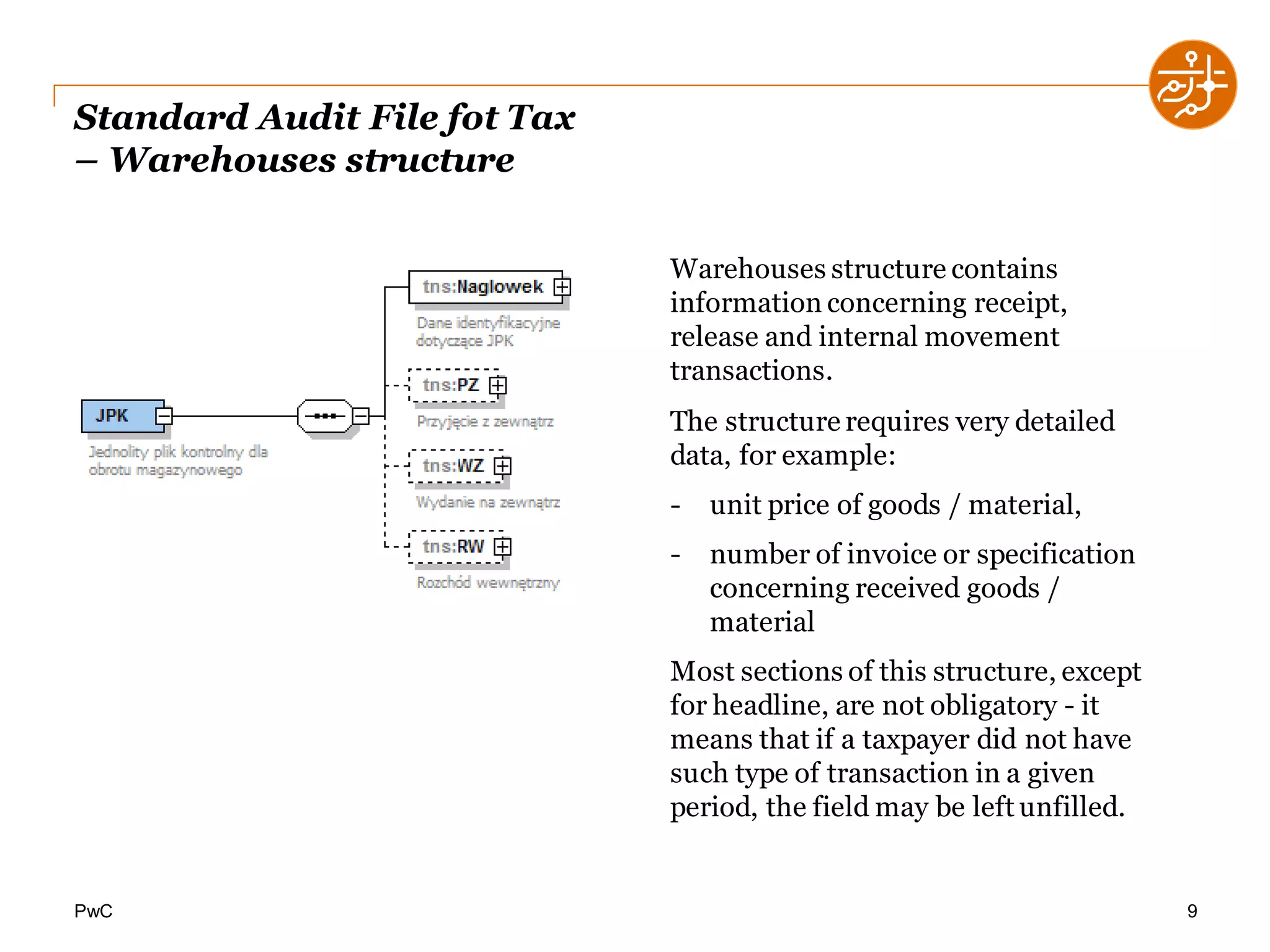

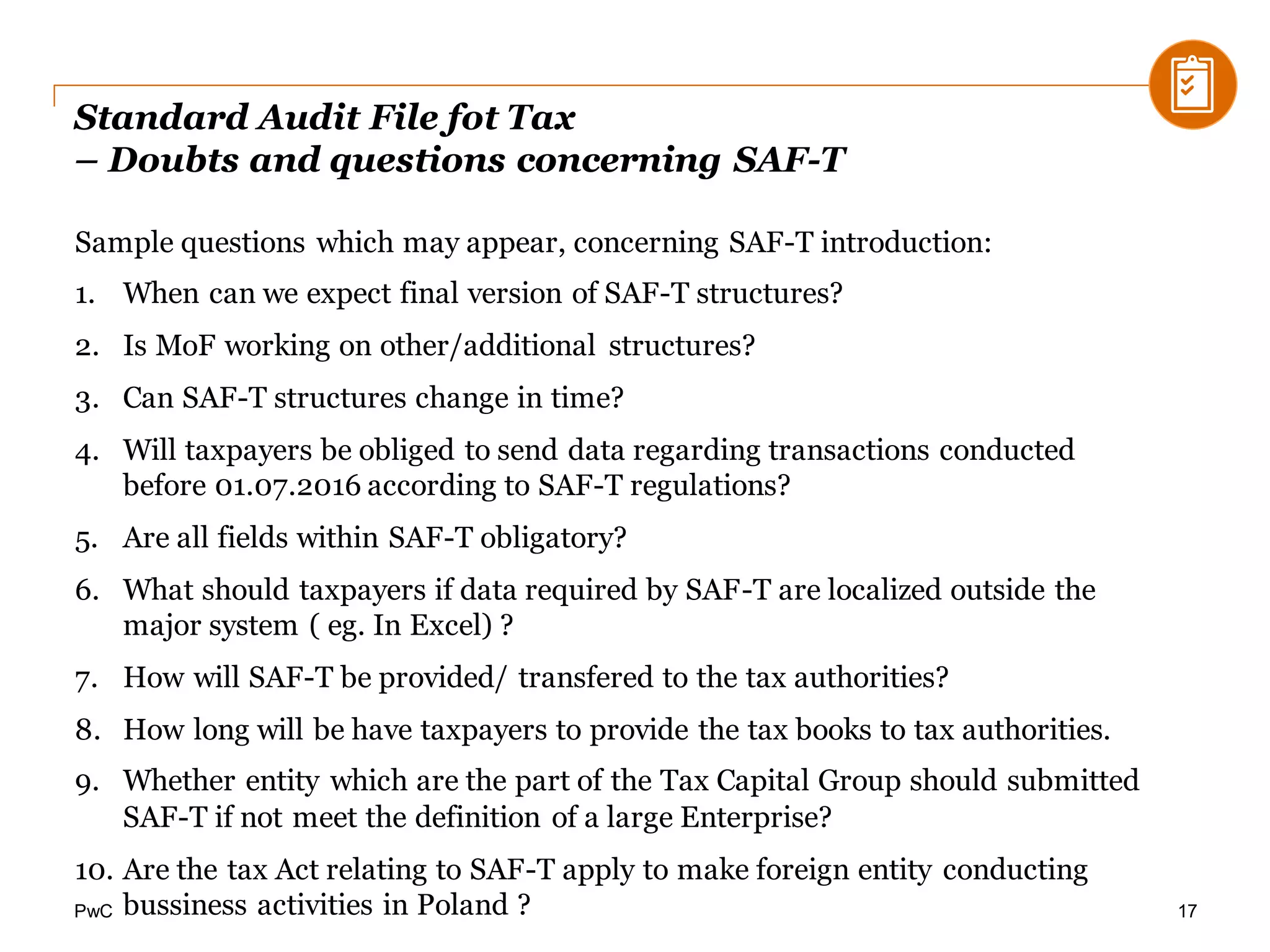

The document discusses the Standard Audit File for Tax (SAF-T), aiming to enhance tax audits by identifying non-compliance and reducing audit costs. SAF-T structures include various components such as accounting books, bank statements, and VAT evidence, and will require compliance from companies based on size and revenue thresholds starting July 2016. It also addresses the process for data generation and submission to tax authorities, along with common questions and considerations related to implementation.