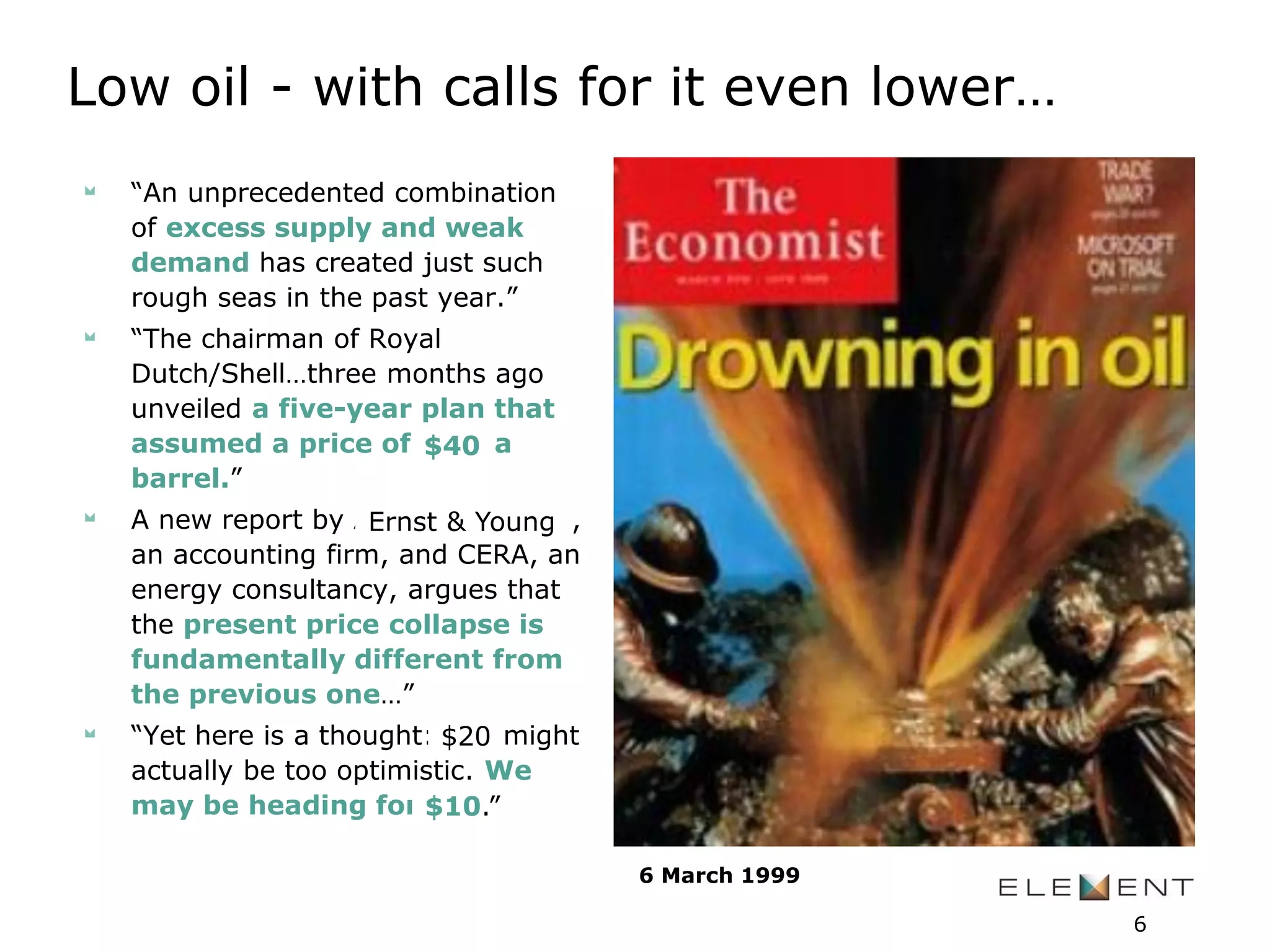

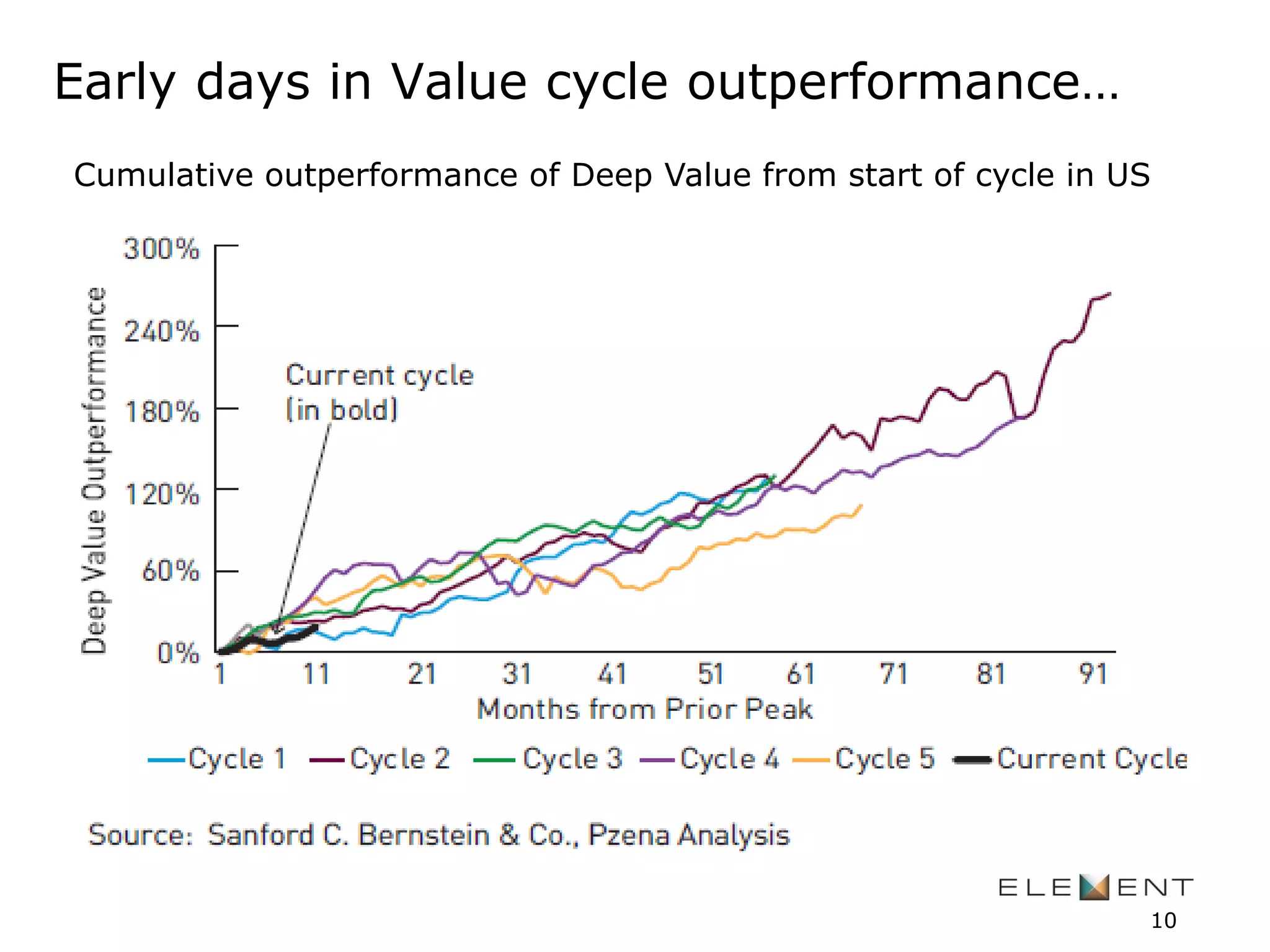

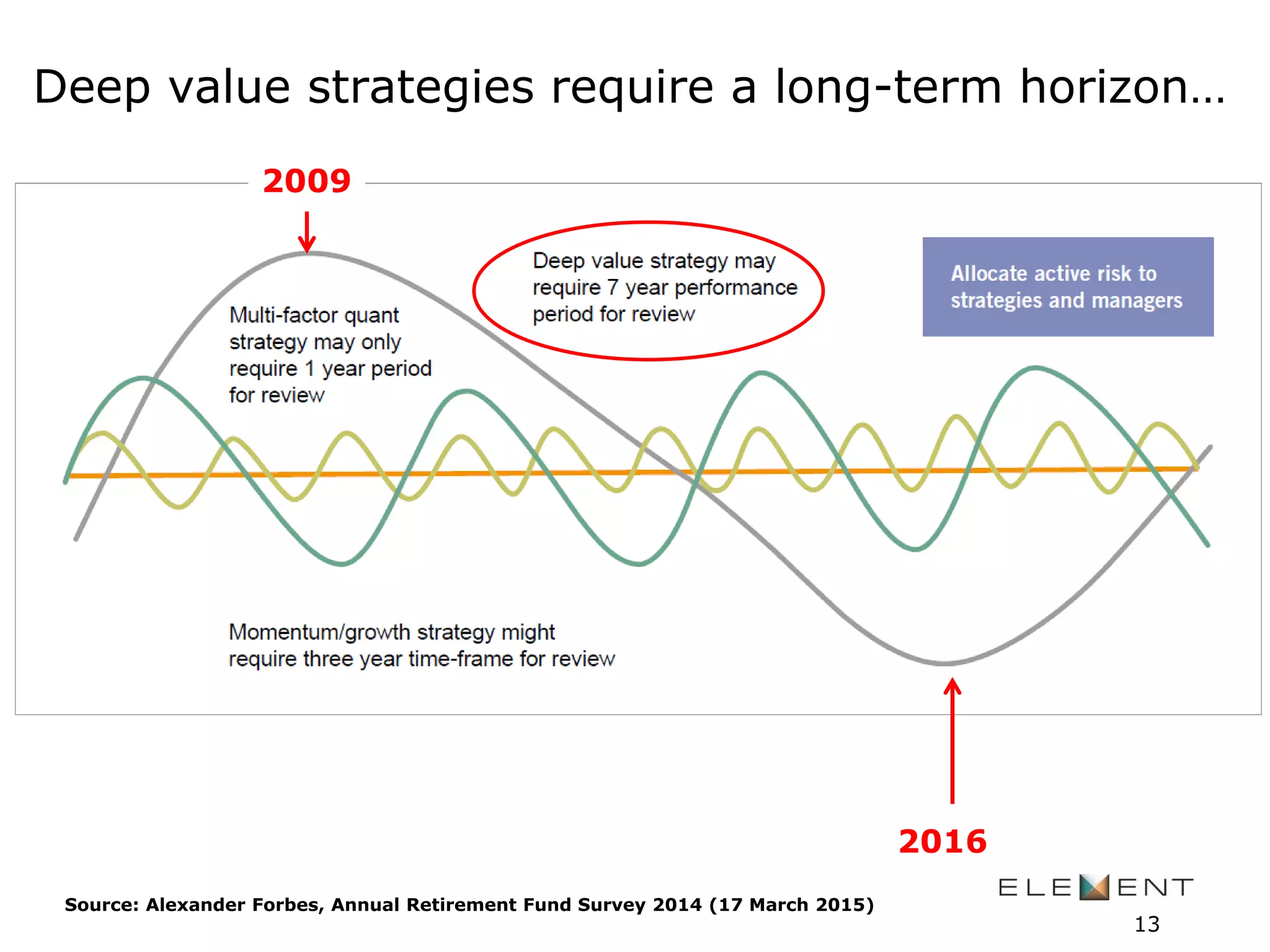

