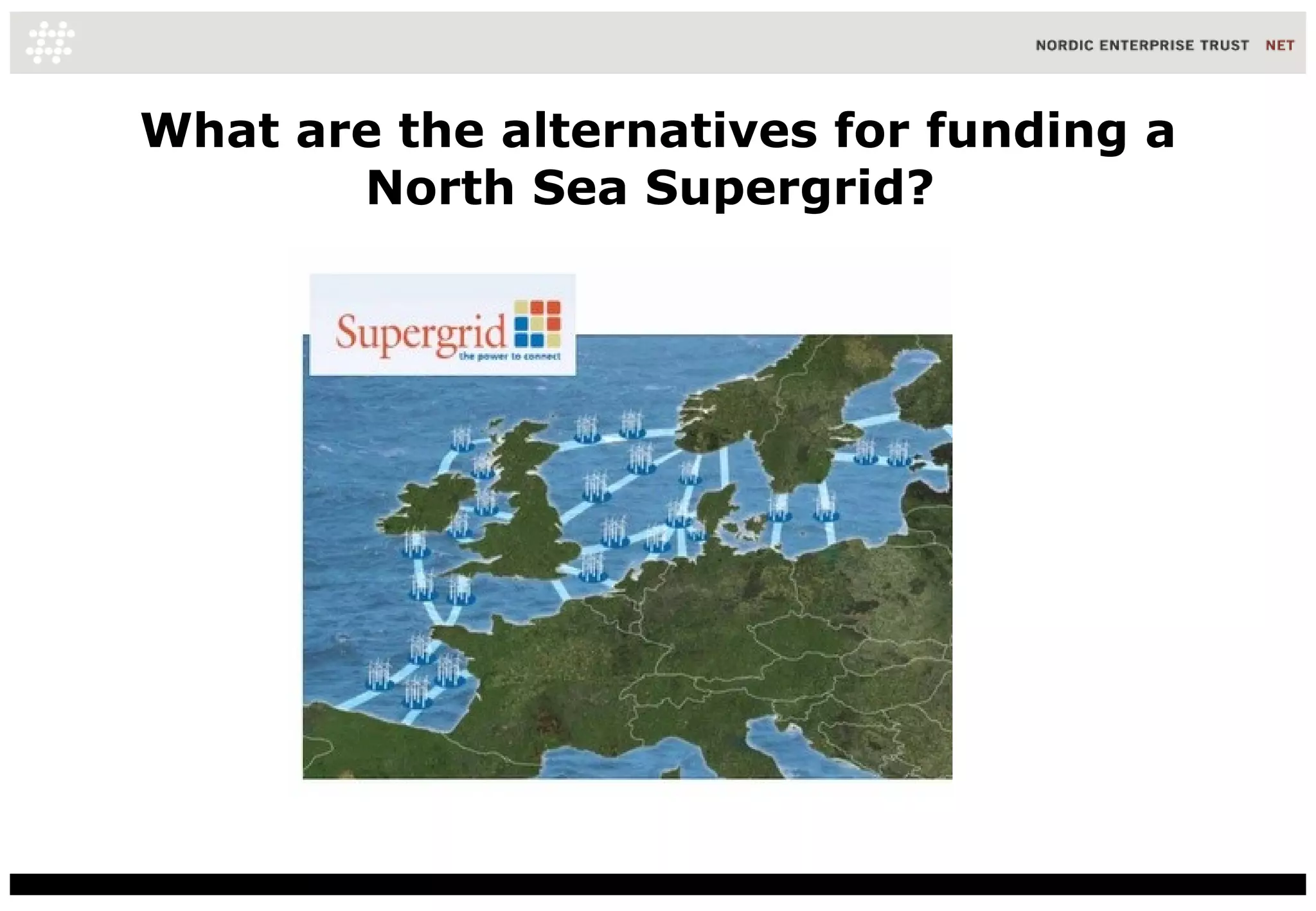

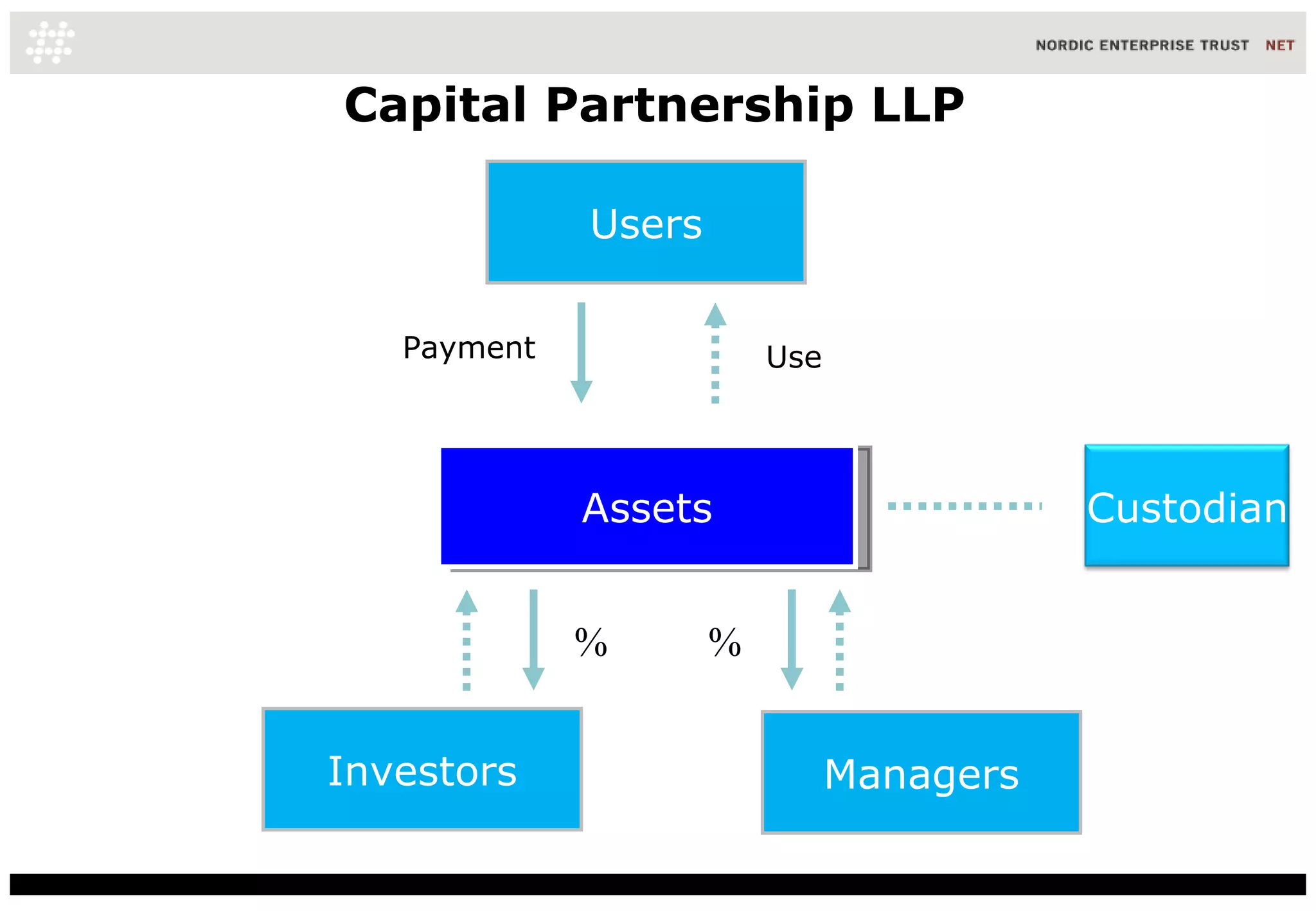

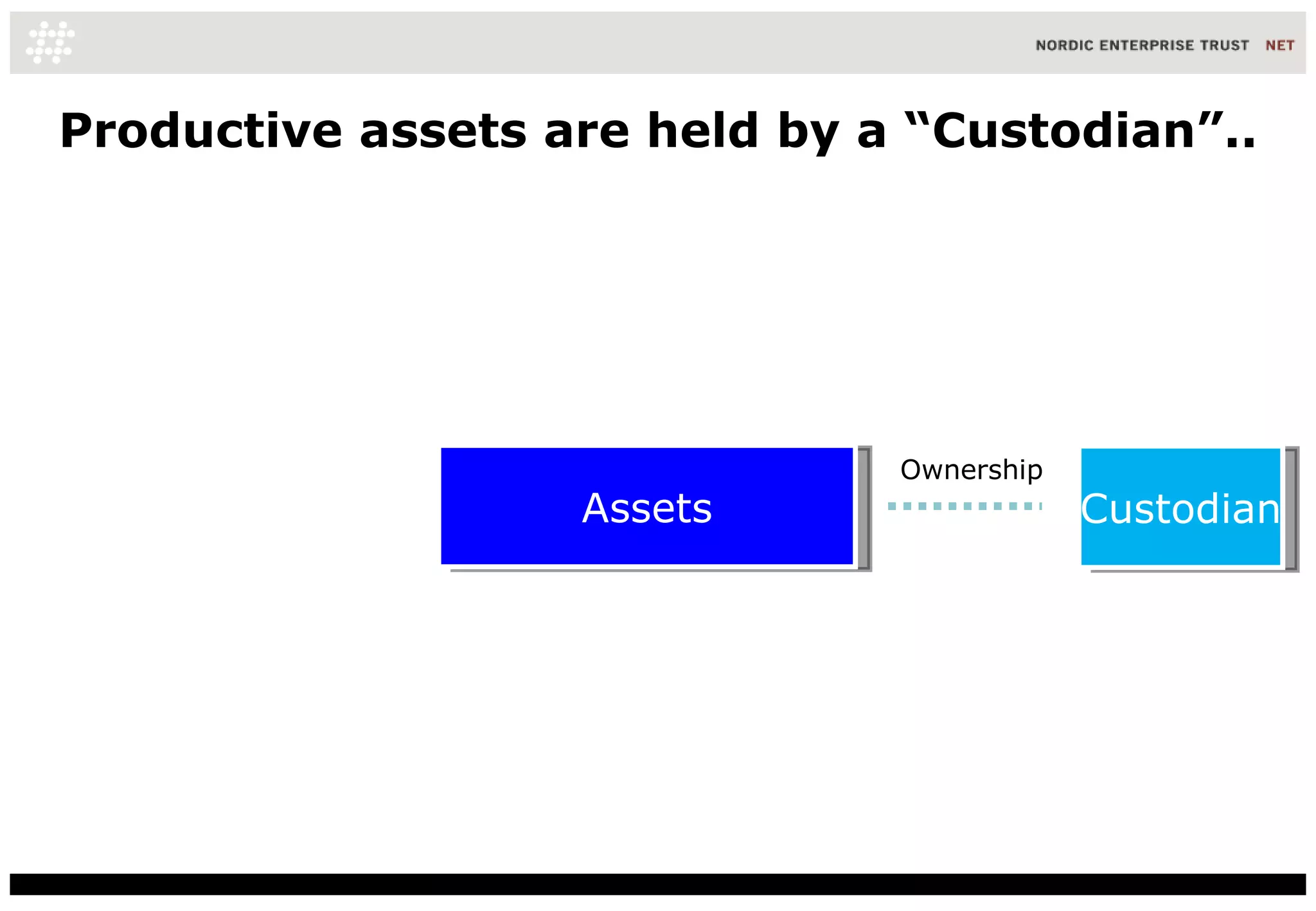

