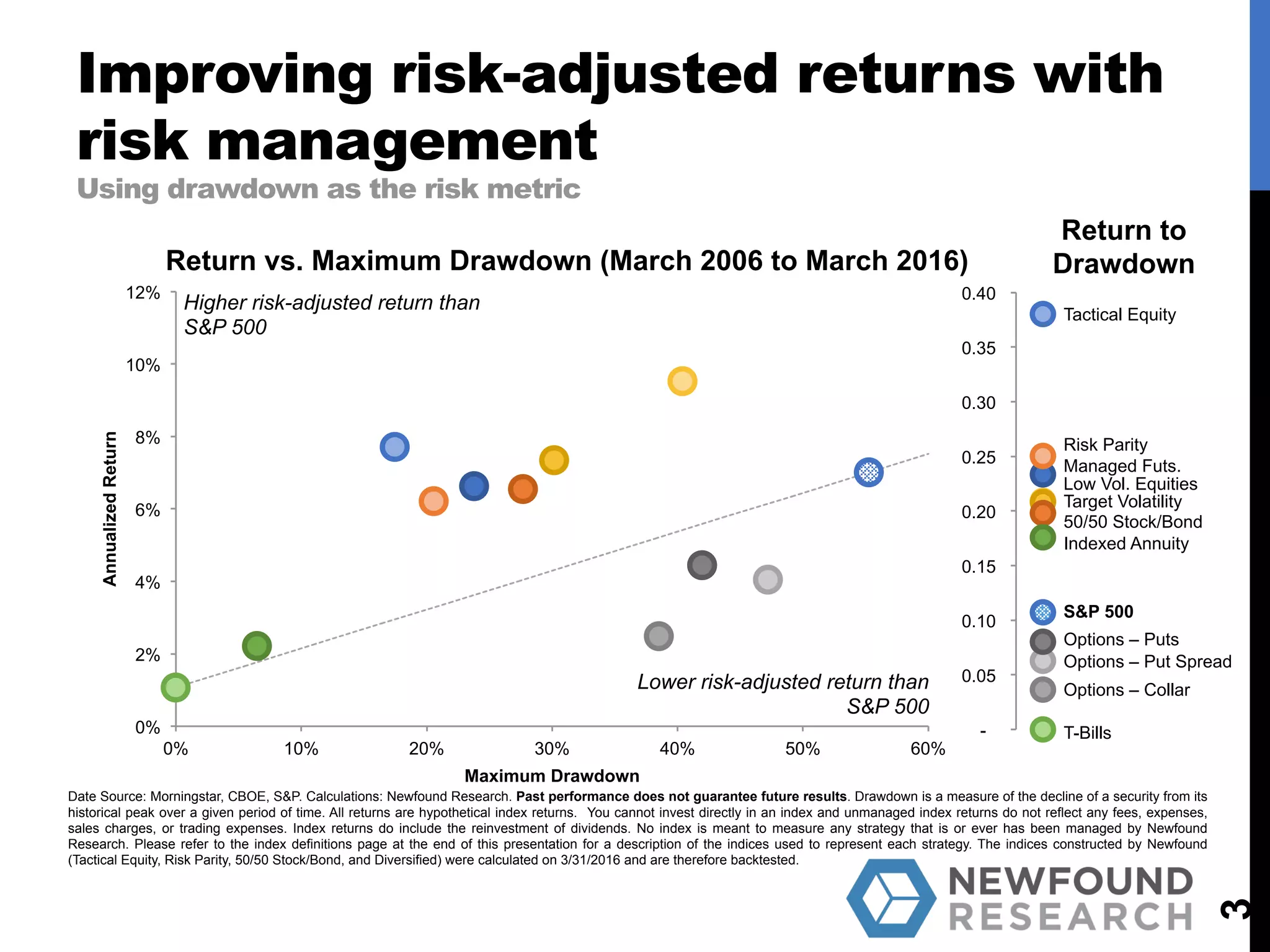

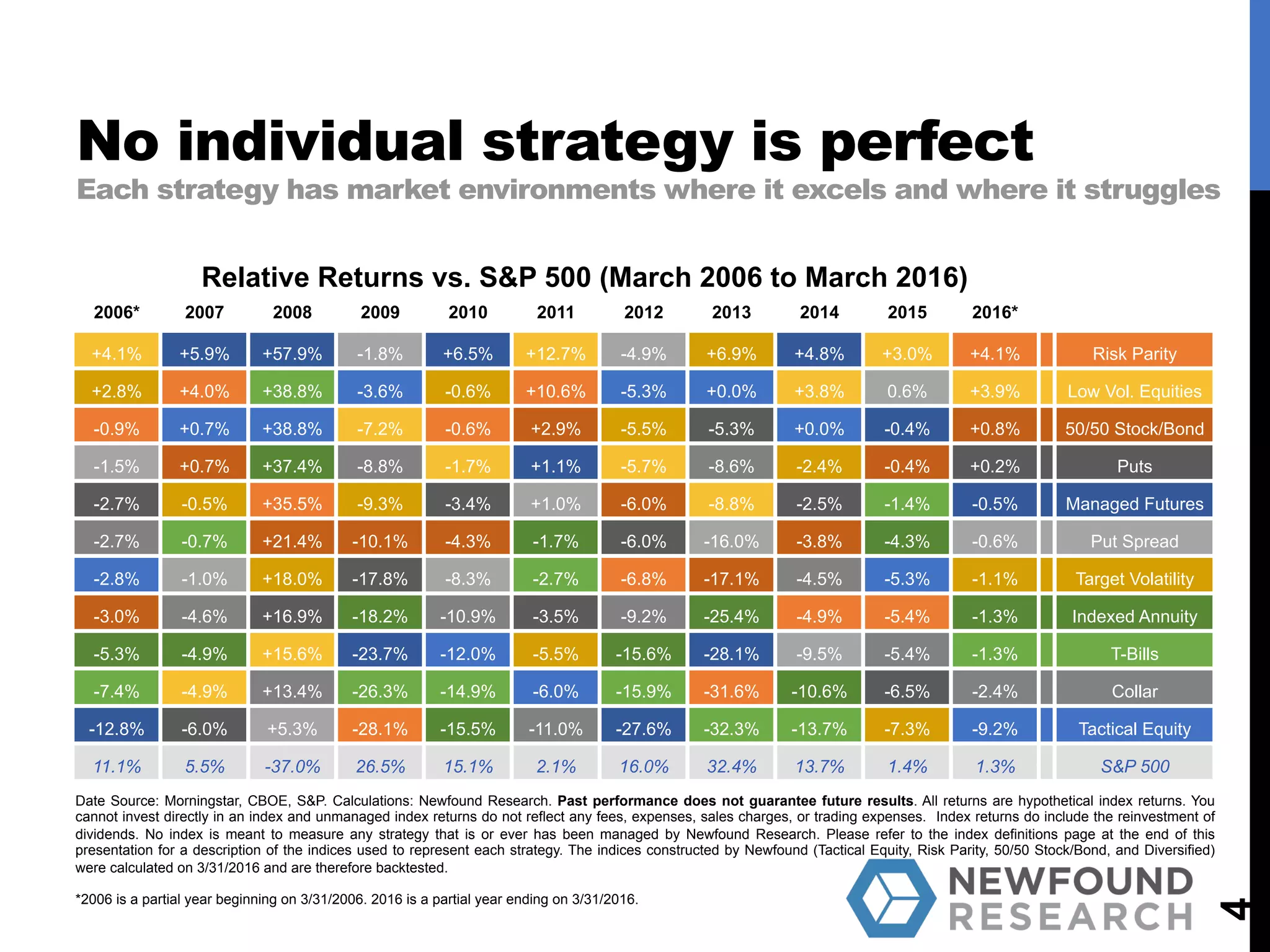

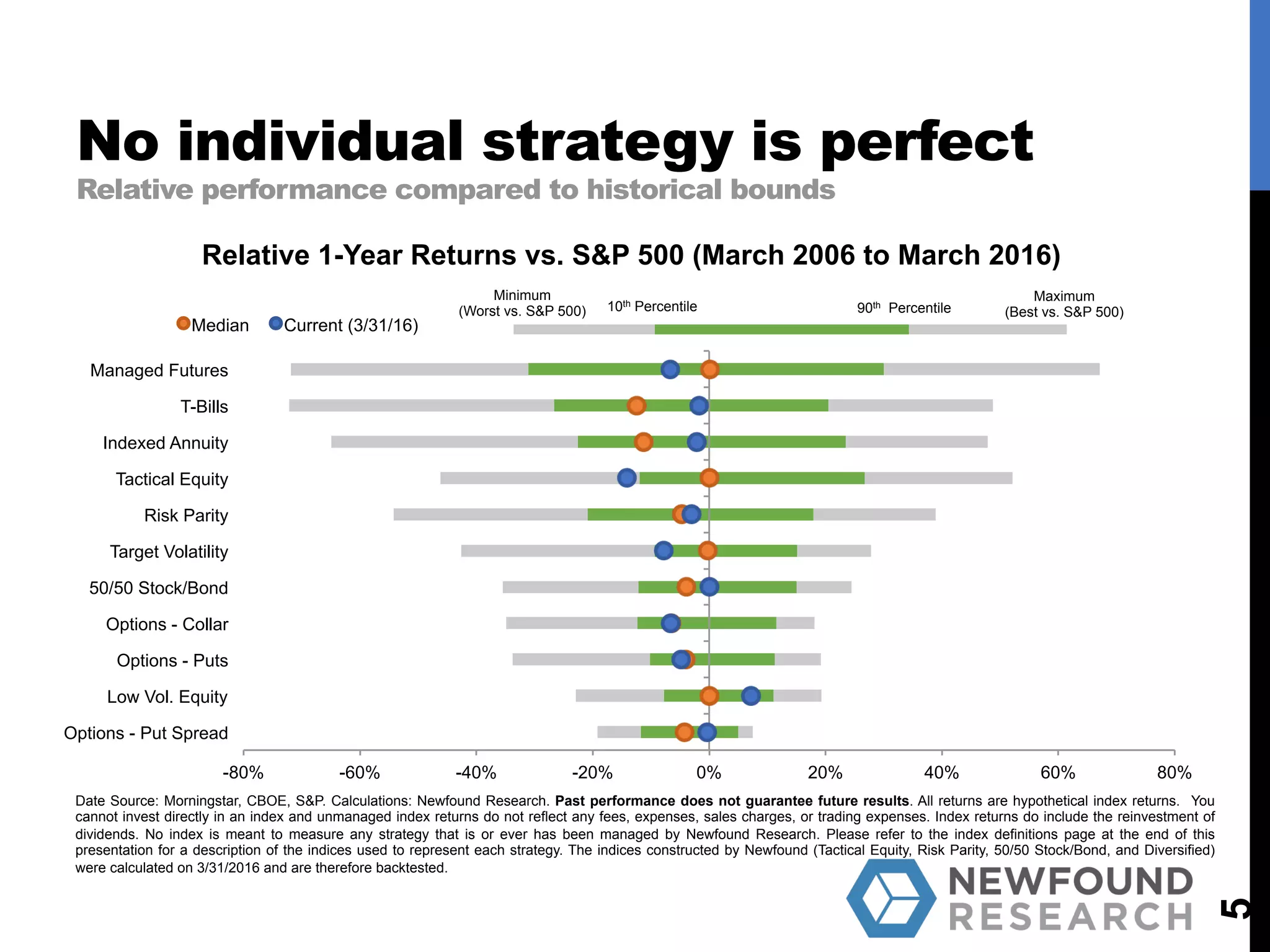