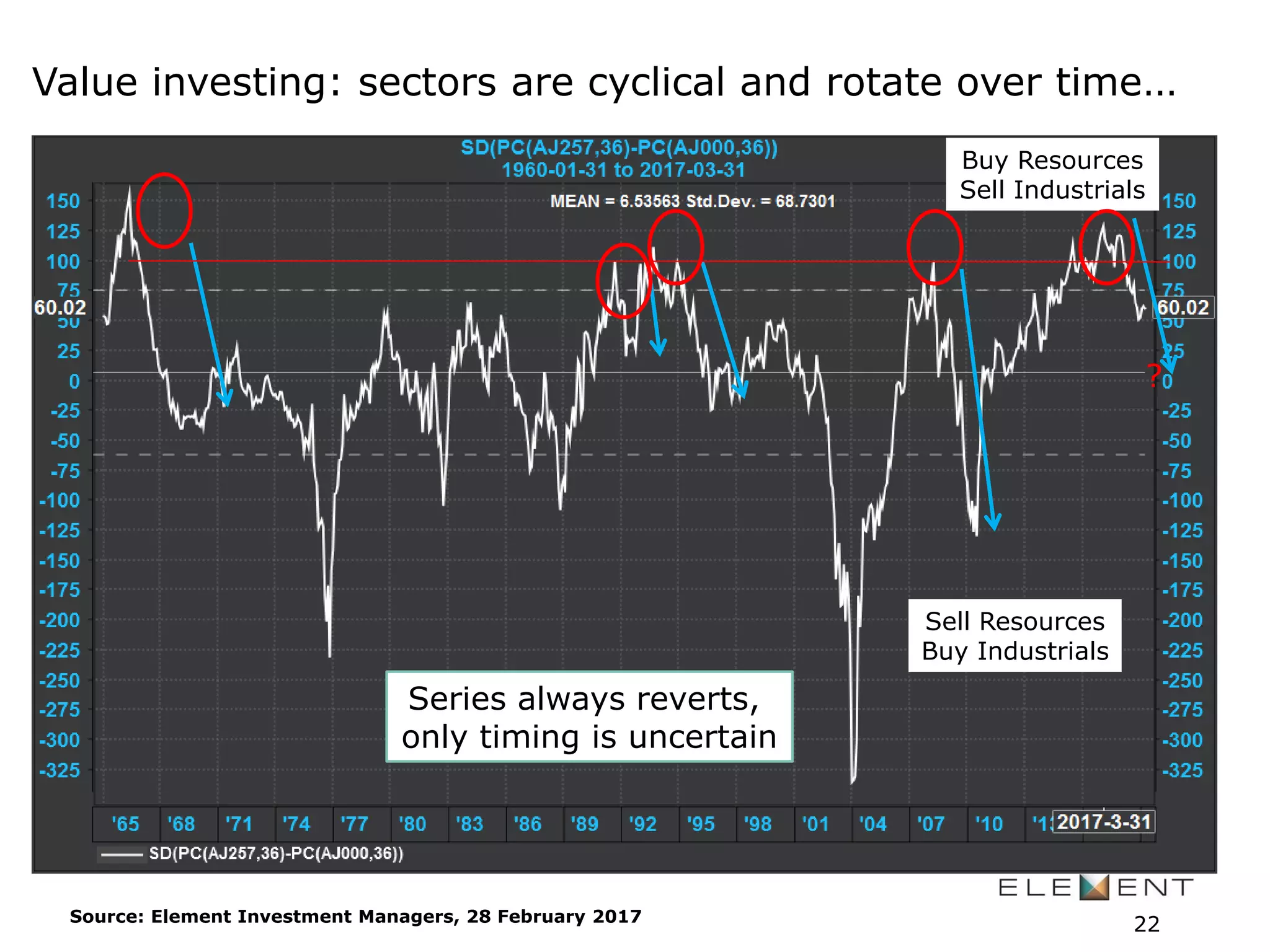

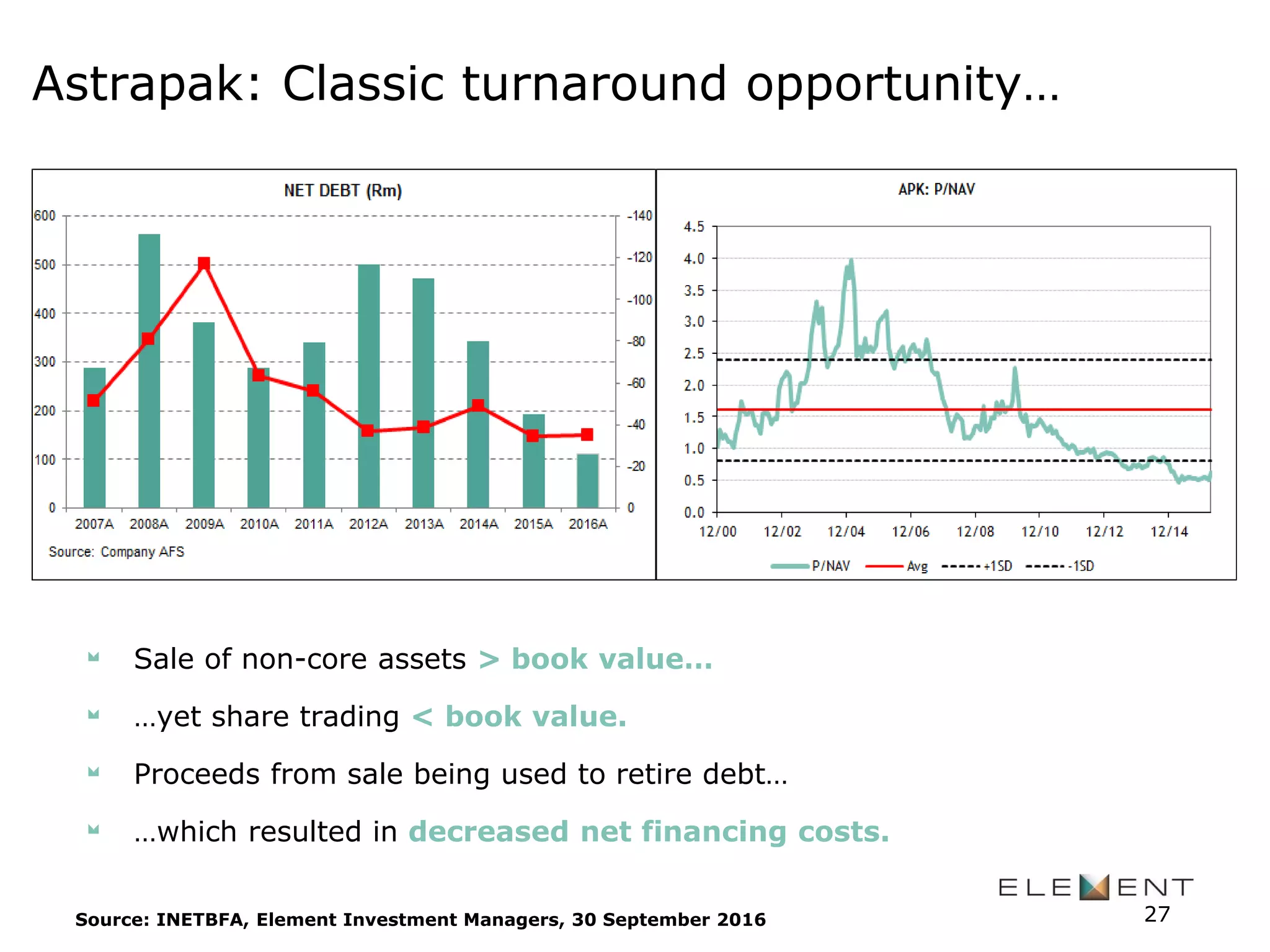

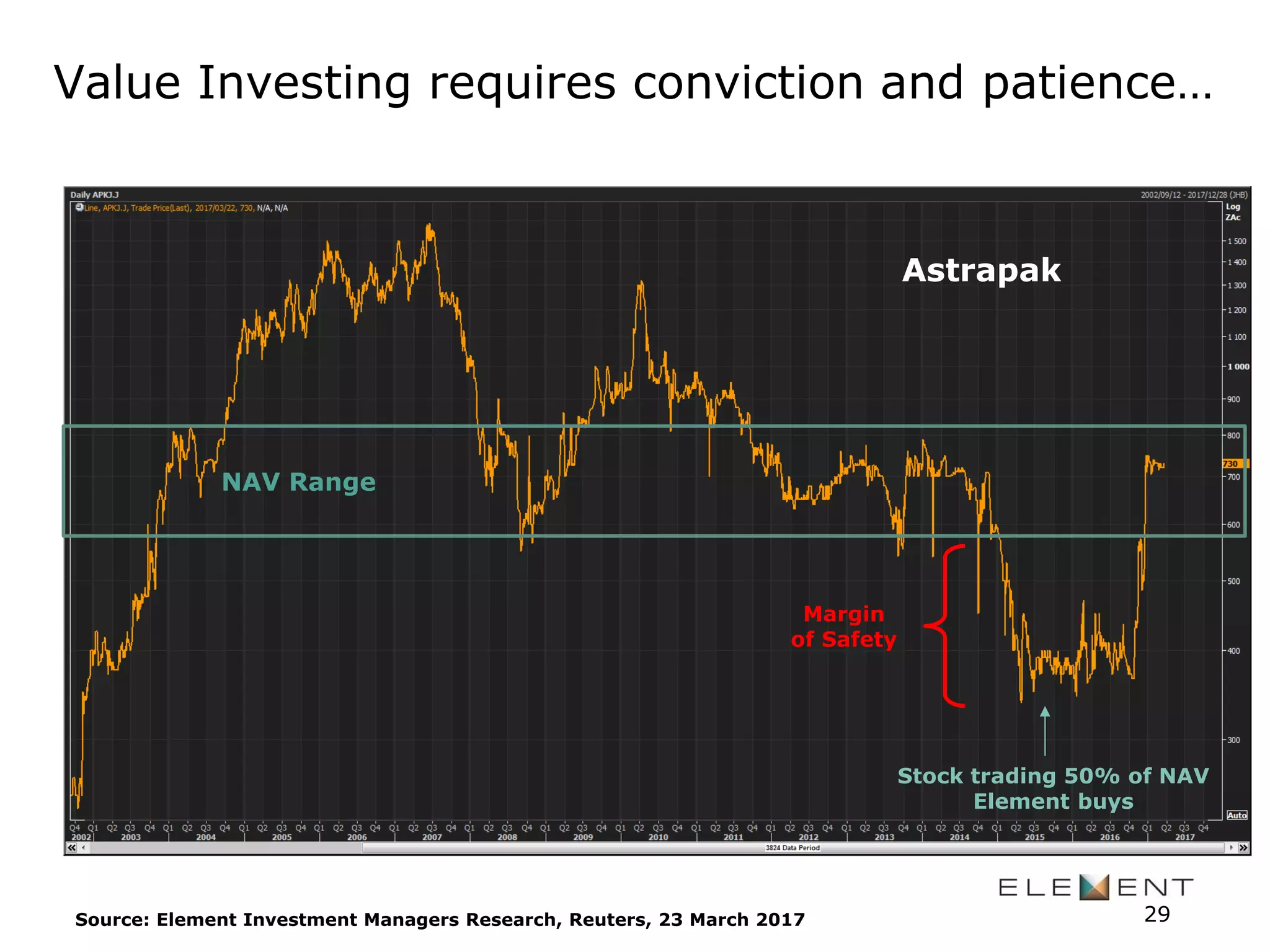

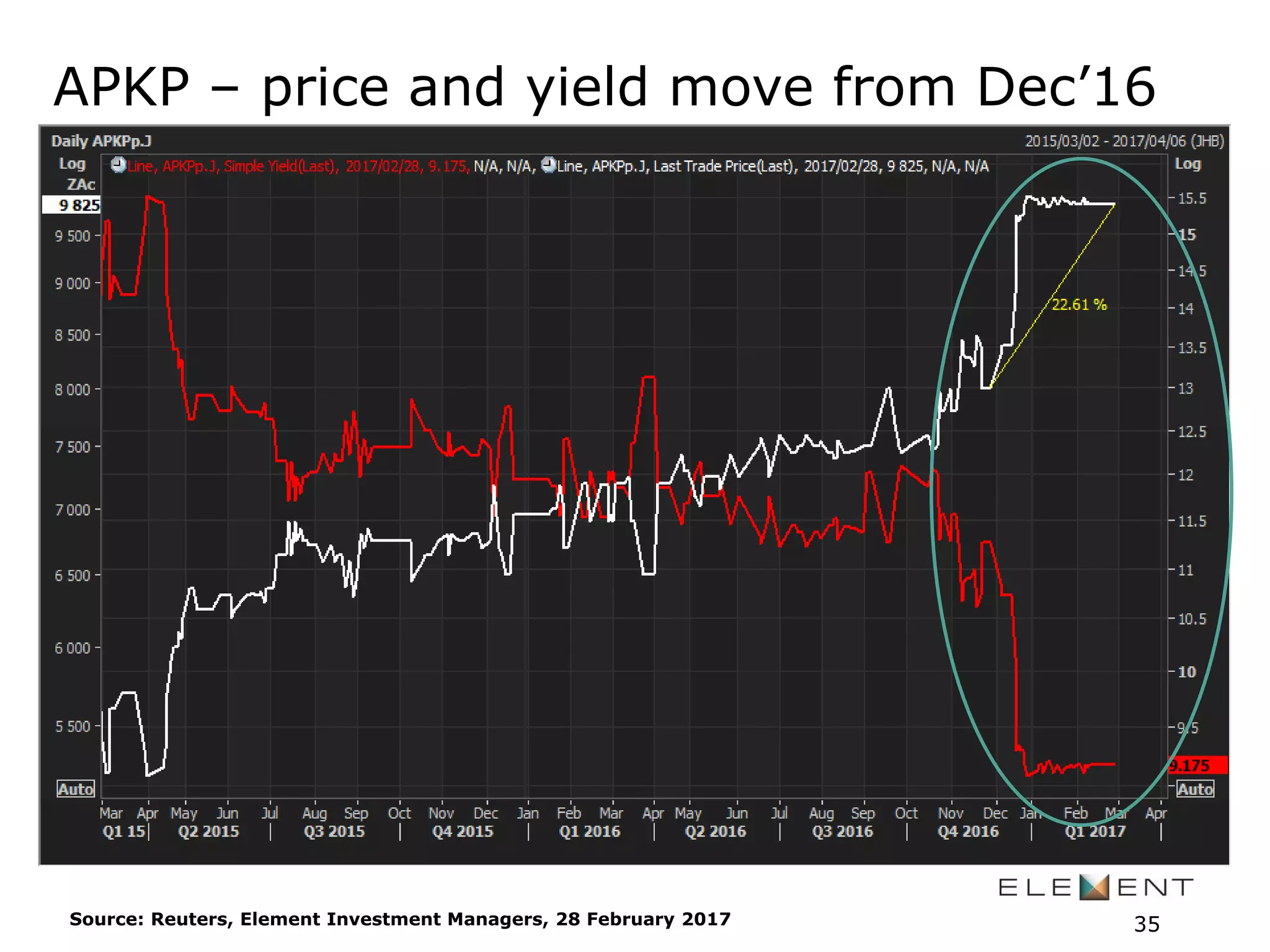

