Liv Watson from Workiva presented on regulatory technology (RegTech) and how it can help organizations more efficiently and effectively meet growing regulatory reporting demands. Some key points included:

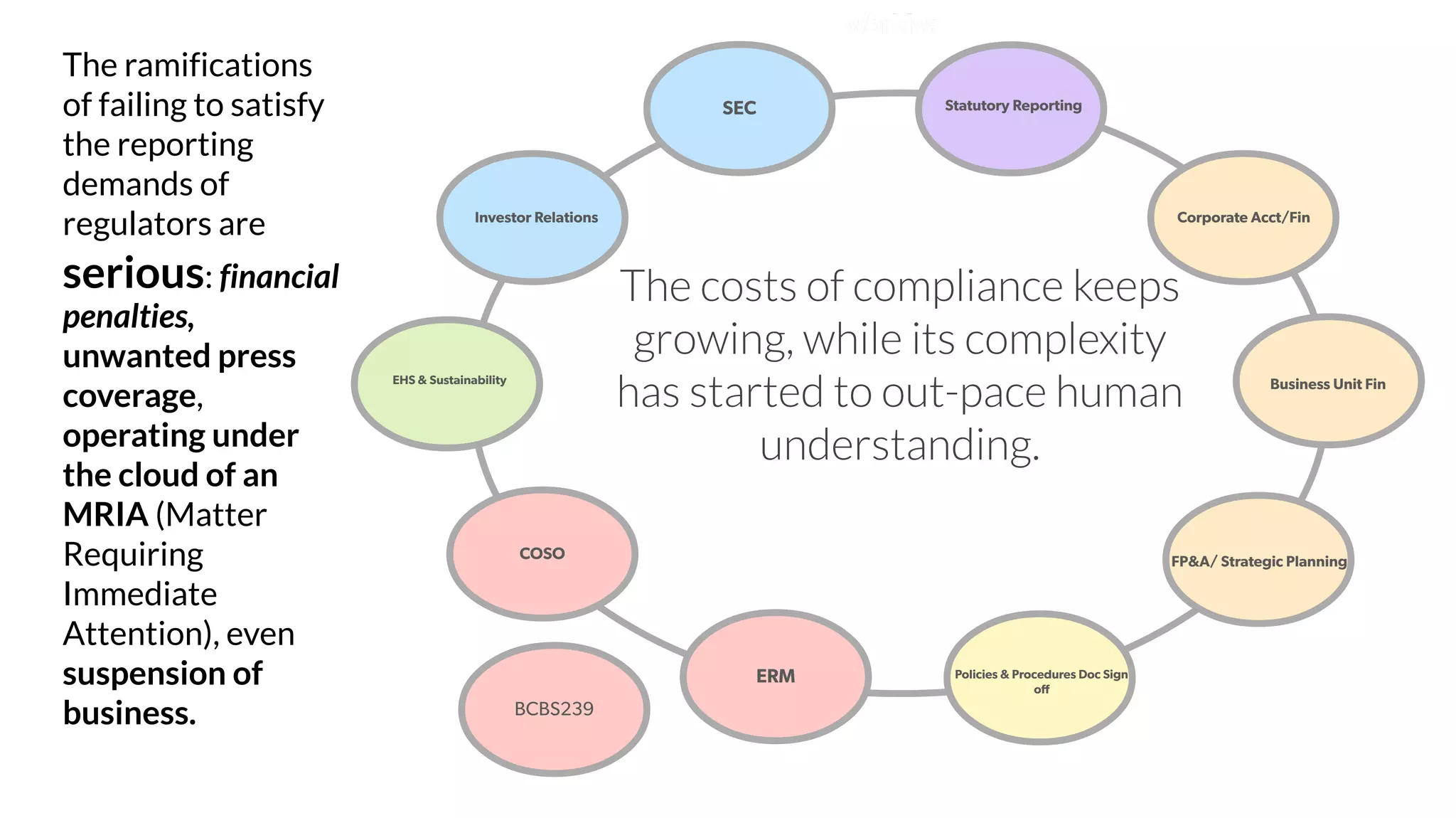

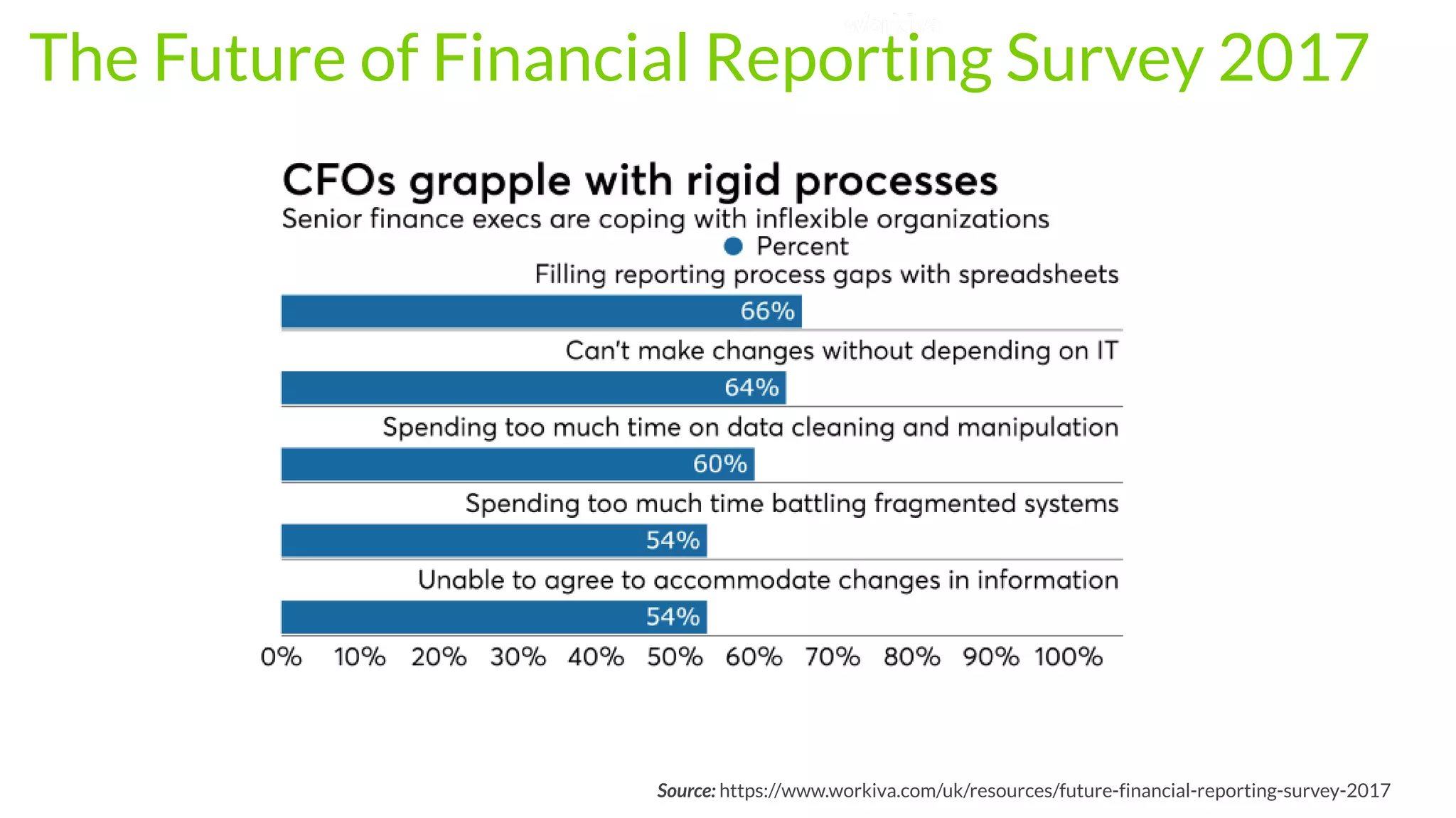

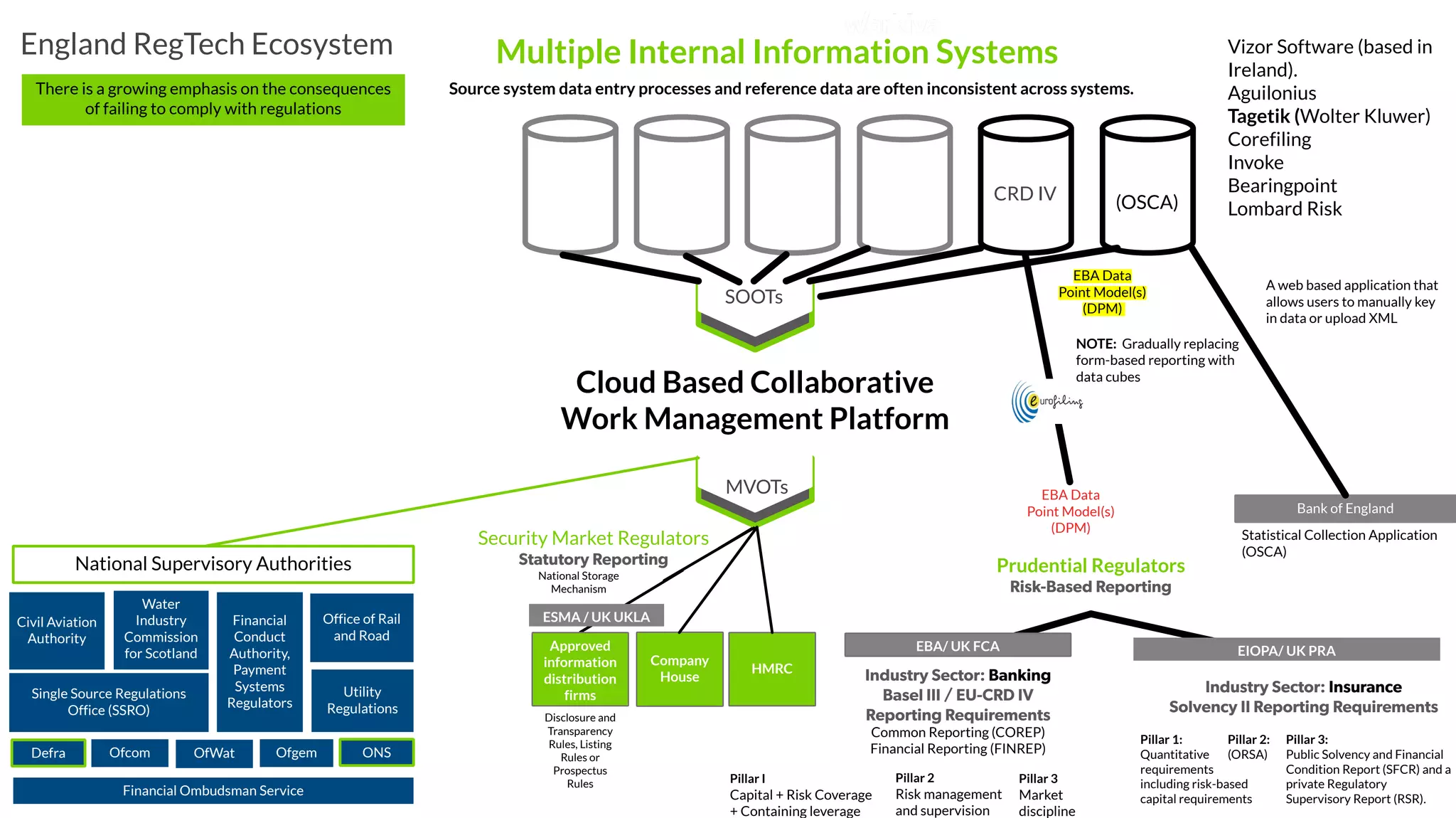

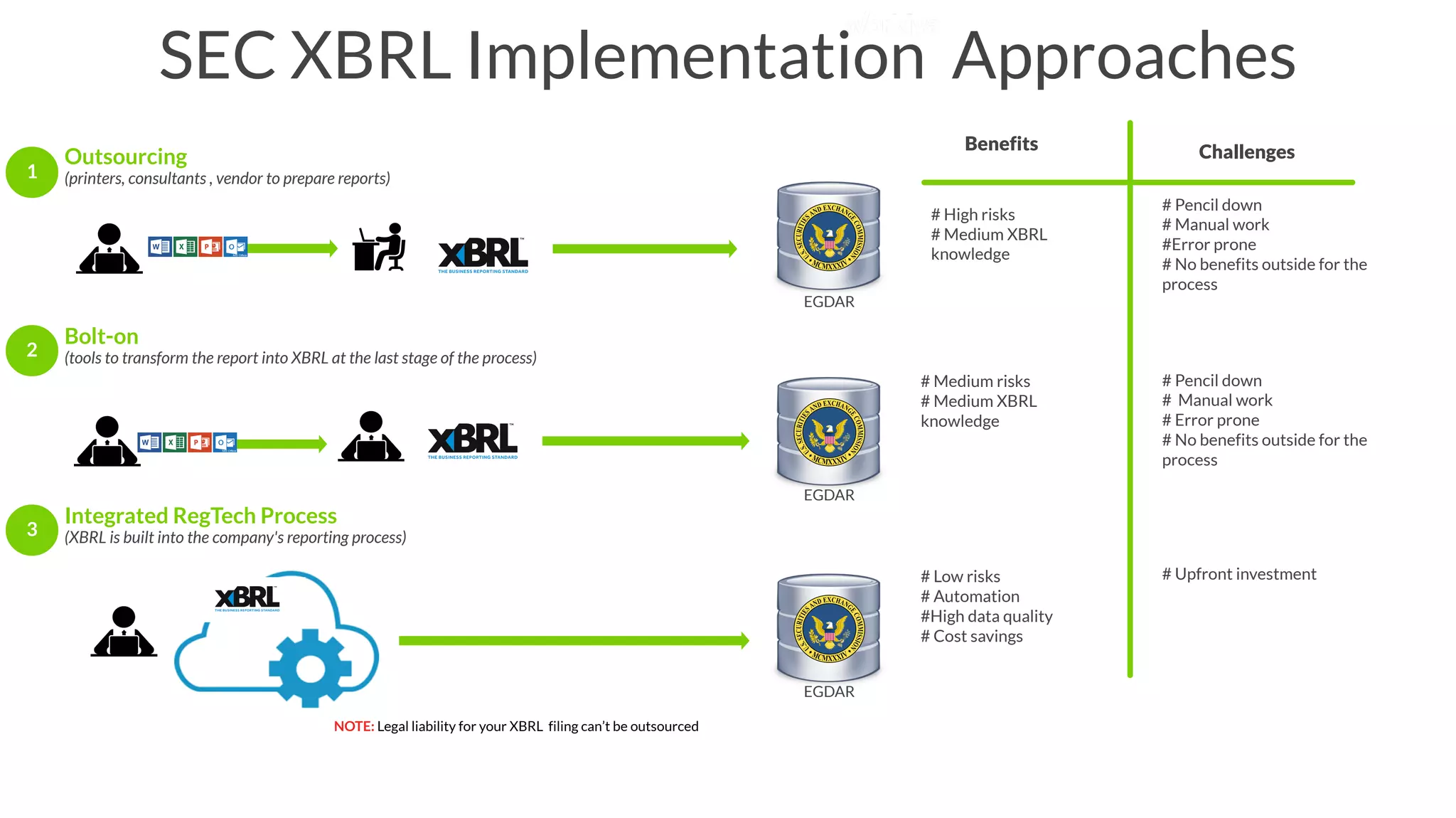

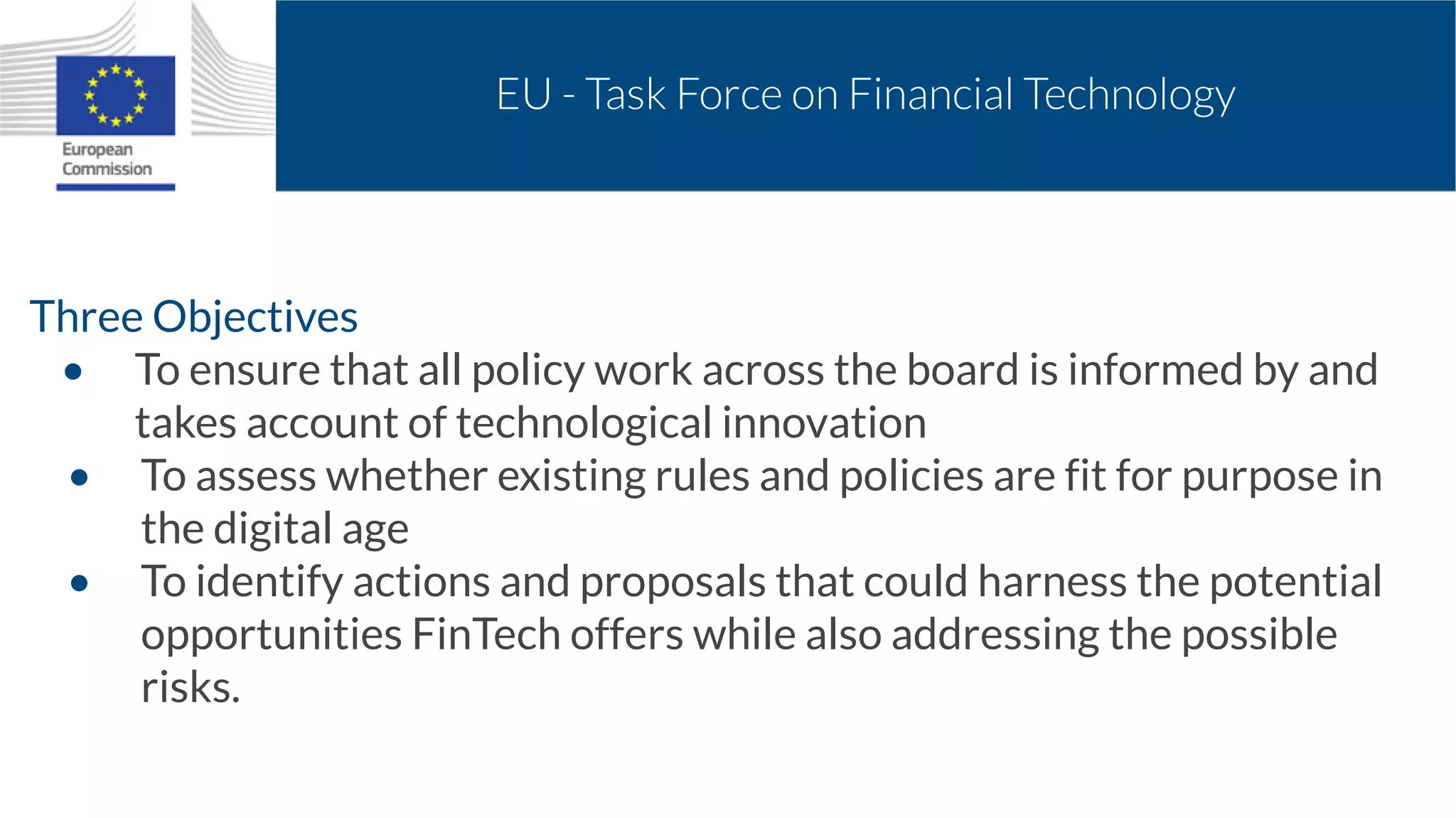