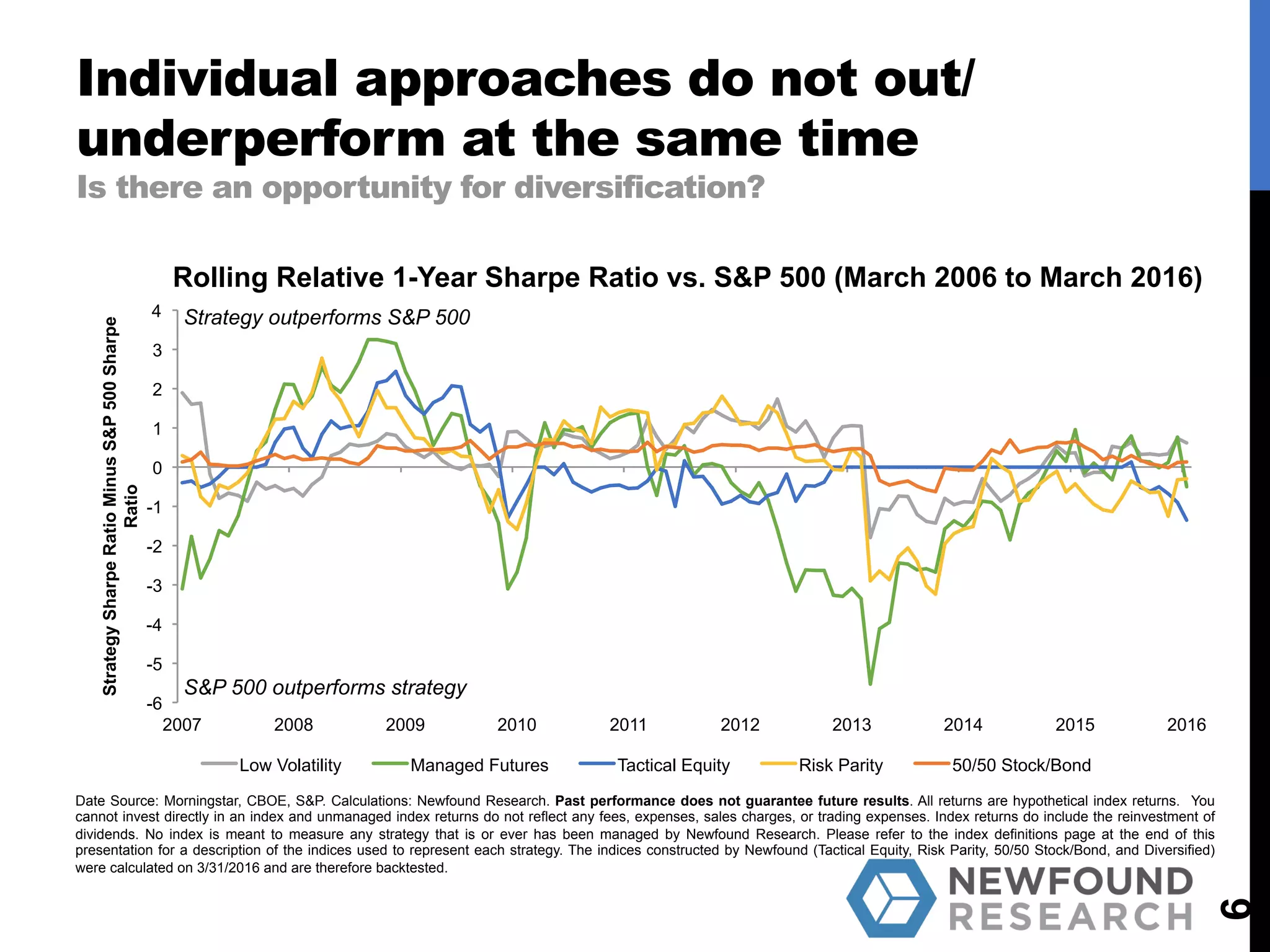

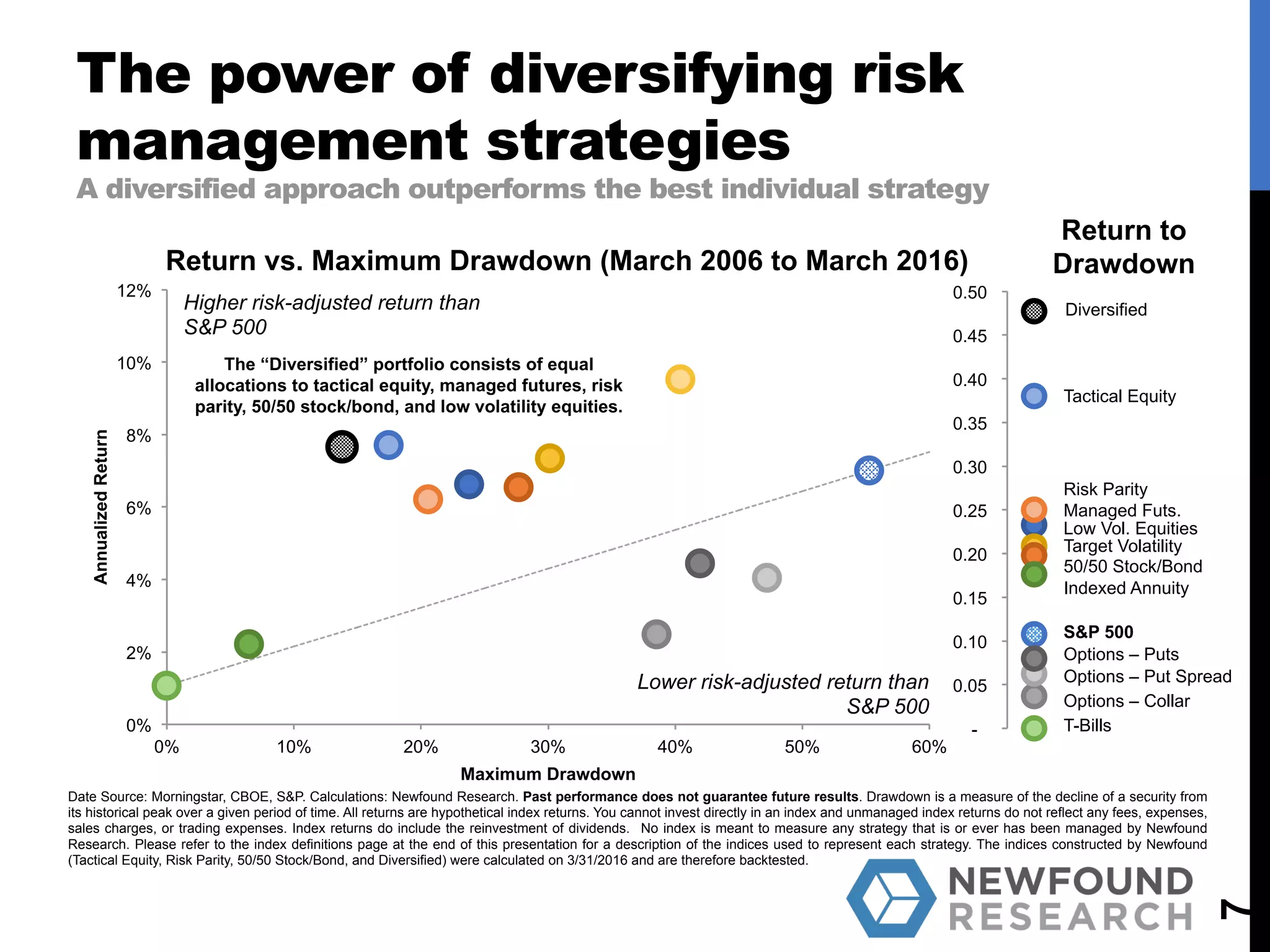

