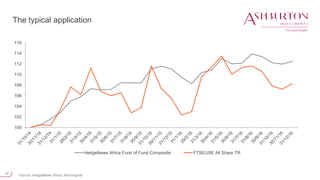

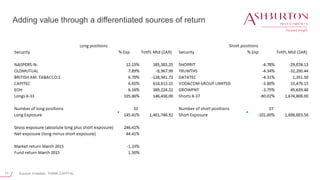

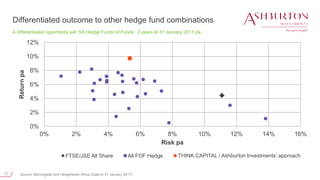

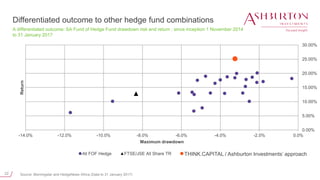

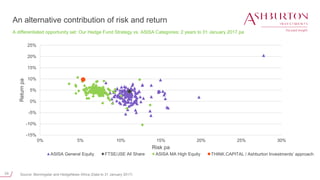

The document provides information about the Ashburton Select Retail Investor Hedge Fund of Funds. It introduces Elmien Wagenaar as the appointed investment manager from THINK.CAPITAL Investment Management, who has 16 years of experience analyzing and investing in hedge funds locally and globally. It also provides the investment manager's track record from 2002-2015 managing a R2 billion portfolio. Additionally, it discusses the benefits of hedge funds, including their risk-return characteristics and ability to provide differentiated outcomes compared to traditional investments. It positions the fund of funds as providing downside protection while participating in market upside.