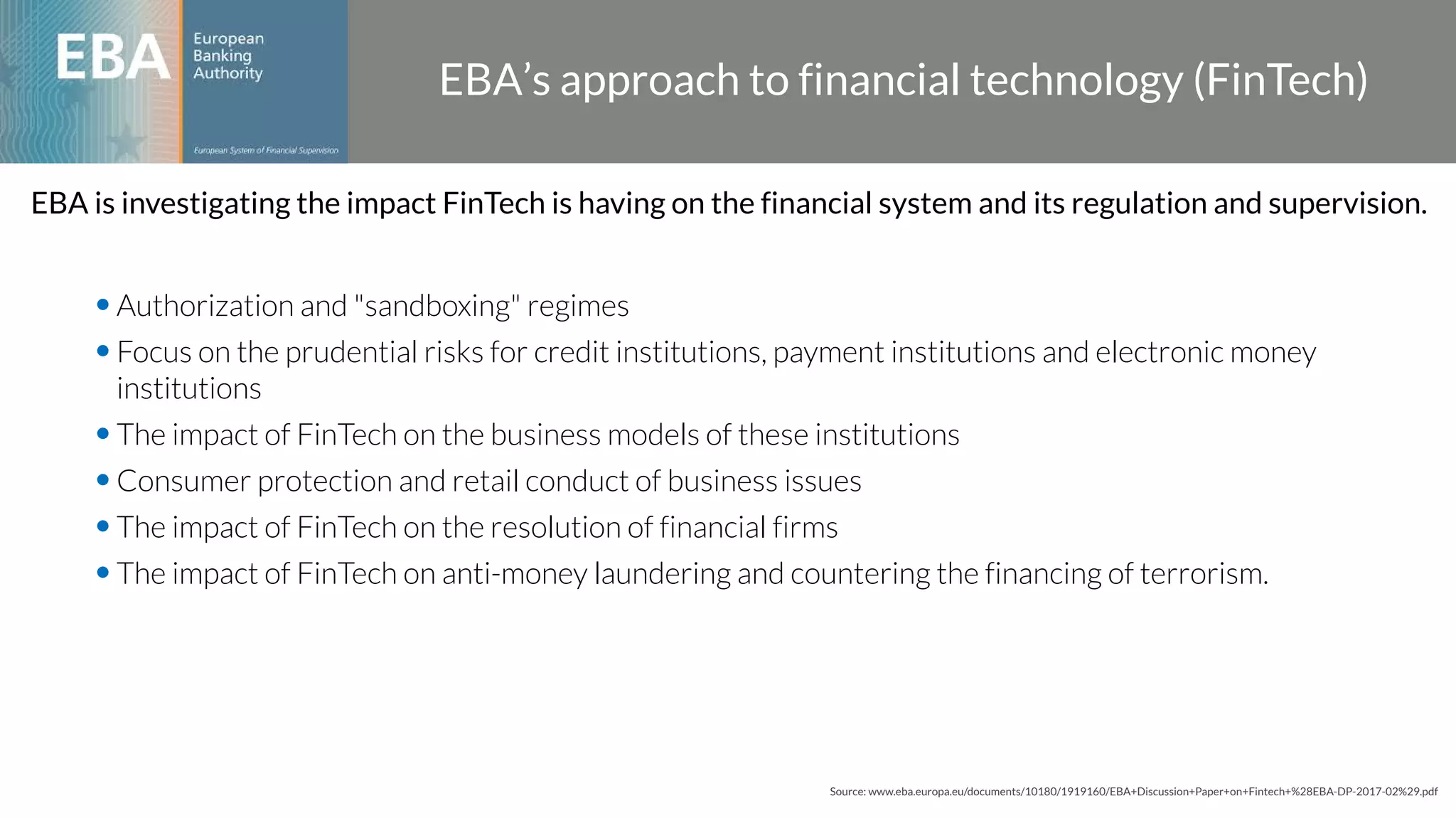

- Regulatory requirements have increased in complexity and volume, outpacing human capabilities without technology. RegTech aims to address this through automation.