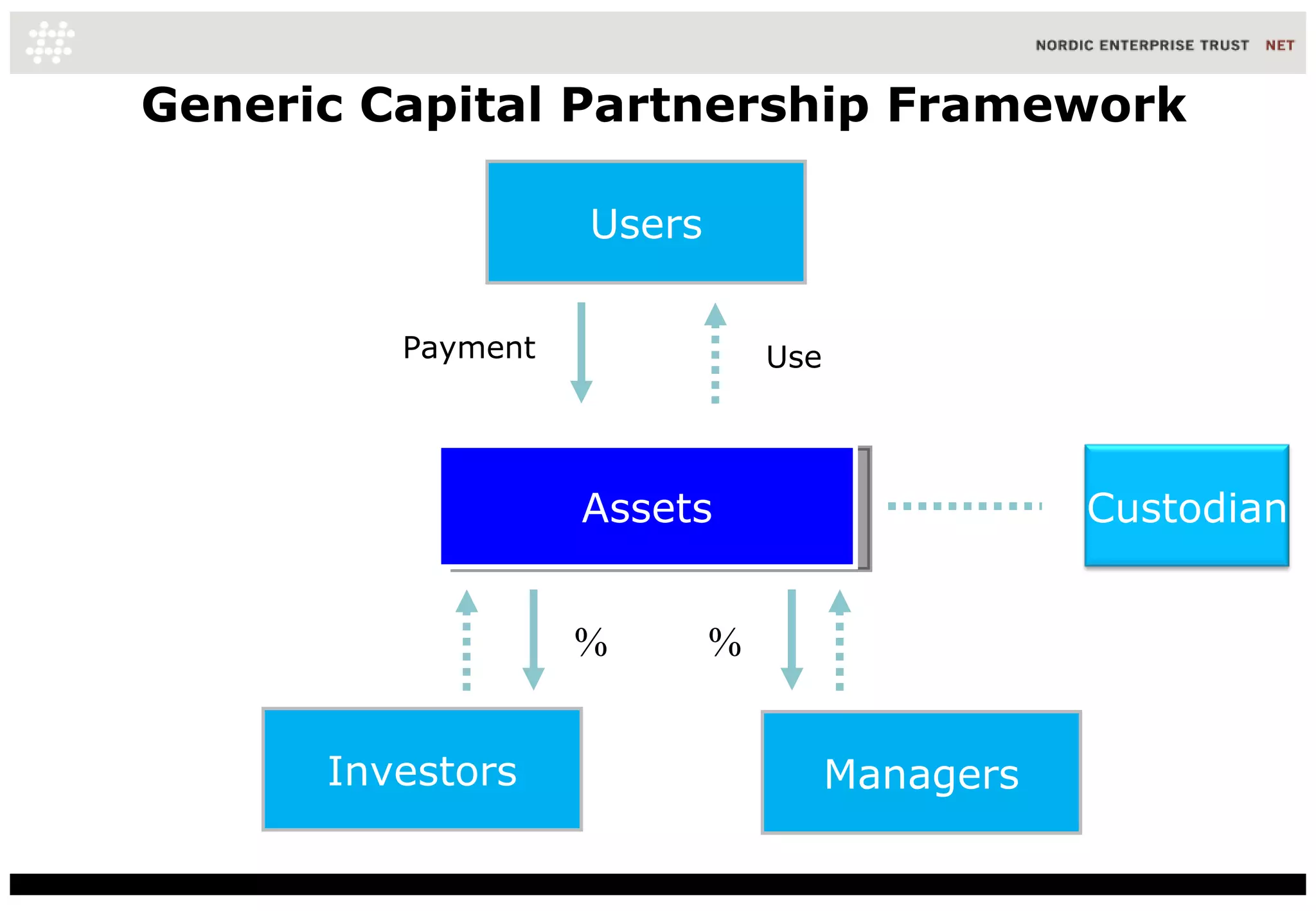

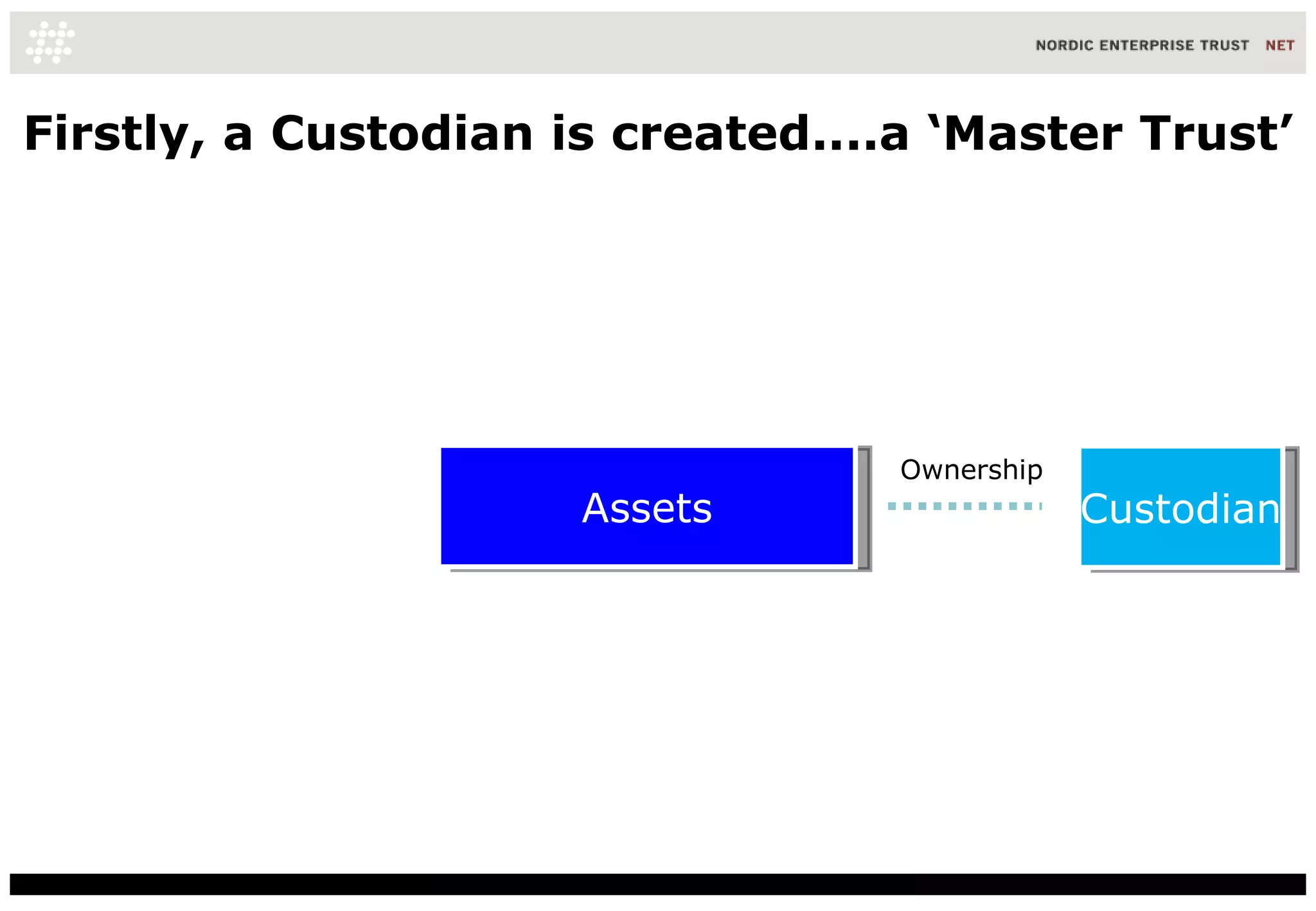

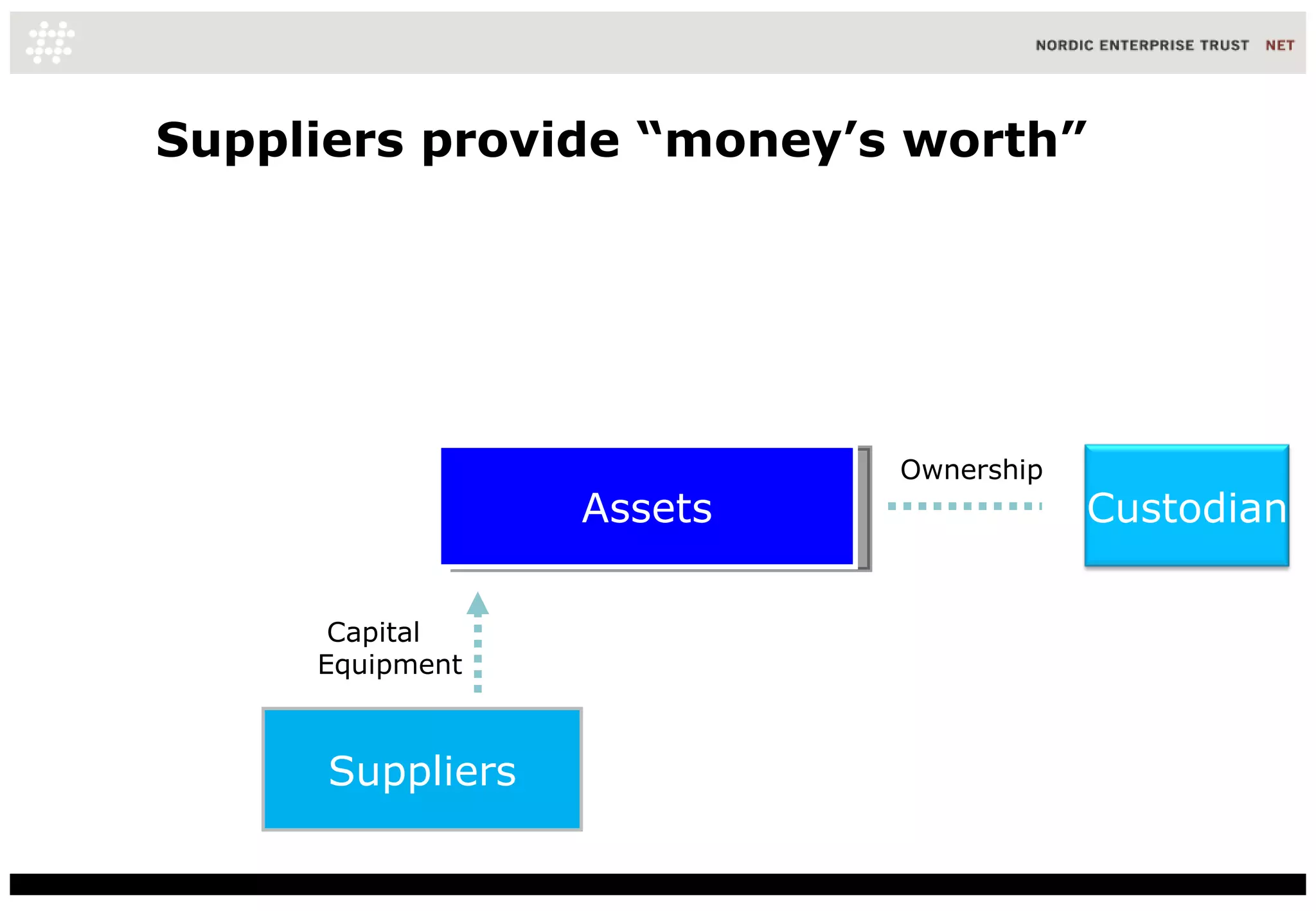