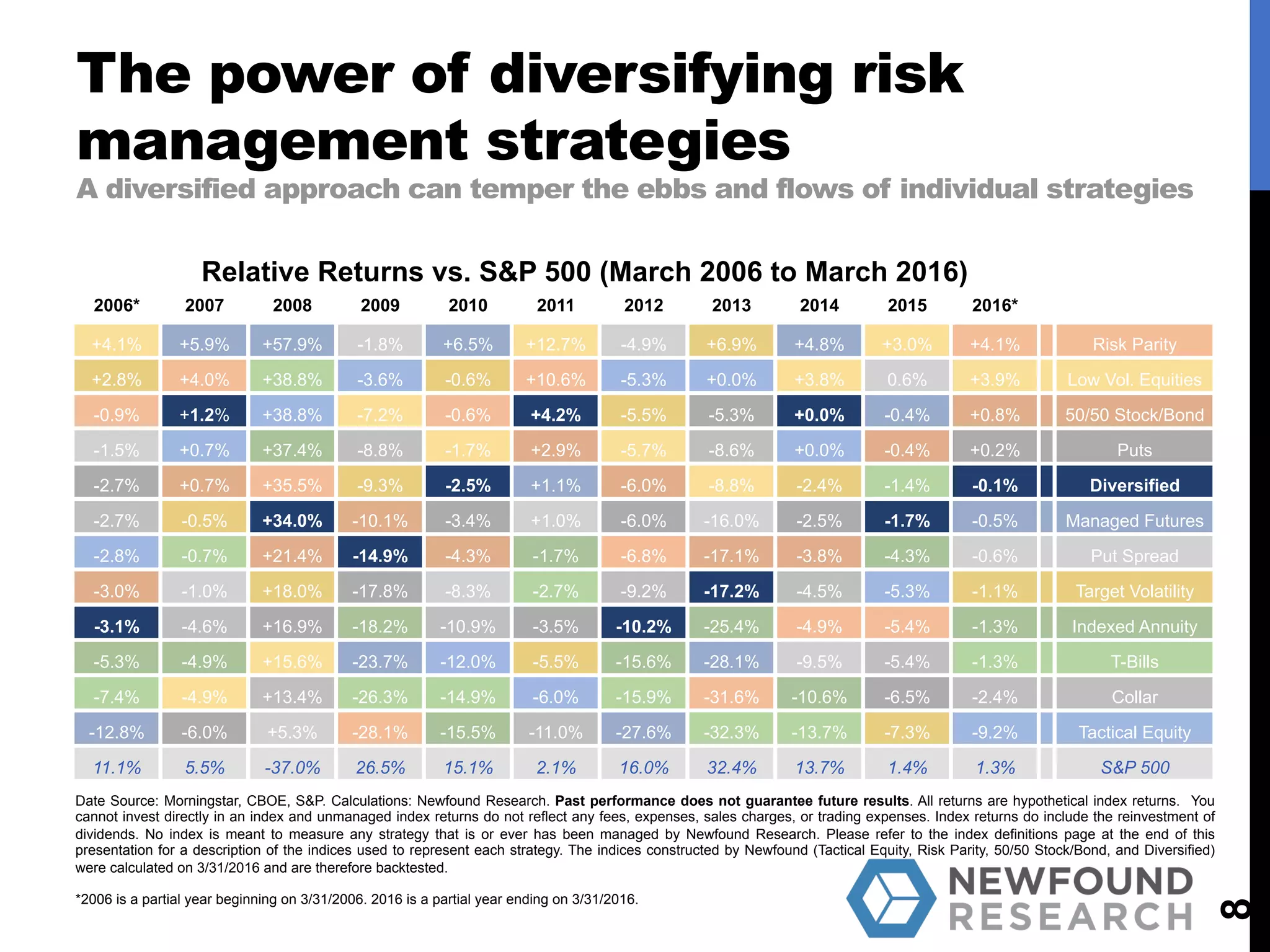

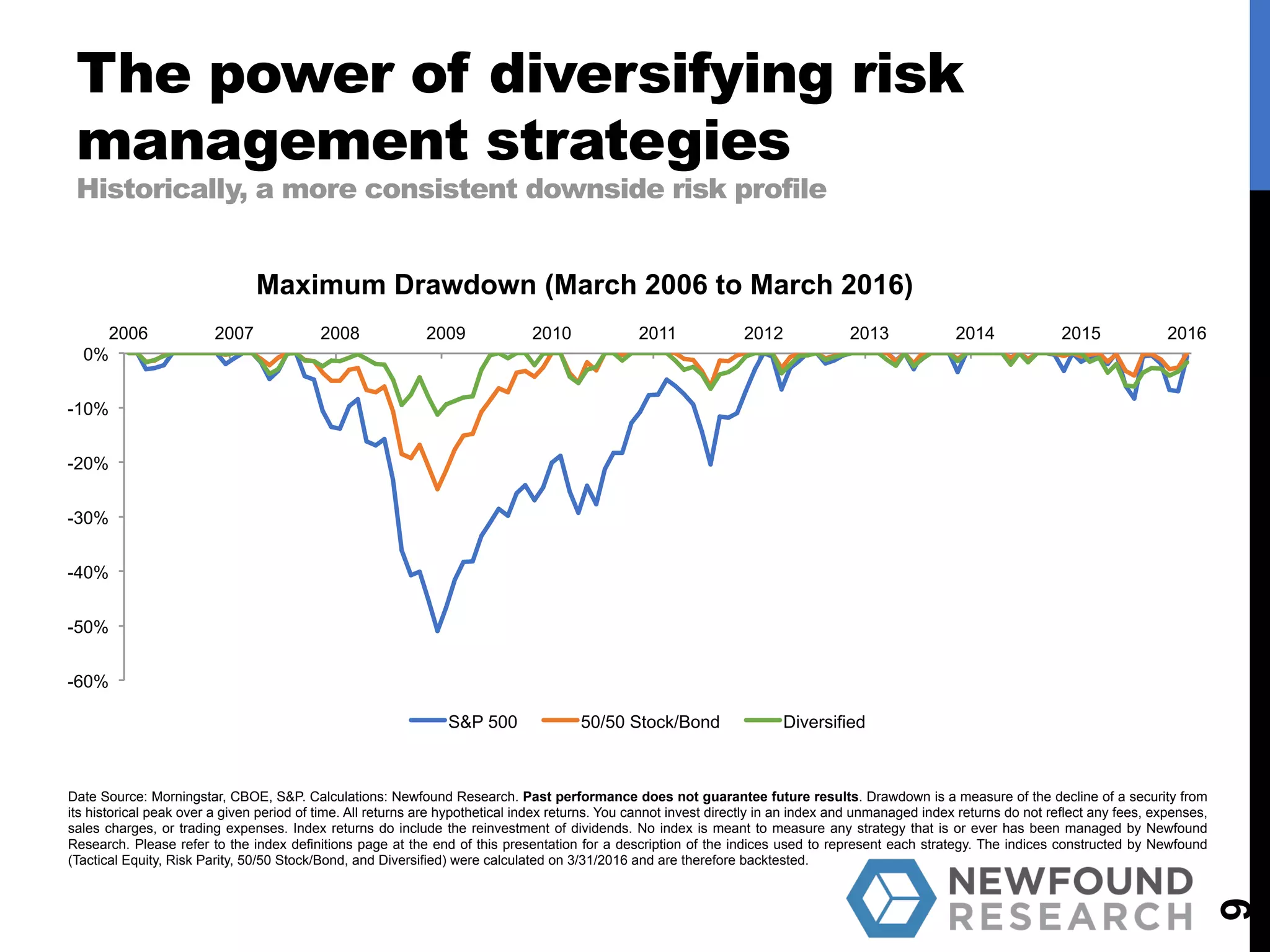

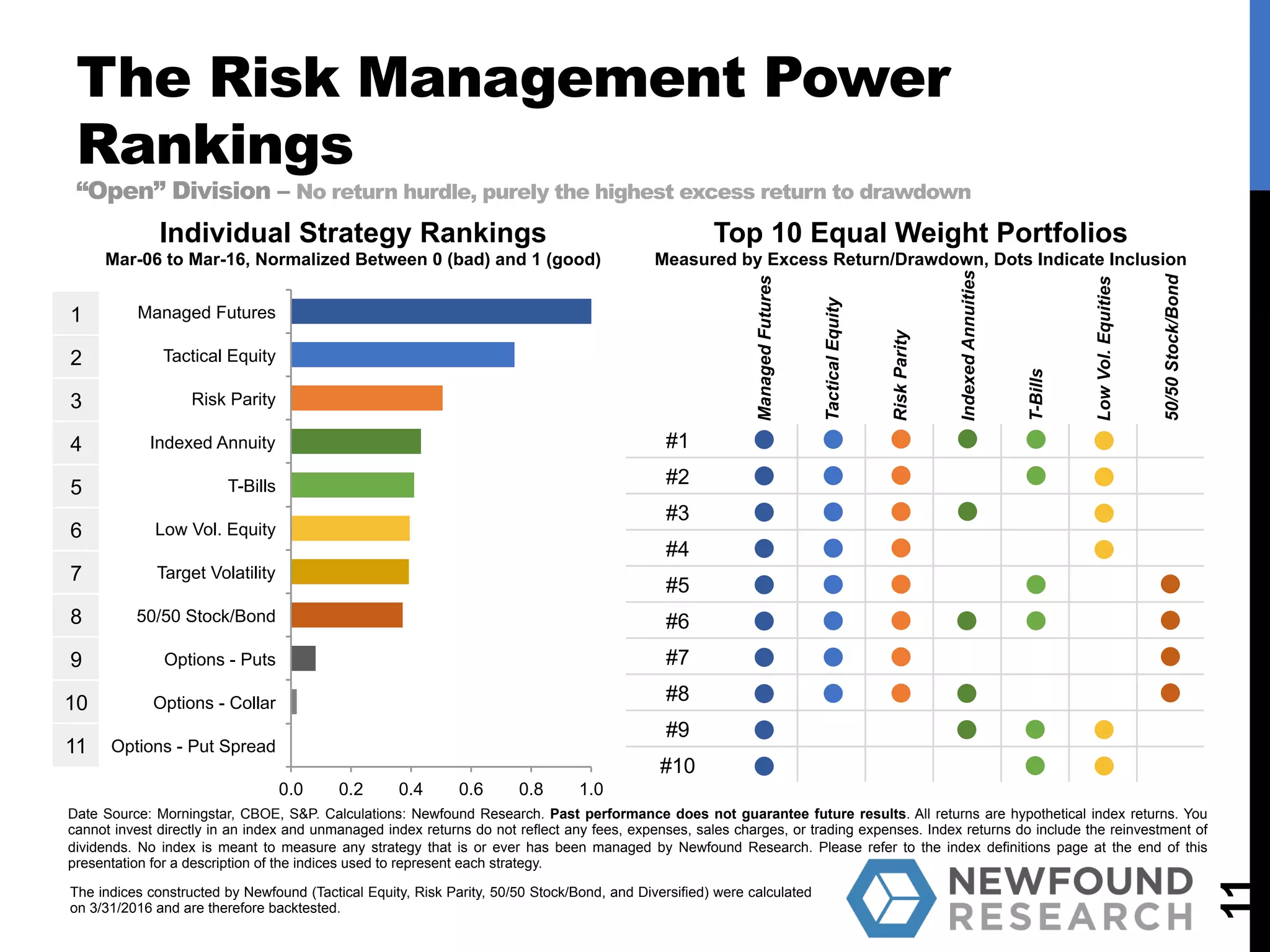

