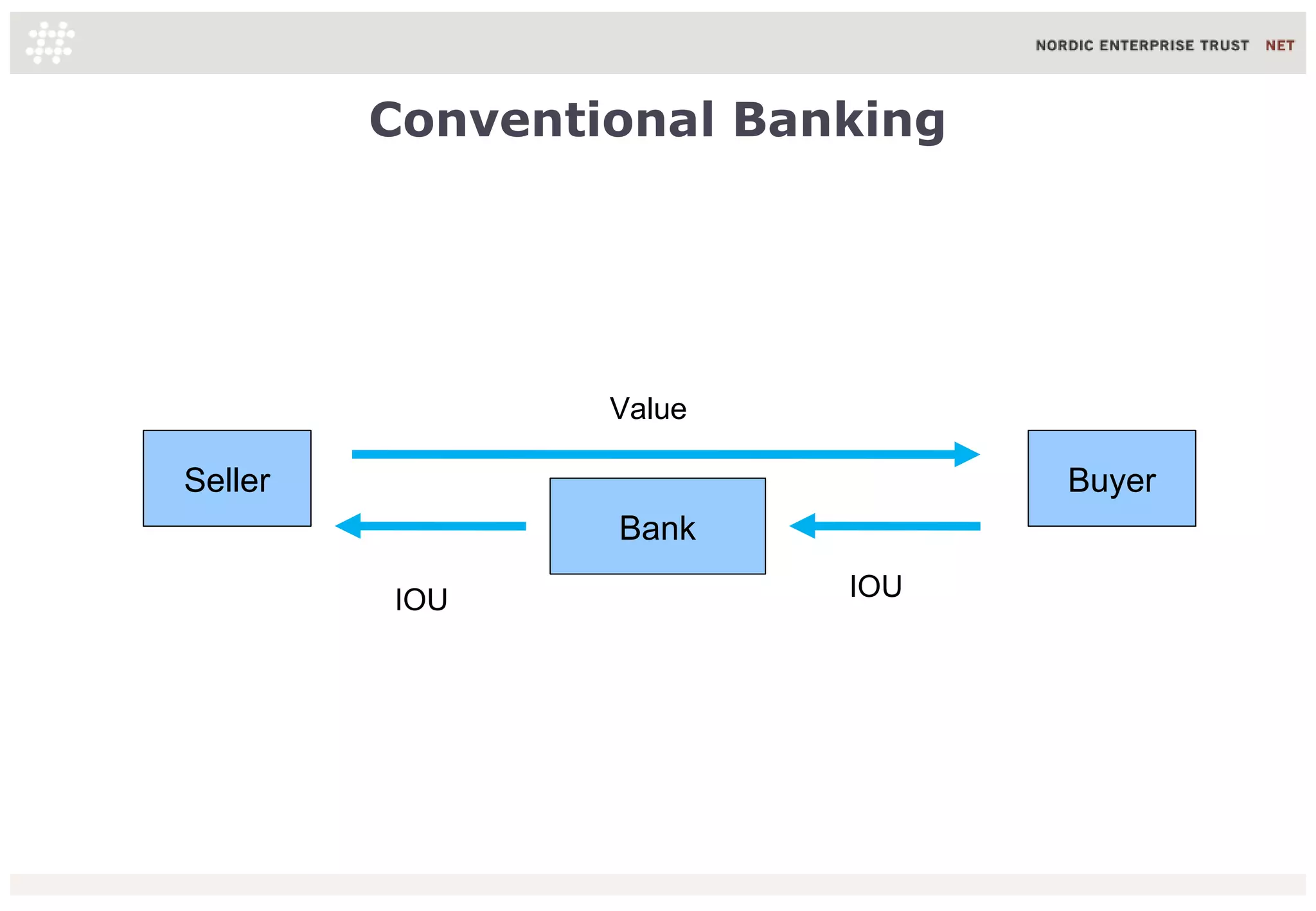

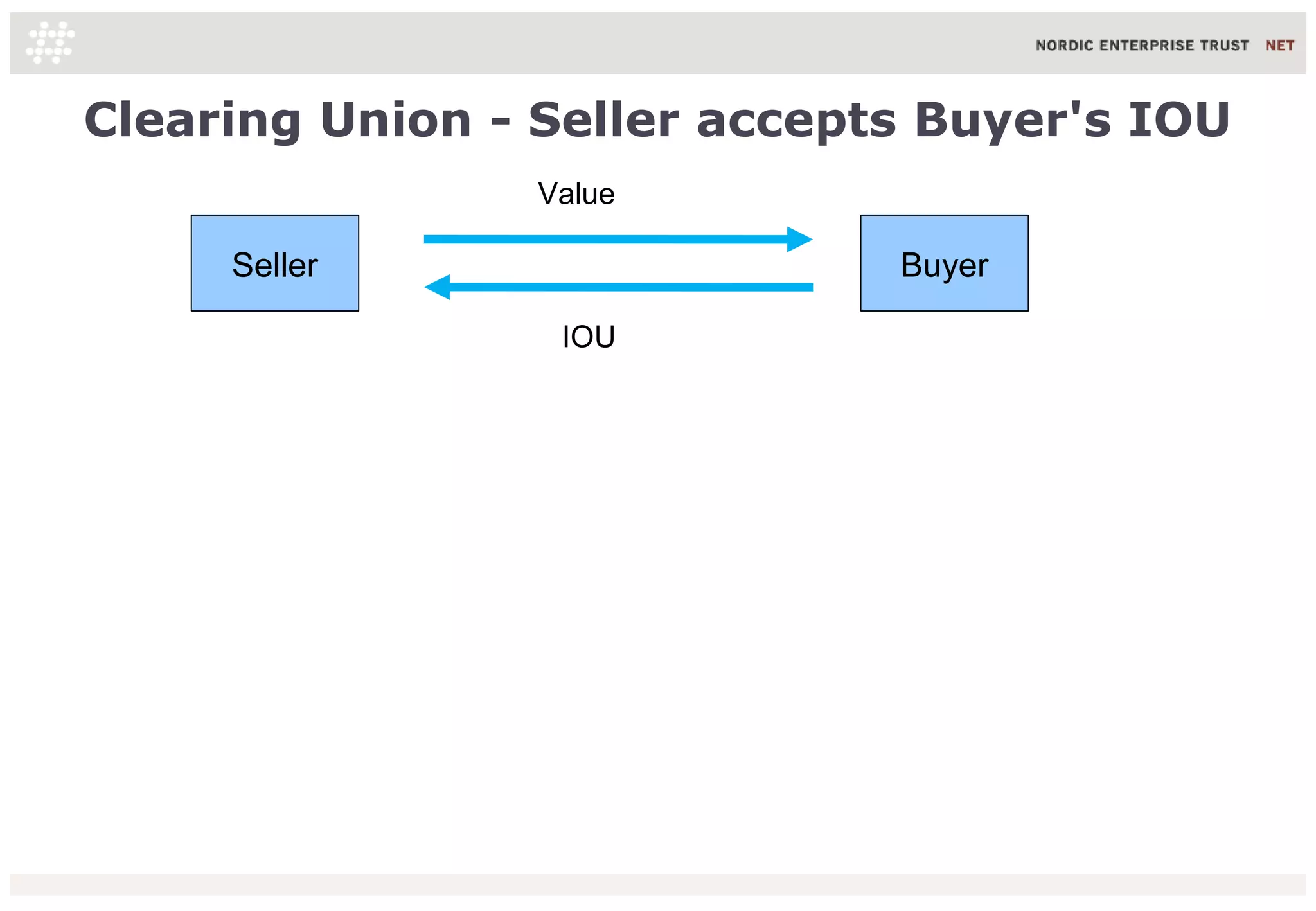

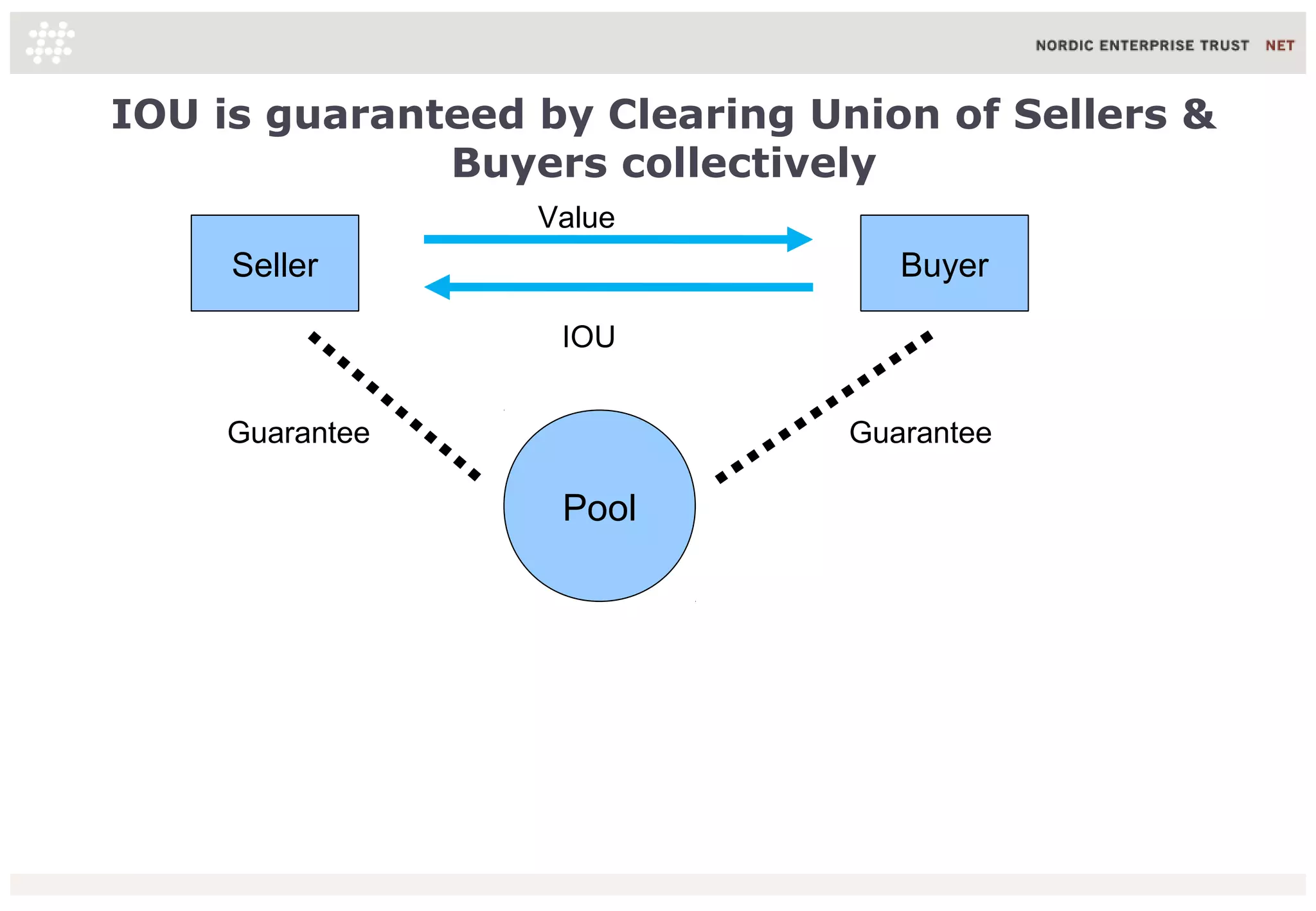

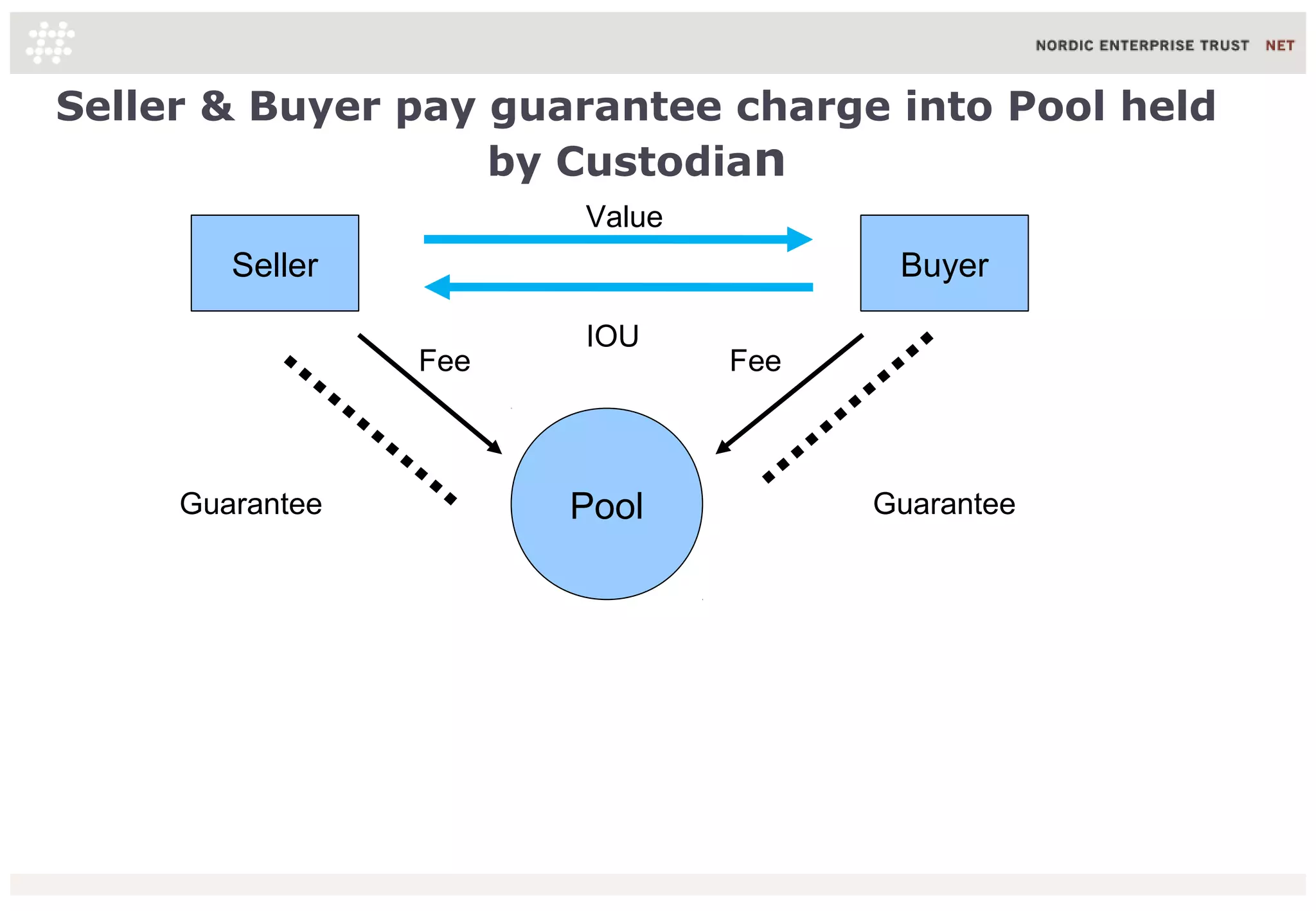

