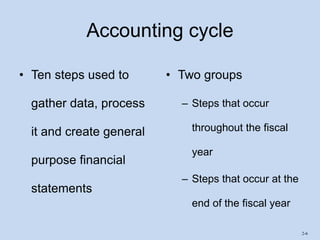

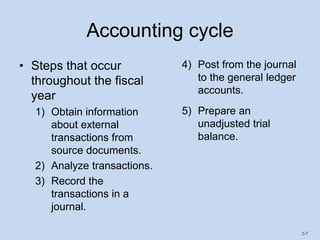

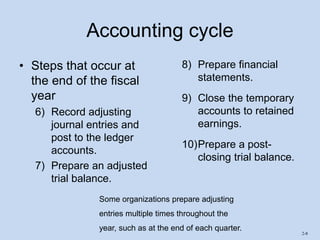

1) The document discusses the accounting cycle which includes 10 steps to gather financial data, process it, and create financial statements. It describes the steps that occur throughout the fiscal year and those that occur at the end.

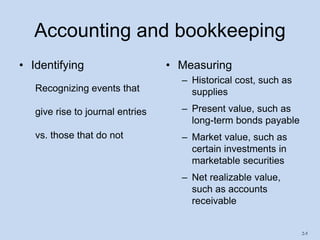

2) It also covers accounting and bookkeeping, distinguishing accounting as communicating economic information and bookkeeping as identifying and measuring that information.

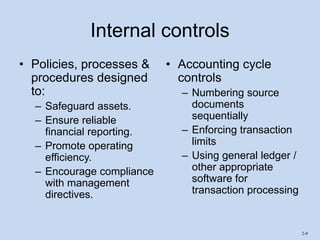

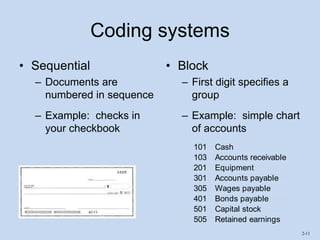

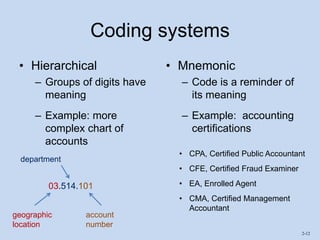

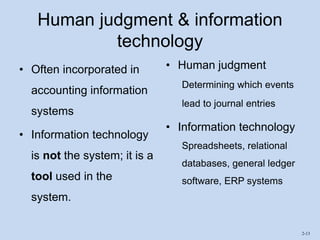

3) Internal controls, coding systems, and how human judgment and information technology impact the accounting cycle are also summarized. Coding methods like sequential, block, hierarchical and mnemonic are defined.