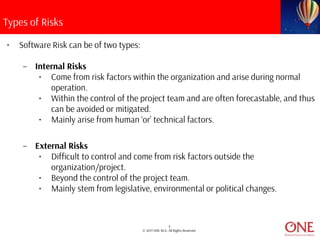

The document outlines concepts related to software risk analysis, including definitions of risk, types of risks (internal and external), and examples of scenarios where risks arise. It discusses the processes of risk identification, analysis, management, and treatment, highlighting strengths and limitations of risk analysis. Additionally, it includes a case study that examines risk assessment in a financial service company to validate their information systems and improve security measures.