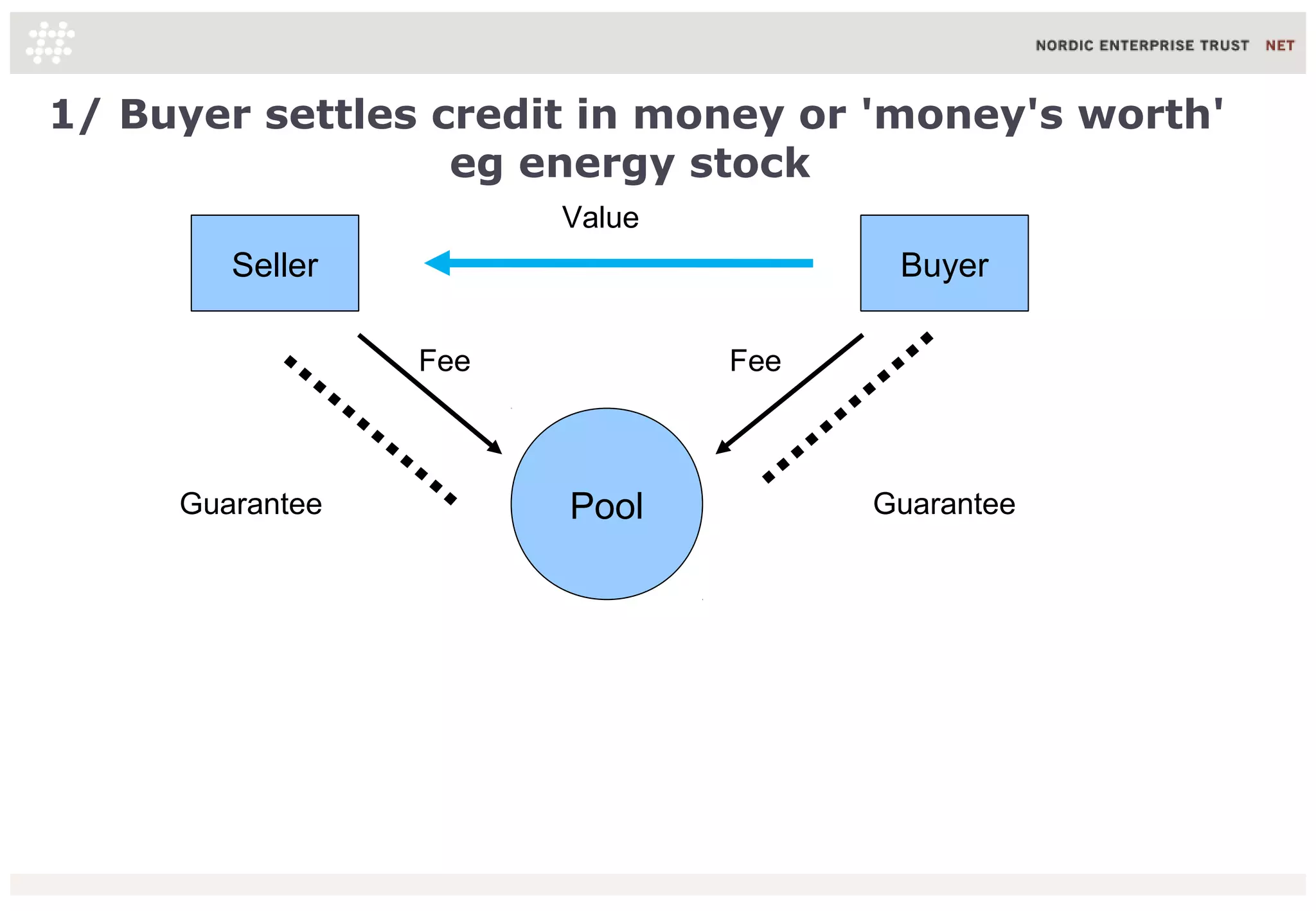

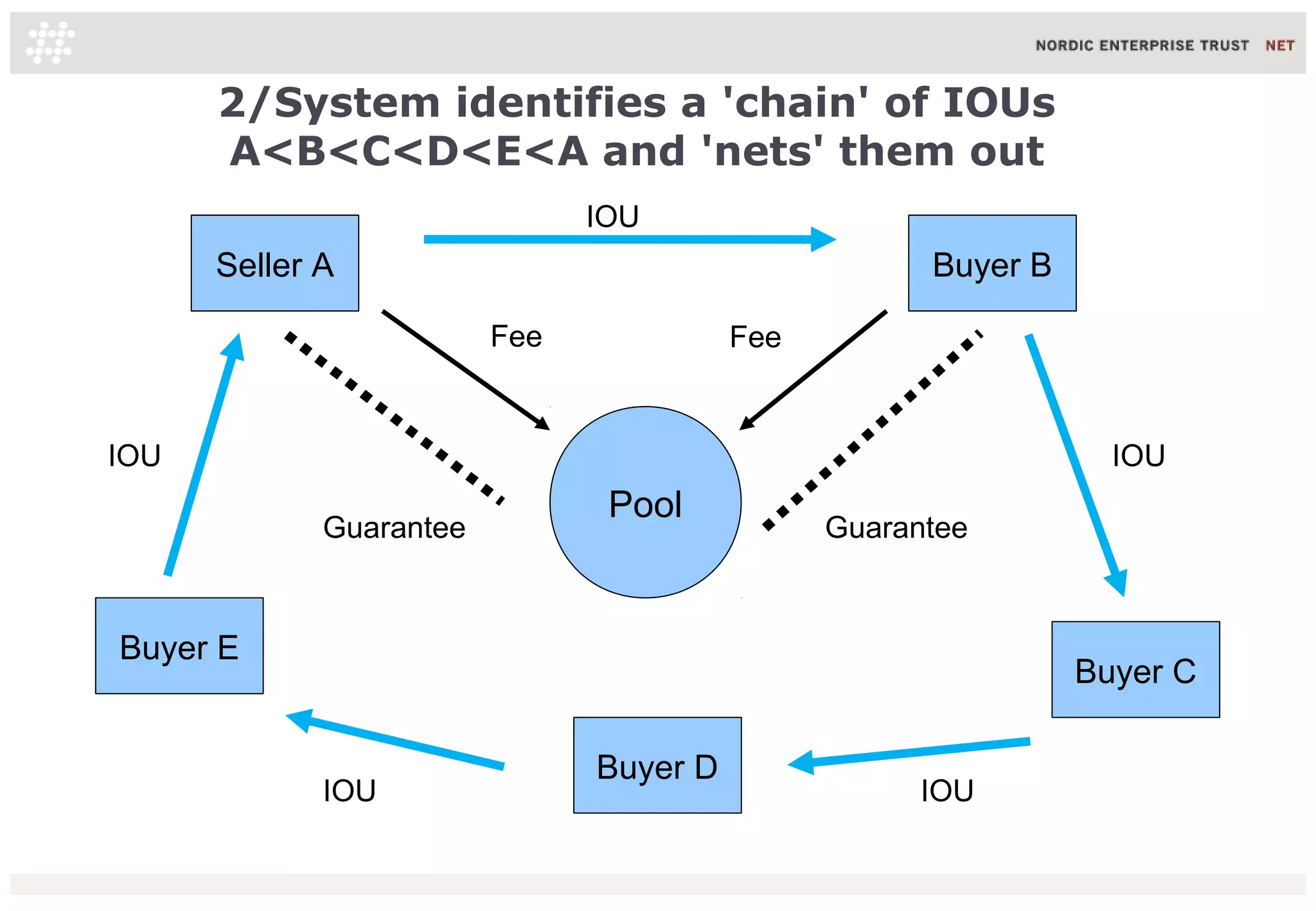

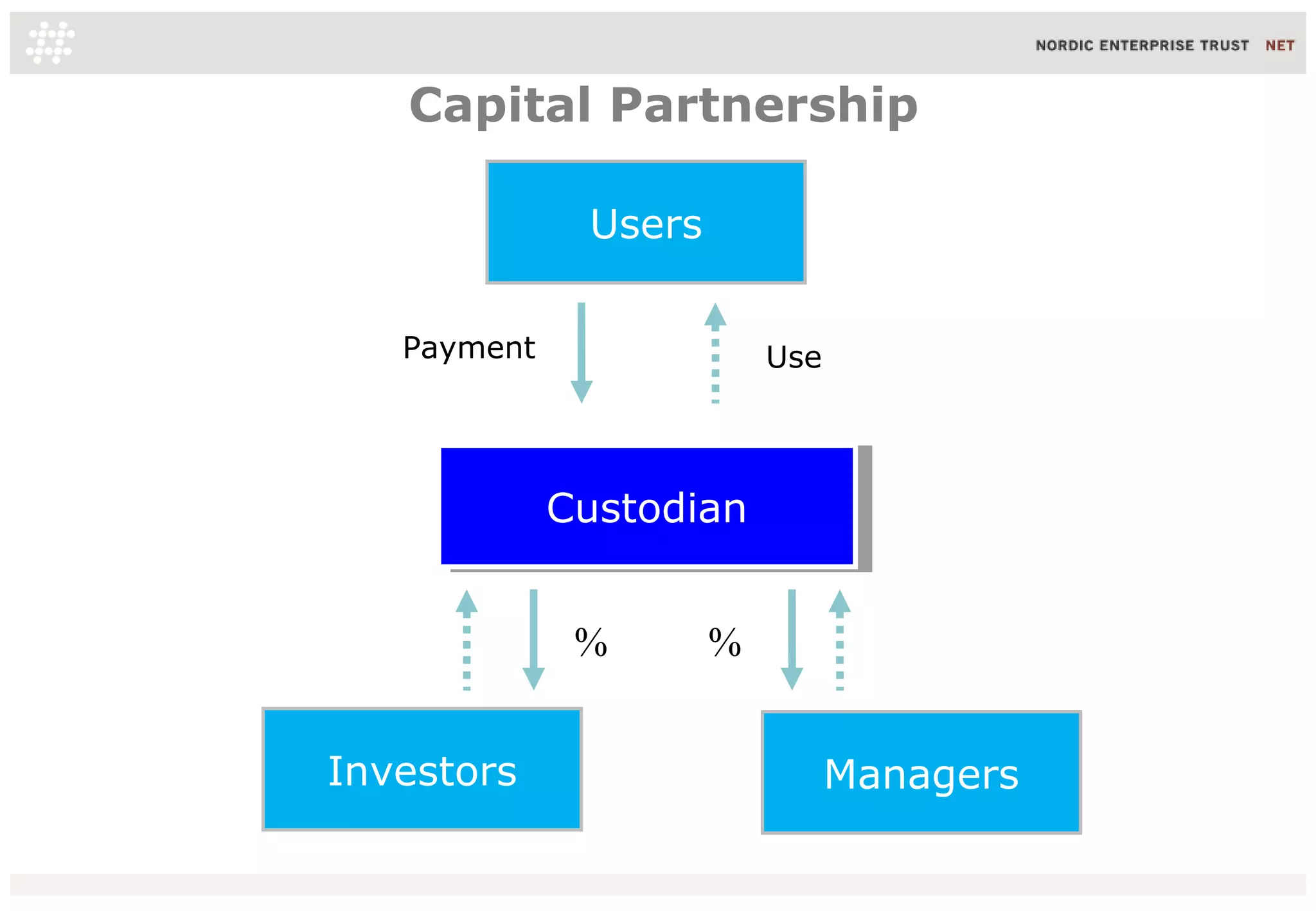