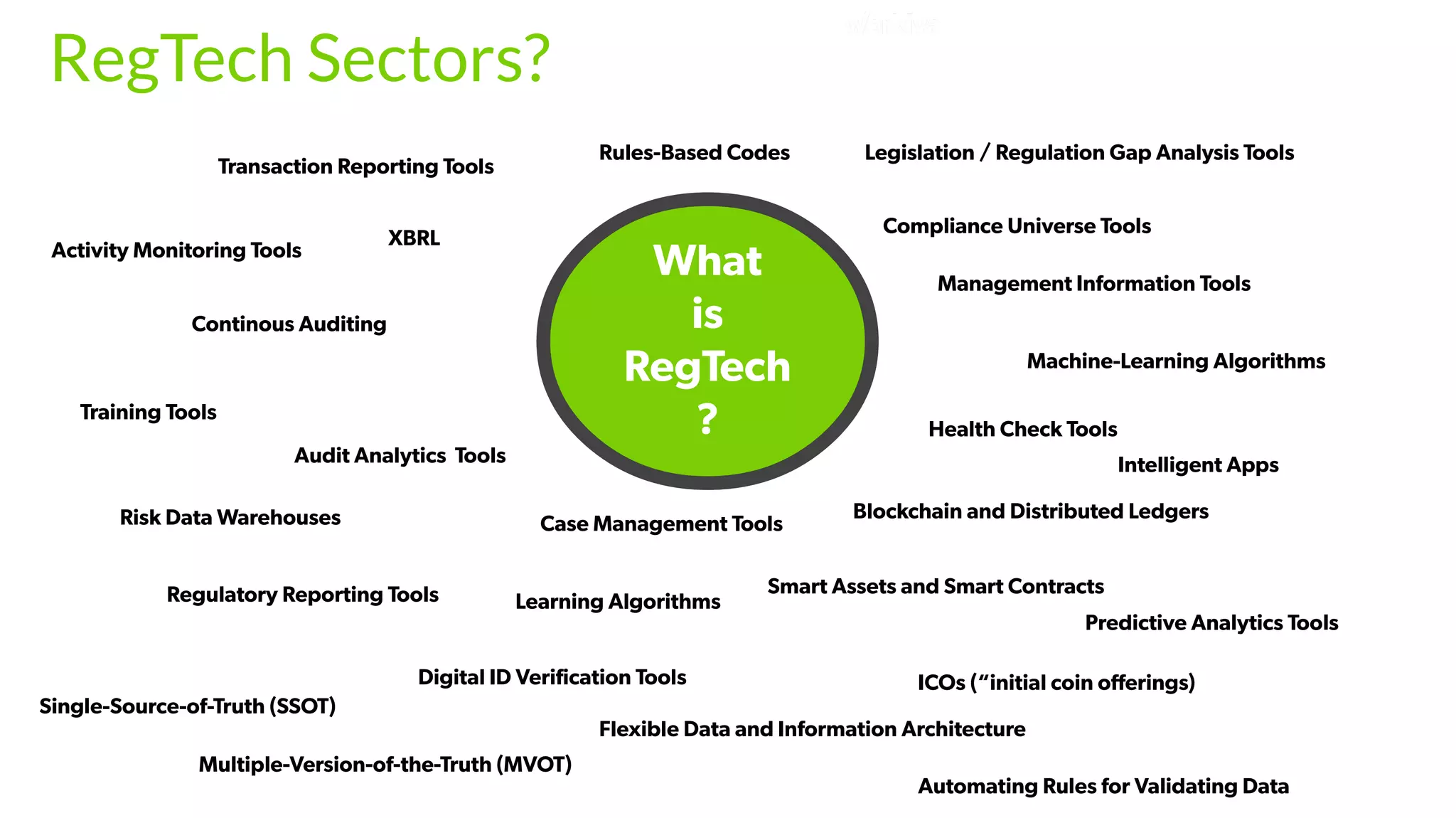

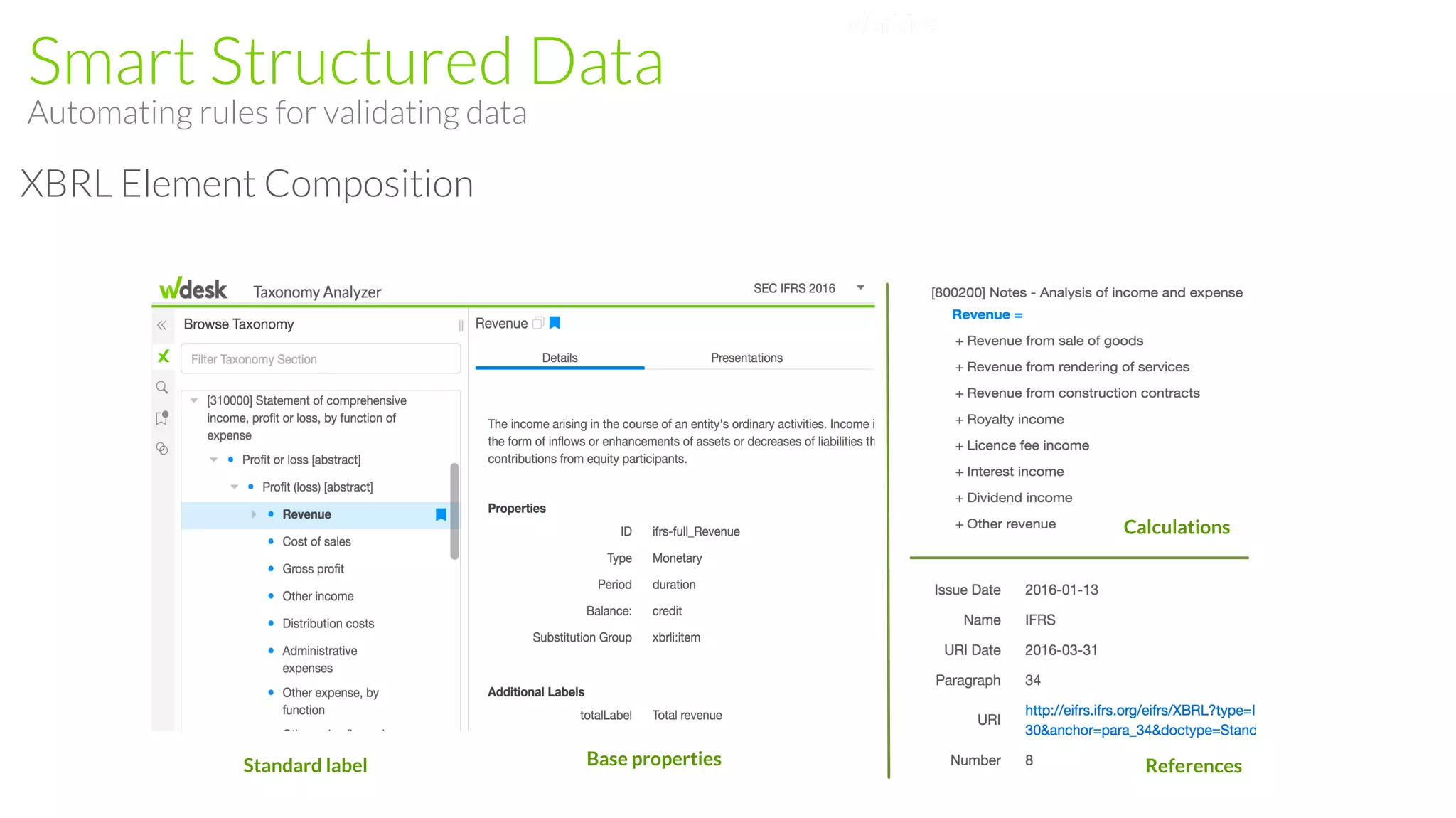

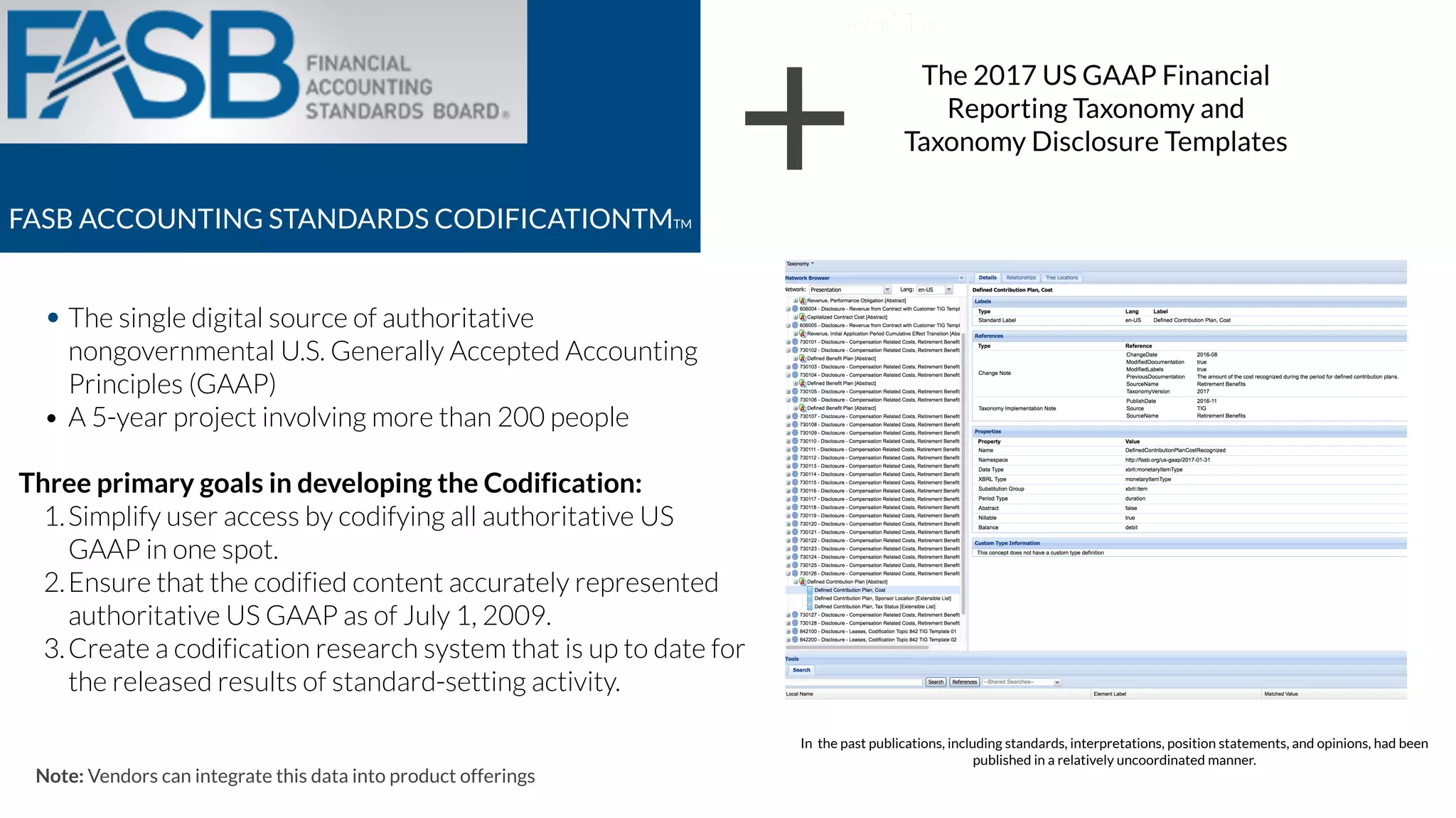

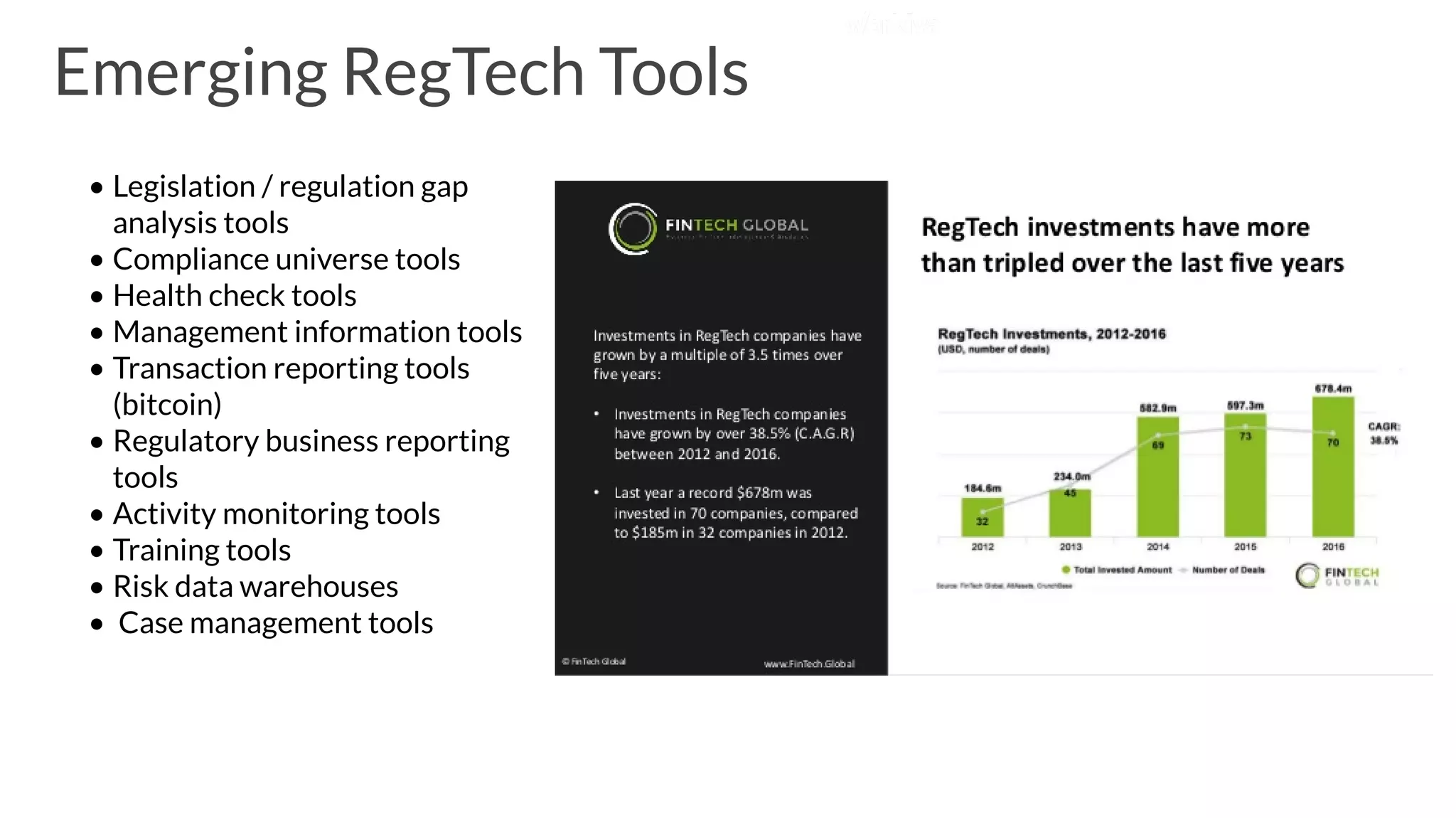

