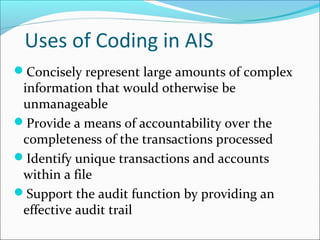

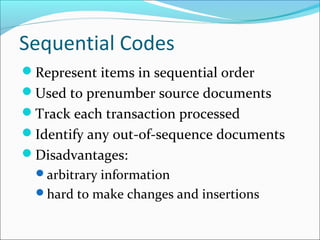

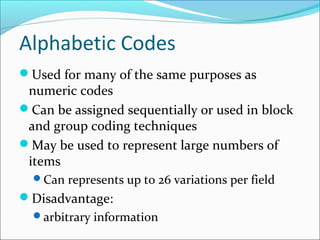

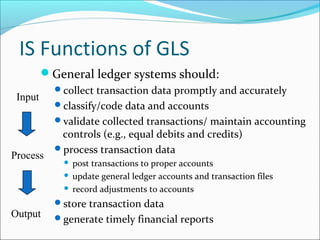

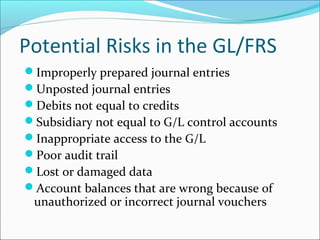

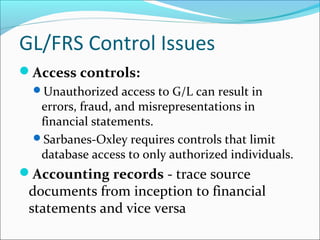

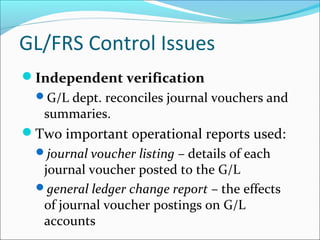

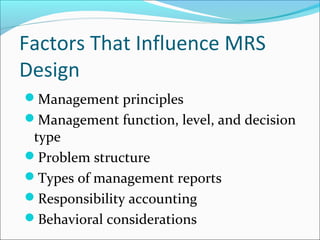

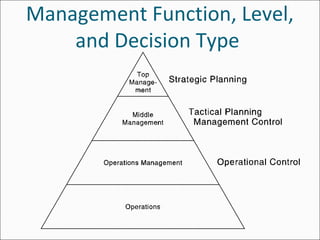

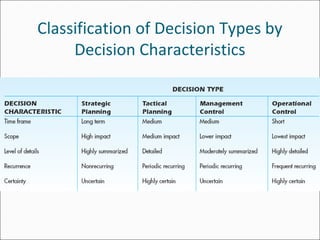

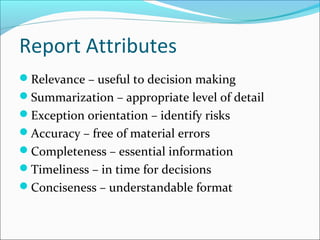

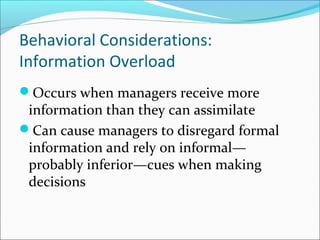

This document outlines the objectives and key concepts around coding schemes, general ledger systems, financial reporting systems, and management reporting systems from Accounting Information Systems, 6th edition by James A. Hall. It discusses various types of coding schemes (sequential, block, group, alphabetic, mnemonic), the functions and components of a general ledger system, controls over the general ledger/financial reporting system, and factors that influence the design of management reporting systems such as management principles, functions/levels/decision types, problem structure, types of reports, responsibility accounting, and behavioral considerations.