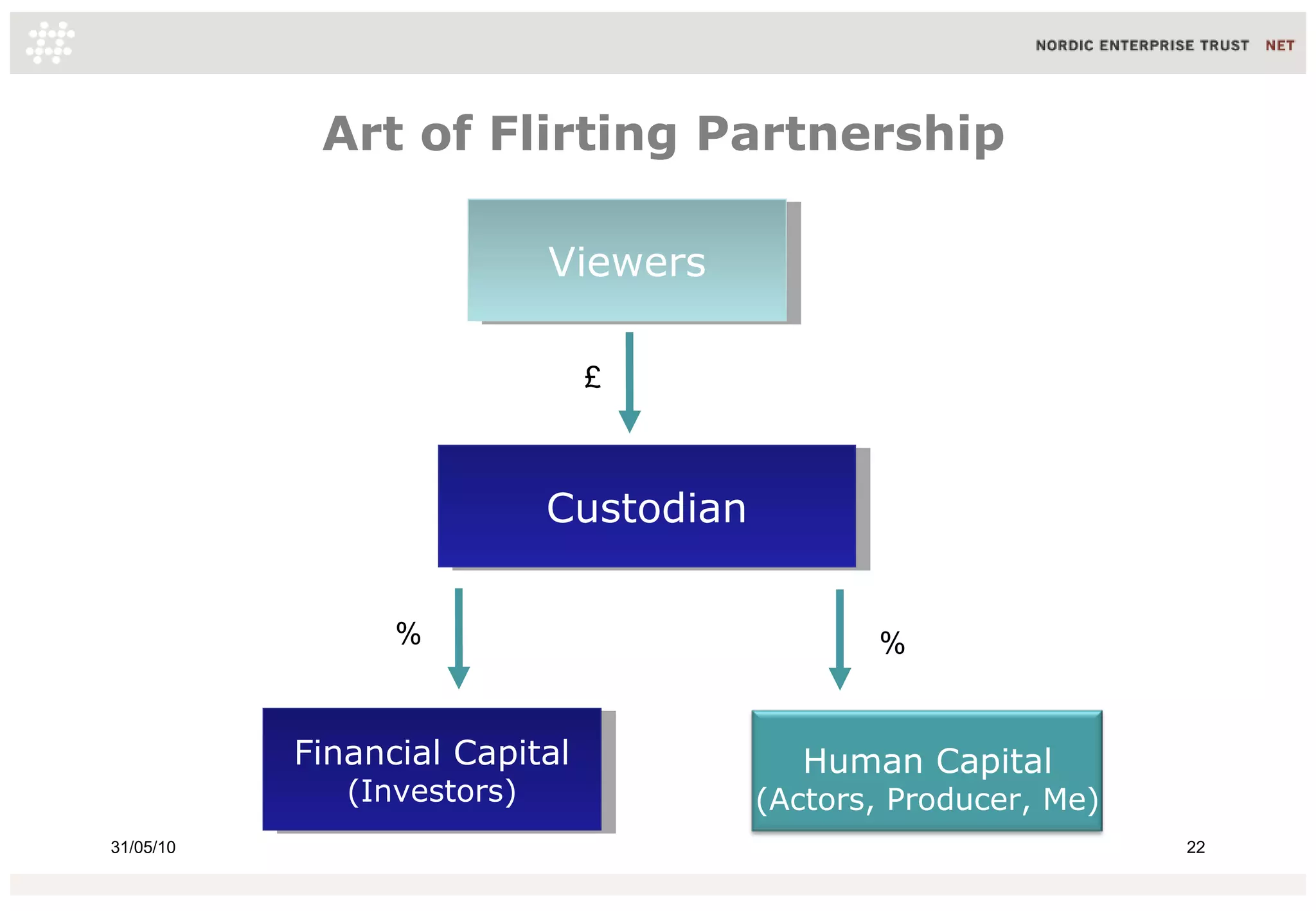

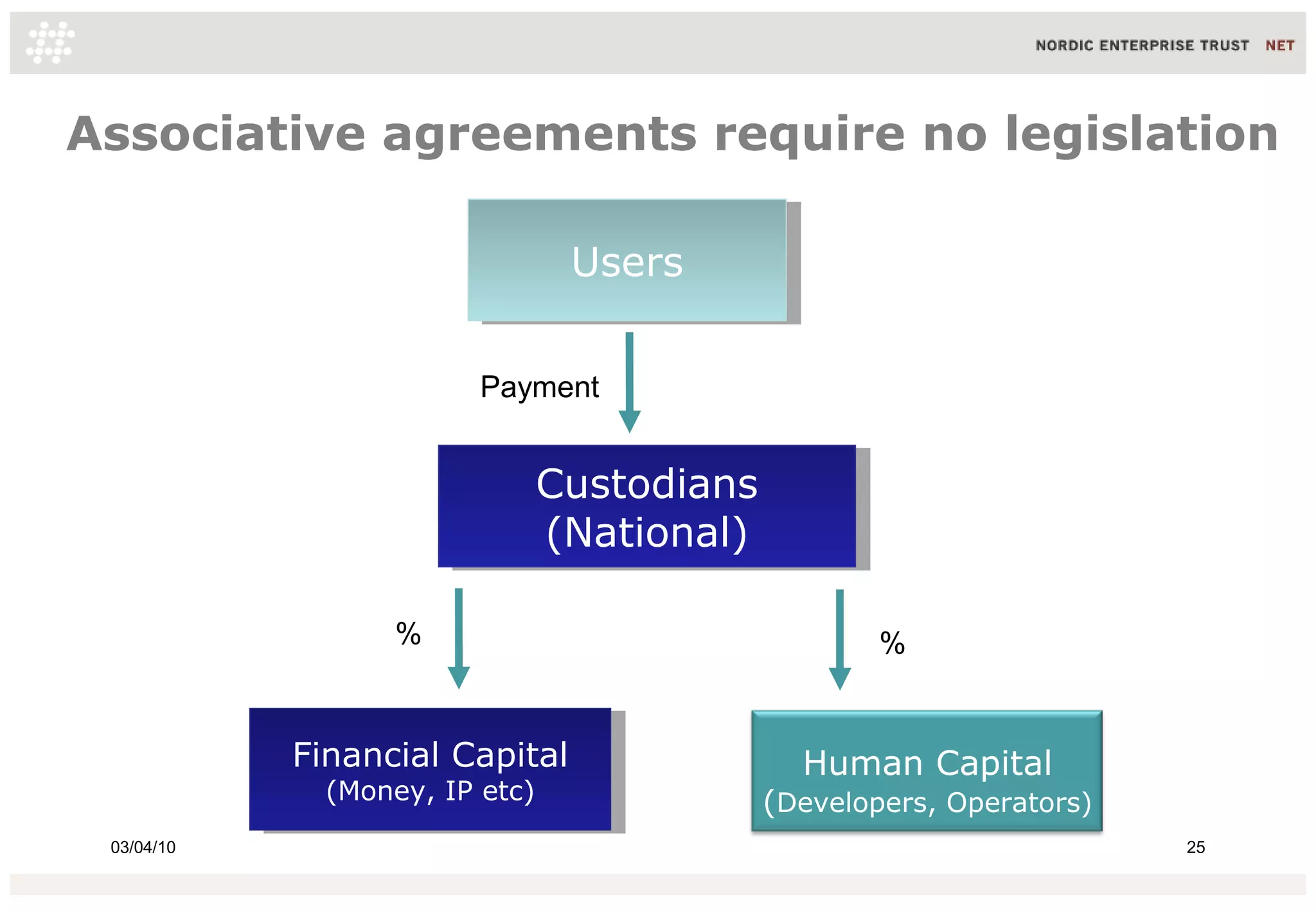

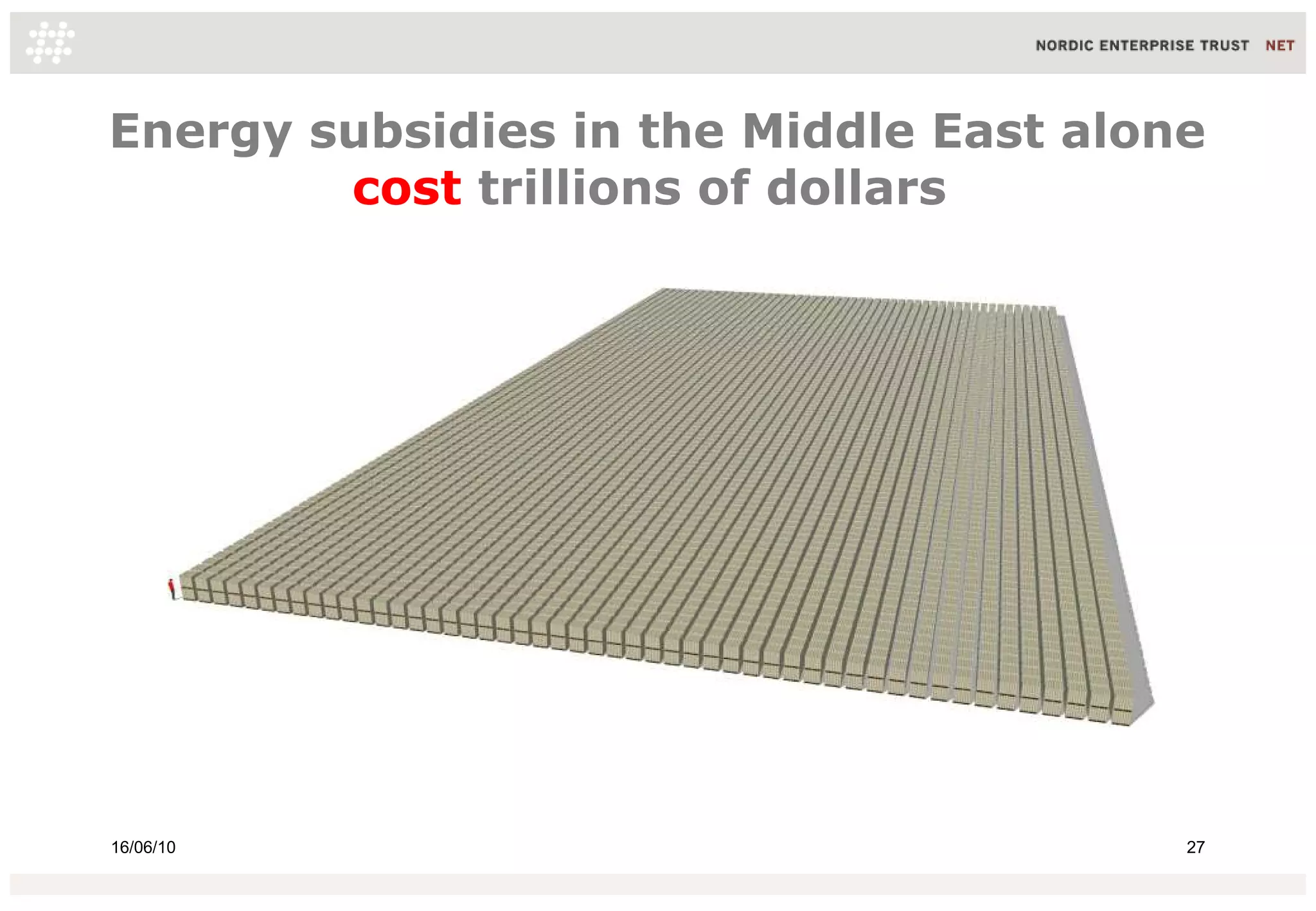

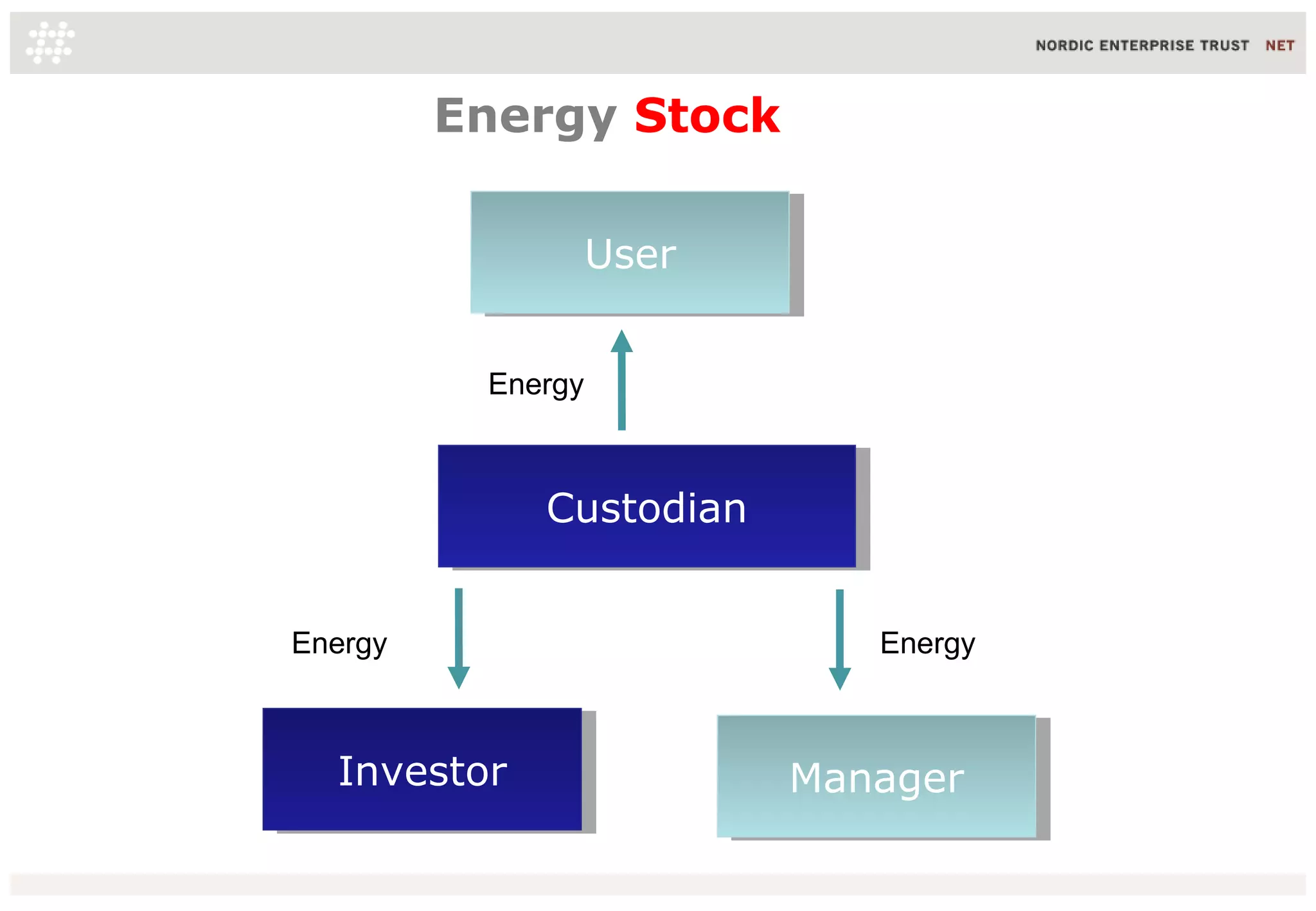