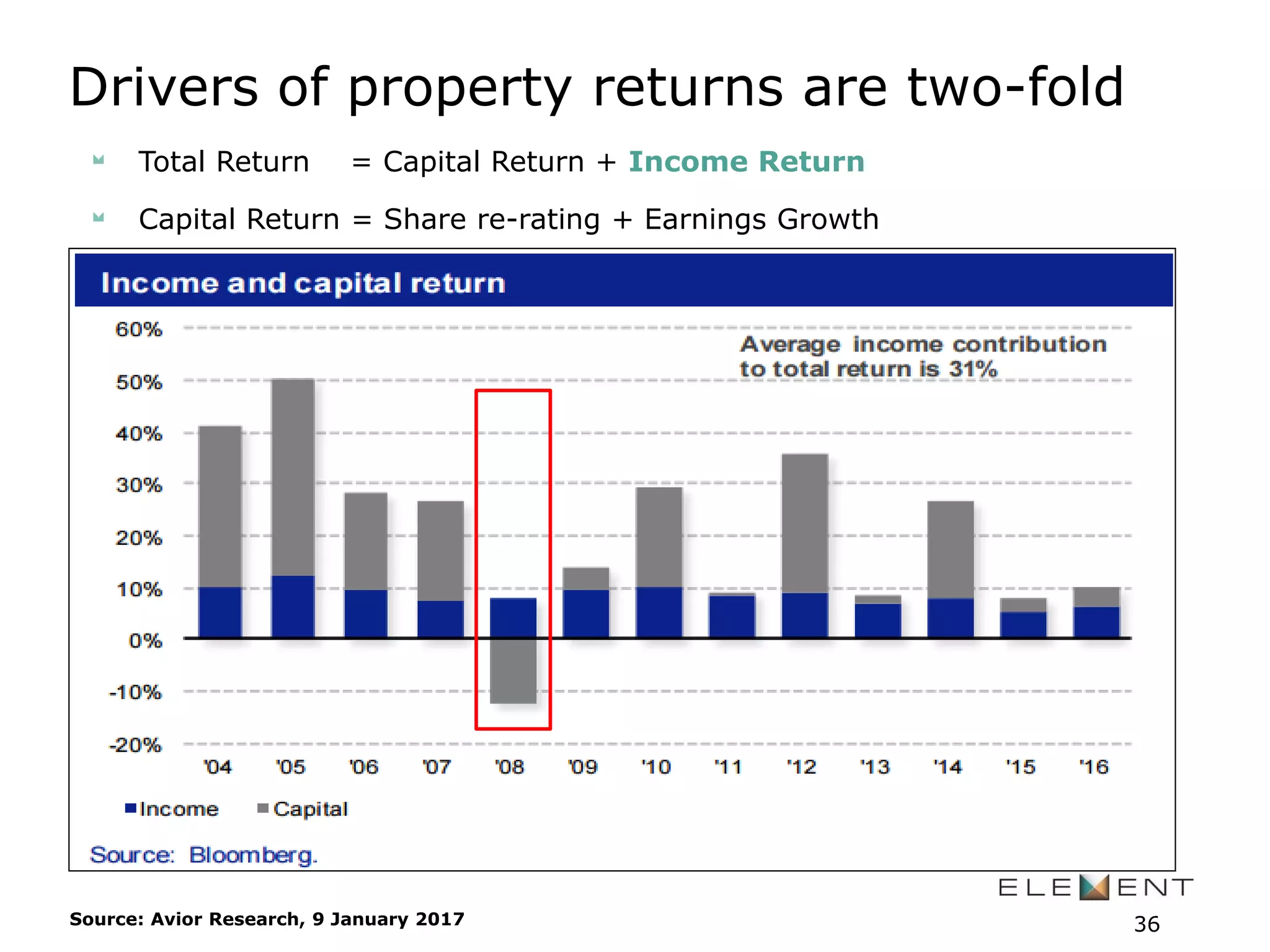

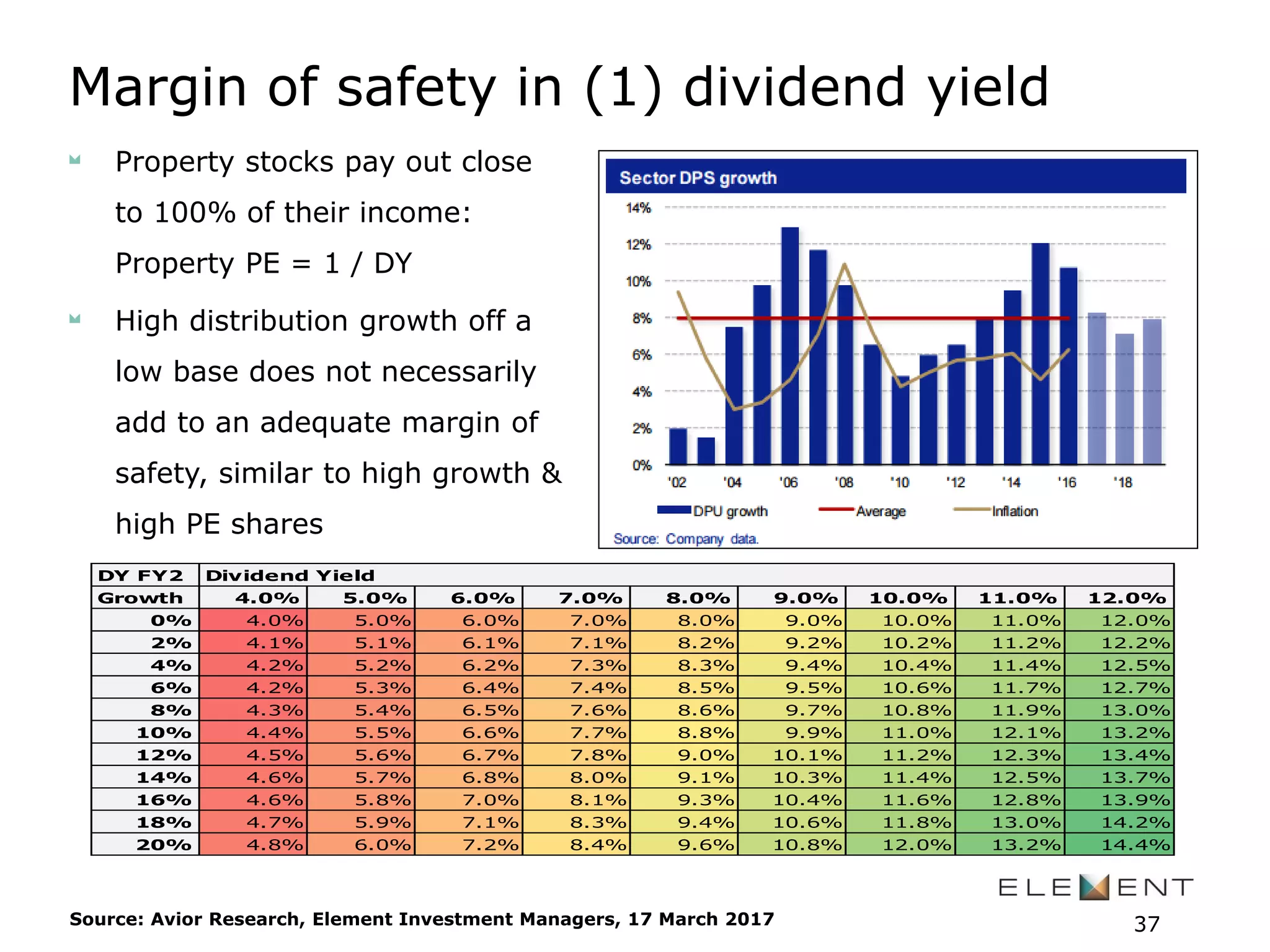

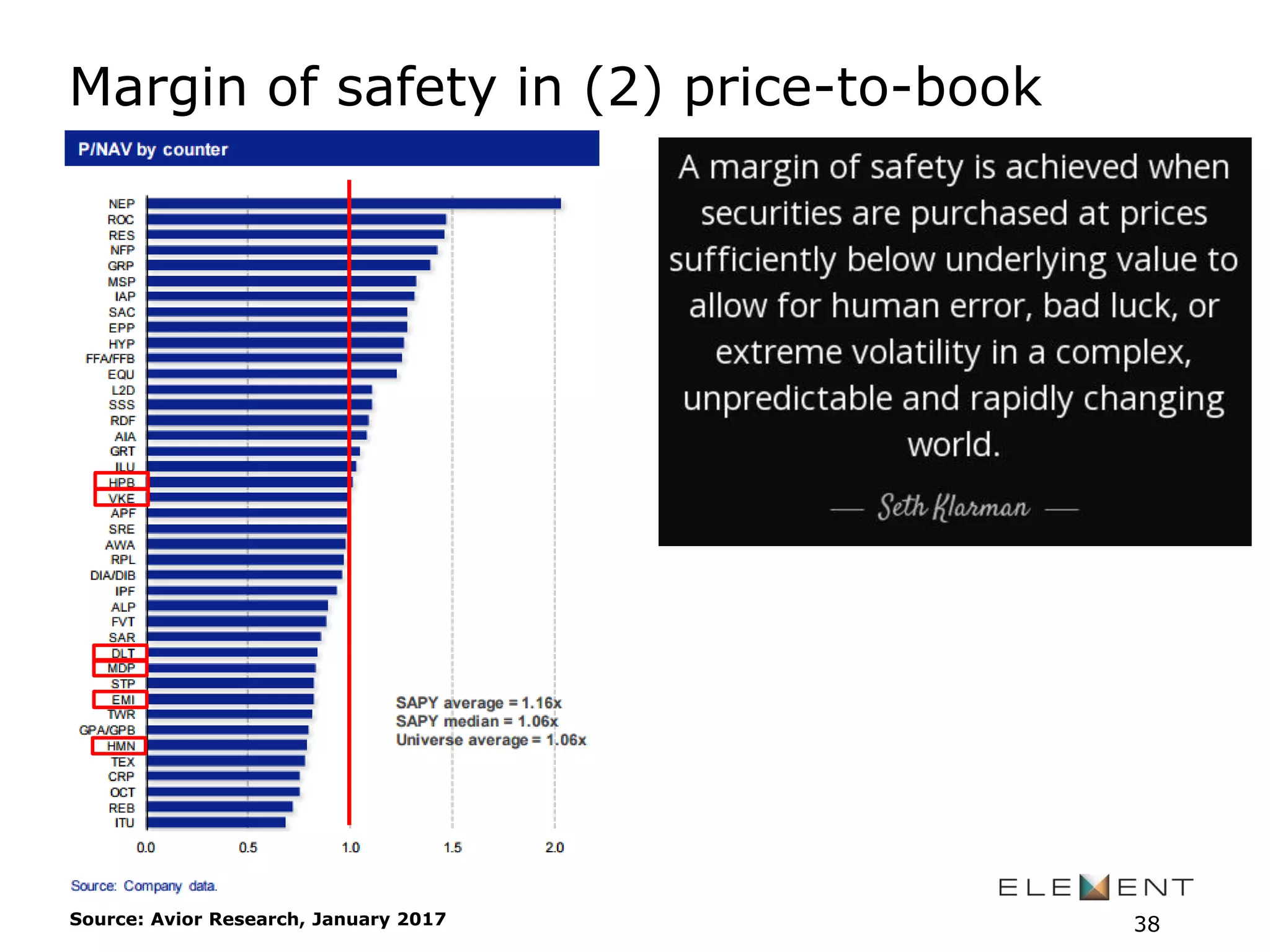

