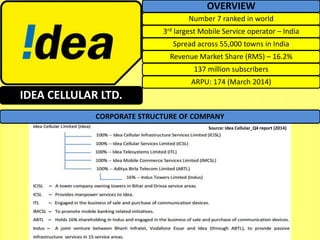

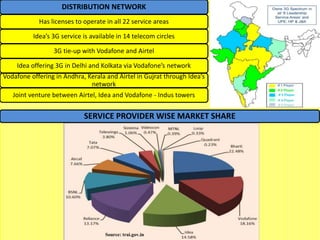

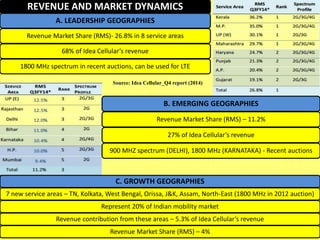

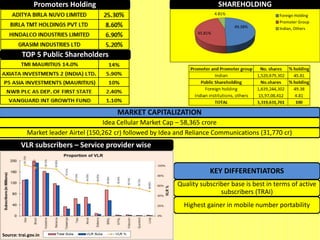

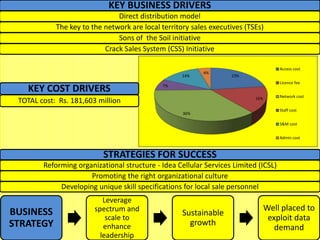

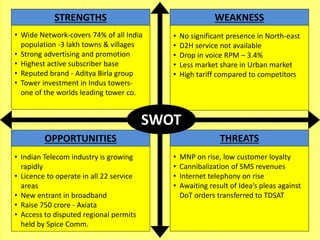

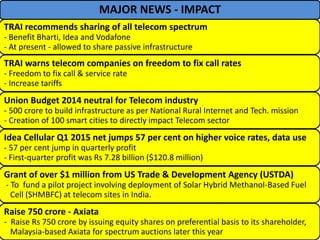

Idea Cellular is the third largest mobile service provider in India with 137 million subscribers. It operates in all 22 service areas across the country and has a 16.2% revenue market share. While leadership areas contribute 68% of its revenue, emerging and growth areas make up 26.8% and 5.3% respectively. Idea differentiates itself through quality subscribers and network coverage across 74% of India. However, competition and rising data usage pose threats. Recent developments like proposed spectrum sharing and fundraising are expected to support Idea's growth.