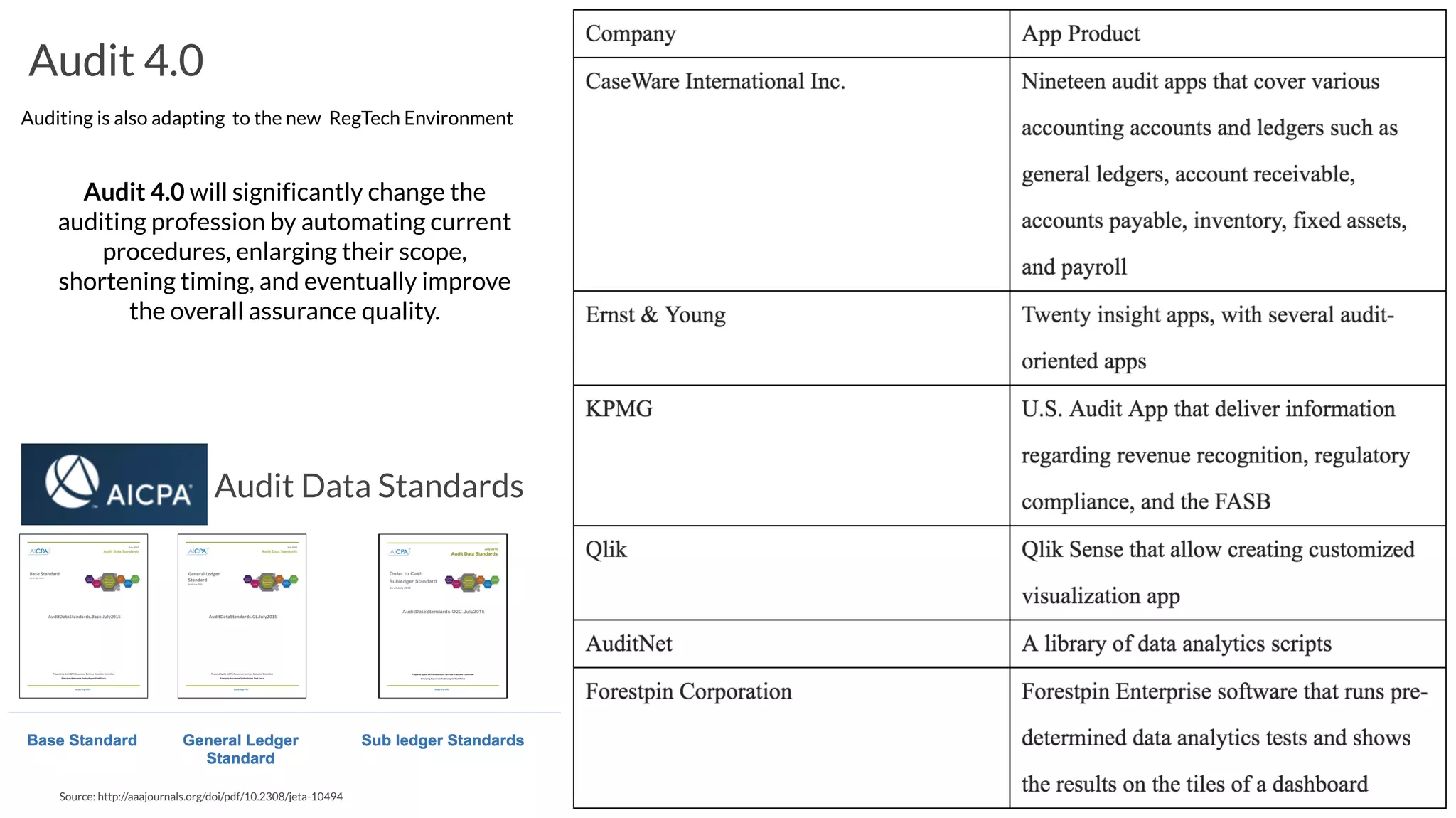

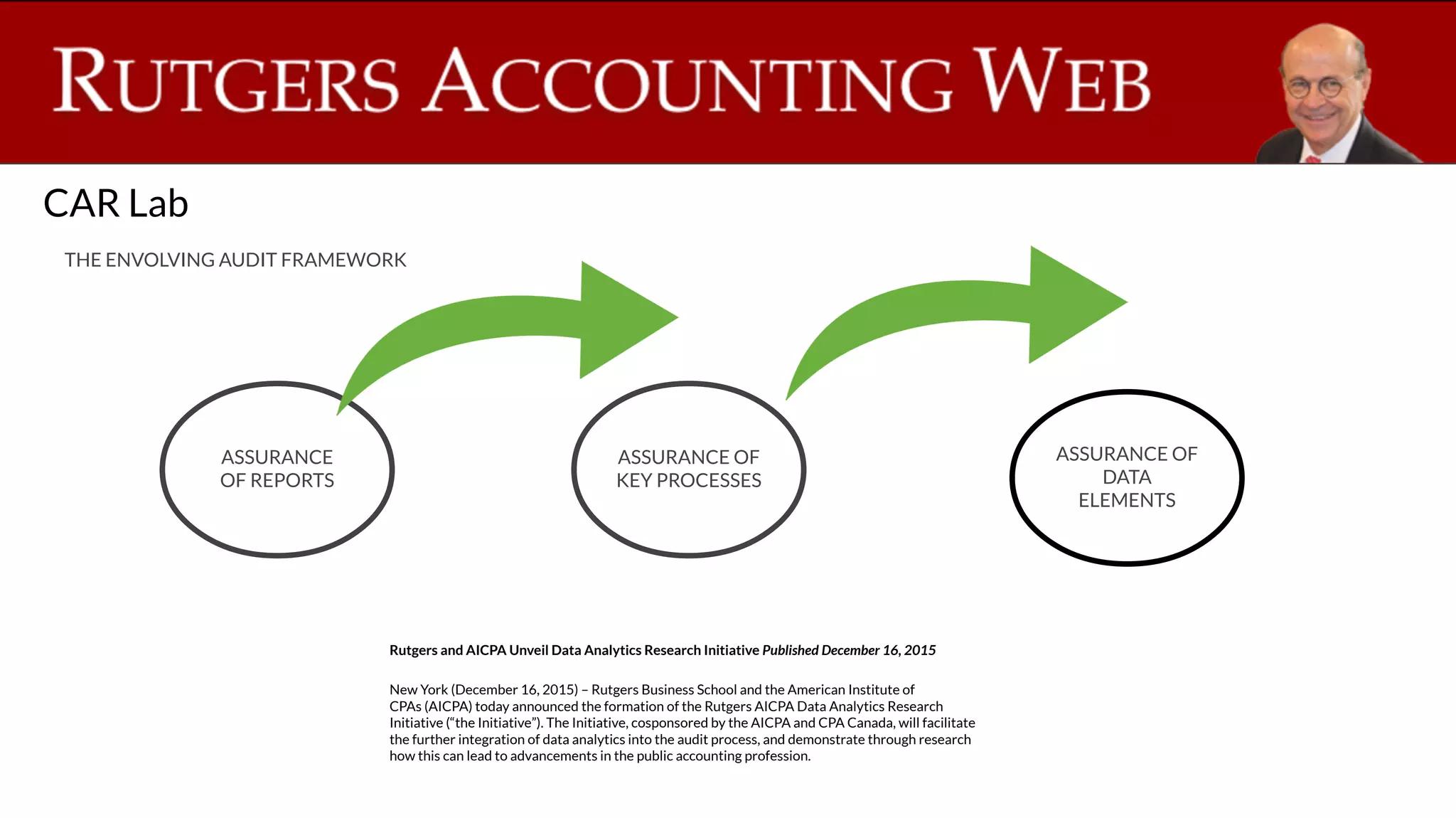

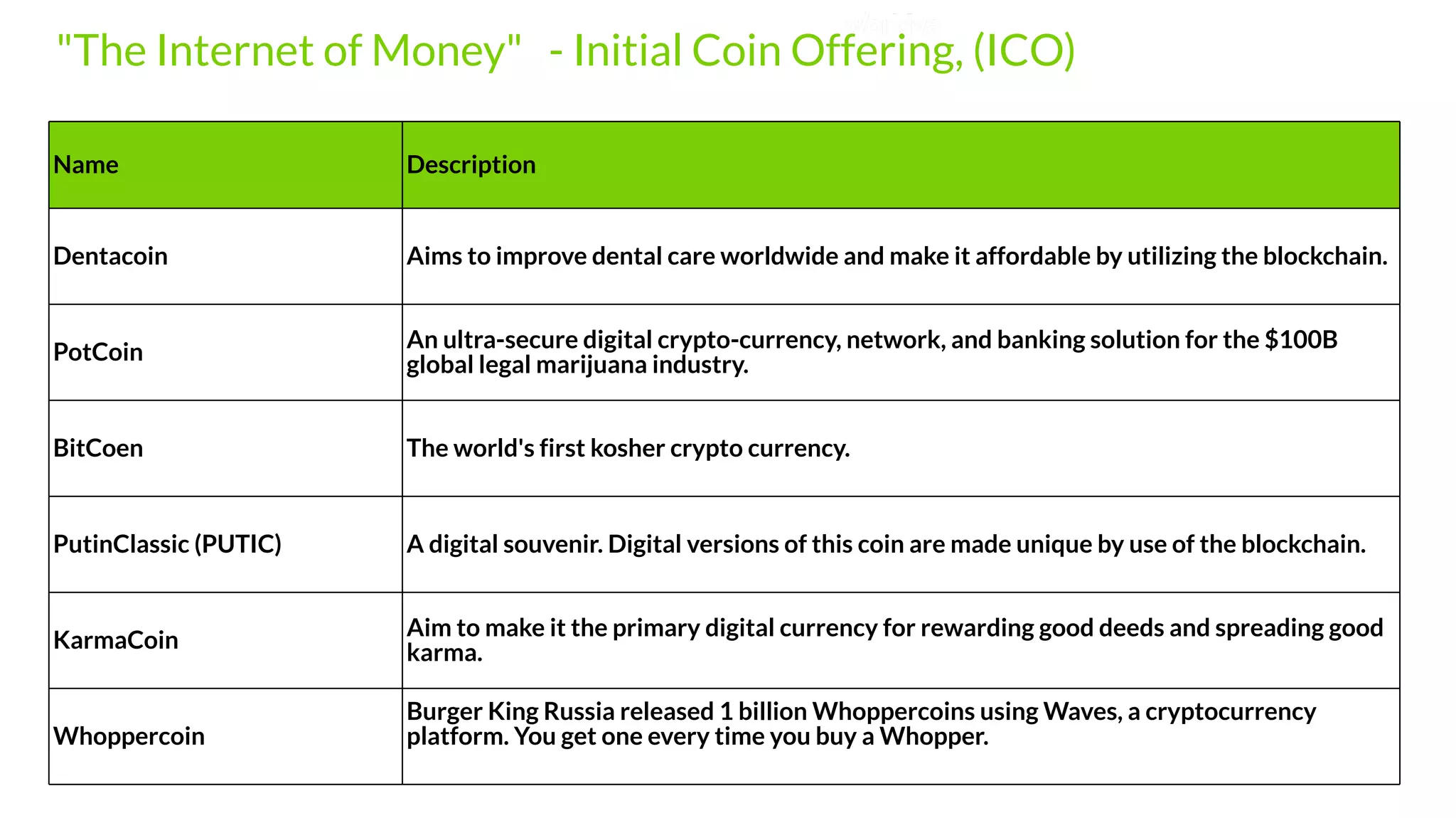

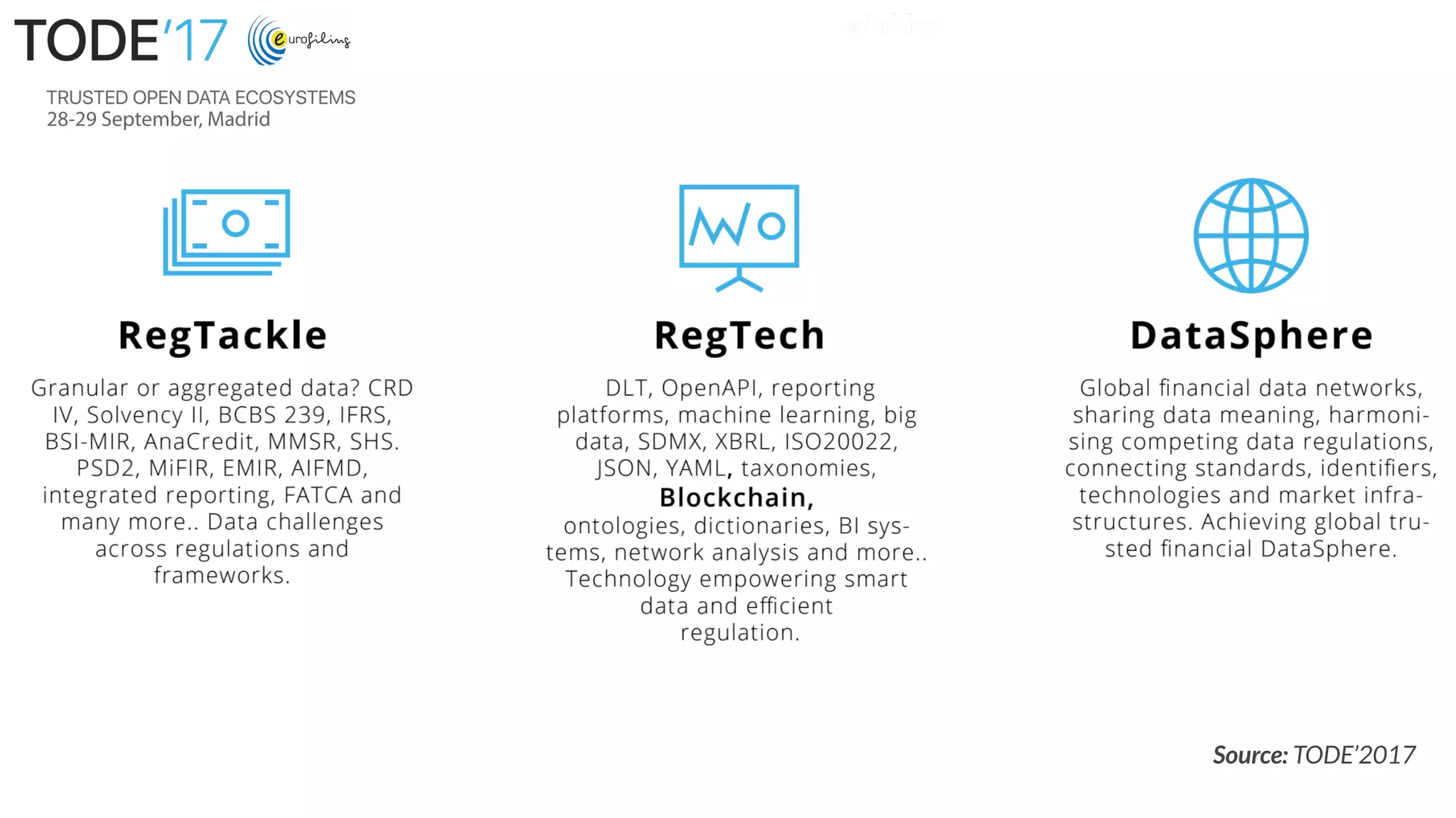

- RegTech tools and strategies span areas like compliance management, regulatory reporting, risk management, and "smart audits". Emerging areas include blockchain, data standards like XBRL, and predictive analytics.