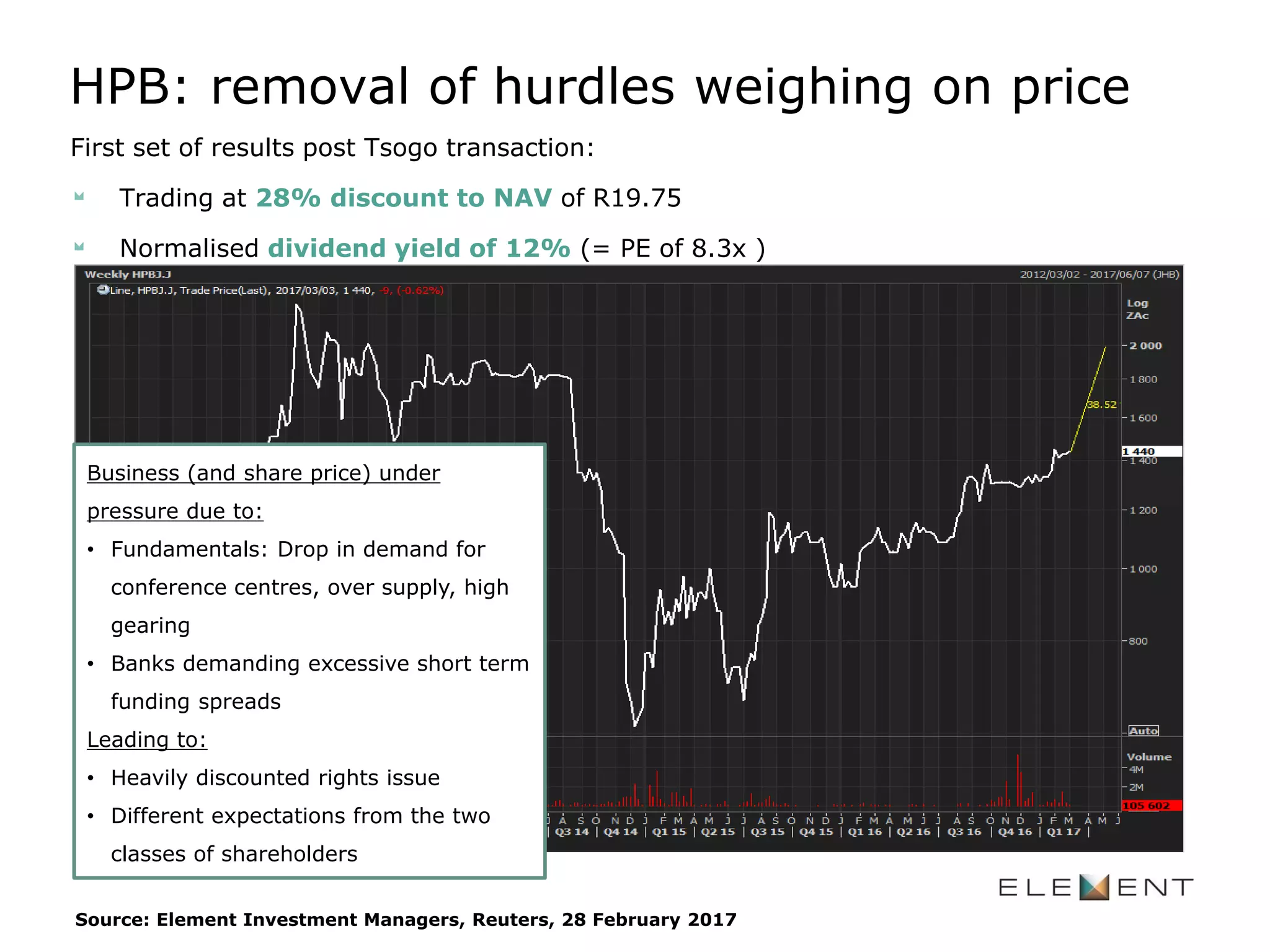

The document provides an overview of value investing strategies and opportunities. It discusses defining value investing as buying stocks trading at a significant discount to intrinsic value. It also notes that value investing requires a contrarian mindset and long-term horizon. Examples of potential value opportunities discussed include stocks trading at low price-to-book ratios like Astrapak, preferred shares providing high yields and upside to par value, and discounted property stocks. The document advocates that value investing requires patience as undervaluations can persist for long periods but rotating sectors will eventually revert to the mean.