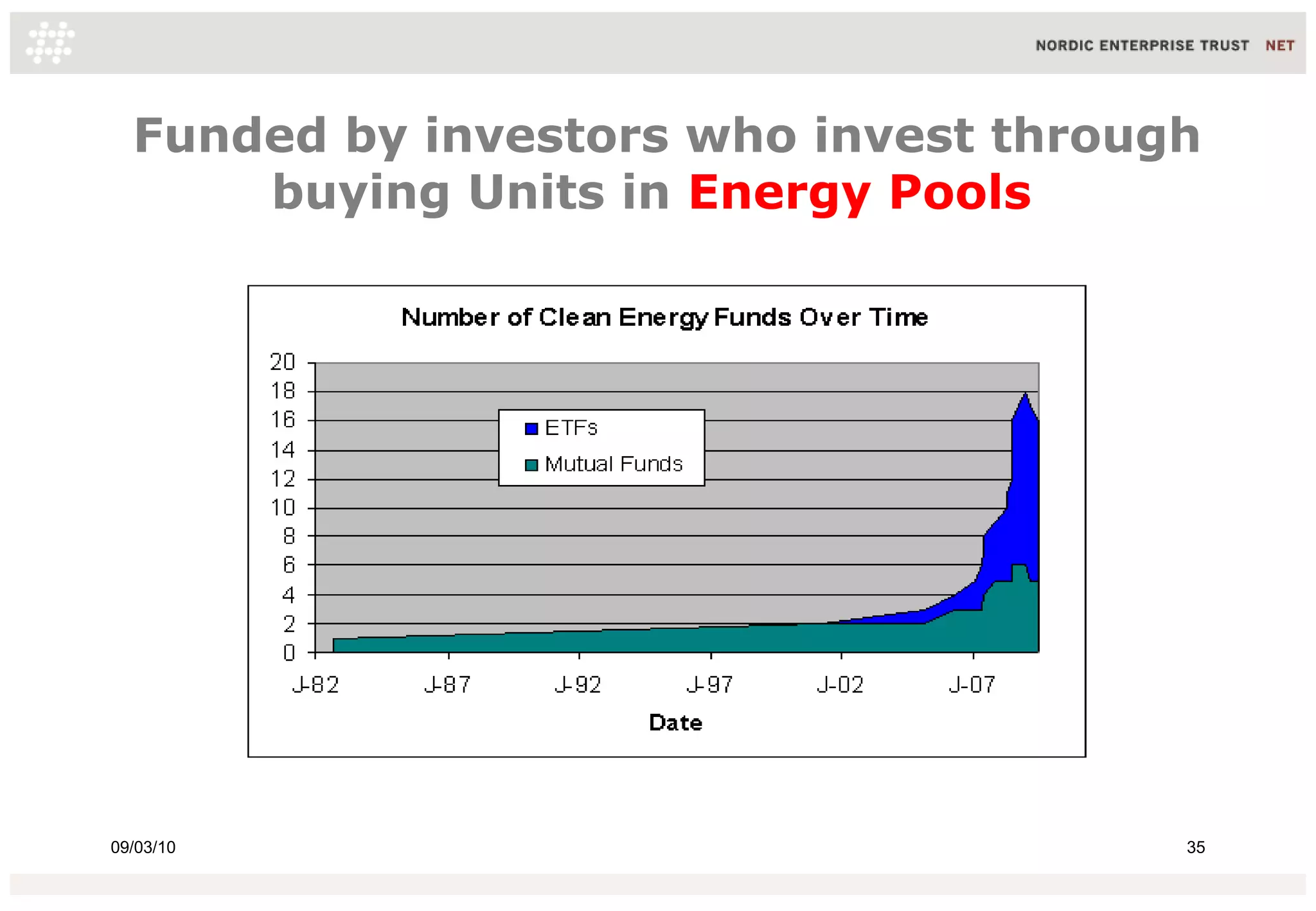

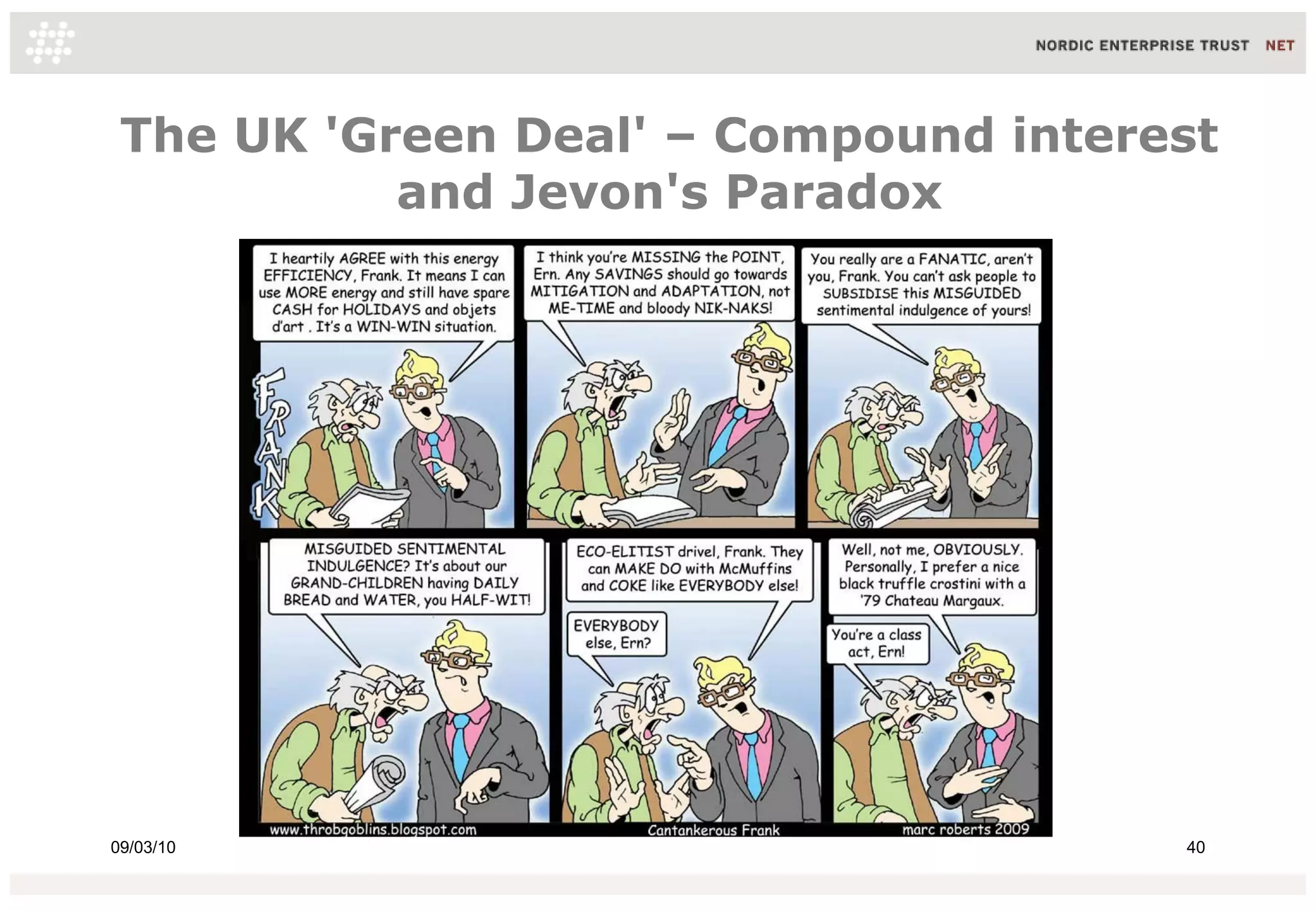

This document discusses alternatives to conventional banking and financing models, including peer-to-peer credit systems, clearing unions, capital partnerships, and energy stocks. It proposes that these systems could help transition economies away from fossil fuels by funding investments in renewable energy and energy efficiency. Specifically, it suggests that a carbon levy could fund an energy pool to invest in renewables and green deals for energy savings. The energy pool would pay out an energy dividend in the form of stock that is returnable to purchase energy, creating a carbon currency based on the intrinsic value of energy.