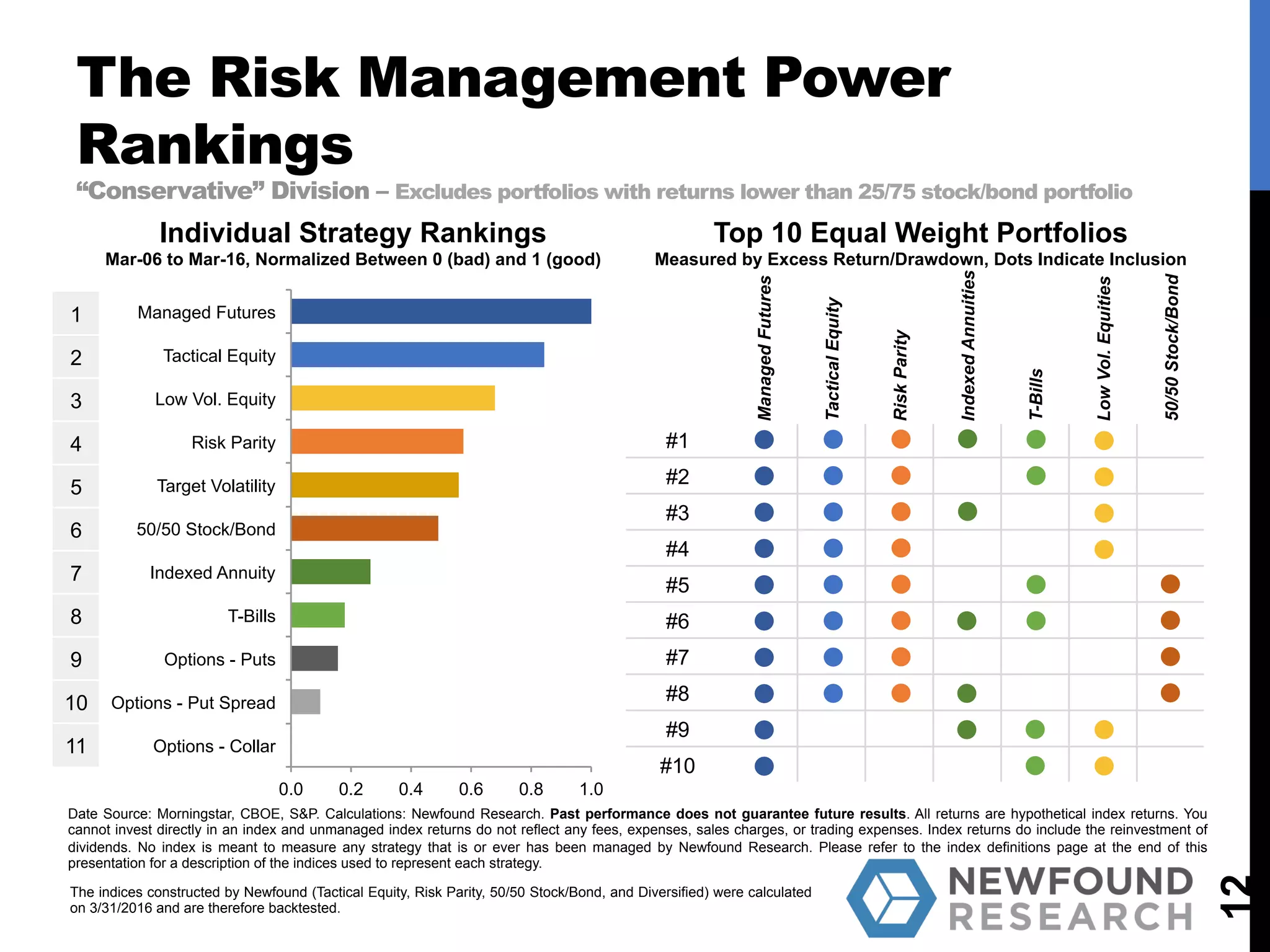

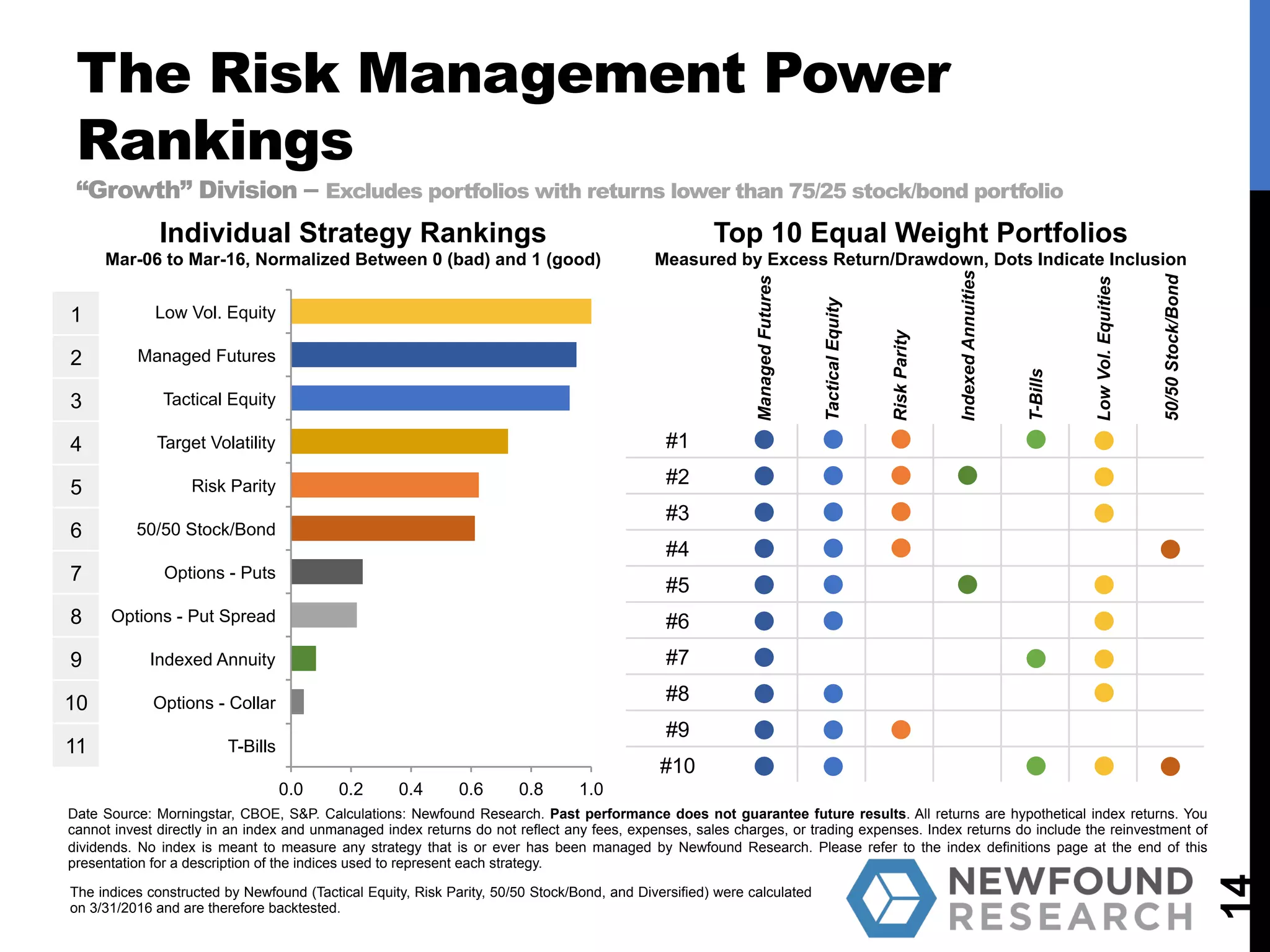

The document discusses the performance of various investment strategies from March 2006 to March 2016, focusing on risk-adjusted returns and drawdown metrics. It emphasizes the benefits of a diversified approach to risk management, highlighting that no single strategy consistently outperforms others. Additionally, the findings indicate that a diversified portfolio structure can enhance overall returns while managing downside risks effectively.