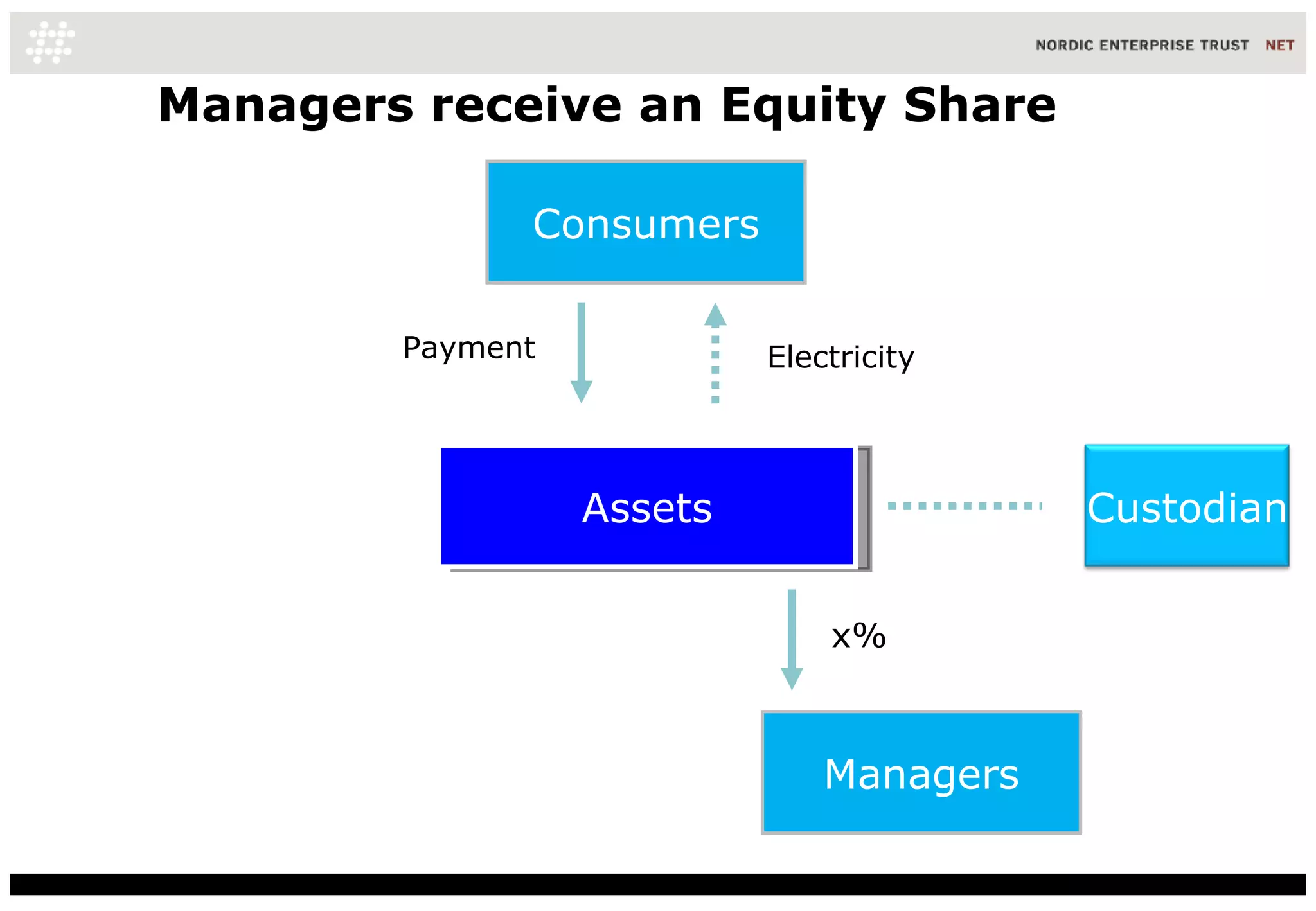

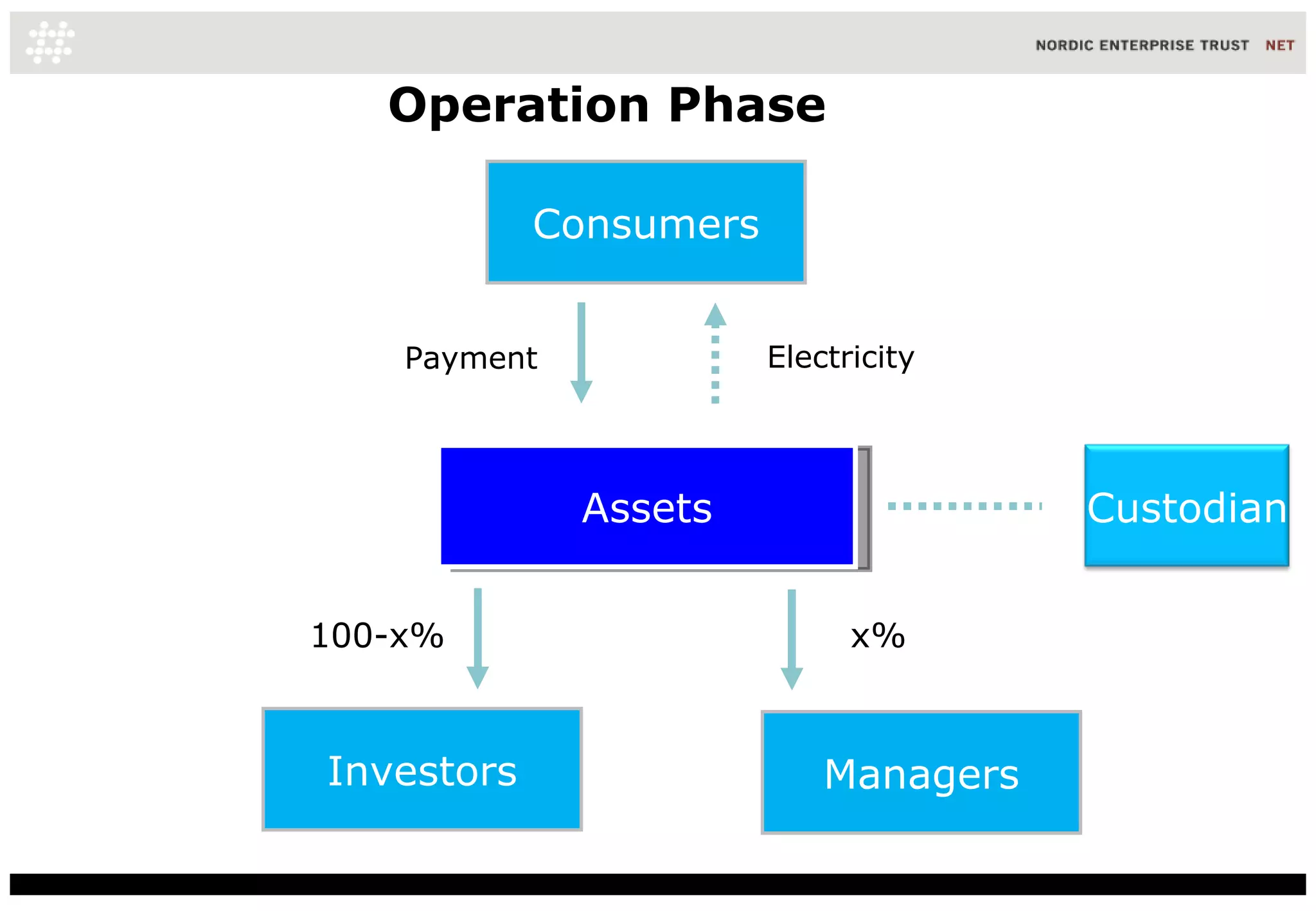

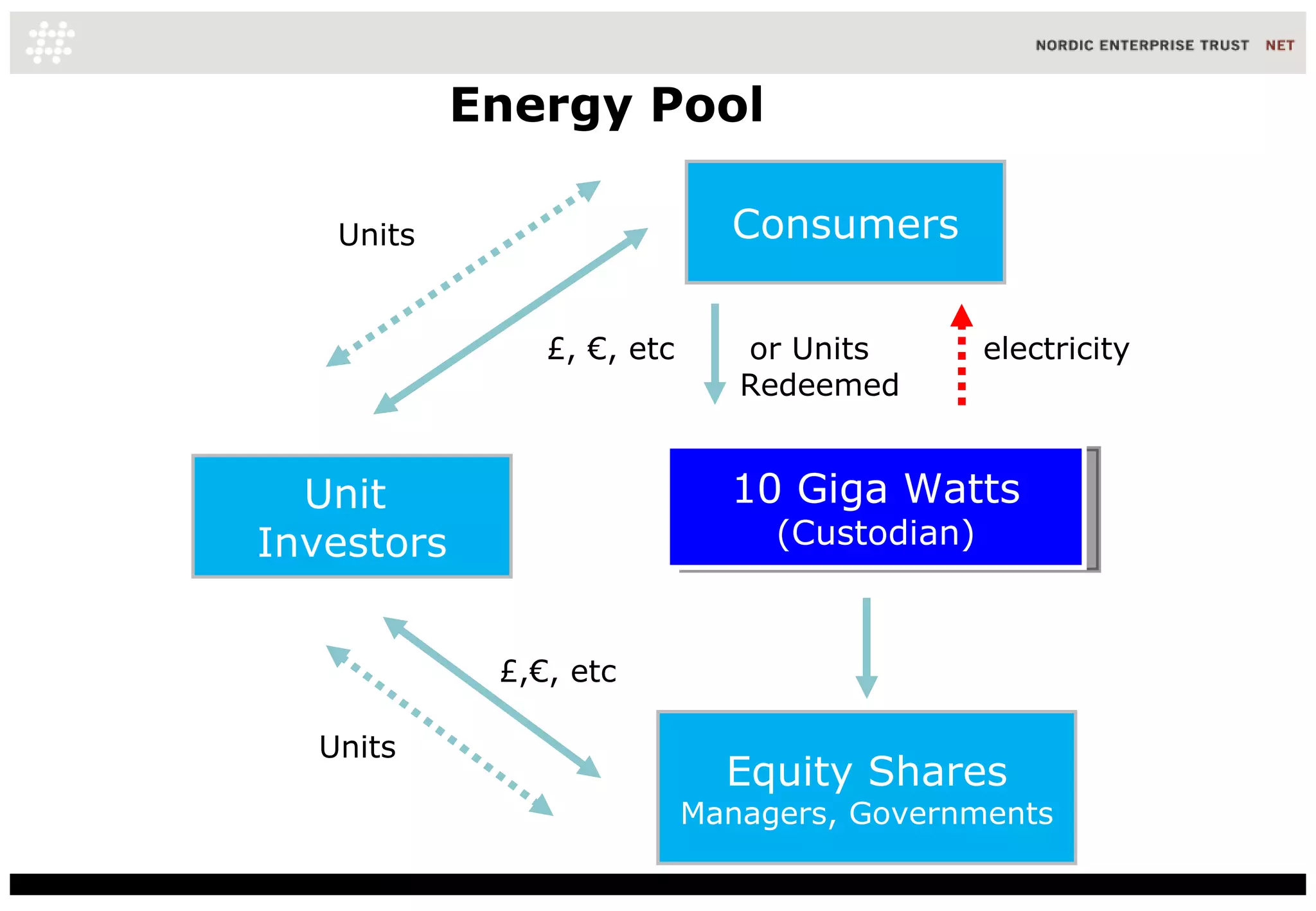