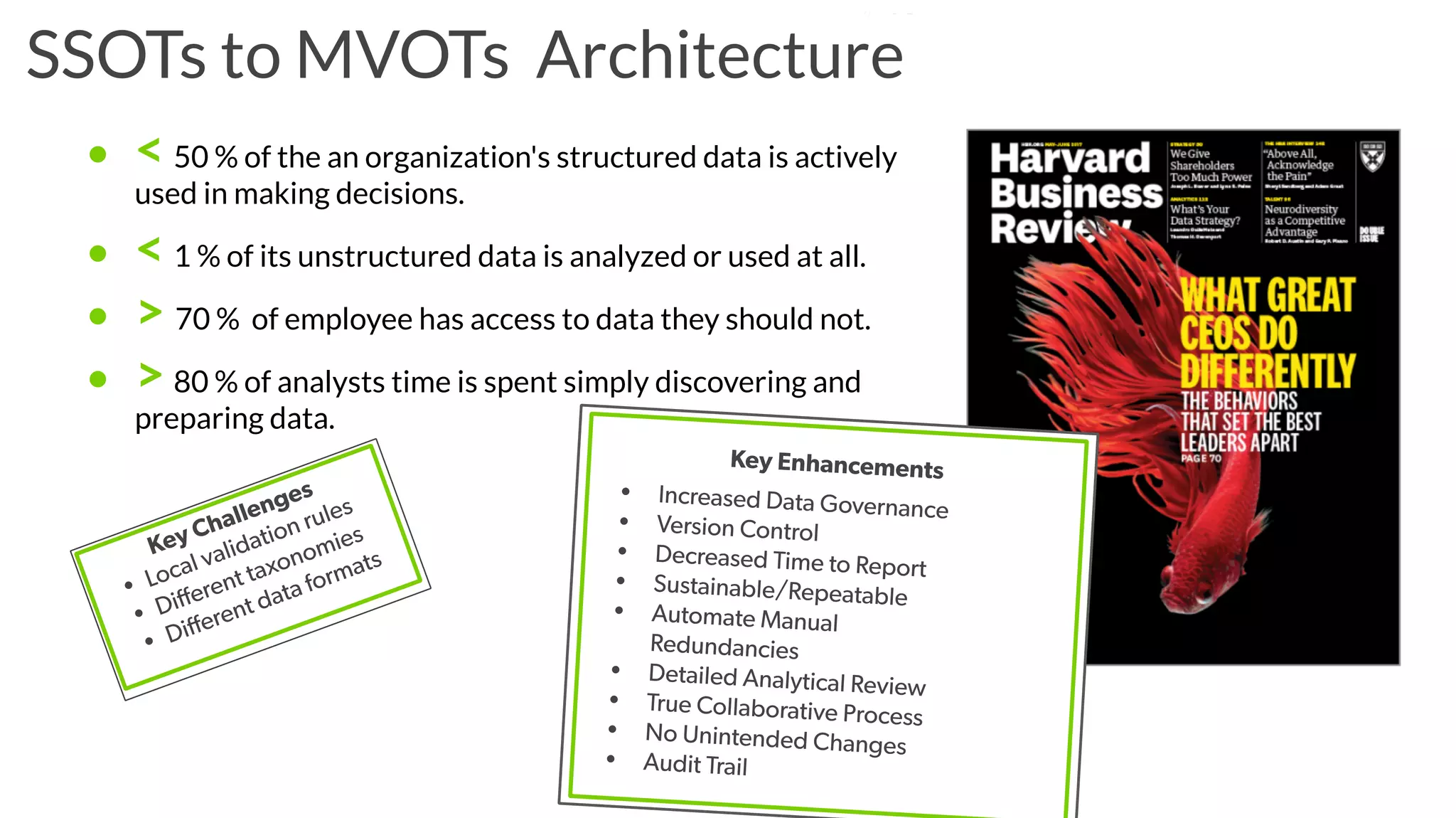

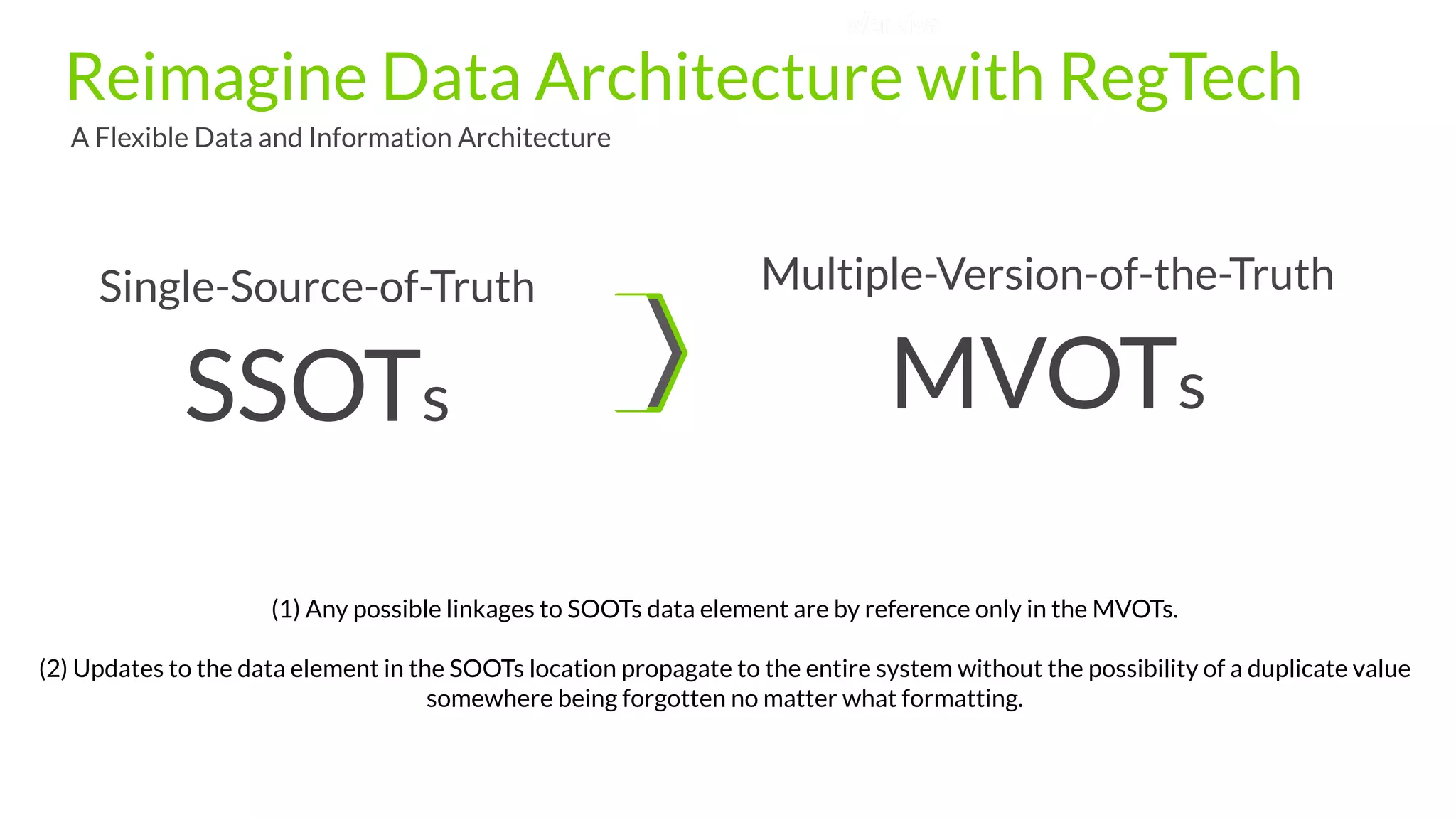

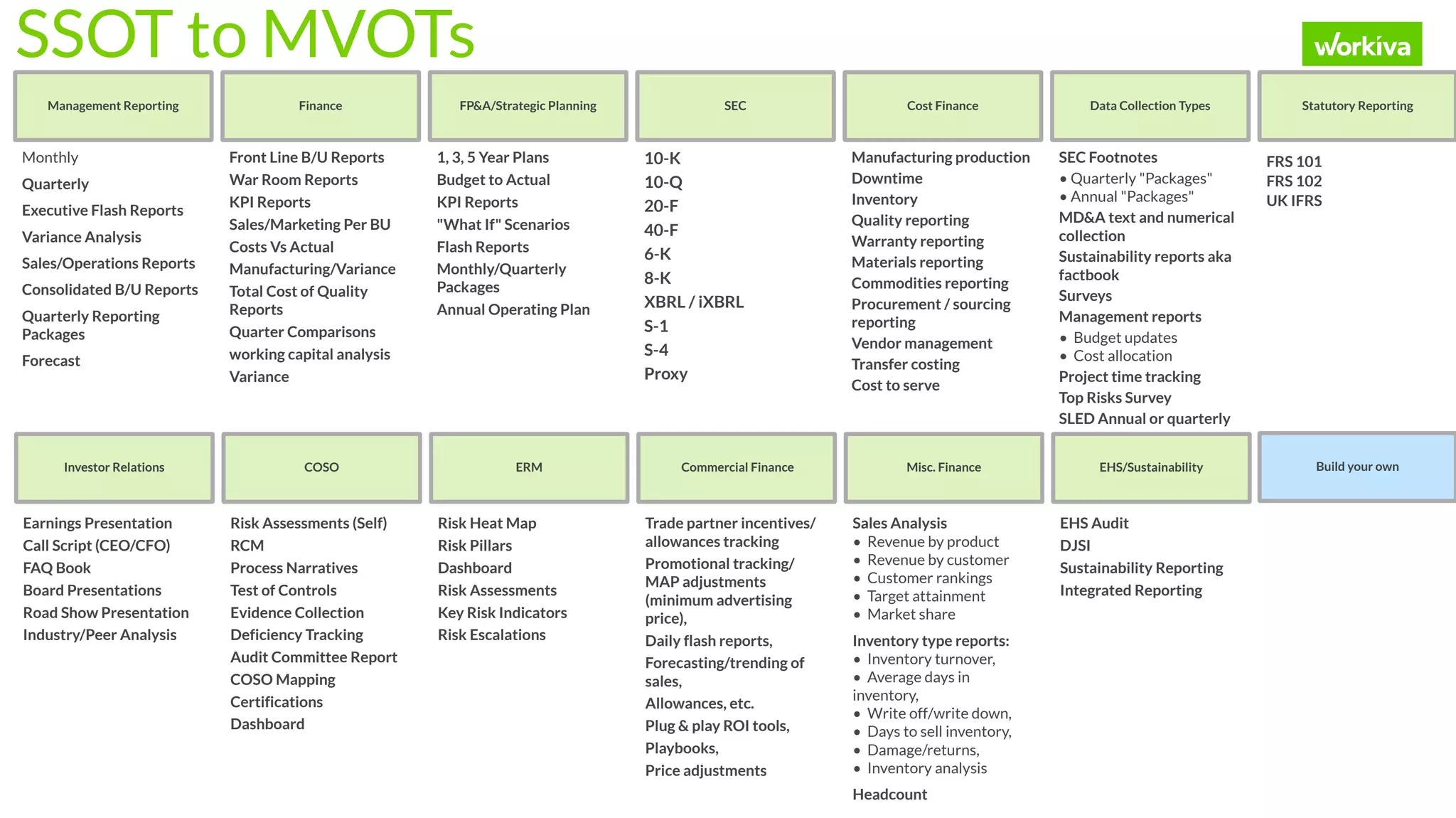

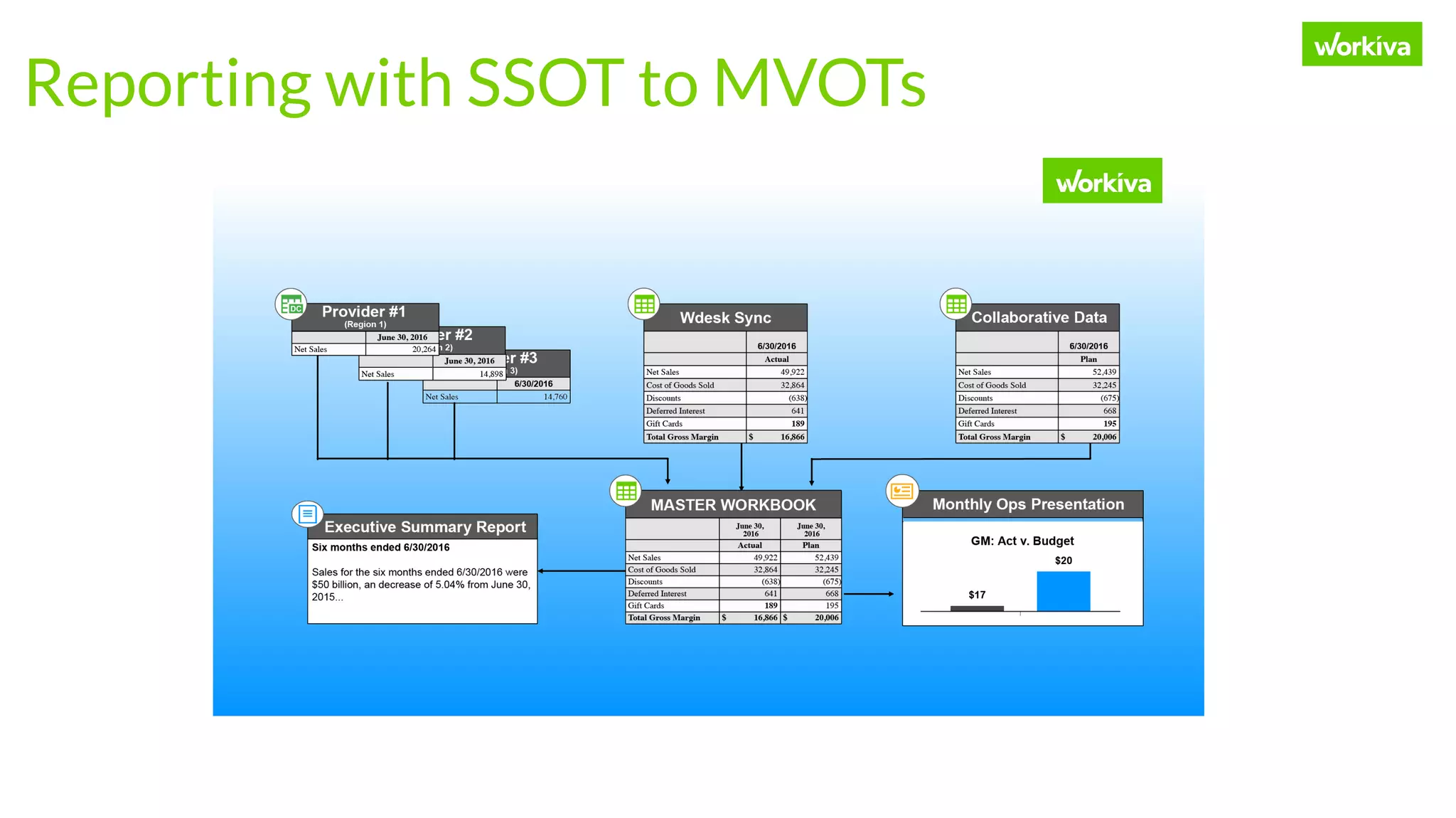

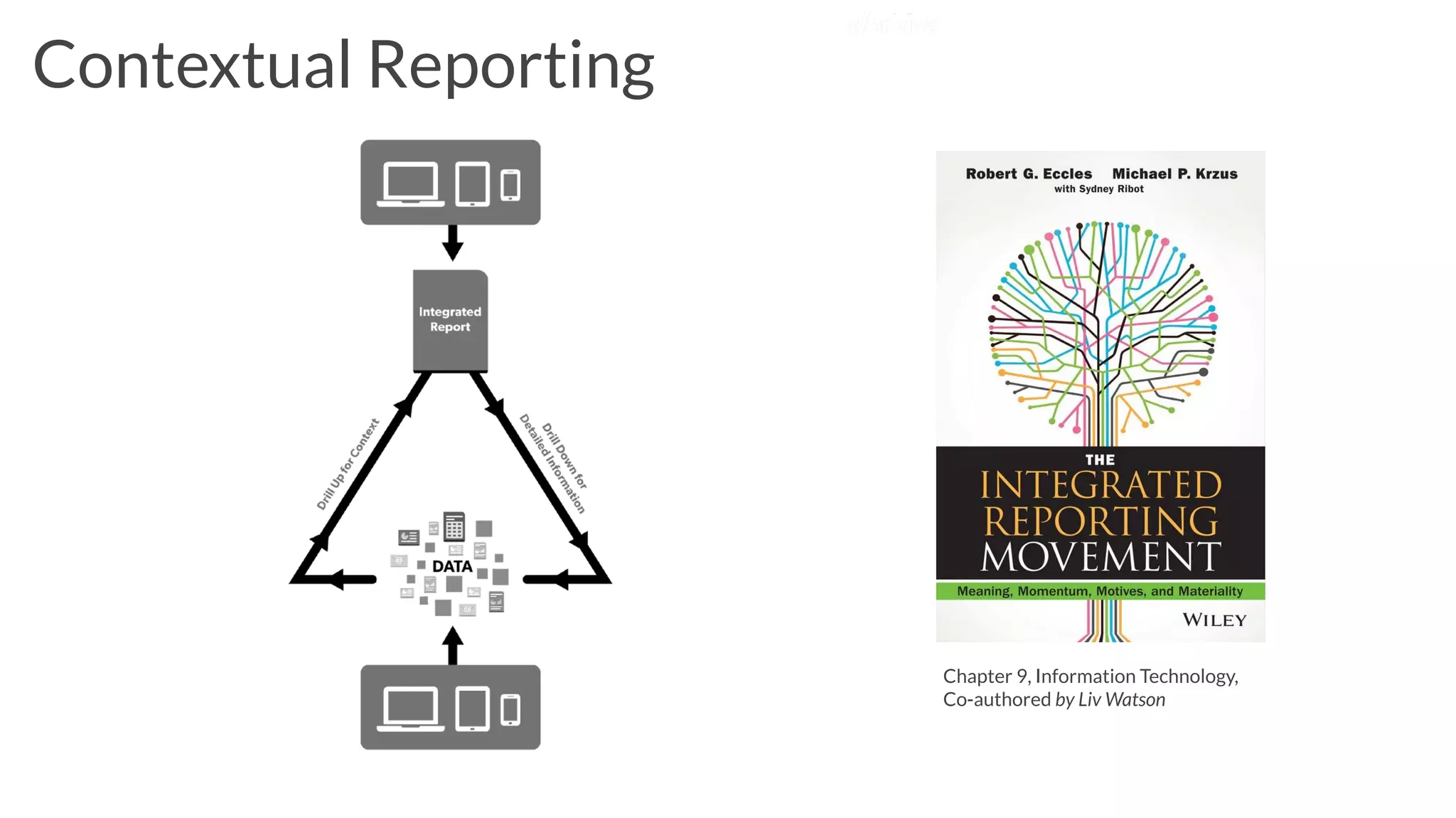

- Adopting a flexible data architecture with single-source and multiple-version data models can help organizations better leverage RegTech across functions like finance, risk, and ESG reporting.