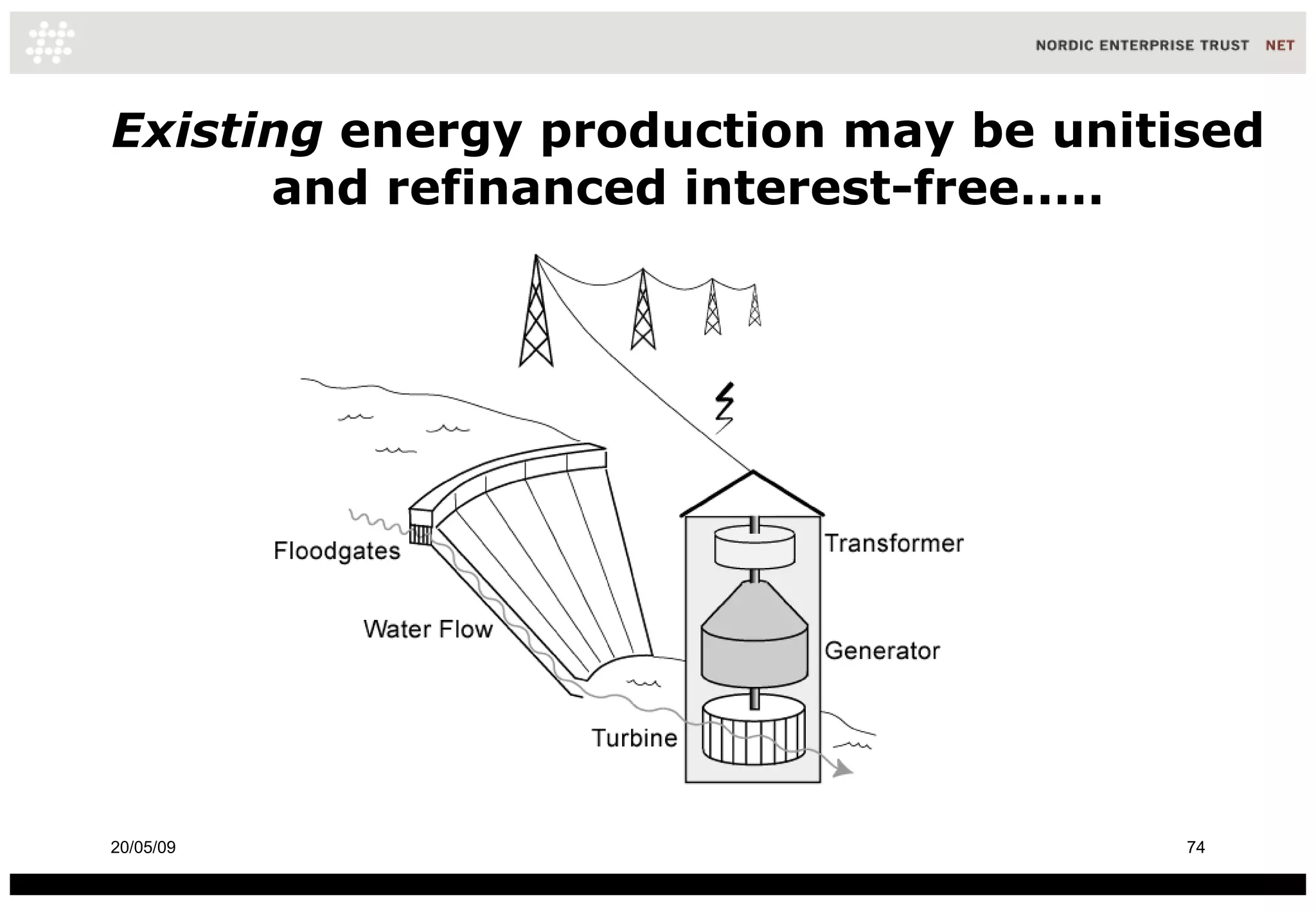

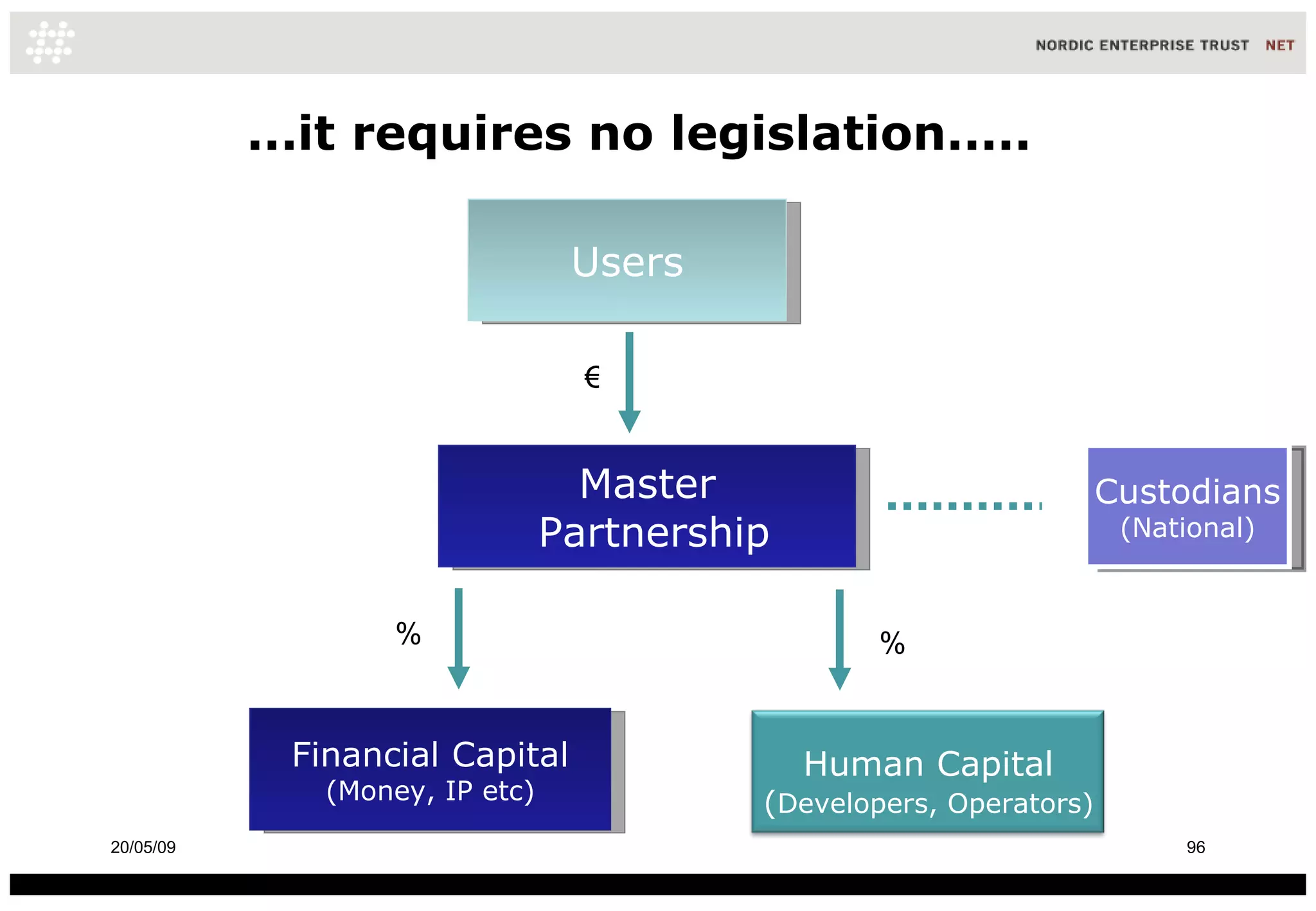

The document proposes an "Energy Pool" framework for funding the development and operation of a North Sea Supergrid through direct peer-to-peer investment and partnerships. It involves creating a custodian entity to hold assets, and issuing redeemable "Units" that represent ownership in the Energy Pool and can be redeemed for electricity production. This framework aims to finance renewable energy projects through monetizing future energy production without relying on public borrowing or traditional credit models.